Stablecoins: Innovation, Infrastructure, and the Global Regulatory Landscape

TechFlow Selected TechFlow Selected

Stablecoins: Innovation, Infrastructure, and the Global Regulatory Landscape

Stablecoins are evolving from crypto speculation tools into an entirely new category of digital financial infrastructure.

By: Jsquare Research Team

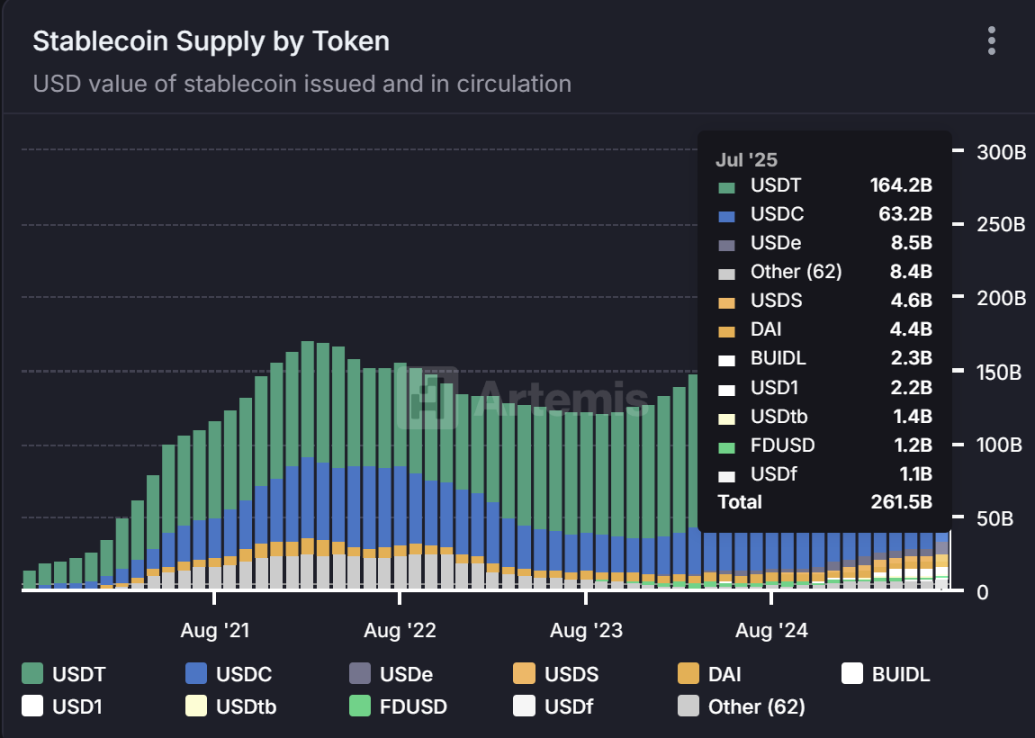

Stablecoins are evolving from crypto speculation tools into a new category of digital financial infrastructure. As of August 2025, the total market capitalization of stablecoins has surpassed $271.4 billion, but more important than size is their composition, yield mechanisms, and diverging use cases.

We believe the market is undergoing a decisive shift: from dollar-denominated tokens focused solely on liquidity to composable, yield-bearing settlement assets directly linked to real-world cash flows and corporate systems. This article explores the evolution of stablecoin types and regulatory dynamics across global regions.

Stablecoin Market Size

Stablecoins have broken out of the crypto sandbox. Supply growth is driven primarily by USDT, USDC, and emerging institutional tokens such as PayPal USD (PYUSD). Today, annual on-chain settlement volumes exceed the combined totals of Visa and Mastercard—reaching $27.6 trillion in 2024 alone. Originally convenient dollar-pegged tokens, stablecoins have evolved into mature, yield-bearing, cross-chain cash layers. Regulators, payment networks, and treasurers are increasingly treating stablecoins with the same standards applied to bank money. Circle’s successful IPO in June 2025, raising $624 million with a $6.9 billion valuation, underscores market confidence in regulated stablecoin issuers.

