IOSG | Current State of Crypto Infrastructure: Challenges and Opportunities

TechFlow Selected TechFlow Selected

IOSG | Current State of Crypto Infrastructure: Challenges and Opportunities

The cryptocurrency infrastructure sector is experiencing significant market fatigue.

Author: Yiping @IOSG

Challenges Facing Crypto Infrastructure

Market Fatigue and Declining Valuations

The cryptocurrency infrastructure sector is experiencing significant market fatigue. After years of explosive growth, valuations for infrastructure projects are shrinking, and investors have become more selective. This trend reflects an increasingly mature market where technological innovation alone is no longer sufficient to command high valuations.

Innovation Dilemma

Today’s infrastructure projects face a critical dilemma: most offer similar functionalities with minimal differentiation. Despite technical progress, we have yet to see breakthrough use cases that enable entirely new application categories. The ecosystem struggles to present a compelling value proposition for established Web2 platforms (such as X or Instagram) to migrate onto blockchain. Beyond decentralization, these platforms have little incentive to overhaul their existing operations. This fundamental adoption gap leaves trading and speculation as the dominant applications for most infrastructure layers, limiting the transformative potential of the field.

Overbuilding Infra, Underutilized Infrastructure

Many infrastructure projects tend to prioritize forward-looking technical innovation over developers’ actual needs. They often focus excessively on elements beyond core functionality—such as privacy, trust assumptions, verifiability, and transparency. This overly ambitious technical roadmap overlooks short-term market acceptance and practical application, not only increasing difficulty in early-stage market adoption but also making it hard for projects to obtain effective user feedback and validation.

The surge in such infrastructure projects has created a paradoxical situation — too many platforms competing for too few attractive applications. This imbalance has led to numerous “ghost chains” with extremely low actual usage and virtually no revenue generation, creating unsustainable economic models that rely primarily on token appreciation rather than genuine utility.

For example, although ZKVM technology is highly advanced, its verifiability does not currently address real-world challenges faced by blockchains or drive greater integration between Web2 applications and blockchain technology. As a result, ZKVM remains more of an idealized concept than a practical infrastructure product at this stage.

In contrast, cloud computing directly responds to a market-validated need: how to efficiently manage server resources across different configurations, times, and locations. This demand already had a relatively mature market foundation, and cloud platforms meet developers’ practical needs in rapid deployment, elastic scaling, and cost optimization through modular, API-driven services for servers, databases, and storage. Precisely because they solve real pain points for enterprises and developers, cloud technologies quickly gained market recognition and evolved into critical infrastructure underpinning the internet economy.

Breaking the Feedback Loop

A healthy crypto ecosystem requires an efficient feedback loop between application developers and infrastructure builders. Currently, this loop is broken — application developers are constrained by infrastructure limitations, while infrastructure teams lack clear signals about which features would drive real usage. Restoring this feedback mechanism is crucial for sustainable growth. Despite these challenges, infrastructure development remains lucrative: 35 out of the top 50 cryptocurrencies by market cap maintain their own infrastructure layer. However, the bar for success has risen significantly — new infrastructure projects must now demonstrate concrete use cases, strong user appeal, and compelling narratives to achieve meaningful valuations.

The Most Successful New Infrastructure Over the Past Year

Evolution of Blockchain Infrastructure

Past cycles of blockchain infrastructure were largely focused on addressing Ethereum's limitations, with projects positioning themselves as "faster and cheaper" alternatives while offering little truly innovative functionality. Today, the landscape has shifted dramatically, with recently successful projects introducing more diverse and specialized infrastructure solutions.

