The New Asset Revolution: RWA Comprehensive Research and Investment Opportunity Analysis

TechFlow Selected TechFlow Selected

The New Asset Revolution: RWA Comprehensive Research and Investment Opportunity Analysis

The RWA industry is transitioning from a technology-driven "first half" to a "second half" defined by institutional demand and regulatory compliance.

Author: Pharos Research

Executive Summary

Real-world asset (RWA) tokenization has become a core narrative in the current crypto cycle, aiming to bring hundreds of trillions of dollars worth of traditional financial assets on-chain and build next-generation financial infrastructure connecting the real economy with decentralized finance (DeFi). Despite immense market potential (projected by Boston Consulting Group to reach $16 trillion by 2030), its development still faces three structural bottlenecks: regulatory compliance, asset mapping, and secondary market liquidity.

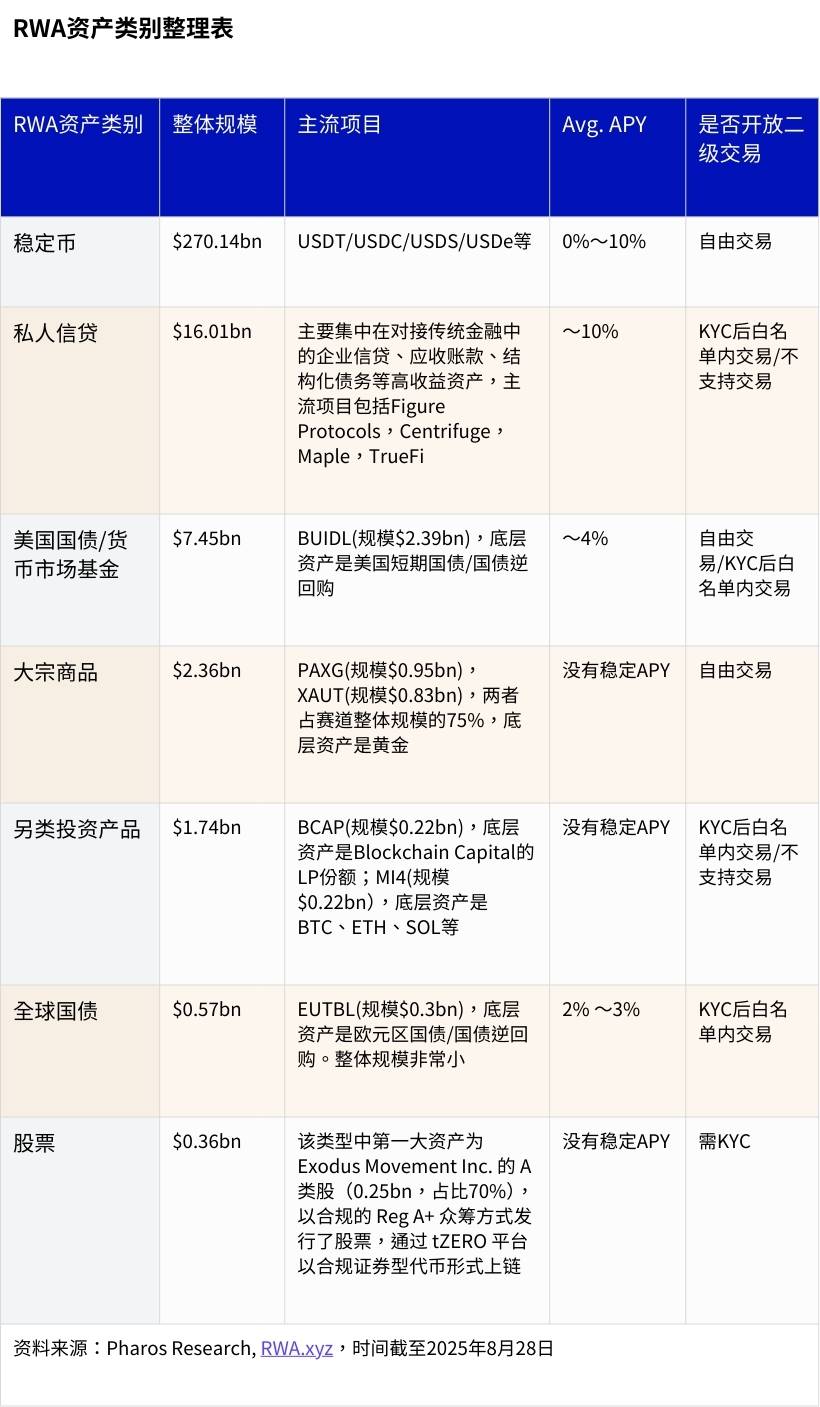

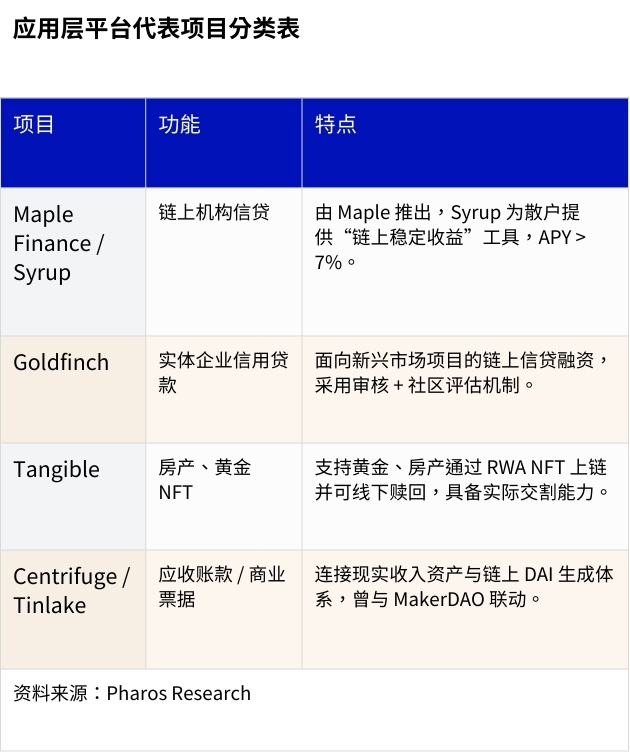

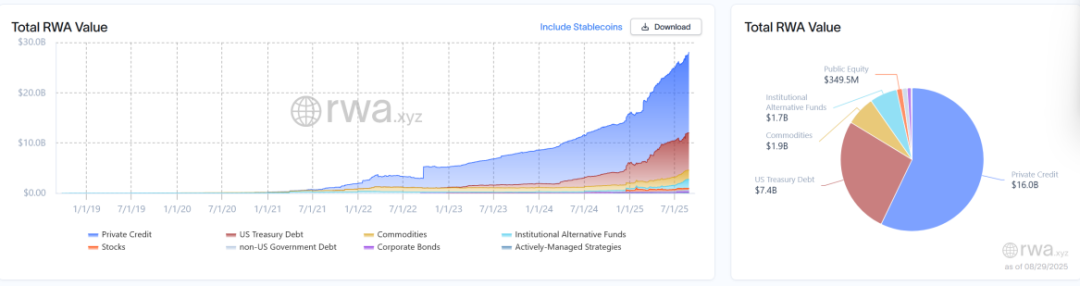

As of end-August 2025, the global non-stablecoin RWA market size is approximately $28 billion, up 114% year-on-year. The market structure is dominated by debt-type assets, with private credit accounting for an absolute majority at $16 billion (about 56%), followed by U.S. Treasuries ($7.5 billion) and commodities ($2.4 billion). Ethereum serves as the primary network hosting RWA activity today.

This report provides an in-depth analysis of three core sectors:

• Private Credit: As the largest RWA sector by volume, its core value lies in improving efficiency and transparency in traditional lending processes. However, pre-loan underwriting, risk control, and default resolution remain highly dependent on off-chain legal frameworks. The market is transitioning from early exploration to a phase of institutional diversification led by platforms such as Maple and Figure.