As of August 2025, the total circulating supply of stablecoins stands at $269.5 billion. USDT dominates with $154.4 billion (57.3%), followed by USDC at $65.8 billion (24.4%). Other significant stablecoins include USDe ($10.5 billion), DAI ($4.1 billion), and USDS ($4.8 billion), while smaller or emerging stablecoins such as FDUSD, PYUSD, and USDX each hold less than 1% market share. This concentration reflects both the dominance of traditional issuers and growing pressure on new entrants to differentiate through compliance and strategic integration into financial infrastructure.

Source: https://app.artemis.xyz/stablecoins

Stablecoins Are Evolving Into Yield Engines

With money market rates exceeding 4% in 2024, issuers began tokenizing U.S. Treasuries and passing coupon yields to holders. Currently, the market cap of tokenized Treasuries exceeds $5.8 billion, maintaining over 20% quarterly growth despite rate volatility. Broader RWA (real-world asset) tokenization—including short-term credit, receivables, and even real estate shares—has pushed the total on-chain RWA market cap to $35 billion, with analysts projecting it will surpass $50 billion by year-end.

The difference in 2024 lies not only in scale but in the direct linkage between on-chain yields and real-world assets (RWAs). A year ago, holding stablecoins was about capital preservation; today, structures exist that offer 4–10% annual percentage yield (APY):

-

sUSDe (Ethena): Generates yield via delta-neutral derivatives and basis trades, with a market cap of $3.49 billion.

-

USDM (Mountain): Short-term Treasuries tokenized under a Bermuda-regulated wrapper, market cap $47.8 million.

-

USDY (Ondo): Tokenized short-term government bonds, market cap $636 million.

-

Plume Yield Tokens: Distribute money market fund (MMF) yields cross-chain, market cap $235 million.

(Data source: CoinGecko, June 17, 2025)

We believe this area warrants close attention. Over $5.8 billion in tokenized Treasuries are now in circulation, and yield-bearing stablecoins are growing at a compound rate exceeding 25% per quarter. These assets blur the lines between stablecoins, money market funds, and tokenized fixed-income products.

By Q2 2026, yield-bearing stablecoins will account for over 15% of total stablecoin supply (currently around 3.5%). They are no longer purely DeFi-native products but compliant, composable base-layer assets deeply integrated into the RWA ecosystem.

Where Smart Money Flows: Three Trends Shaping the Next Stablecoin Leaders

1. Enterprise Integration

PYUSD is no marketing gimmick—the $952 million market cap stablecoin is deeply integrated into Venmo wallets and supports merchant rewards. JPMorgan’s JPM Coin facilitates over $10 billion in daily transaction settlements within treasury systems. As stablecoins accelerate integration into ERP systems, payroll, and digital banking architectures, we expect the sector to grow tenfold.

2. Cross-Chain Interoperability

Blockchain fragmentation once constrained industry development, but protocols like LayerZero, Axelar, and CCIP are solving this with omnichain capabilities. The next generation of mainstream stablecoins will be natively omnichain—"mint once, use everywhere."

3. Regulatory Certification as Moat

Certifications such as "MAS-approved" and "MiCA-compliant" have become key differentiators in the stablecoin market, offering tangible distribution advantages in B2B and corporate cash flows. Compliant issuers’ tokens will command a trust premium in secondary markets.

4. Infrastructure Maturity

In CeFi, Stripe’s $1.1 billion acquisition of Bridge Network signals traditional payment giants’ commitment to stablecoin rails. In DeFi, liquidity hubs like Curve, stablecoin swap pools, and collateralized lending platforms significantly improve capital efficiency. As the ecosystem matures, stablecoins are becoming deeply embedded across financial system layers—more trusted and functionally robust infrastructure.

