The Weird VC Awards: 10 Typical Crypto VCs, Which Ones Have You Met?

TechFlow Selected TechFlow Selected

The Weird VC Awards: 10 Typical Crypto VCs, Which Ones Have You Met?

Do not compromise on choosing investors just for the sake of fundraising.

Author: rosie

Translation: TechFlow

In this industry, all of us have to deal with venture capitalists (VCs) to some extent. Some VCs are gifts from heaven, but most aren't. Below is a "field identification guide" to help you recognize their true nature before it's too late.

Disclaimer: This article is satire. If you feel offended, you're likely in categories 1–9.

No actual VCs were harmed in the making of this article.

1. Anti-Airdrop Preachers

They preach loudly about "building real value," but immediately dump as soon as their tokens unlock. What they really mean: "We don't support your airdrops, but we'll happily take our own." These are the people who'll lecture you on tokenomics while your project crashes 80%. The first rule of the VC dumping club is: you don't talk about the VC dumping club.

2. Marketing Family Salesmen

They invested $50K and now want you to hire their cousin's marketing agency at $60K to recoup their losses. That agency has only three clients: you and two other projects backed by the same VC. Their marketing strategy? Pay influencers who bought the same NFT to post tweets.

3. Outdated Theorists

Their investment thesis hasn’t been updated since 2021. They’re still talking about “Web3 social” and “metaverse infrastructure,” but secretly searching “what is TEE technology” under the table during your pitch. But slap an “AI” label on your business plan, and they’ll invest instantly.

4. Founder-Friendly Ghosters

They spend three weeks deeply analyzing your project, make you fill out 17 forms, and introduce you to their entire team. But when it’s time to wire funds, they vanish completely. Six months later, they’ll tweet congratulations on your successful raise from other investors.

5. TradFi Transplants

Joined crypto in 2022, but never let you forget they used to work at Goldman Sachs. They may be active on Crypto Twitter (CT), but still obsessed with flexing past roles on LinkedIn. Their full suite of value-added services? “Professional email templates” and “equity structure best practices.” Never used a hardware wallet, and still ask, “What’s gas fee?”

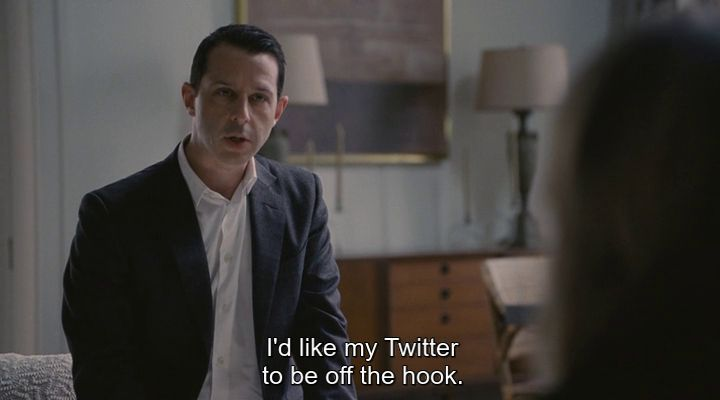

6. FOMO Front-Runners

Ignore your project for months, then suddenly slide into your DMs demanding an “urgent call” after seeing another VC mention your space on Twitter. They offer terrible terms with a 24-hour exploding deadline. Once you accept, they take three weeks just to send over the documents.

7. Long-Term Paper Hands

After watching one Cathie Wood interview on CNBC where she says Bitcoin will hit $1.5M by 2030, they endlessly repeat “we’re long-term holders” and “we align with founders on a five-year vision.” Yet, once the market drops 30%, they panic-sell and blame “uncontrollable market conditions.” Still insist on keeping a board seat though.

8. Bearish Thought Leaders

Built 50K followers by retweeting others’ takes. Their pinned tweet is about “builder culture,” yet they’ve never built anything themselves. Offer to “mentor” your project—in exchange for 2% of tokens. Their advice usually: “Have you tried getting anonymous Twitter influencers to promote you?”

9. Early-Stage High-Maintenance Investors

Pretend investing in your seed round is a favor, but demand Series B privileges. Require daily progress updates, board control, and direct access to your dev team. Will message you at 11 PM on a Sunday: “Quick question—when can I buy a Lamborghini?”

10. The Real Builder Unicorns

They ask the right technical questions, have lived through multiple cycles, and never waste your time. They offer more than capital—real value. They understand your vision because they’ve stood where you stand.

They’re like unicorns—you might think they don’t exist, but once you find one, no other VC will ever compare.

Final Advice

Don’t compromise on investor choice just to close a round. Finding the right partner is the difference between success and pivoting six months later into “an AI-powered Web3 social layer for DeFi users” (Translator’s note: a jab at grand narratives without execution).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News