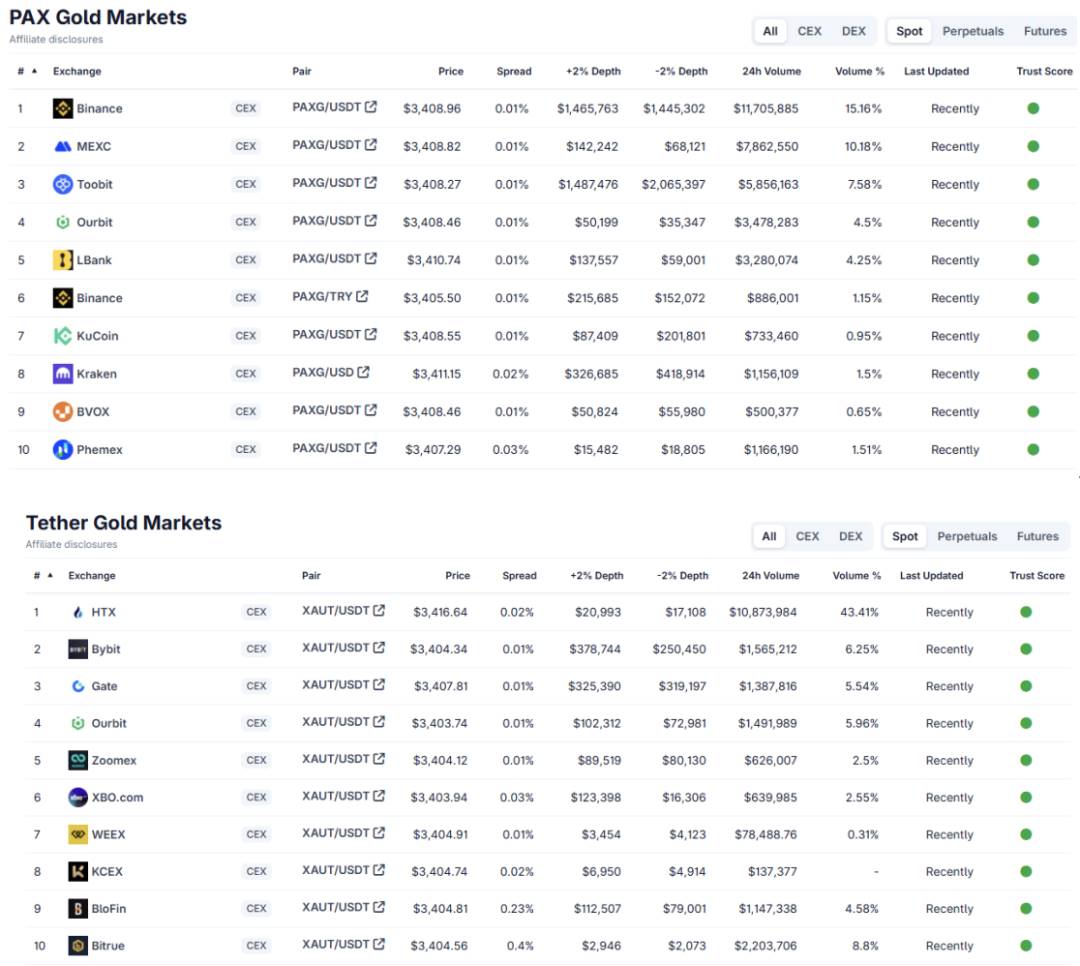

• Commodities: The market is dominated by a duopoly of gold-backed tokens—PAXG and XAUT—which together hold over 75% of market share. Liquidity is concentrated primarily on centralized exchanges, with limited integration into DeFi ecosystems. Future growth will depend on expanding issuers and underlying assets (e.g., other precious metals beyond gold and silver, agricultural products).

• Stocks: This sector remains in its very early stages, with a total market cap (around $360 million) negligible compared to traditional stock markets and suffering from severe illiquidity—yet possessing enormous growth potential. The market is evolving along two paths: one represented by Robinhood, which prioritizes high compliance at the expense of composability via a “walled garden” model; the other exemplified by xStocks, pursuing deep integration with DeFi through an “open financial bridge” model. The entry of major players like Ondo Finance holding full compliance licenses signals intensifying competition ahead.

Conclusion: The RWA industry is transitioning from a technology-driven "first half" to a "second half" defined by institutional demand and regulatory compliance. Its long-term value does not lie in short-term speculation, but rather in the steady expansion of on-chain asset scale, meaningful deepening of secondary market liquidity, and robust refinement of legal and technical frameworks. RWA will establish next-generation financial infrastructure linking real-world value with the blockchain world, significantly advancing a more transparent, efficient, and inclusive global financial system.

Keywords: RWA; Tokenization; Regulatory Compliance; Financial Infrastructure

01 Introduction

As the crypto market moves away from leveraged speculative gains toward sustainable growth models deeply tied to the real economy, the tokenization of real-world assets (Real World Assets, RWA) has emerged as the most visionary core narrative of this cycle. It not only opens vast channels for on-chain systems to access real-world value but also offers a digital migration path for hundreds of trillions of dollars in traditional financial assets toward higher efficiency and greater liquidity. At its essence, RWA acts as a key "connector" for building next-generation financial markets; its maturity will directly determine whether blockchain technology can transcend closed, crypto-native loops and integrate into the broader future of the global economy.

Although institutions such as Boston Consulting Group (BCG) project a potential market space exceeding ten trillion dollars[1], the path to "onboarding assets" is far from smooth. Translating grand visions into viable commercial practices, RWA must overcome three structural hurdles: regulatory compliance, asset mapping, and market liquidity. How can legal equivalence between on-chain tokens and off-chain rights be ensured? How can effective secondary market liquidity be created while maintaining compliance? These are fundamental challenges practitioners are actively working to solve.

To comprehensively present this complex and dynamic field, this report systematically analyzes the topic from macro to micro levels. It begins by outlining the RWA industry landscape, including market size, growth drivers, and core bottlenecks. Then, it focuses on the three fastest-growing core sectors—private credit, commodities, and equities—conducting deep dives into each sector’s market structure, operational models, and leading players. Through this report, we aim to provide readers with a clear blueprint of the current state, future trends, and potential opportunities within the RWA ecosystem.

02 Industry Overview and Trend Analysis

2.1 Definition of RWA

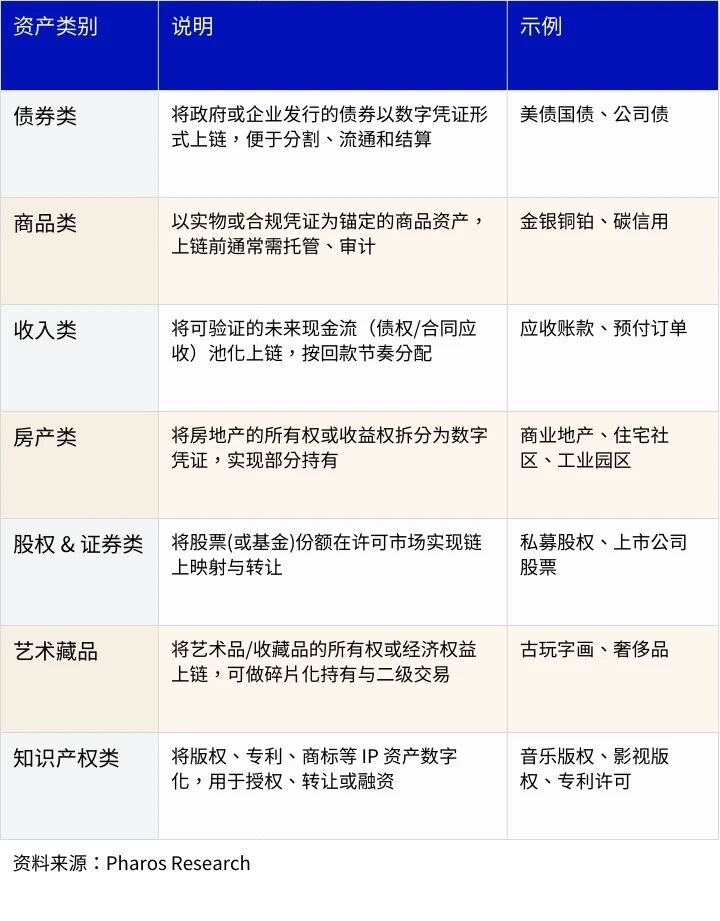

Real-world assets (Real World Assets, RWA) refer to tangible, economically valuable assets existing off-chain that are converted into tradable digital tokens on-chain through issuance, mapping, pledging, or fractionalization. The core logic involves leveraging smart contracts and open financial protocols to enable efficient utilization, transparent operation, and flexible composition of assets within blockchain systems.

