What are the real use cases of Uniswap V4's "hooks"?

TechFlow Selected TechFlow Selected

What are the real use cases of Uniswap V4's "hooks"?

Hook 「Hook」was born at Uniswap, surpassing Uniswap.

By: 0xTodd

Recently I deposited some funds into Uniswap V4, so I took a deep dive into Uni's hooks. Many people have privately told me that after the launch of V4, they didn't feel the same sense of amazement as when V3 was released. The main reason is that the concept of "hooks" itself is too abstract and has to take the blame.

Rather than translating "Hook" literally as "hook," in my humble opinion, it would be better translated as "plugin." Hooks are essentially about adding functionalities to pools that go beyond Uniswap's native capabilities. Their documentation repeatedly emphasizes when hooks can be called, but most people don’t actually care—what they really want to know is what hooks can do.

[Examples of Hook Use Cases]

-

For example, it allows you to create a pool like ETH-USDT that only specific addresses can access;

-

Or, it enables your pool to charge higher fees during busy periods and lower fees during idle times;

-

It could even allow your pool to operate without using the X*Y=K curve (PS: probably inspired by Curve).

In short, you can freely develop all kinds of features you need—things that the official Uniswap team may never build.

It’s kind of like Steam Workshop—both represent a shift where the official team steps back, letting others freely create.

Another change is that previously, there were only two profitable roles within Uniswap’s ecosystem: LPs and traders—and they essentially profited at each other’s expense. With V4 introducing hooks, now script-savvy developers also have a way to earn.

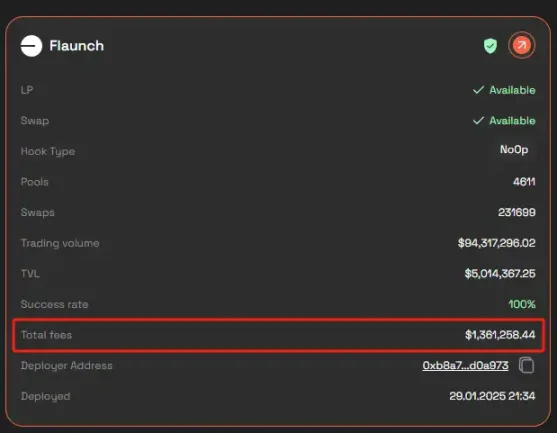

You write a hook, and others can pay to use it when creating their pools (selling... hooks?). Each pool can use one hook plugin, but one set of hook plugins can be subscribed to by countless pools, resulting in very low marginal costs. There’s a website called Hook Rank listing hundreds of hooks, showing how much each has earned. One of the most popular hooks right now, Flaunch, has reportedly earned its developer over $1 million already.

What does it do? Using this hook, when launching a meme coin pool, you can direct any portion—say 80%—of the trading fees to your own wallet, while allocating the remaining 20% toward buybacks.

Luckily, Trump’s son didn’t know about this feature when he launched $Trump, otherwise he might have routed all fees straight to Future World Finance?

Also, as the saying goes, only competitors truly understand you. PancakeSwap quickly followed suit by introducing hooks too—though they didn’t call it V4, instead branding it as Pancake Infinity. But that’s another story for another time. In summary, hooks are quite an interesting innovation, worthy of being named V4.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News