Coinbase Q1 Earnings Explained: Net Profit Plunges 94% Amid Investment Portfolio Unrealized Losses, Revenue Misses Expectations

TechFlow Selected TechFlow Selected

Coinbase Q1 Earnings Explained: Net Profit Plunges 94% Amid Investment Portfolio Unrealized Losses, Revenue Misses Expectations

Retail trading revenue decreased 19% sequentially, while institutional trading revenue decreased 30% sequentially.

Compiled by: Felix, PANews

Coinbase, the U.S. cryptocurrency exchange, released its first-quarter (Q1) earnings on May 8 local time. Revenue and net profit both missed expectations as market trading cooled compared to the previous quarter's post-U.S. election surge.

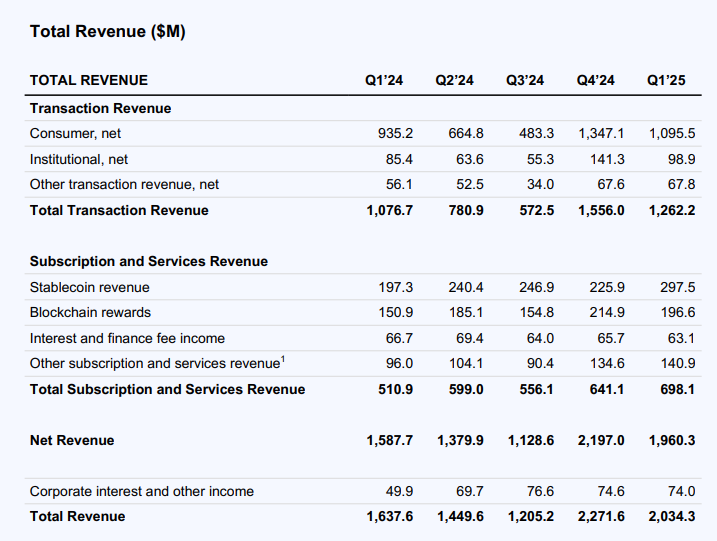

As of March 31, adjusted net income was $527 million. Earnings per share were $0.24, below the market consensus estimate of $1.93. Total revenue was $2 billion, slightly below the expected $2.12 billion and lower than Q4 2024’s $2.3 billion. Q1 trading revenue declined 19% to $1.2 billion, with trading volume down 10%.

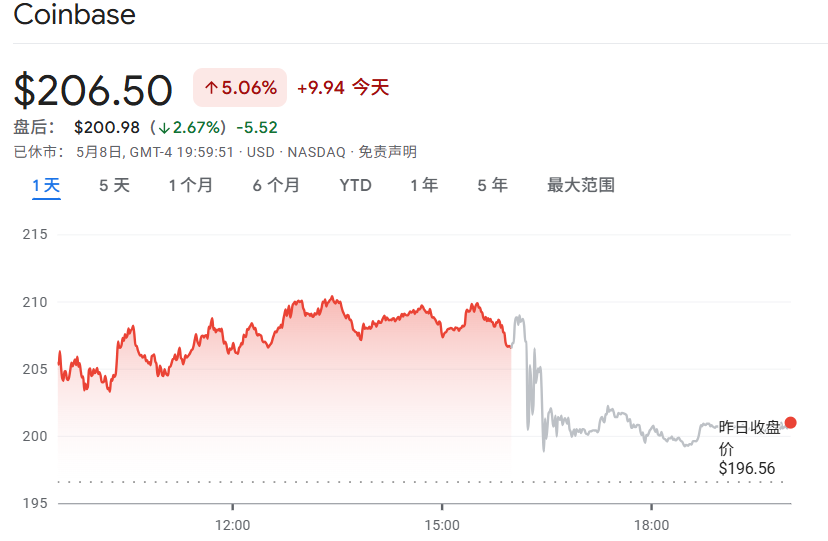

Following the report, Coinbase (COIN) shares fell 2.67% in after-hours trading, after rising 5% in the prior session. COIN has dropped 16.83% year-to-date.

Revenue

Average volatility of crypto assets rose during Q1, with BTC hitting an all-time high in January. However, crypto prices fell in line with broader markets due to tariff policies and macroeconomic uncertainty. Compared to the end of Q4, total crypto market capitalization dropped 19% to $2.7 trillion by the end of Q1.

Against this backdrop, Coinbase generated $2 billion in revenue, a 10% sequential decline; net income plummeted 94% sequentially to $66 million, primarily due to a pre-tax loss of $597 million from its crypto asset investment portfolio, mostly unrealized losses. Adjusted net income was $527 million, and adjusted EBITDA was $930 million.