Currently, the scope of RWA covers a broad range of categories across traditional finance and physical assets. Government and corporate bonds, commodities, real estate, equity securities, artworks, and intellectual property can all be tokenized for verification, division, and trading on-chain.

The advantages of bringing RWAs on-chain are mainly reflected in three areas: liquidity, transparency, and cost efficiency. On one hand, on-chain conversion enhances global circulation and settlement efficiency while significantly reducing intermediary costs. On the other, the traceability of blockchains and smart contract mechanisms make transactions and management more transparent. Moreover, once on-chain, RWAs can further integrate deeply with decentralized finance (DeFi) ecosystems, creating new use cases and yield models, giving rise to the concept of "RWAfi".

Notably, some RWA products have already achieved breakthrough applications, providing investors access to asset classes previously difficult to reach in traditional markets. For example, Goldfinch’s Private Debt FoF product is backed by private debt assets from large funds such as Ares. In traditional finance, these products have extremely high investment thresholds, whereas on the Goldfinch platform, investors can participate with just $100. Similarly, products like USDY, backed by U.S. Treasuries, effectively address compliance barriers preventing certain country-based investors from directly purchasing U.S. Treasury bonds.

2.2 Market Size and Growth Potential

2.2.1 Market Size

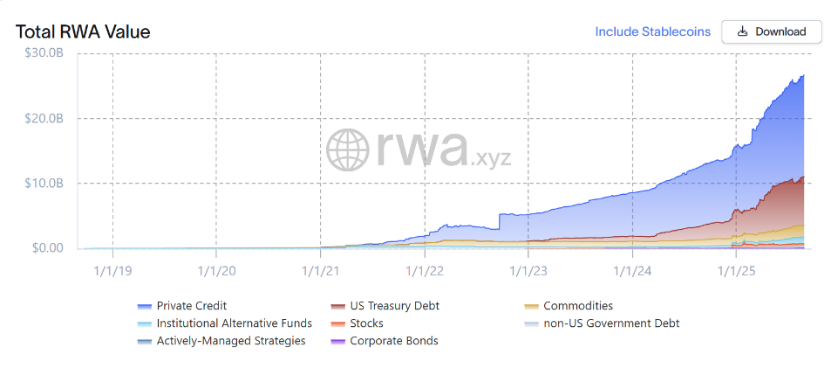

As of end-August 2025, the global on-chain non-stablecoin RWA market totals about $28 billion, representing a year-on-year growth rate close to 114%, and a compound annual growth rate (CAGR) of approximately 111% over the past three years. Debt-type RWAs, particularly U.S. Treasuries and private credit, are the main drivers, with respective three-year CAGRs of 1,523% and 104%.

Source: Pharos Research, RWA.xyz

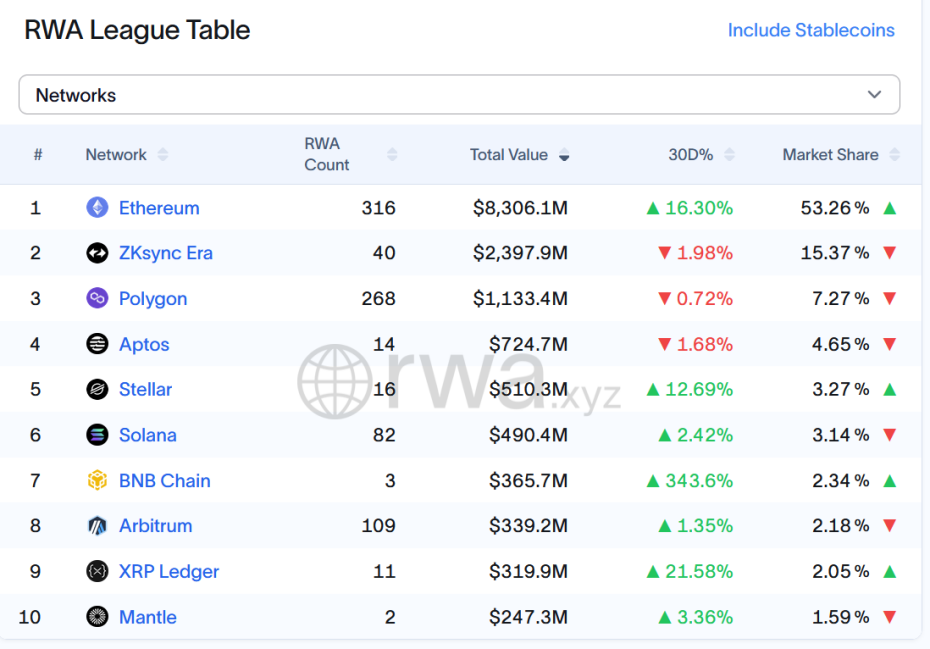

In terms of chain distribution, Ethereum remains the core platform for RWAs, capturing about 53.3% of the market share with $8.31 billion in managed assets. ZKsync Era ranks second with 15.4% market share and approximately $2.4 billion in scale.

Note: There is inconsistency in RWA.xyz's data collection methodology regarding "commodities"; another source reports $1.9bn. After cross-verification, we adopt the $2.36bn figure.

By asset category: the top three RWA segments are Private Credit, US Treasury Debt, and Commodities, currently valued at $16 billion, $7.5 billion, and $2.4 billion respectively, accounting for approximately 56%, 27%, and 9%. Private Credit primarily connects high-yield assets such as corporate loans, accounts receivable, and structured debt. Key platforms include Figure Protocols, Centrifuge, Maple, and TrueFi. The flagship product in the U.S. Treasuries segment is BUIDL (valued at $2.39 billion), whose underlying assets cover short-term Treasuries and reverse repos. The commodities segment is primarily driven by PAXG and XAUT, together comprising 75% of the gold tokenization market.

Note: All sources above are from RWA.xyz, compiled by Pharos Research

Source: Pharos Research, RWA.xyz

2.2.2 Growth Potential

Looking ahead, the market widely believes that RWA’s expansion potential remains far from saturation. According to a joint research report titled "Relevance of On-Chain Asset Tokenization in ‘Crypto Winter’" published in July 2022 by Boston Consulting Company (BCG) and digital securities platform ADDX, the global tokenized asset market could reach $16 trillion by 2030—over 600 times the current level[1].

A significant benchmark is the development of crypto ETFs. As of market close on August 27, 2025, Bitcoin ETFs totaled $144.6 billion and Ethereum ETFs $32.6 billion, collectively about 6.6 times the size of the non-stablecoin RWA market. Structurally, their roles in capital markets differ markedly: ETFs serve primarily as "entry points," packaging on-chain crypto assets into traditional financial products to allow conventional capital to enter; RWA, conversely, acts as an "export channel," mapping off-chain real assets onto-chain to create new market foundations for DeFi ecosystems.

ETFs are significant for establishing compliant pathways and gaining recognition at the public fund level, yet their investment targets remain confined to BTC and ETH, primarily meeting speculative and hedging demands. In contrast, RWA offers broader asset coverage and support from real yields. Bonds, gold, real estate, and corporate credit can all form the underlying portfolios for on-chain assets, enabling DeFi protocols to carry richer real-world value. Compared to ETFs, which essentially repackage existing crypto assets, RWA holds greater potential for deep structural integration with traditional finance. Through smart contracts and on-chain account systems, RWA can be embedded into multiple DeFi applications such as collateralized lending, yield aggregation, and stablecoin backing, driving the formation of new financial market structures.

