The crypto ETF boom has arrived—where’s the next opportunity?

TechFlow Selected TechFlow Selected

The crypto ETF boom has arrived—where’s the next opportunity?

The SEC is reviewing 72 applications for cryptocurrency ETFs, covering Solana, XRP, Litecoin, Dogecoin, and even trending meme assets such as Trump and Pudgy Penguins.

By Douglas Lampi

Translation: Baicai Blockchain

Editor's Note:

In 2025, the U.S. Securities and Exchange Commission (SEC) is reviewing 72 cryptocurrency ETF applications, covering Solana, XRP, Litecoin, Dogecoin, and even trending Meme assets like Trump and Pudgy Penguins. These filings come from top-tier institutions such as Grayscale, Bitwise, and Franklin Templeton, signaling unprecedented institutional enthusiasm.

XRP leads with 10 applications, followed closely by Solana, foreshadowing a potential flood of capital. If approved, these ETFs could reshape the market by giving investors easy access to crypto without complex technical barriers.

Here are more details about these alt-token ETFs:

Do you feel like you might be missing out on the next wave of the cryptocurrency market? While Bitcoin and Ethereum ETFs dominate headlines, an even more significant story is quietly unfolding.

Recall the early days of Bitcoin and Ethereum—those who recognized their potential early reaped massive rewards.

ETFs began trading on January 11, 2024

Now imagine a similar opportunity emerging—one that hasn’t yet captured mainstream attention.

The “truth” not being reported on evening news is this: beyond the major players, over a dozen other cryptocurrencies now have pending ETF applications at the U.S. Securities and Exchange Commission (SEC).

These include diverse digital assets ranging from Memes and Layer-1 giants to NFT-related tokens—names you might never have expected.

As of April 2025, the SEC is reviewing 72 cryptocurrency-related exchange-traded fund (ETF) applications covering a wide range of digital assets. The list includes major cryptocurrencies such as Solana (SOL), XRP (Ripple), Litecoin (LTC), and Dogecoin (DOGE), as well as emerging tokens like Sui (SUI), Hedera (HBAR), Avalanche (AVAX), and even theme-based assets such as Trump Meme and Pudgy Penguins token (PENGU).

Prominent asset management firms involved in these filings include Grayscale, 21Shares, Bitwise, Canary Capital, WisdomTree, CoinShares, and Franklin Templeton. Notably, XRP leads with over 10 separate ETF applications, while Solana has five, reflecting strong institutional interest in these assets.

Bloomberg ETF analyst James Seyffart has compiled a detailed list of pending ETF applications, with relevant information available across multiple industry reports.

The key point is that approval could unlock massive capital inflows.

As we've seen with Bitcoin and Ethereum ETFs, regulatory approval can open the floodgates for both institutional and retail investment. Those who position themselves early may reap substantial returns.

While you may be bombarded with crypto news, this particular development remains under the radar for most people.

Don’t let FOMO (fear of missing out) on big names blind you to other potentially profitable opportunities.

This is a chance to get in before the broader market takes notice.

That’s why paying attention now is critical. The list of cryptocurrencies with pending ETF applications represents a field full of potential.

By preparing for these potential approvals, you can position yourself ahead of the anticipated surge.

Below is a partial list of submitted applications—including some names that might surprise you…

1. Solana (SOL)

Firmly trailing only Ethereum, Solana has drawn applications from VanEck, 21Shares, Bitwise, Grayscale, Canary Capital, and even Franklin Templeton. This high-performance Layer-1 has attracted institutional attention due to its scalability and vibrant ecosystem. A SOL ETF could pave the way for mass adoption.

2. XRP (Ripple)

Despite regulatory turbulence, XRP has not backed down. Bitwise, Grayscale, WisdomTree, 21Shares, Franklin Templeton, CoinShares, ProShares, Teucrium, and Volatility Shares have all filed ETF applications. This level of institutional interest is remarkable for a token that has endured years of legal challenges.