The Regulatory Arbitrage Window Is Closing

Until 2023, stablecoin issuance operated in a regulatory gray zone. That window is now rapidly closing. The latest regulatory landscape:

1. United States (GENIUS Act)—On July 18, 2025, the Guaranteed Enterprise Note Issuance and Unified Stability Act (GENIUS Act) took effect, marking a new era for dollar stablecoin regulation. Alongside the 2025 Digital Asset Market Clarity Act (CLARITY Act), it explicitly defines compliant payment stablecoins as non-securities, aiming to provide regulatory certainty, strengthen consumer protection, and maintain U.S. competitiveness in global digital asset markets. Key provisions:

-

100% Reserves Requirement: Stablecoins must be fully backed 1:1 by cash and short-term U.S. Treasuries. High-risk assets (including crypto or credit exposures) are prohibited, and rehypothecation is banned except for limited liquidity needs.

-

Transparency & Certification: Issuers must publish monthly audited reserve reports; CEOs/CFOs must personally certify report accuracy.

-

Bankruptcy Protection: Stablecoin reserves are held in separate trusts; holders’ redemption rights take priority over other creditors (similar to bank deposit protections).

-

Yield Ban: Algorithmic stablecoins (e.g., UST) and fractional-reserve models are prohibited; only fully collateralized "payment stablecoins" are recognized; interest payments to holders are banned to avoid securities classification.

The GENIUS Act’s strict reserve and transparency requirements are expected to boost consumer confidence and drive broader stablecoin adoption. A clear regulatory framework will also attract more institutional participation, reinforcing U.S. global leadership in digital asset regulation.

GENIUS Act policy link: https://www.whitehouse.gov/fact-sheets/2025/07/fact-sheet-president-donald-j-trump-signs-genius-act-into-law/

2.European Union (MiCA Regulation)—The EU’s Markets in Crypto-Assets Regulation (MiCA) implements the following:

-

Licensing & Oversight: Only licensed e-money institutions or credit institutions may issue fiat-backed stablecoins (EMTs); the European Banking Authority (EBA) supervises "significant" stablecoins; euro/dollar stablecoin issuers must hold e-money or banking licenses.

-

Full Reserves: Reserves must match 1:1 with circulating supply; over 60% of reserves for major stablecoins must be held in EU banks; only low-risk assets (government bonds, bank deposits) allowed.

-

Usage Limits: Non-euro stablecoins exceeding 1 million transactions or €200 million in daily volume face mandatory restrictions on further expansion.

-

Algorithmic Ban: Fully unbacked algorithmic stablecoins are banned; only redeemable, prudently backed tokens are permitted.

As of July 2025, the EBA has received over 50 stablecoin licensing applications, including major players like Circle (issuer of USDC), adjusting operations to comply with MiCA.

MiCA regulation link: https://www.esma.europa.eu/esmas-activities/digital-finance-and-innovation/markets-crypto-assets-regulation-mica

3.UK Regulatory Framework—The UK treats stablecoins as regulated payment instruments, with core rules:

-

Reserves: Only fully fiat-collateralized stablecoins allowed; reserves must consist of bank deposits or short-term Treasuries—highly liquid assets.

-

No Yield: Interest payments to holders are banned; reserve income goes to issuers (for operational costs).

-

Licensing: Issuers require FCA authorization (new e-money/payment institution license); must meet financial-grade prudential standards: capital adequacy, liquidity management, T+1 rigid redemption commitment.

-

Innovation Focus: Encourages banks and licensed entities to issue payment stablecoins; emphasizes cross-border remittances and micropayments.

FCA guidance link: https://www.fca.org.uk/publications/consultation-papers/cp25-14-stablecoin-issuance-cryptoasset-custody

4.Singapore (MAS Framework)—The Monetary Authority of Singapore (MAS) introduced a tiered regulatory approach:

-

Flexible Licensing: Stablecoin issuers with less than S$5 million in circulation can operate under a standard Digital Payment Token License; larger issuers need a Major Payment Institution License and must follow specific stablecoin rules.

-

High-Quality 1:1 Backing: Reserves limited to cash, cash equivalents, or AAA-rated short-term sovereign bonds; accepts government debt from anchor currency countries maturing within three months.

