Regulatory Rollback Fuels RWA Narrative in U.S. Stocks: Opportunities and Challenges for Tokenized Equities

TechFlow Selected TechFlow Selected

Regulatory Rollback Fuels RWA Narrative in U.S. Stocks: Opportunities and Challenges for Tokenized Equities

If some high-dividend blue-chip stocks could be introduced, they might be adopted by yield-generating DeFi protocols.

Author: @Web3_Mario

Summary: As Trump's policies are being implemented one by one—using tariffs to attract manufacturing backshoring, actively triggering a stock market bubble to force the Fed to cut rates and loosen monetary policy, and promoting financial innovation and industrial development through deregulation—this combination of measures is tangibly transforming the market. Among them, the RWA sector, benefiting from deregulatory policies, is increasingly drawing attention from the crypto industry. This article primarily explores the opportunities and challenges of tokenized stocks.

Overview of the Development History of Tokenized Stocks

In fact, tokenized stocks are not a new concept. Since 2017, attempts at STO (Security Token Offering) have already begun. STO, or Security Token Offering, is a fundraising method in the cryptocurrency space that essentially digitizes and places traditional financial securities' rights onto a blockchain, achieving asset tokenization through blockchain technology. It combines the compliance of traditional securities with the efficiency of blockchain technology. As a key category of securities, tokenized stocks represent the most watched application scenario within the STO field.

Prior to the emergence of STO, the dominant fundraising model in the blockchain space was ICO (Initial Coin Offering). The rapid rise of ICOs relied heavily on the convenience of Ethereum smart contracts, but most tokens issued did not represent real asset rights and lacked regulatory oversight, leading to frequent fraud and exit scams.

In 2017, the U.S. SEC (Securities and Exchange Commission) issued a statement regarding the DAO incident, stating that certain tokens might qualify as securities and thus fall under the regulation of the Securities Act of 1933. This marked the formal inception of the STO concept. In 2018, STO, conceptualized as a "compliant ICO," gradually gained popularity and industry attention. However, due to the lack of unified standards, poor secondary market liquidity, and high compliance costs, market development proceeded slowly.

With the arrival of DeFi Summer in 2020, some projects began experimenting with decentralized solutions, using smart contracts to create derivatives pegged to stock prices, enabling on-chain investors to directly invest in traditional stock markets without undergoing complex KYC procedures. This paradigm is commonly known as the synthetic assets model, which does not directly hold U.S. equities and allows trading without trusting centralized institutions, thereby bypassing expensive regulatory and legal costs. Notable projects include Synthetix and Terra’s Mirror Protocol.

In these projects, market makers can mint on-chain synthetic U.S. stocks by providing over-collateralized crypto assets and provide market liquidity. Traders can then directly trade these instruments via secondary markets on DEXs, gaining price exposure to the underlying anchored stocks. At that time, Tesla was the star stock in the U.S. market, not Nvidia as in the previous cycle. Hence, most project slogans highlighted the ability to trade TSLA directly on-chain.

However, looking at final market developments, trading volume for on-chain synthetic U.S. stocks has remained unsatisfactory. Taking sTSLA on Synthetix as an example, including primary market minting and redemption, it has accumulated only 798 on-chain transactions in total. Later, most projects publicly cited regulatory concerns as the reason for delisting synthetic U.S. equity assets and shifting to other business areas. However, the core reason may well be the failure to achieve product-market fit (PMF), making it impossible to establish a sustainable business model. The synthetic asset business model relies on substantial on-chain trading demand to attract market makers who mint assets via the primary market and earn fees by providing liquidity on the secondary market. Without such demand, market makers cannot profit from synthetic assets and must instead bear the short-side risk exposure associated with the anchored U.S. stocks, leading to further liquidity contraction.

Besides the synthetic assets model, some well-known CEXs have also attempted to offer crypto traders access to U.S. stock trading through centralized custody models. In this model, third-party financial institutions or exchanges hold actual stocks and directly create tradable instruments on the CEX. Prominent examples include FTX and Binance. On October 29, 2020, FTX launched its tokenized stock trading service in partnership with German financial firm CM-Equity AG and Swiss Digital Assets AG, allowing users outside the U.S. and restricted regions to trade tokens linked to U.S. listed stocks such as Facebook, Netflix, Tesla, and Amazon. In April 2021, Binance also began offering tokenized stock trading, with Tesla (TSLA) as its first listed stock.

