Hotcoin Research | Unichain Under the Million-Dollar Incentive Program: Can It Reshape the Layer2 Landscape?

TechFlow Selected TechFlow Selected

Hotcoin Research | Unichain Under the Million-Dollar Incentive Program: Can It Reshape the Layer2 Landscape?

This article will conduct an in-depth analysis of Unichain from multiple dimensions, including its mechanism principles and features, on-chain data performance, ecosystem development status, opportunities and challenges, as well as future prospects, to gain a comprehensive understanding of the positioning and potential of this emerging Layer 2 project.

Author: Hotcoin Research

1. Introduction

As the most representative Automated Market Maker (AMM) decentralized exchange in the Ethereum ecosystem, Uniswap has long maintained its position as the leading DEX, playing a foundational role in advancing the DeFi ecosystem. However, as user numbers and trading volumes continue to grow, the Ethereum mainnet on which Uniswap operates has gradually exposed bottlenecks such as limited scalability, high transaction costs, and MEV leakage.

To address these challenges, Uniswap Labs, in collaboration with Flashbots, OP Labs, and Paradigm, launched a new Layer 2 network called Unichain. Built on Optimism’s OP Stack, this network integrates a decentralized validation network and verifiable block-building mechanisms while aiming to optimize MEV handling logic and improve user transaction experiences. On April 15, Unichain initiated a million-scale UNI liquidity incentive program, driving rapid growth in total value locked (TVL) and quickly capturing market attention.

This article provides an in-depth analysis of Unichain from multiple dimensions, including its underlying mechanisms and features, on-chain data performance, ecosystem development status, opportunities and challenges, and future outlook. Our goal is to offer readers a panoramic understanding of this emerging Layer 2 project's positioning and potential.