Therefore, in terms of scale potential, ETF development caters more to hundred-billion-dollar inflows, while RWA’s ceiling corresponds to the over $100 trillion global investable financial assets. The former aligns closer to derivative layers in traditional markets, while the latter directly accesses underlying assets in primary and secondary markets. RWA’s development path is more complex, but its long-term significance and depth of ecosystem integration clearly surpass those of ETFs.

2.3 Industry Drivers

The continued rise in RWA adoption is driven by three main forces: interest rate cycles, institutional participation, and regulatory progress.

2.3.1 Rising Interest Rate Cycle: Real Yields Anchor On-Chain Allocation

Since 2022, the global economy has entered a high-interest-rate environment, especially with the U.S. federal funds rate persistently above 5%, significantly boosting the attractiveness of traditional assets like U.S. Treasuries and money market funds. Meanwhile, as the crypto market undergoes deleveraging and reduced risk appetite during bull-bear transitions, low risk-free rates in traditional DeFi and saturated yield strategies have become increasingly apparent. Investor demand for "stable, predictable" income-generating assets is accelerating. RWA fits precisely here: by mapping U.S. Treasuries, bonds, and other verifiable income instruments on-chain, it offers on-chain capital an alternative allocation with "low volatility + real interest," re-establishing a link between on-chain returns and off-chain interest rate centers.

2.3.2 Leading Institutions Driving Adoption: Supply and Credibility Go On-Chain Together

Starting in 2023, global financial giants such as BlackRock, Franklin Templeton, WisdomTree, JPMorgan Chase, and Citigroup have successively entered the RWA space. Their approaches include issuing on-chain fund shares, tokenizing U.S. Treasury products, and launching tokenized asset funds, attempting to achieve "natively on-chain" assets rather than simple bridging. With sovereign and institutional credit on one side and on-chain settlement and composability on the other, the convergence of trust and efficiency has significantly increased market acceptance and sustainability of RWA. Notable examples include: Franklin Templeton issuing U.S. money market fund shares as BENJI tokens on Polygon and Stellar; BlackRock investing in Securitize and planning to issue tokenized funds on Ethereum; and Citigroup piloting on-chain settlement for certain custodial bonds. These initiatives expand the supply of compliant on-chain assets and strengthen market expectations through major institutional involvement.

2.3.3 Regulatory Framework Taking Shape: Marginal Opening of Compliance Channels

Unlike the unregulated ICO era, RWA typically involves heavily regulated assets such as securities, bonds, and funds, requiring advancement within existing legal and licensing systems. Over the past two years, regulators in multiple jurisdictions have clarified the legal basis for asset tokenization, token issuance, and holder rights, providing institutional safeguards for pilot projects and scaling.

Note: Reg A+ is a "light-touch" public offering mechanism under U.S. securities law, allowing issuers to offer stocks or tokens to retail investors without a full IPO, capped at $75 million annually. Exodus Movement, INX, and tZERO have all completed asset offerings under this framework.

In practical implementation, Switzerland’s Sygnum Bank has issued tokenized bonds, enabling investors to participate in corporate financing via blockchain. Hong Kong has supported China Construction Bank in issuing a HK$200 million tokenized green bond, seen as one of Asia’s first government-supported tokenized bond projects. These explorations demonstrate that, given legal certainty and clear holder rights, RWA productization and scalability follow replicable paths.

2.4 Key Players in the Industry

Across the full "asset–issuance–trading–data" value chain, the RWA ecosystem generally comprises four types of participants: asset issuers, infrastructure providers, application-layer platforms, and data service providers. These entities collaborate through specialized roles in compliance, custody, clearing/settlement, and user access.

2.4.1 Asset Issuers (Token Issuers)

Asset issuers convert real-world assets (e.g., U.S. Treasuries, gold, real estate) into on-chain tradable tokens and bear core responsibilities including compliance structuring, yield distribution, and custodial oversight.

2.4.2 Infrastructure Providers (RWA Infra & Issuance Chains)

Infrastructure providers offer foundational capabilities such as issuance, identity verification, compliance support, and asset custody, commonly found in dedicated public chains, permissioned chains, or compliant issuance platforms.

2.4.3 Application-Layer Platforms (Access Products & User Protocols)

Application-layer platforms provide investment and portfolio management interfaces for users, often coupled with DeFi modules to connect retail investors with on-chain RWAs.

2.4.4 Data and Index Service Providers (Oracles & Indices)

Data and index providers deliver price feeds, indices, and reference rates to on-chain protocols, serving as bridges between off-chain information and on-chain contracts.

2.5 Industry Bottlenecks

In the short term, RWA’s scalable advancement is not hindered by a single technical bottleneck, but rather by a set of profound structural constraints. These stem from the dynamic evolution of business models, inherent limitations in market liquidity, and fundamental challenges in compliance frameworks and asset mapping, ultimately shaping the current unique audience structure and market landscape.

2.5.1 Dynamic Evolution of Business Models: High Maturity and Information Verification Costs

Most RWA projects today remain in exploratory and experimental phases, frequently shifting core products and strategic positioning. This leads to significant time lags and content discrepancies between publicly disclosed information and actual operations. A typical case is that press releases or news articles from months ago no longer accurately reflect current business priorities—for instance, projects like Credix have shifted from early-stage narratives around credit platforms to PayFi product matrices. Such frequent business iterations impose high information verification costs and assessment difficulties on external institutions conducting due diligence and ongoing monitoring.

2.5.2 Structural Liquidity Bottleneck: Permissioned Trading Remains Dominant

In terms of trading structure, the liquidity of most RWA products today is strictly limited. Whether LP tokens from private credit (Private Credit) or mainstream tokenized Treasury products, their trading and transfer are generally restricted to whitelisted addresses. Only a few asset classes allow permissionless, freely circulating secondary markets, primarily falling into two categories: (1) highly standardized commodities (e.g., gold); (2) U.S. Treasury products (such as $USDY) issued by institutions like Ondo Finance under specific compliance frameworks with broader circulation. This permissioned-dominated market structure severely limits effective price discovery and exit efficiency for holders.

2.5.3 Fundamental Challenges in Compliance and Asset Mapping: Bridging Cross-Domain Governance Gaps

The core of RWA lies in establishing reliable mappings between on-chain digital tokens and off-chain legal rights and physical assets. Current mainstream solutions adopt a "hybrid architecture": compliance checks (KYC/AML) are conducted off-chain through SPVs or regulated custodians, followed by issuing standardized tokens (e.g., bTokens) on-chain for circulation. However, amid divergent regulatory policies across jurisdictions and the absence of on-chain identity systems, the sustainability of this model is questionable, raising several issues:

• Regulatory arbitrage and policy risks: Many projects lack securities issuance licenses in their operating jurisdictions, instead using intricate structures to circumvent the legal definition of "securities." Operating in regulatory gray zones exposes them to tightening regulations, potentially leading to compliance crises and forced shutdowns if the regulatory environment shifts.

• Fragility in asset verification and rights protection: Whether on-chain tokens maintain accurate and reliable correspondence with off-chain physical assets is a top concern for investors. Currently, users mostly rely on audit reports or asset proofs issued unilaterally by project teams or custodians, lacking uniform standards and legal enforceability. More critically, when extreme events occur—such as defaults, early redemptions, or SPV bankruptcies—the claims process and recovery procedures for on-chain token holders are extremely opaque. Smart contracts alone cannot automatically execute complex off-chain legal proceedings. The incident involving Maple Finance, where LPs were unable to redeem due to borrower defaults, is a typical example, ultimately resolved through off-chain legal channels.

• Legal dilemmas in DeFi integration: Integrating RWA as collateral into DeFi lending or automated market maker (AMM) protocols is a key direction for enhancing its utility, but introduces new challenges in legal classification. Existing legal frameworks do not clearly define such hybrid products, exposing both project teams and users to potential accusations of "illegal securities issuance" or "cross-border transaction violations."