However, the regulatory environment at the time was not particularly favorable. Moreover, since the initiative came primarily from CEXs, it created direct competition with traditional stock trading platforms like Nasdaq, naturally inviting significant pressure. FTX achieved its highest-ever tokenized stock trading volume in Q4 2021, with $94 million traded in October 2021 alone. However, after FTX’s bankruptcy in November 2022, its tokenized stock trading service ceased operations. Binance, too, announced in July 2021—just three months after launching the service—that it would discontinue tokenized stock trading due to regulatory pressure.

Subsequently, as the market entered a bear phase, development in this sector stalled. It wasn’t until Trump’s election, and his financial deregulation policies that shifted the regulatory landscape, that market interest in tokenized stocks resurfaced—now under a new name: RWA. This paradigm emphasizes compliant architectural design, introducing qualified issuers to issue tokens on-chain backed 1:1 by real-world assets, with token creation, trading, redemption, and collateral management strictly adhering to regulatory requirements.

Current Market Status of Stock RWA

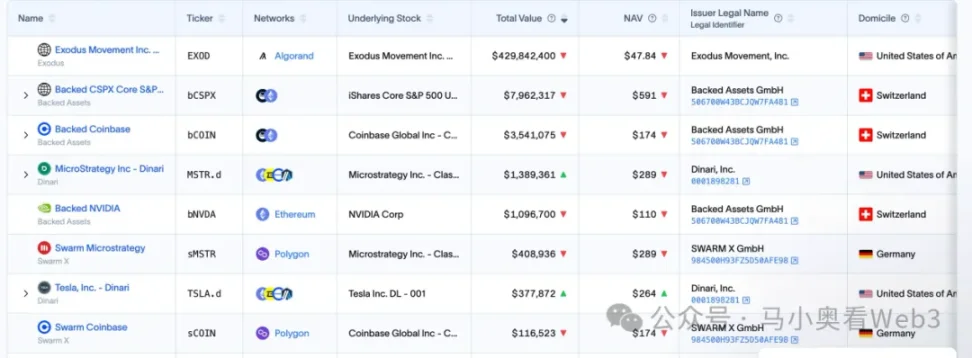

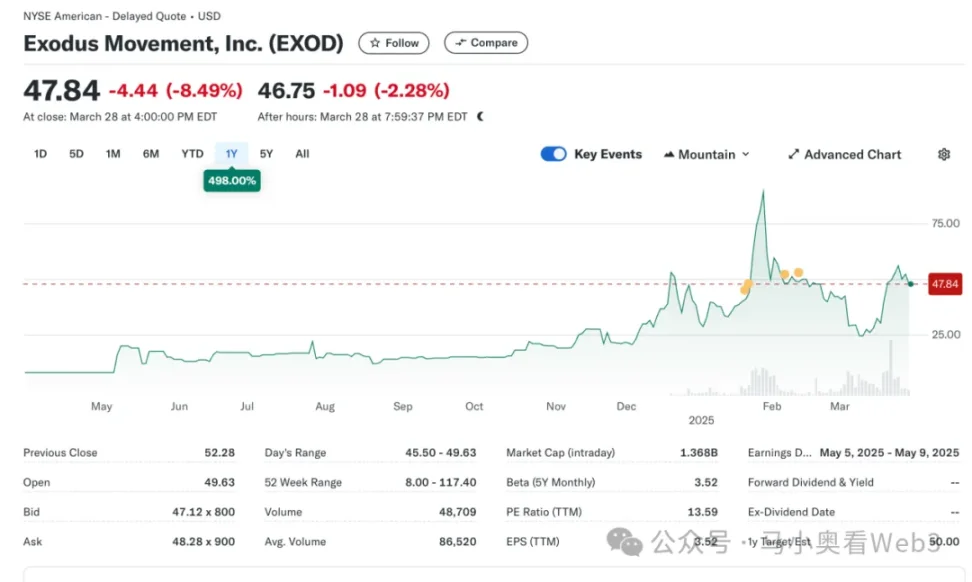

Next, let’s examine the current state of the stock RWA market. Overall, this market remains in its early stages and is still predominantly focused on U.S. equities. According to data from RWA.xyz, the total issuance in the current stock RWA market has reached $445.40M. However, notably, $429.84M of this volume is attributable to a single asset, EXOD—the on-chain stock issued by Exodus Movement, Inc., a software company focused on developing self-custody cryptocurrency wallets. Founded in 2015 and headquartered in Nebraska, USA, the company’s stock is listed on NYSE America and allows users to migrate their Class A common shares to the Algorand blockchain. Users can view the price of these on-chain assets directly within the Exodus Wallet. The company currently has a market capitalization of $1.5B.

Exodus has become the only U.S. company to tokenize its common stock on a blockchain. However, it should be noted that the on-chain EXOD token is merely a digital representation of its stock and does not carry voting, governance, economic, or any other rights. Additionally, the token cannot be directly traded or circulated on-chain.