Most Influential New Projects

Over the past year, several infrastructure projects have achieved remarkable milestones through TGEs or major funding rounds. According to Cryptorank data, these represent the most influential new infrastructures in both primary and secondary markets:

Blockchain Infrastructure

-

Movement: MoveVM Ethereum Layer2

-

Berachain: Proof of Liquidity, EVM-compatible Layer1; Monad: High-performance EVM-compatible Layer1

-

Solayer: Re-staking based on Solana ecosystem, ultra-fast SVM

-

Succinct: ZK proof generation network and ZKVM

Emerging Infrastructure

-

Walrus: Blob storage solution

-

Aethir: GPU computing network

-

Double Zero: Decentralized physical fiber-optic network infrastructure

-

Eigenlayer: Provides Ethereum's security to new protocols

-

Humanity: Digital identity protocol platform

Bridge Between Web2 and Web3

-

Ondo: RWA Layer2

-

Plume: RWAFi blockchain

-

Story: AI-driven IP programmable platform

Below is an overview table of project data (as of 2024/4, for reference only):

Key Observations and Analysis

Based on analysis of recently successful infrastructure projects and the current market environment, several key observations can be distilled:

Market Maturity and Valuation Reset: From Tech Hype to Value Reversion

The most notable feature of today’s market is a shift in valuation logic. The earlier model of attracting investment purely through technical narratives and high FDV (fully diluted valuation) faces severe challenges.

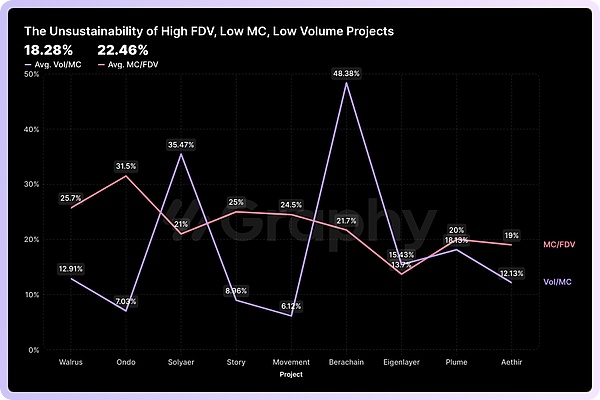

Unsustainable Token Economics

Many projects exhibit characteristics of high FDV, low market cap (MC), and low trading volume. This suggests that future large-scale token unlocks will bring sustained selling pressure. Even if projects achieve technical progress, prices may still fall due to token dilution, eroding user confidence and creating a negative feedback loop. This underscores that a sound, sustainable token economic model is as crucial to long-term infrastructure health as the technology itself.

Valuation Ceiling and Exit Challenges

Even successful projects appear to face an invisible ceiling of around $10 billion in valuation. This means that for investors to achieve outsized returns (e.g., 100x), entry must occur very early (at valuations below $50 million), highlighting the importance of timing and early judgment. The market no longer easily pays premiums for pure potential, demanding clearer proof of value.

Execution Trumps First-Mover Advantage

Not all projects pioneering new narratives achieve the highest valuations. For instance, although Double Zero, Story, and Eigenlayer were pioneers in their respective fields, many follow-up projects have achieved comparable or even higher valuations through superior execution, better market timing, or more optimized designs. This indicates that in an increasingly crowded market, high-quality execution, effective market strategy, and timing are becoming ever more critical.

Rise of Technical Pragmatism: Focus on Optimization, Integration, and Real Needs

Technical directions in infrastructure show a clear pragmatic tilt. The market increasingly favors solutions that solve real problems, optimize existing paradigms, or effectively connect to the real world.

Enduring Value of "Faster and Cheaper"

