Eight Next-Gen Perp DEX Comparative Overview: Who Will Emerge in the Second Half of the Contract Race?

TechFlow Selected TechFlow Selected

Eight Next-Gen Perp DEX Comparative Overview: Who Will Emerge in the Second Half of the Contract Race?

The next 12 months will be a critical period for competition, with winners potentially monopolizing liquidity and losers eventually fading into obscurity.

Written by: arndxt

Translated by: Azuma (@azuma_eth)

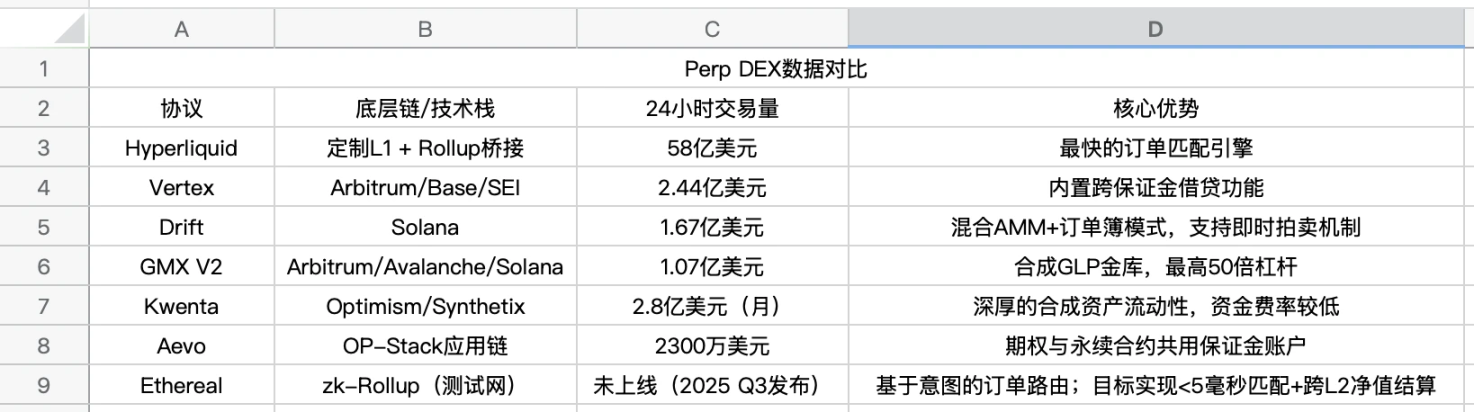

Editor's note: Decentralized perpetual contract exchanges (Perp DEXs) have become one of the most competitive sectors in the industry. While Hyperliquid appears to be emerging as the leader, a new wave of next-generation Perp DEXs is rapidly gaining momentum. In the following analysis, crypto analyst arndxt conducts a differentiated evaluation of core strengths across several rising stars in the Perp DEX space, covering eight projects—Vertex, Drift, GMX V2, Kwenta, Aevo, Ethereal, OstiumLighter, and edgeX—potentially helping investors uncover alpha opportunities within this sector.

The rise of decentralized perpetual exchanges (Perp DEXs) is inevitable, as their economic mechanisms eliminate the risk of centralized platform collapses.

Current technical architectures are converging toward a design that retains Binance-level user experience while completely eliminating custody risks. The next 12 months will be critical for the development of this sector—winners will monopolize liquidity by optimizing this structural design, while losers will remain mediocre projects sustained only by token incentives.

Necessary Design Mission

The collapse of FTX in November 2022 disrupted what had been an industry-default trajectory—exchanging custody rights for speed and liquidity. Suddenly, execution speed became meaningless in the face of fundamental fund security concerns.

However, first-generation Perp DEXs (such as GMX V1 and Gains) were too slow and rigid to compete with centralized exchanges (CEXs) on execution quality. The gap between "CEX-grade speed" and "DeFi-grade security" has become the central challenge the industry must solve.

Today, a new wave of Perp DEXs is directly addressing this issue, achieving普遍 sub-10 millisecond matching speeds, fully on-chain settlement, and never holding user funds in custody.

Liquidity is increasingly concentrating around orderbook engines rather than vAMM models. Whoever crosses the daily trading volume threshold of $1–5 billion first will build a moat—arbitrageurs and copy-trading bots will settle there.

Beyond the much-discussed Lighter and Ostium, Ethereal also deserves attention. If its team achieves sub-5 millisecond matching speeds while remaining non-custodial, it could become the first "high-frequency trading-grade" DEX to directly integrate intent routing instead of operating isolated orderbooks.

How New Entrants Build Moats

It’s becoming increasingly clear that competition among next-gen Perp DEXs extends beyond trading volume—it now includes intent-based trading, vertical-specific specialization, and filling systemic gaps left unaddressed by industry leaders like Hyperliquid.

Against this backdrop, the growth strategy of emerging Perp DEXs is straightforward: first identify trading demands unmet by Hyperliquid, then build dedicated execution layers around them, powered by novel technological primitives that weren’t feasible just two years ago.

Currently, the following projects are targeting areas not yet covered by Hyperliquid:

-

Ostium: Traditional finance assets (TradFi Assets);

-

Lighter: Cryptographic fairness;

-

edgeX: Ultra-private throughput;

-

Ethereal: Cross-L2 intent routing;

When assessing the state of major Perp DEXs in Q3 2025, I prefer to use differentiated order flow—not raw trading volume—as the key evaluation metric.

-

Hyperliquid: Still the undisputed king; awaiting second-season airdrop.

-

Vertex Protocol + Drift Protocol: Pioneers of cross-margin trading on the two fastest blockchains (Arbitrum and Solana).

-

edgeX + Lighter: Once zk-proof throughput is battle-tested, they may become institutional-grade choices.

-

Ostium: Dark horse contender—nominal trading volume in RWA perpetuals could surpass native crypto assets.

Traditional vAMM-based Perp DEXs (GMX, Gains): Still have a strong retail base, but must launch orderbooks or risk losing volume.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News