This event carries symbolic significance, indicating a clear shift in the SEC’s stance toward on-chain stock assets. Indeed, Exodus’s attempt to issue on-chain stocks was not smooth sailing. In May 2024, Exodus first submitted an application for common stock tokenization, but due to the SEC’s unchanged regulatory posture at the time, the on-chain plan was initially rejected. However, in December 2024, after continuously refining its technical approach, compliance measures, and disclosure practices, Exodus ultimately received SEC approval and successfully completed the on-chain tokenization of its common stock. This milestone led to strong market enthusiasm for the company’s stock, pushing its price to record highs.

Aside from EXOD, the remaining ~$16M market share is primarily held by a Swiss project called Backed Finance. Through a compliant structure, Backed allows KYC-compliant users to pay USDC via its official primary market to mint on-chain stock tokens. Upon receiving the crypto assets, Backed converts them into USD and purchases COIN stock in the secondary market (with potential delays due to market opening hours). Once purchased, the stocks are held by a Swiss custodian bank, and a 1:1 minted bSTOCK token is sent to the user. The redemption process works in reverse. Reserve asset security is verified through regular proof-of-reserves reports issued by auditing firm Network Firm. On-chain investors can directly purchase these on-chain stock assets via DEXs like Balancer. Importantly, Backed does not grant stock token holders ownership of the underlying assets or any additional rights, including voting rights. Only KYC-compliant users can redeem USDC via the primary market.

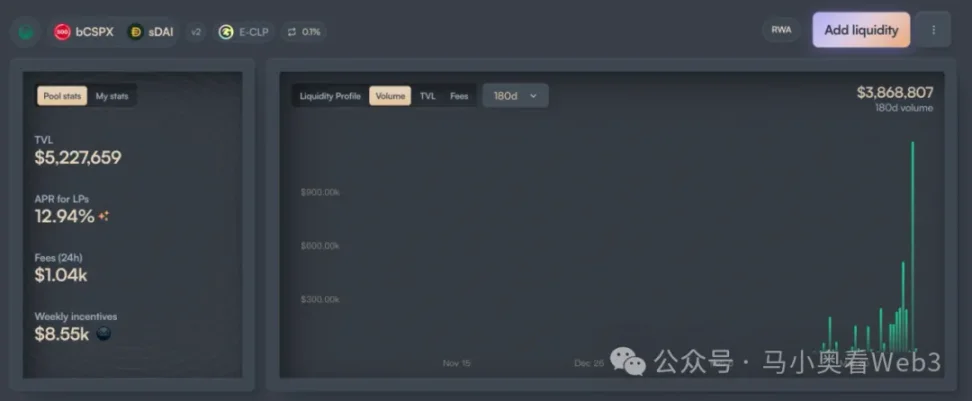

In terms of issuance volume, Backed’s adoption is concentrated in two assets: CSPX and COIN, with issuance of approximately $10M and $3M respectively. Regarding on-chain liquidity, it is primarily concentrated on Gnosis and Base chains, with around $6M in bCSPX liquidity and about $1M in wbCOIN liquidity. Trading volumes, however, remain low. For instance, the largest bCSPX liquidity pool, deployed on February 21, 2025, has recorded a cumulative trading volume of approximately $3.8M and around 400 transactions.