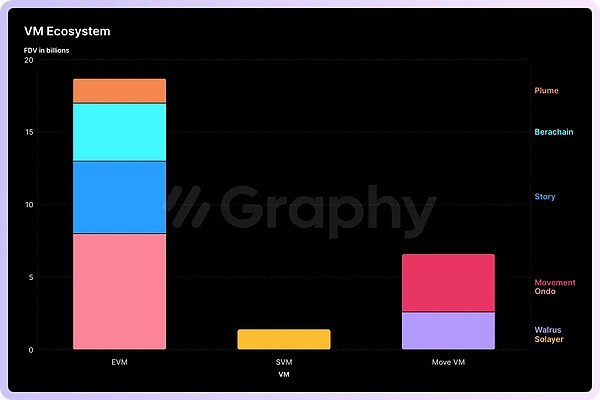

Despite market appetite for breakthrough innovation, demand for optimizing core blockchain performance remains strong. Projects like Monad, Movement, Berachain, and Solayer have achieved significant valuations by enhancing the performance of existing virtual machines (EVM, MoveVM, SVM) rather than introducing entirely new paradigms. This suggests that until the next killer application emerges, improvements in speed, cost, and efficiency remain central value propositions for infrastructure. Network-layer optimizations (e.g., Double Zero) and security enhancements (e.g., Succinct, Eigenlayer) also fall into this category.

Embracing the Real World, Connecting Web2

Projects bridging real-world applications and assets demonstrate strong market appeal. Ondo and Plume focus on RWA (real-world assets), while Story targets programmability of IP (intellectual property), all achieving high valuations. These projects apply blockchain technology to proven Web2 concepts (such as asset management and IP monetization), infusing them with programmability, global liquidity, and new financial possibilities. This lowers user learning curves and expands application scenarios.

DeFi and AI as Value Anchors

In terms of target use cases, finance (DeFi, RWA) and artificial intelligence (AI) are currently the two domains most recognized by the market and capable of supporting high-valued infrastructure. This indicates that infrastructure enabling these high-potential areas is more likely to gain favor from capital and the market.

Cooling Enthusiasm for Some New Narratives

Meanwhile, some infrastructure narratives once highly anticipated—such as pure gaming chains, Rollup-as-a-Service (RaaS), dedicated validator layers, multi-VM chains, Agent chains, certain DePIN, and Desci—have yet to produce billion-dollar leading projects this cycle. This may reflect that these areas either lack sufficient technical maturity or have not yet identified clear, large-scale market demands and sustainable business models.

Ecosystem Synergy and Precise Storytelling: Dual Engines for Value Amplification

Beyond technology and market positioning, building robust ecosystems and conducting effective market communication have become key levers for infrastructure project success.

Network Effects of Ecosystems

The vast majority of projects valued above $1 billion are committed to building or integrating into dedicated ecosystems. Whether L1/L2s attract developers to build apps, or platforms like Eigenlayer provide shared security to other protocols, the importance of network effects is evident. Ecosystems with multiple composable projects create far greater value than isolated solutions, forming positive feedback loops that attract more users, developers, and capital.

Layered Narrative, Precise Communication

Infrastructure must serve two core audiences—end users and developers—whose needs and priorities differ significantly. For end users, complex technologies need to be translated into intuitive "experience" stories (e.g., fast transactions, low costs, ease of use), emphasizing direct benefits. For developers, detailed explanations of technical "capabilities" (e.g., performance metrics, developer tools, scalability, security) are required, providing professional and precise information for evaluation. Successful projects often tailor their messaging strategies to different audiences, effectively conveying their value propositions.

Future Investment Opportunities in Blockchain Infrastructure

Target Underserved Web2 Markets

The most promising infrastructure opportunities will target large Web2 markets that blockchain solutions have not yet adequately served. These projects can create globally accessible markets while introducing improved financialization mechanisms.

Create New Infrastructure Categories

Compared to incremental improvements, entirely new infrastructure categories will generate substantial value, such as:

-

Intent-based infrastructure: Protocols enabling users to express desired outcomes instead of specific transactions, automatically handling execution optimization.

-

Privacy for every blockchain—HTTPS infrastructure for Web3

Infrastructure That Meets User Needs and Generates Stable Revenue

As the blockchain industry matures, the long-term value of infrastructure is gradually returning to its core functions: meeting real user needs and generating sustainable revenue. Early market enthusiasm may be driven by expectations and technical narratives, but ultimately, infrastructure that fails to effectively serve users and establish a robust economic model will struggle to survive.