-

Redemption Guarantee: Users have a 1:1 hard redemption right (within five business days); unreasonable redemption fees are prohibited.

A new Stablecoin Issuance Service License introduced in March 2025 allows firms to focus exclusively on stablecoin operations, reducing compliance burdens. MAS clarified in Q2 2025 that stablecoin issuers must be Singapore-registered banks or non-bank financial institutions.

MAS policy details: https://www.mas.gov.sg/news/media-releases/2025/mas-clarifies-regulatory-regime-for-digital-token-service-providers

5.Hong Kong (Proposed Framework)—Hong Kong’s Stablecoin Ordinance takes effect August 1, 2025, with key elements:

-

Full Reserves: Reserve value must ≥ outstanding stablecoin face value; only HKD cash, bank deposits, and Hong Kong/U.S. government bills/bonds allowed.

-

Mandatory HKMA Licensing: All stablecoins issued or promoted in Hong Kong (including foreign-currency pegged ones) require a license; Ant Group has announced plans to apply.

-

Financial-Grade Standards: Reserves must be independently held by licensed custodians; regular operational audit reports required; strict AML/CFT risk controls must be established.

Standard Chartered, Animoca Brands, and HKT have formed a joint venture to launch a Hong Kong dollar stablecoin for cross-border payments. The ordinance aims to align with digital yuan pilots and strengthen Hong Kong’s role as an international financial hub.

HKMA guidance: https://www.hkma.gov.hk/eng/news-and-media/press-releases/2025/07/20250729-4/

6.United Arab Emirates (UAE) Framework—The UAE Central Bank (CBUAE) launched its Payment Token Services Regulation in June 2025, establishing a stablecoin regime classifying them as “payment tokens.” AE Coin, a dirham-pegged compliant stablecoin, exemplifies this framework emphasizing reserve integrity and transparency. Key clauses:

-

Local Issuance: Only UAE-licensed entities may issue dirham-pegged stablecoins; full reserves and regular audits required.

-

Foreign Stablecoin Restrictions: Permitted only in virtual asset trading; banned from domestic payments to protect dirham sovereignty.

-

AML Compliance: Issuers and custodians must enforce strict KYC and transaction monitoring to meet AML/CFT standards.

-

Digital Dirham (CBDC) Plan: The central bank digital currency could reshape the payment landscape; state-led digital payment systems take priority.

The framework strengthens confidence in local stablecoins like AE Coin, but restrictions on foreign stablecoins may hinder broader crypto market growth.

CBUAE rulebook: https://rulebook.centralbank.ae/en/rulebook/payment-token-services-regulation

7.Japan Stablecoin Policy—Japan’s 2025 amendment to the Payment Services Act (PSA) establishes a globally leading stablecoin regulatory regime, formally recognizing stablecoins as payment instruments from May 2025. Key innovations:

-

Flexible Reserves: Trust-based stablecoins may hold as little as 50% in reserves; low-risk assets like Japanese and U.S. short-term Treasuries are permitted.

-

New Intermediary License: Introduces “electronic payment instrument / crypto asset service provider” category; waives capital requirements for custody-only intermediaries.

-

Bankruptcy Safeguards: Learning from the 2022 FTX Japan collapse; mandates that exchange-held assets remain within Japan.

-

Enhanced Transparency: Mandatory registration with the Financial Services Agency (FSA); on-chain transaction data must support AML/CFT reviews.

This policy is expected to promote trust-based stablecoins, reduce transaction costs via new intermediary models, and significantly improve user fund security through domestic asset retention.

Japan stablecoin policy details: https://law.asia/japan-crypto-stablecoin-regulations-2025/

8.South Korea Stablecoin Policy

In 2025, South Korea is actively advancing stablecoin legislation, focusing on legalizing and regulating won-pegged stablecoins to enhance economic autonomy and compete in global digital finance. Under President Lee Jae-myung, the ruling Democratic Party is pushing the Digital Asset Basic Act and related bills to establish a legal framework for private-sector stablecoin issuance, aiming to reduce reliance on dollar stablecoins like USDT and USDC. Core policy points:

-

Won Stablecoin Legalization: Legislation lifts the ban on won-pegged stablecoins; allows private firms to issue under strict oversight; aims to boost domestic digital transactions and reduce capital outflows.