Another noteworthy development is the progress of Ondo Finance. With Ondo announcing its Ondo Chain and Ondo Global Markets strategic vision on February 6, 2025, tokenized stocks have become a core trading asset within Ondo Global Markets. Ondo, potentially leveraging broader TradFi resources and stronger technical capabilities, might accelerate the development of this sector—though this remains to be seen.

Opportunities and Challenges of Stock RWA

Next, we explore the opportunities and challenges of stock RWA. Typically, the market recognizes three main advantages of stock RWA:

-

24/7 Trading Platform: Due to blockchain’s inherent technical characteristics, tokenized stocks can operate around the clock. This eliminates the time constraints imposed by traditional exchanges, fully unlocking latent trading demand. For example, while Nasdaq has extended pre- and post-market sessions to offer near 24-hour trading, regular trading hours are still limited to weekdays. In contrast, a blockchain-based trading platform could achieve true 24/7 operation at a lower cost.

-

Low-Cost Access to U.S. Assets for Non-U.S. Users: With the widespread adoption of payment stablecoins, non-U.S. users can directly use stablecoins to trade U.S. assets, avoiding cross-border banking fees and settlement delays. For instance, if a Chinese investor uses Tiger Brokers to invest in U.S. stocks, even excluding currency exchange fees, the international wire transfer fee is about 0.1%, and settlement typically takes 1–3 business days. Using an on-chain channel eliminates both of these costs.

-

Financial Innovation Potential via Composability: Thanks to programmability, tokenized stocks can integrate with the DeFi ecosystem, unlocking greater potential for on-chain financial innovation, such as in lending and borrowing scenarios.

However, the author believes that tokenized stocks currently face two major uncertainties:

-

Pace of Regulatory Advancement: From the cases of EXOD and Backed, we see that current regulations still fail to adequately address the “equity-token parity” issue—ensuring that owning a tokenized stock confers the same legal rights as holding the physical stock, such as governance rights. This limits many transaction scenarios, such as corporate mergers conducted via secondary markets. Furthermore, the compliant use cases for tokenized stocks remain unclear, which hampers financial innovation. Thus, progress heavily depends on the pace of regulatory evolution. Given that the current Trump administration’s primary focus remains on manufacturing repatriation, the timeline for financial deregulation may be further delayed.

-

Adoption of Stablecoins: Historically, the core target users of tokenized stocks are likely not native crypto users, but rather traditional, non-U.S. investors in U.S. equities. For this group, the increasing adoption of stablecoins is a critical factor—and this is closely tied to stablecoin regulations in various countries. For example, Chinese investors face a 0.3%–1% premium when acquiring stablecoins via OTC markets compared to standard official channels, which is significantly higher than the cost of investing in U.S. stocks through traditional routes.

Therefore, in summary, in the short term, the author sees two market opportunities for stock RWA:

For publicly listed companies, they can follow the EXOD model and issue on-chain stock tokens. While there are few practical use cases in the short term, the potential for financial innovation may lead investors to assign higher valuations to such companies. For firms offering on-chain asset management services, this approach could transform investors into product users and convert their held shares into the company’s AUM, thereby enhancing business growth potential.

For tokenized high-dividend U.S. stocks, yield-focused DeFi protocols could become potential users. As market sentiment shifts, the yields from most native on-chain real-yield scenarios are expected to decline significantly. Yield-oriented DeFi protocols like Ethena will need to constantly seek alternative real-yield sources to maintain competitiveness—for example, as demonstrated by Ethena’s allocation to BUIDL. High-dividend stocks, typically from mature industries with stable earnings models, ample cash flow, and consistent shareholder payouts, often exhibit low volatility and strong resistance to economic cycles, making investment risks more manageable. Therefore, if high-dividend blue-chip stocks become available, they may gain traction among yield-seeking DeFi protocols.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News