These issues necessitate a fundamental reassessment of the ambitious "asset mapping" narrative, increasing uncertainty in compliance and regulation. Specific market cases reflect responses to these concerns: Backed Finance voluntarily limits trading to whitelisted addresses to ensure compliance, sacrificing potential liquidity; RealT’s on-chain property ownership tokens still heavily depend on KYC verification mechanisms within U.S. entities for final value realization.

In summary, given these constraints, the current market positioning of RWA exhibits a "middle-layer effect." On one hand, traditional institutions remain highly cautious about on-chain operational risks and compliance uncertainties. On the other, crypto-native users seeking high volatility and short-term gains find RWA yields unattractive. Consequently, RWA’s core target audience primarily consists of traditional finance retail investors (TradFi Retail) seeking stable asset allocation and large on-chain capital holders (Whales)—a demand particularly pronounced in high-inflation countries globally (e.g., Latin America, Southeast Asia).

03 Core Sector Analysis: Private Credit

3.1 Market Overview

Among various RWA forms (excluding stablecoins), private credit consistently ranks among the largest by volume and share. With $16.0B in Active Outstanding Loans (loans disbursed but not yet repaid), it accounts for approximately 56% of this sector.

Source: Pharos Research, RWA.xyz

As a key branch of private finance, the private credit market, pioneered since the 1980s and 1990s by giants like Blackstone and KKR, has evolved into a mature asset class. Especially after the 2008 financial crisis, as traditional bank lending tightened, private credit rapidly filled the gap, becoming a vital funding source for small and medium enterprises (SMEs). By 2023, its global market size exceeded $1.6 trillion. This asset class primarily offers privately traded loans to SMEs unable to secure financing from public markets or banks due to various reasons.

The operation of private credit can be clearly divided into two layers: off-chain and on-chain. Off-chain, the source of assets remains legally binding loan contracts, typically held and managed by a special purpose vehicle (SPV). On-chain, protocols encapsulate these SPV-held debts into standardized digital tokens using technical standards such as ERC-20 or NFTs.

Key characteristics of private credit include: high investment thresholds, targeting family offices and professional private funds as qualified investors seeking high fixed-income returns; naturally limited liquidity due to low transparency, often perceived as a "black box," with long loan durations making early exits difficult. Nonetheless, private credit features standardized fixed-income structures with clear interest rates, repayment schedules, and maturities. Backed by SPVs (special purpose vehicles) and KYC-compliant frameworks, disclosure and audit standards are increasingly institutionalized. Common underlying assets include SME loans, invoice and accounts receivable financing, trade finance, consumer loans, and mortgage loans.

3.2 Value and Limitations of Tokenization Models

The core value of on-chain private credit lies in reshaping and optimizing traditional workflows using blockchain technology. Protocols directly connect capital providers and borrowers, using smart contracts to automate historically manual processes—custody, fund transfers, repayment management, and interest distribution—into visible, traceable, on-chain procedures. For investors, this simplifies investment to token subscription, with tokens clearly representing entitlements to principal and interest from underlying loans. Ultimately, this significantly improves overall processing efficiency and transparency.

It must be emphasized that tokenization does not alter the offline nature and dependencies of these assets. Borrowers, pre-loan underwriting, collateral management, repayments, and default handling all occur off-chain. The on-chain layer functions more as a digital certificate and settlement layer. If an off-chain default occurs, on-chain tokens cannot automatically exercise rights and must still rely on traditional legal and compliance frameworks. Thus, SPVs act as off-chain compliance intermediaries—investors do not directly hold loan assets but indirectly own debt claims through SPVs, with registration, operations, audits, and default procedures governed by off-chain legal systems. Borrower onboarding, KYC, credit evaluation, and risk control are centrally managed by centralized entities, making open matching unlike algorithmic models such as Aave difficult to achieve.

3.3 Key Players

Since emerging in 2021, the cumulative issuance volume of on-chain private credit (including repaid portions) has surpassed $29 billion, with over 2,500 loan projects launched. The current average annual percentage rate (APR) stands at 9.75%.[2] The market landscape is gradually clarifying, with a group of leading players standing out due to stable operations and high total value locked (TVL), including Maple, Goldfinch, Figure, Centrifuge, PACT, and Tradable.

3.3.1 Maple: Stable Institutional-Grade On-Chain Lending Market

Project website:

https://maple.finance/

Official X account:

https://x.com/maplefinance

Maple Finance is an institutional-grade lending platform, initially focused on unsecured lending. Following the Orthogonal Trading default incident, the platform has strategically shifted toward more conservative over-collateralized models (requiring 150% collateral ratio) and tri-party agreement models. Under this model, an independent third party monitors collateral value, while Maple focuses on executing smart contracts. If collateral value drops below a preset threshold and the borrower fails to replenish collateral within 24 hours of receiving a margin call, the third party triggers liquidation to protect lenders' interests. As of end-August 2025, Maple Finance manages over $3.3 billion in assets, with cumulative lending exceeding $8.9 billion.[3]

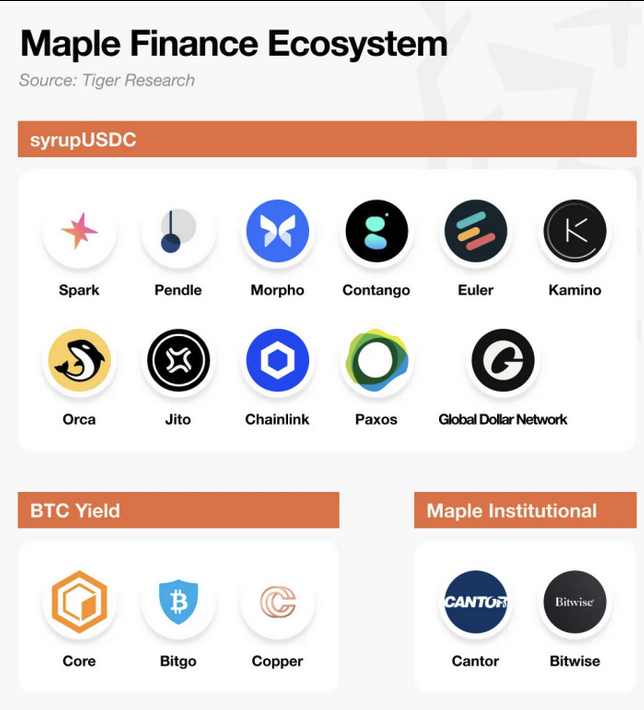

Source: Pharos Research, Maple Finance, Tiger Research

Source: Pharos Research, Maple Finance

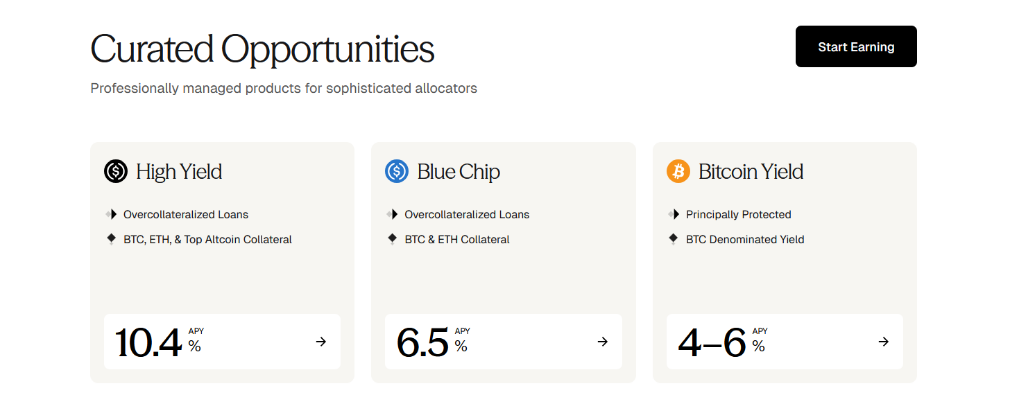

The platform's core products are divided into two categories—"Permissioned Access" and "Open Access"—to meet the needs of institutional and retail investors respectively.