-

Capital Requirements: Issuers must maintain minimum capital of 5–10 billion KRW (~$360k–$720k); prevents undercapitalized operators from destabilizing the market.

-

Reserves & Transparency: 100% reserve requirement (1:1 peg); regular public reserve audit reports; aligned with U.S. GENIUS Act and EU MiCA standards.

-

Regulatory Structure: Dual oversight by the Financial Services Commission (FSC) and Bank of Korea (BOK); enhanced coordination on foreign exchange risk management.

-

Digital Asset Ecosystem Support: Companion legislation includes STO and crypto ETF provisions; aims to position South Korea as an Asian digital finance hub.

This policy is expected to complete legislative passage before end-2025, potentially making South Korea the first Asian country with a comprehensive stablecoin regulatory framework.

South Korea stablecoin policy details: https://coinedition.com/south-korea-new-stablecoin-regulation/

GENIUS Act—The U.S. Stablecoin Standard

The GENIUS Act holds special significance due to its potential to become a global regulatory benchmark. Key impacts:

1. Institutional Credibility

-

Grants stablecoins status as settlement assets under Federal Reserve (Fed) oversight

-

Elevates their credit standing to levels comparable to bank deposits or Treasury bills (T-bills)

2. Enterprise-Grade Programmable Money

Drives adoption in corporate finance:

-

Treasury management

-

Real-time FX conversion

-

ERP system-integrated payments

3. Suppression of High-Risk Stablecoins

-

Distinguishes regulated tokens (e.g., PayPal USD, Circle USDC)

-

May force offshore/algorithmic stablecoins (e.g., USDT, crvUSD) off U.S. exchanges

4. Uncertainty Around Yield Distribution

-

Does not clarify whether issuers can distribute T-bill yield from reserves to holders

-

This will be a critical factor influencing institutional adoption

Stablecoins: The Digital Eurodollars

Stablecoins are quietly replicating the transformation of 1970s Eurodollars—they are becoming offshore, interest-bearing, dollar-denominated settlement systems outside sovereign monetary control. But unlike Eurodollars, stablecoins are programmable, composable, and globally interoperable.

This fusion of technological innovation and regulatory clarity positions stablecoins as a "light-sovereignty," dollar-like, programmable cash infrastructure. With proper regulatory design, stablecoins may become the most scalable form of financial globalization since SWIFT.

Evolution of Use Cases

Stablecoins were initially optimized for native crypto functions: market-neutral trading, collateral staking, and cross-exchange arbitrage. That phase is ending. The new era focuses on real-world applications:

-

Savings & Payments in Emerging Markets: In high-inflation economies, dollar stablecoins are becoming digital alternatives to bank deposits. Accessing dollars via stablecoins is often more reliable than relying on local banking systems.

-

Cross-Border Remittances: Workers in the Philippines, Nigeria, and Mexico are already using stablecoins to bypass traditional remittance channels characterized by high fees and slow settlements.

-

Tokenized Cash Equivalents: In developed markets, regulated stablecoins like USDC and sUSDe will function like tokenized money market funds, offering 4–8% APY while maintaining intraday liquidity and programmable APIs for fintech platforms.

The Future of Stablecoins

Future stablecoins will not just be crypto assets, but programmable, yield-bearing, API-accessible cash equivalents operating across blockchains and jurisdictions. Functionally similar to tokenized money market funds, they will be designed for minimal trust and instant transfers. As regulatory frameworks mature and enterprise adoption accelerates, we believe stablecoins will evolve from digital wrappers of the dollar into globally interoperable cash infrastructure, potentially challenging SWIFT as the internet-native global settlement layer.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News