Trading Revenue

Coinbase's earnings report shows trading remains its primary revenue source, accounting for over 60% of total revenue. Q1 trading revenue was $1.3 billion, down 19% sequentially. Coinbase’s spot trading volume decreased 10% sequentially to $393.1 billion, outperforming the global spot market, where volume dropped 13% sequentially. In derivatives, Coinbase achieved $803.6 billion in trading volume, with market share continuing to grow.

During Q1, retail trading volume was $78.1 billion, down 17% sequentially. Retail trading revenue was $1.1 billion, down 19% sequentially, broadly in line with the decline in trading volume. For institutional trading, volume was $315 billion, down 9% sequentially, while institutional trading revenue was $99 million, down 30% sequentially.

Besides macro factors, the second reason for the sequential revenue decline is the derivatives business. The report states that Coinbase is investing in trading rebates and incentives to build liquidity and attract customers. These rebates and rewards have been deducted from institutional trading revenue.

Other Transaction Revenue

Q1 other transaction revenue was $68 million, flat sequentially. Base transaction volume increased 16% sequentially, but average revenue per transaction declined 21%.

Subscription and Services Revenue

Q1 subscription and services revenue was $698 million, up 9% sequentially, driven by growth in stablecoin and Coinbase One revenue, with USDC market cap reaching a record high above $60 billion. However, blockchain rewards revenue declined 9% sequentially, partially offsetting the growth. The decline was mainly due to lower average asset prices, especially ETH and SOL.

Q1 stablecoin revenue grew 32% sequentially to $298 million. Coinbase noted this growth was partly offset by lower average interest rates. Average USDC holdings within Coinbase products increased 49% sequentially to $12.3 billion.

Other subscription and services revenue was $141 million, up 5% sequentially. Subscription numbers for Coinbase One hit a new quarterly high, and premium Coinbase One service ($300/month) also saw growth.

Expenses

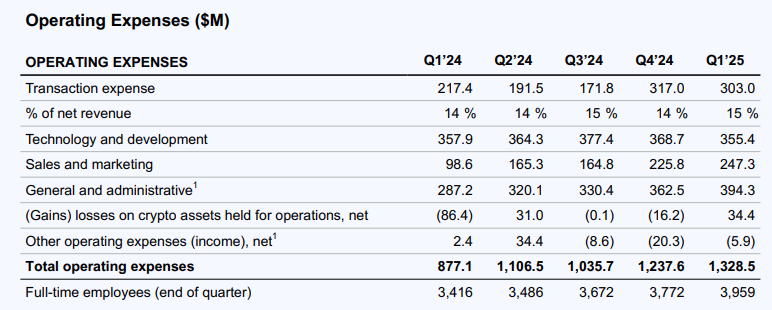

Total operating expenses in Q1 were $1.3 billion, up 7% ($91 million) sequentially, mainly due to higher variable costs from increased market activity at the start of the quarter and losses on crypto assets held for operations. Technology and development, general and administrative, and sales and marketing expenses collectively increased by $40 million, or 4% sequentially, primarily due to higher marketing spending (including performance marketing and USDC rewards) and increased customer support costs. Full-time employees at Coinbase increased 5% sequentially to 3,959 by the end of the quarter.

Transaction expenses were $303 million, representing 15% of net revenue, down 4% sequentially. The decrease was primarily due to reduced customer trading activity and lower blockchain rewards expenses linked to declining average asset prices.

Technology and development expenses were $355 million, down 4% sequentially. The decline occurred despite headcount growth, due to lower personnel-related costs. General and administrative expenses were $394 million, up 9% sequentially, mainly driven by increased customer support and personnel-related costs. Sales and marketing expenses were $247 million, up 10% sequentially.

Outlook

In April, Coinbase’s total transaction revenue was approximately $240 million. The company expects Q2 subscription and services revenue to be between $600 million and $680 million, as anticipated sequential growth in stablecoin revenue will likely be offset by declines in blockchain rewards revenue due to falling asset prices. Transaction expenses are expected to remain around 15% of net revenue. Technology and development, along with general and administrative expenses, are projected to be between $700 million and $750 million.

Notably, Coinbase is expanding into the derivatives market, announcing a $2.9 billion acquisition of Deribit, the world’s largest Bitcoin and Ethereum options exchange. The deal includes $700 million in cash and 11 million shares of Coinbase common stock, subject to customary purchase price adjustments. The transaction is subject to regulatory approval and other customary closing conditions, and is expected to close by year-end. Last year, Deribit had over $30 billion in open interest and more than $1 trillion in trading volume.

Coinbase CFO Alesia Haas said on the earnings call: “We expect Deribit to immediately enhance our profitability and increase the diversity and durability of our trading revenue.”

In addition, Coinbase CEO Brian Armstrong said on the investor call that this quarter, Coinbase will launch a pilot program allowing businesses to use stablecoins for payments and expenditures.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News