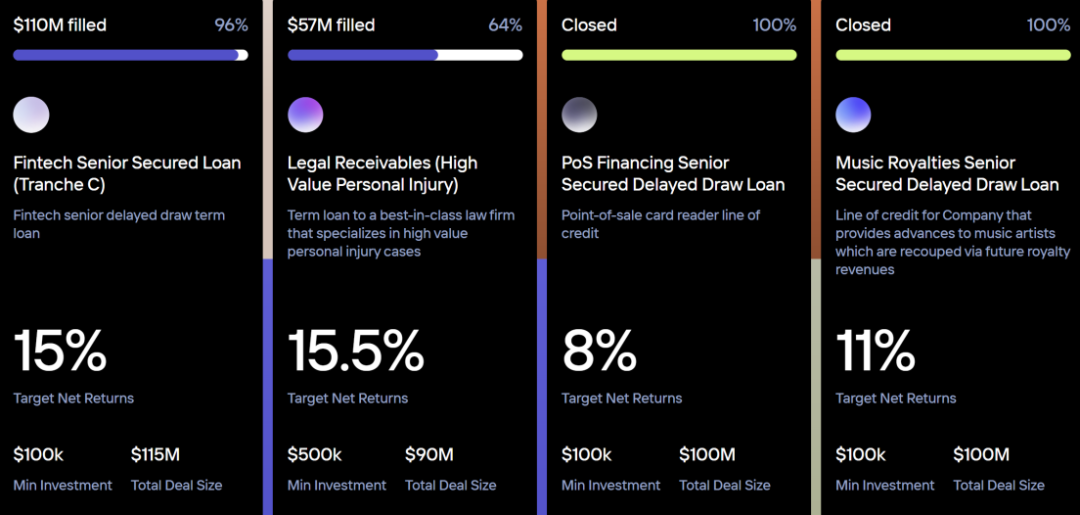

"Permissioned Access" products are designed for institutional clients, featuring KYC verification and a minimum investment threshold of $100,000. They offer 24/7 white-glove services similar to private banking, providing personalized support in solution design, fund management, and problem resolution. This series includes three products:

• Blue Chip Lending Pool: Designed for risk-averse investors, accepting only mature crypto assets like Bitcoin and Ethereum as collateral, investing in high-credit-rated loan projects, offering an annual yield of about 6.5%.

• High Yield Lending Pool: Targeting investors seeking higher returns who can tolerate corresponding risks, its core strategy amplifies yield through asset staking or secondary lending, rather than passively holding collateral, achieving annual yields up to 10.4%.

• Bitcoin Yield Product (BTC Yield): Aligned with growing institutional demand for Bitcoin allocation, this product leverages Core DAO's dual staking mechanism. Institutional clients can deposit their Bitcoin with institutional custodians like BitGo or Copper, earning 4–6% staking rewards by committing not to sell during the lock-up period.

Source: Pharos Research, Maple Finance

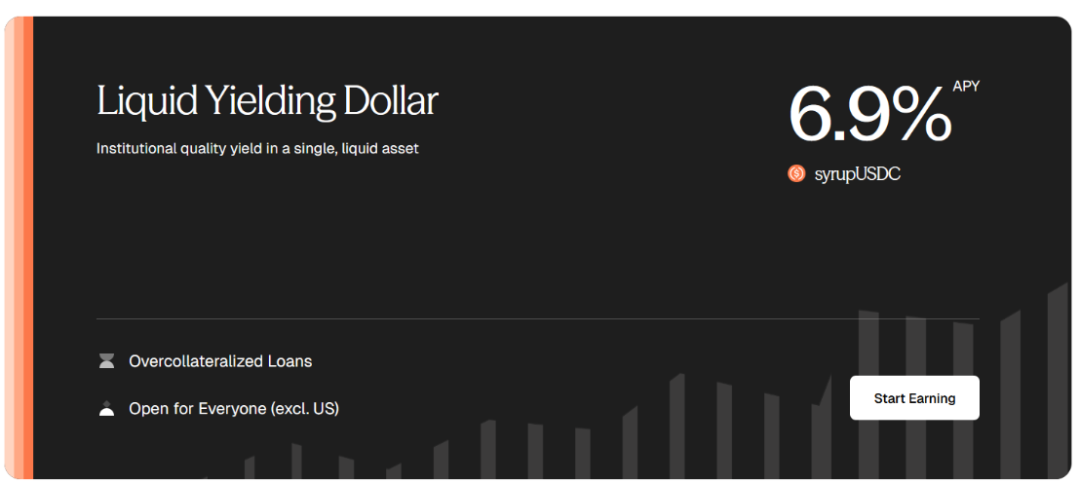

To enable participation by ordinary retail investors, Maple Finance launched the Syrup series of liquidity provider (LP) tokens in late 2024. As of end-August 2025, SyrupUSDC’s total value locked (TVL) exceeds $2.2 billion, and SyrupUSDT exceeds $152 million, both offering an annual yield of approximately 6.9%.[4] Funds raised through Syrup are lent to institutional borrowers from Maple’s Blue Chip and High Yield pools, with interest distributed directly to Syrup depositors. Although sharing similar underlying asset structures with institutional pools, its risks are independently isolated.

While Syrup’s direct yield is slightly lower than institutional products, Maple introduced the "Drips" reward system to incentivize long-term participation. This system calculates additional rewards every four hours via compounding interest, allowing users to exchange accumulated points for the platform’s governance token SYRUP at the end of each quarter. Staking SYRUP itself earns a 2.98% annual yield, and the platform allocates 20% of its lending fee revenue (ranging from 0.5% to 2%) to buy back and distribute to SYRUP stakers on public markets.

In addition, to enhance liquidity and composability, SyrupUSDC has been integrated into multiple leading DeFi protocols, including:

• Spark: As a sub-DAO of the Sky ecosystem, Spark has allocated $300 million into the SyrupUSDC pool, sourcing yield for its stablecoin.

• Pendle: Users can trade the principal and yield components of SyrupUSDC (PT-SyrupUSDC and YT-SyrupUSDC) on Pendle, receiving a 3x Drips reward multiplier.

• Morpho / Kamino: Within these lending protocols, SyrupUSDC and its derivatives can serve as eligible collateral to borrow other assets like USDT or USDC.

3.3.2 Goldfinch: On-Chain Unsecured Credit Protocol Focused on Emerging Markets

Project website:

https://www.goldfinch.finance/

Official X account:

https://x.com/goldfinch_fi

In the on-chain private credit sector, Goldfinch stands out for its unique focus on "unsecured credit." The protocol’s core business model involves financing fintech companies and lending institutions in emerging markets, with borrowers widely distributed across Latin America, Southeast Asia, and Africa. The underlying assets primarily consist of consumer credit, education loans, and microenterprise financing—examples include funding support for Greenway, an Indian electric vehicle company, and QuickCheck, a Nigerian consumer lending platform. To date, Goldfinch has facilitated over $160 million in loans.[7]