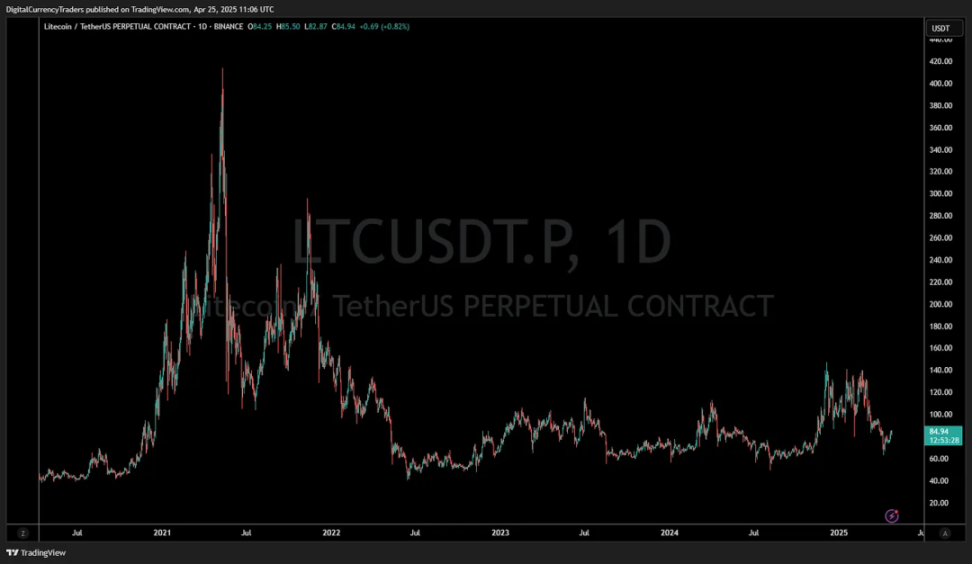

3. Litecoin (LTC)

Often overshadowed by Bitcoin, Litecoin has quietly earned respect as a reliable digital asset. Canary Capital, Grayscale, and CoinShares have all filed ETF applications related to LTC. This veteran cryptocurrency is gaining renewed regulatory attention.

4. Dogecoin (DOGE)

Yes, the Meme coin is going mainstream. Bitwise, Grayscale, and Rex Shares have filed applications, suggesting Dogecoin may soon join Bitcoin in the regulated asset class. A token born as a joke could end up in your retirement portfolio.

5. Avalanche (AVAX)

VanEck sees promise in Avalanche’s subnets and scalability, having filed an ETF proposal. Though still early, AVAX’s modular chain design has already caught institutional interest.

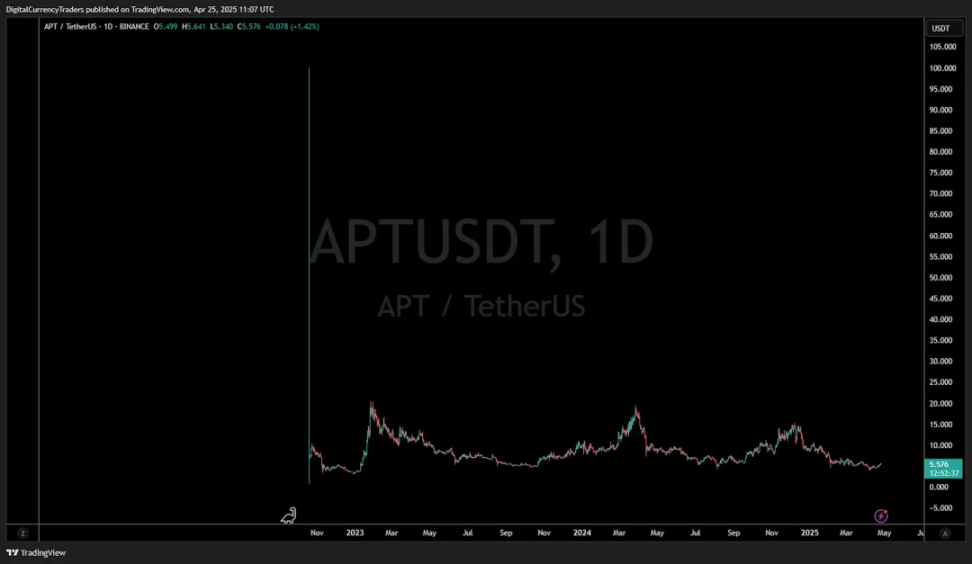

6. Aptos (APT)

A more speculative project, but Bitwise has officially filed an application. Aptos is a Layer-1 originating from Meta’s Diem project, with unique advantages—now drawing attention from institutional players.

7. Sui (SUI)

Canary Capital has filed an application for SUI, another Diem sister protocol focused on Move programming and fast parallel execution. Still in early stages, but its inclusion on the ETF list is notable.

8. Hedera (HBAR)

With strong enterprise partnerships and a unique hashgraph consensus mechanism, Hedera continues to gain momentum. Canary Capital’s filing of an HBAR-based ETF adds credibility to its long-term vision.

9. Trump Meme (TRUMP)

Filed by Rex Shares, this is less a monetary asset than a political Meme. Yet it’s now officially on the SEC’s list. Whether it’s satire or serious depends on market reaction—but regardless, it’s part of the process.

10. BONK

Rex Shares filed BONK along with other applications—a Solana-based Meme coin with growing grassroots popularity. Seeing it appear in ETF form could mark the beginning of regulated Meme trading.

11. Pudgy Penguins (PENGU)

NFT enthusiasts, take note! Canary Capital has filed an ETF application related to PENGU (Pudgy Penguins). This could be one of the first NFT-related tokens considered for an ETF.

What does this mean for you?

ETFs offer traditional investors exposure to cryptocurrencies without the hassle of managing wallets and private keys.

If even a few of these applications are approved, they could trigger massive inflows into the underlying assets.

The window to enter before ETFs officially launch may be narrower than most expect.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News