What exactly is the cross-border payment advance financing that Huma Finance, the leading project in the PayFi sector, is doing?

TechFlow Selected TechFlow Selected

What exactly is the cross-border payment advance financing that Huma Finance, the leading project in the PayFi sector, is doing?

Huma's core to gaining community trust lies in the ability to put this information on-chain in the future, or directly disclose certain borrower information, ensuring full-process control over funds.

Article by: Yue Xiaoyu

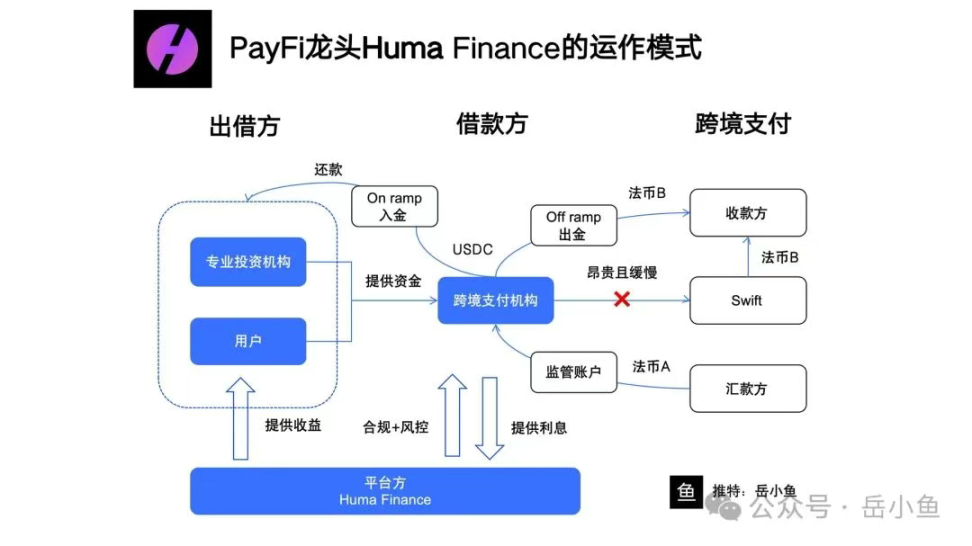

We can directly examine the overall business flow of the Huma platform to gain a holistic understanding:

1. User Lending:

(1) Ordinary users (on-chain lenders) deposit stablecoins (USDC) into Huma’s decentralized platform.

(2) No KYC required; funds are locked via smart contracts, generating fixed returns.

(3) Funds enter Huma’s lending pool for borrowers to utilize.

2. Cross-Border Payment Providers Submit Loan Requests:

(1) Compliant cross-border payment institutions (e.g., licensed payment service providers) register on the Huma platform and submit loan applications.

(2) Purpose of borrowing: providing fast cross-border payment services for remitters (clients).

(3) Loan amount: typically short-term advances (3–5 days), matching the scale of remittances.

3. Collateral Custody:

(1) The payment provider must supply fiat currency collateral equivalent in value—i.e., the fiat currency A (such as euros) paid by the remitter.

(2) This fiat currency is held in a regulated account designated by Huma and managed by Arf, a licensed entity acquired by Huma.

4. Borrowing USDC and Executing Payments:

(1) Huma disburses USDC loans to the payment provider through smart contracts.

(2) The payment provider uses USDC as an intermediary currency, transferring funds via blockchain (Solana) to Country B.

(3) In Country B, the provider converts USDC into local fiat currency B (e.g., USD) through local partners (exchanges or OTC desks) and delivers it to the recipient.

5. Repayment:

(1) Within 3–5 days (billing cycle), the payment provider repays the principal and interest on Huma’s loan using either the custodied fiat A (collateral) or subsequent client funds, converted into USDC.

(2) Huma returns the principal and earnings to lenders, deducting platform fees (the interest spread—the difference between borrowing rate and lending yield).

6. Revenue Distribution:

(1) Lenders receive stable returns (e.g., 10% annualized yield).

(2) Huma earns the interest spread (e.g., 15% borrowing rate – 10% lending yield = 5%).

(3) Payment providers earn customer fees from fast payment services (lower than SWIFT’s 1%–3%) while covering their borrowing costs.

Roles and positioning of each party throughout the process:

We see that Huma has built a lending platform where ordinary users act as lenders providing capital, while cross-border payment institutions serve as borrowers.

In cross-border payments, when a sender pays fiat currency A from Country A, using traditional SWIFT settlement would take 3–6 business days and involve high fees—including exchange rate spreads and conversion charges—typically 1%–3%.

Instead of using SWIFT, after receiving the remittance, the payment institution leverages USDC as an intermediary currency. It borrows USDC via the Huma platform and immediately cashes out USDC into local currency B in destination country B, completing the entire payment within the same day.

In this process, Huma provides short-term bridging finance via USDC for cross-border payment institutions during settlement, requiring just one deposit and one withdrawal operation.

Huma’s borrower side consists of compliant cross-border payment institutions that must provide equivalent fiat collateral (such as the remitter’s local currency) and place funds into regulated custody accounts to ensure risk control.

The lender side participates on-chain through smart contracts with no KYC requirement, simply depositing stablecoins.

The platform manages borrower eligibility, loan applications, and earns the interest spread (where the borrowing rate exceeds the lending yield).

A key point is Huma Finance's acquisition of Arf:

Arf is a financial institution registered in Switzerland, authorized to offer stablecoin-based settlement services to licensed payment providers globally.

By acquiring Arf, Huma directly resolved licensing and compliance challenges, enabling operations under this regulated entity.

It’s well known that compliance is both the most challenging and highest barrier in financial services.

Huma cleverly bypassed this hurdle by acquiring a licensed institution, thereby solving compliance issues and establishing a strong competitive moat.

In summary:

Huma’s operational workflow and business model are relatively clear. However, the off-chain components remain a black box, leaving room for potential manipulation.

The core to earning community trust lies in Huma’s future ability to bring these processes on-chain or disclose partial borrower information, ensuring full traceability and control over fund flows.

It’s also important to note that Huma aims to do more than just cross-border payment bridging—this use case is merely a critical entry point. The platform plans to expand into broader applications:

Cross-border payments represent a $4 trillion market, credit card transactions a $16 trillion market, and further expansion into Trade Finance (trade finance) is also feasible.

Overall, Huma is building a PayFi platform and ecosystem—an integration of practical utility and compelling narrative—making it a project worth long-term attention.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News