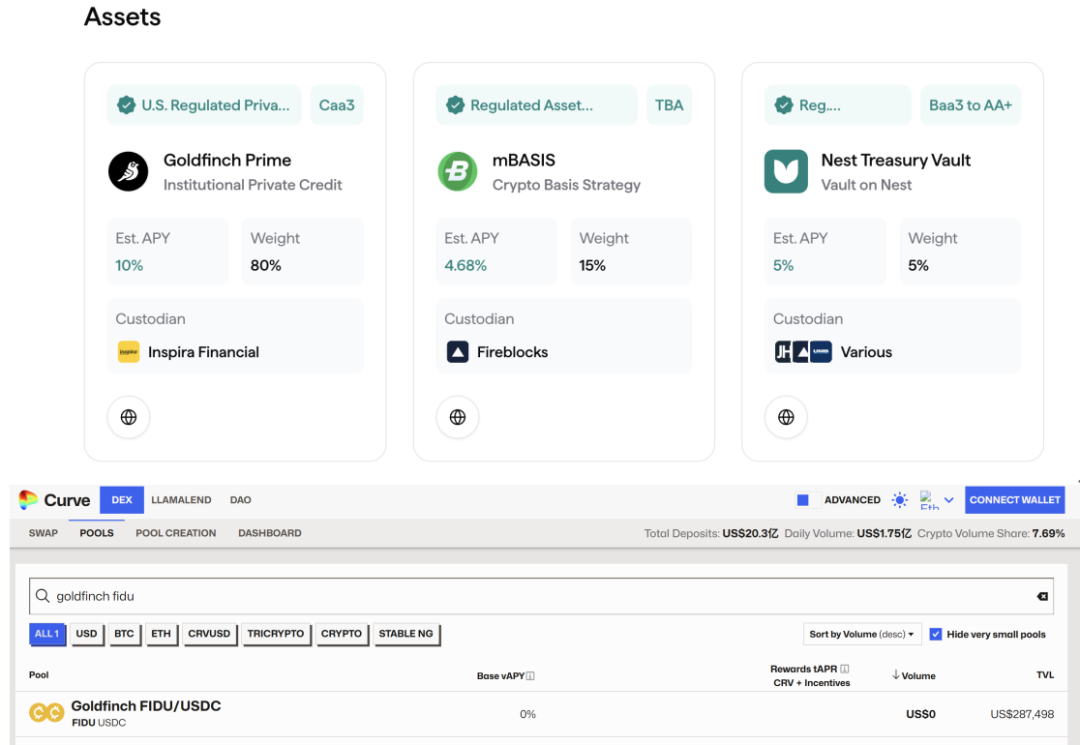

Source: Pharos Research, Goldfinch Finance, Curve

The protocol’s structure revolves around a main funding pool (Senior Pool) and multiple independent borrower pools (Borrower Pool). In a typical loan transaction, the main pool supplies about 90% of the funds, automatically allocated by the protocol’s smart contract. The remaining portion is provided by "backers," playing a role similar to junior investors in traditional finance, accessible only to qualified investors. Ordinary investors, acting as liquidity providers (LP), can earn FIDU tokens by depositing USDC into the main pool. FIDU represents their proportional claim across all borrowing projects and entitles them to monthly or quarterly interest payments. This investment channel is open to retail investors outside the U.S. and qualified investors in the U.S., with a minimum investment threshold of $100. While FIDU tokens theoretically qualify for additional GFI token incentives in Curve’s liquidity pools, their secondary market liquidity is currently extremely limited.

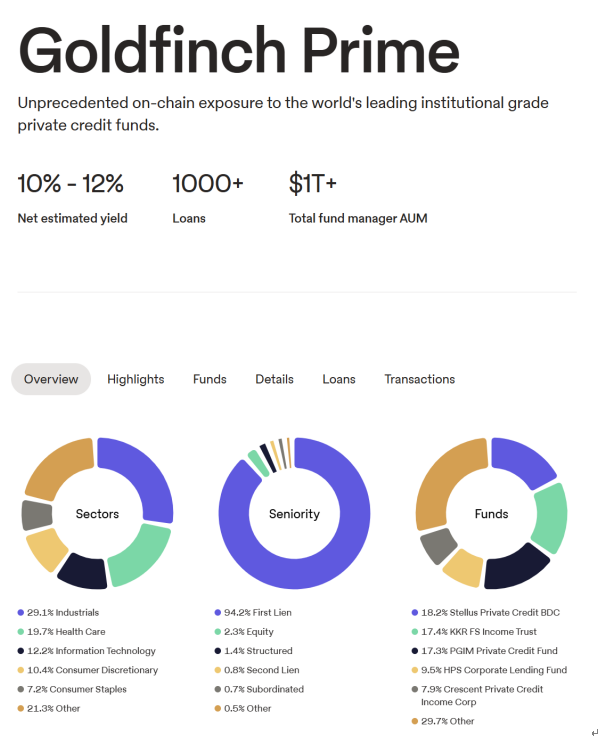

Additionally, to expand institutional-level business, Goldfinch launched Goldfinch Prime, a private credit asset pool. This product packages assets from top-tier private equity funds such as Apollo, Ares, Golub, and KKR onto the blockchain and, via Plume-supported Nest Vault, allows retail users to deposit USDC for an annual yield of about 7%. However, this pool has a 10-day redemption lock-up period, and its current TVL of $440,000 is relatively small.

Source: Pharos Research, Goldfinch Finance

3.3.3 Figure: Institution-Grade Credit Ecosystem Built on a Compliant Permissioned Chain

Project website:

https://www.figure.com/

Official X account:

https://x.com/Figure

As a representative force in the U.S. private credit RWA ecosystem, Figure has become one of the largest on-chain loan issuers by volume. Its business spans multiple categories, including home equity lines of credit (HELOC), refinancing loans, and consumer credit, with cumulative loan issuance surpassing $16 billion[5]. Unlike Goldfinch, Figure’s underlying assets are primarily secured loans, extending credit against real-world properties or qualified credit.

Figure’s core operational mechanism relies on its self-developed Provenance blockchain. The protocol uses special purpose vehicles (SPVs) to hold and manage off-chain loan assets and issues corresponding tokenized securities on the Provenance chain. These tokens are not publicly available but are exclusively offered to institutional investors such as funds and asset management companies. Redemption and yield distribution follow strict off-chain compliance procedures, ensuring legality throughout.

Figure’s ecosystem exhibits a highly closed nature. Provenance is a permissioned blockchain built on the Cosmos SDK, where running validator nodes, deploying smart contracts, and transferring assets all require strict whitelisting and compliance review. This characteristic prevents Figure’s RWA assets from freely compositing with the broader DeFi ecosystem and currently offers no direct on-chain investment gateway for retail investors. Thanks to its compliance framework, Figure has established deep partnerships with several traditional financial giants, including Franklin Templeton, Apollo Global Management, Jefferies, and Hamilton Lane. Market expectations suggest these institutions may leverage the Provenance blockchain in the future to issue their own tokenized private credit products.

3.3.4 Centrifuge: Strategic Evolution from Market Pioneer to Compliance Infrastructure

Project website:

https://centrifuge.io/

Official X account:

https://x.com/centrifuge

As an early explorer in the on-chain private credit RWA space, Centrifuge successfully issued multiple real-world asset-backed funding pools via its Tinlake framework, covering diversified assets such as real estate mortgages (New Silver), logistics accounts receivable (ConsolFreight), and microloans (Branch). These asset pools were isolated through independent SPVs and innovatively adopted a tiered structure, issuing DROP tokens representing senior, stable-yield positions and TIN tokens representing junior, high-risk/high-return positions. This model achieved notable success between 2021 and 2023 and briefly became a benchmark project for MakerDAO, enabling the minting of DAI against real-world collateralized debt. Currently, this architecture has fulfilled its historical mission, with the Tinlake frontend integrated into the new Centrifuge App, and relevant asset pools entering repayment and wind-down phases.

Source: Pharos Research, Centrifuge

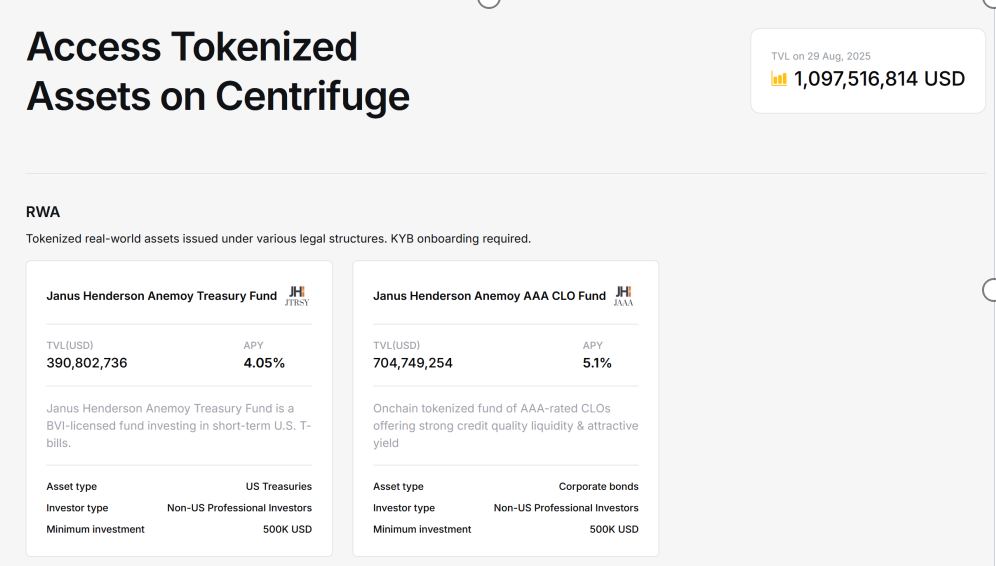

Currently, Centrifuge offers investors access to two main products: tokenized U.S. Treasury products issued by renowned fund manager Janus Henderson, and structured AAA-rated Collateralized Loan Obligation (CLO) fund shares. CLOs bundle multiple floating-rate, lower-credit-quality loans and use SPVs to create structured tranches catering to different investor risk profiles. Both investment products are exclusive to qualified investors and issued on the Ethereum network.