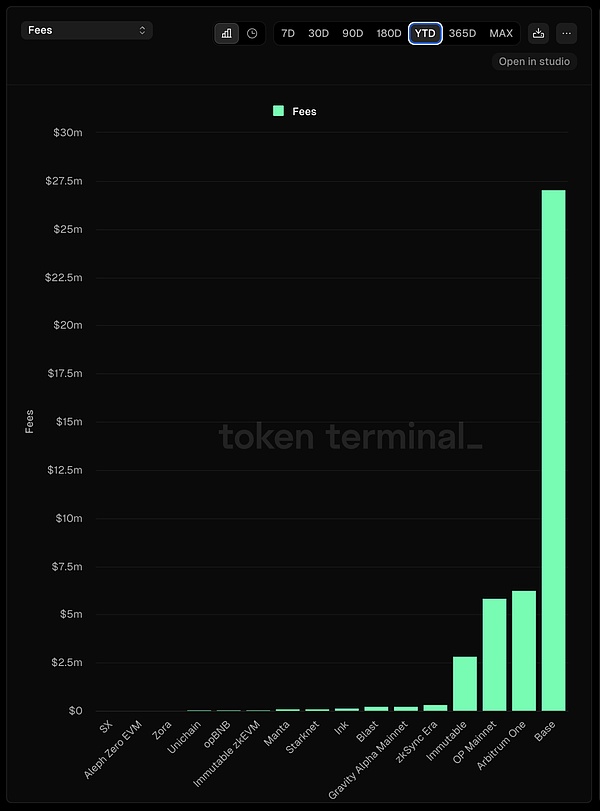

Steady revenue streams are the lifeblood of healthy project operations. They must not only cover high operational costs but also deliver tangible returns to ecosystem participants (e.g., token holders, validators), such as through token buybacks or participant incentives. Currently, some leading L2s like Base, Arbitrum, and OP have achieved notable protocol revenues. Base generates $27.5M in annual fees, while Arbitrum and OP are around $7M. However, due to shifts in investor preferences this cycle, their token prices remain relatively low, reflecting a misalignment between revenue and valuation. Top-tier Layer2s currently have FDVs around 500x their annual protocol revenue. They are actively working to correct this mismatch through measures like token buybacks.

Infrastructure without revenue support relies more heavily on selling tokens to sustain operations—a strategy ill-equipped to withstand market cycle fluctuations. Stable revenue is direct market validation that a project solves real problems and delivers effective services. For developers, the infrastructure should enable hundredfold efficiency gains in implementing widely used complex use cases, or make previously impossible functions feasible. For end users, it should deliver smoother experiences, lower usage costs, and richer features.

Web2 Apps Actively Integrating Blockchain

Building revolutionary applications from scratch requires substantial time and resources. A more efficient approach is to emulate the recent AI revolution: directly integrate blockchain functionality into existing Web2 apps. The astonishing speed of AI adoption was driven less by standalone AI apps and more by thousands of established platforms integrating AI features into their existing user experiences.

Therefore, blockchain infrastructure must prioritize seamless integration paths, enabling Web2 apps to incrementally adopt blockchain features without disrupting their core user experience. The most successful infrastructure will allow familiar applications to offer ownership, trading, and financial functions without requiring users to understand complex blockchain concepts or navigate entirely new interfaces.

Financial incentives may drive this wave of integration. Just as AI features helped Web2 companies create premium tiers and new revenue streams, blockchain integration can unlock new monetization models through tokenization, partial ownership, and programmable royalties. Infrastructure that makes these benefits easily accessible while minimizing technical complexity will catalyze the next phase of mainstream blockchain adoption.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News

![Axe Compute [NASDAQ: AGPU] completes corporate restructuring (formerly POAI), enterprise-grade decentralized GPU computing power Aethir officially enters the mainstream market](https://upload.techflowpost.com//upload/images/20251212/2025121221124297058230.png)