Moreover, recent developments clearly indicate Centrifuge’s strategic shift toward compliance-focused scenarios and permissioned blockchains. In May 2025, the project announced joining Converge—a compliant RWA-dedicated chain co-launched by Securitize and Ethena—as a founding partner. In June, Centrifuge partnered with S&P Dow Jones to jointly explore developing a "Proof-of-Index" mechanism. Then in July, Centrifuge V3 officially launched, integrating Wormhole’s cross-chain architecture to achieve unified multi-chain RWA infrastructure across six major EVM chains, significantly enhancing its cross-chain liquidity and asset management capabilities.

3.3.5 Tradable: High-Performance Institutional Credit Platform Based on ZK Technology

Project website:

https://www.tradable.xyz/

Official X account:

https://x.com/tradable_xyz

Tradable currently focuses on bringing institutional-grade private credit assets onto blockchain and has achieved notable scale in this domain. The platform has cumulatively processed over $2.1 billion in on-chain private credit assets, completed 37 independent transactions, and delivered an average annual yield exceeding 11% to investors.[6] Its core business is providing institutions with an efficient, compliant channel for tokenized credit investments.

To unify high performance with compliance, Tradable builds on a permissioned blockchain based on ZkSync Era (ZK Stack) technology while maintaining compatibility with the Ethereum ecosystem. Its underlying smart contract system embeds strict pre-configured compliance mechanisms, including KYC/AML verification, accredited investor certification, and asset transfer restrictions. This architecture defines its primary clientele as institutions and qualified investors, excluding general retail participation. All prospective investors must first open an account and pass a comprehensive compliance review before gaining eligibility. Additionally, the platform sets high participation thresholds per transaction, typically requiring no less than $100,000.

Source: Pharos Research, Tradable

3.3.6 PACT: Diversified Credit Solutions Incubated in the Aptos Ecosystem

Project website:

https://pactfoundation.com/

Official X account:

https://x.com/pactconsortium

Supported and incubated by the Aptos Foundation, the PACT protocol aims to provide diverse financing solutions for emerging markets and specific regions through tokenized private credit products. To ensure the legal validity of its on-chain assets, PACT adopts an innovative compliance framework: encrypting personally identifiable information (PII) stored off-chain while verifying it on-chain via hash values, complying with the U.S. Uniform Electronic Transactions Act (UETA). All participants (borrowers and investors) must pass KYC/AML reviews before being authorized to apply for loans, issue NFTs, and conduct lending contract transactions on-chain.

Within the PACT ecosystem, each loan is represented by a dynamically updatable NFT, recording loan terms, repayment status, and transfer rights. Through collaboration with BitGo, these debt-representing NFTs support resale and trading in secondary markets. To address secure storage of large-scale RWA data, PACT partners with Shelby Protocol (jointly launched by Aptos Labs and Jump Crypto), leveraging its high-performance, low-latency decentralized storage capability.

To date, the PACT platform has facilitated over $1 billion in loans. Its product portfolio demonstrates high geographic and risk diversity. Selected representative products include:

• BSFG-EM-1: As its flagship product, this pool offers short-term microloans to individual consumers and micro-entrepreneurs in emerging markets, with a volume exceeding $160 million and an interest rate as high as 64.05%.

• BSFG-EM-NPA-1/2: These are specialized asset pools for non-performing or defaulted loans, totaling $184 million, available only to qualified investors, with undisclosed yields.

• BSFG-CAD-1: Secured by Canadian residential properties, sized at $44.51 million, using a senior/subordinated tranched structure. Its low interest rate of 0.13% likely corresponds to the lower-risk senior tranche, but liquidity is constrained due to asset lock-up.

• BSFG-AD-1 and BSFG-KES-1: These pools serve SMEs in the UAE and retail credit markets in Kenya, sized at $20.05 million and $6.39 million respectively, with interest rates reflecting high-growth, high-risk market characteristics at 15.48% and 115.45%.

Sources above: Pharos Research, PACT Foundation

Source: Pharos Research, RWA.xyz

Looking forward, PACT plans to integrate with mainstream DeFi protocols, aiming to introduce its credit tokens into broader decentralized finance scenarios such as revolving credit, leveraged strategies, and liquidity mining, potentially offering investors annual yields between 6% and 15%.

3.4 Trends and Future Outlook

The on-chain private credit sector is transitioning from an early exploratory phase to a period of institutional-led, compliance-based scalable expansion. While top asset managers have taken initial steps, the next stage’s exponential growth will depend on the breadth and depth of broader institutional participation—expanding from a few pioneers to widespread entry by numerous mid-sized and smaller financial institutions. The true catalyst for massive market scale will be a sweeping wave of "institutionalization" on both the asset and capital sides, a profound structural transformation expected to reshape the sector across three dimensions:

First, institutional capital will inevitably demand mature regulatory frameworks. "Compliance-first" and "permissioned" environments will become industry standards, replacing the previous "wild west" growth model.

Second, upon this compliance foundation, the ultimate value of the sector will be unlocked through deep integration into the DeFi ecosystem, transforming from isolated "asset islands" offering yield into efficient, composable assets usable as collateral in mainstream lending protocols.

Third, to meet increasingly complex institutional demands, underlying assets will innovate beyond standardized loans, extending into more diverse products such as Real Estate Investment Trusts (REITs) and structured credits (CLOs), collectively shaping a more mature, integrated, and expansive on-chain credit landscape.

These three trends are interlinked, collectively outlining a clear path toward maturity for the on-chain private credit sector. The future market will no longer be mere on-chain replication, but a deep fusion of traditional finance’s asset depth and compliance rigor with DeFi’s efficient settlement and composability. At that point, on-chain private credit is poised to shed its early labels of high risk and high volatility, truly evolving into a "stable yield cornerstone" for the entire on-chain economy, delivering sustainable, low-correlation cash flows rooted in the real economy to the digital asset world.

04 Core Sector Analysis: Commodities

4.1 Market Overview and Operational Mechanism

Within the RWA (excluding stablecoins) sector, tokenized commodities represent a significant component. Currently ranking third by asset size at $2.4 billion, they occupy 8.6% of the total market. Particularly noteworthy is their strong growth momentum, recording an approximate 136% increase in asset size since the beginning of the year.

The issuance mechanism for such RWAs generally follows a standardized process involving three core steps: physical custody, on-chain mapping, and redeemability, forming a complete closed loop. First, issuers deposit physical assets like gold into regulated professional custodians, ensuring each unit of on-chain token is backed by real physical assets. Next, through smart contracts on blockchains (primarily Ethereum), tokens are issued at a 1:1 ratio, pegged to the physical assets. Finally, users can redeem their tokens for the corresponding physical assets upon meeting compliance requirements. Although KYC verification is typically required for minting and burning tokens in the primary market, as standard ERC-20 tokens, they can circulate freely in secondary markets. Their number of on-chain holders (~83,000) and monthly trading volume (~$1.13 billion) significantly exceed those of other RWA categories like tokenized stocks, though trading activity remains concentrated on centralized exchanges.

Source: Pharos Research, RWA.xyz

Source: Pharos Research, CoinGecko

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News