2. Mechanism and Characteristics of Unichain

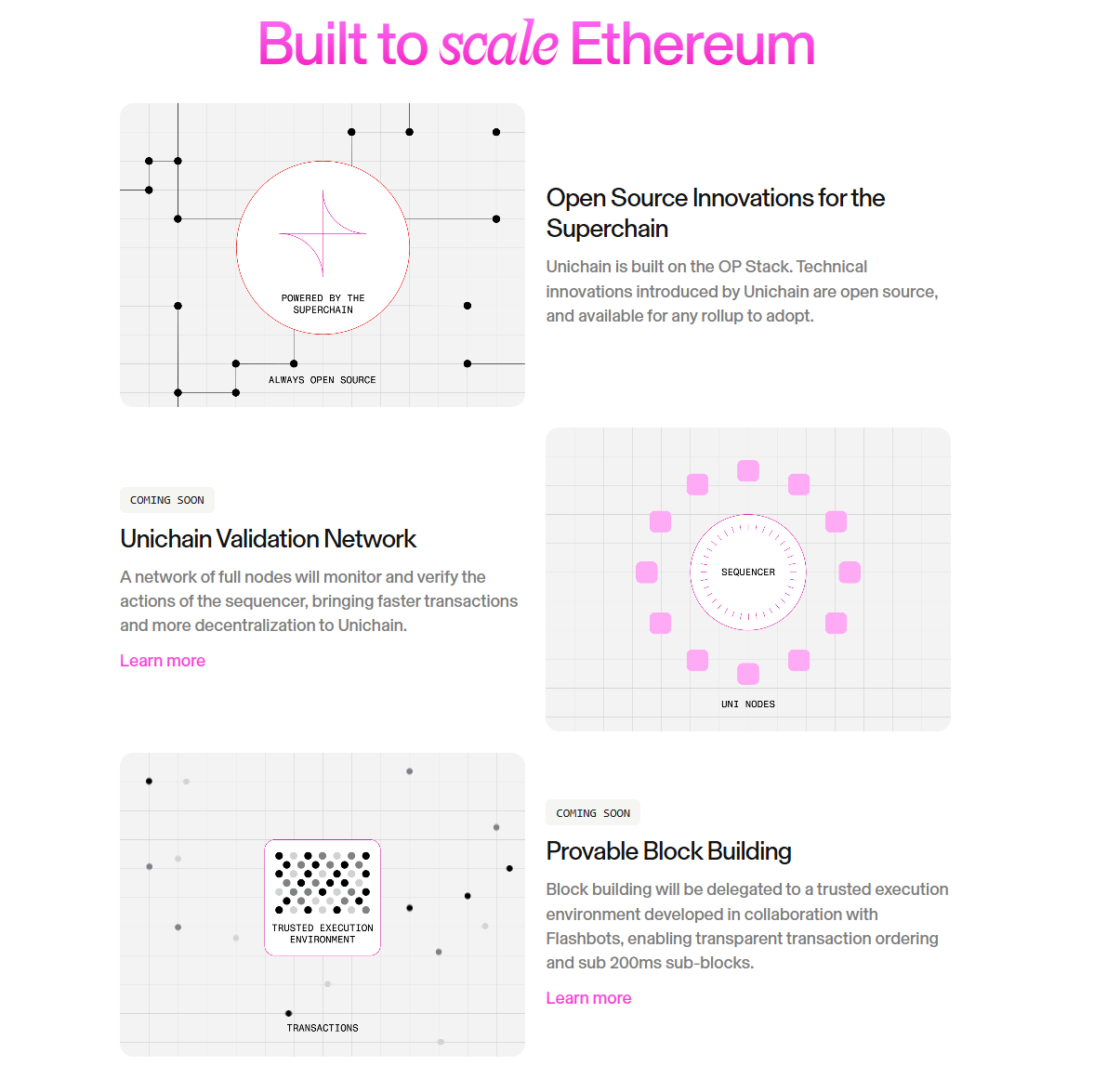

On February 11, Uniswap Labs announced the mainnet launch of its Layer 2 network, Unichain, enabling users and developers to build and use a DeFi application and tool ecosystem on Unichain. The technical architecture of Unichain is based on Optimism’s OP Stack and employs Optimistic Rollup technology, bundling large volumes of transactions before submitting them to the Ethereum mainnet—achieving high throughput and low transaction fees. Additionally, Unichain introduces several innovative mechanisms, including verifiable block building (Rollup-Boost), a decentralized validation network (UVN), and cross-chain interoperability, all aimed at enhancing network performance, security, and user experience.

2.1 Mechanism of Unichain

1) Optimistic Rollup Based on OP Stack: Unichain is built atop Optimism’s OP Stack and utilizes Optimistic Rollup technology, aggregating numerous transactions off-chain and submitting them to the Ethereum mainnet to achieve high throughput and low transaction costs. By moving transaction execution and data storage to the Layer 2 network, Optimistic Rollup reduces the load on the Ethereum mainnet, increases transaction speed, and lowers fees.

Moreover, the OP Stack offers a suite of open-source components that enable one-click chain deployment and interconnectivity among thousands of chains, forming a "Superchain" ecosystem—including Layer 2 networks like Base, Blast, Mantle, and Manta. As part of the OP Stack, Unichain achieves seamless interoperability with other Layer 2 networks, enhancing both interoperability and scalability.

2) Verifiable Block Building (Rollup-Boost): Unichain incorporates the Rollup-Boost module developed in partnership with Flashbots, offering two key functionalities: Flashblocks and Verifiable Priority Ordering.

-

Flashblocks: Splits each block into segments, creating partial blocks every 250 milliseconds and sending them to the sequencer for faster state updates and early execution confirmations. This reduces latency, improves user experience, and mitigates malicious MEV.

-

Verifiable Priority Ordering: Uses cryptographic proofs to ensure transaction ordering is transparent and verifiable, increasing fairness and transparency in transaction processing.

3) Decentralized Validation Network (UVN): The UVN consists of node operators who independently verify blockchain states. Validators must stake UNI tokens and are selected into active validator sets based on their staking weight. They perform validation tasks and earn rewards, thereby enhancing the decentralization and security of the network.

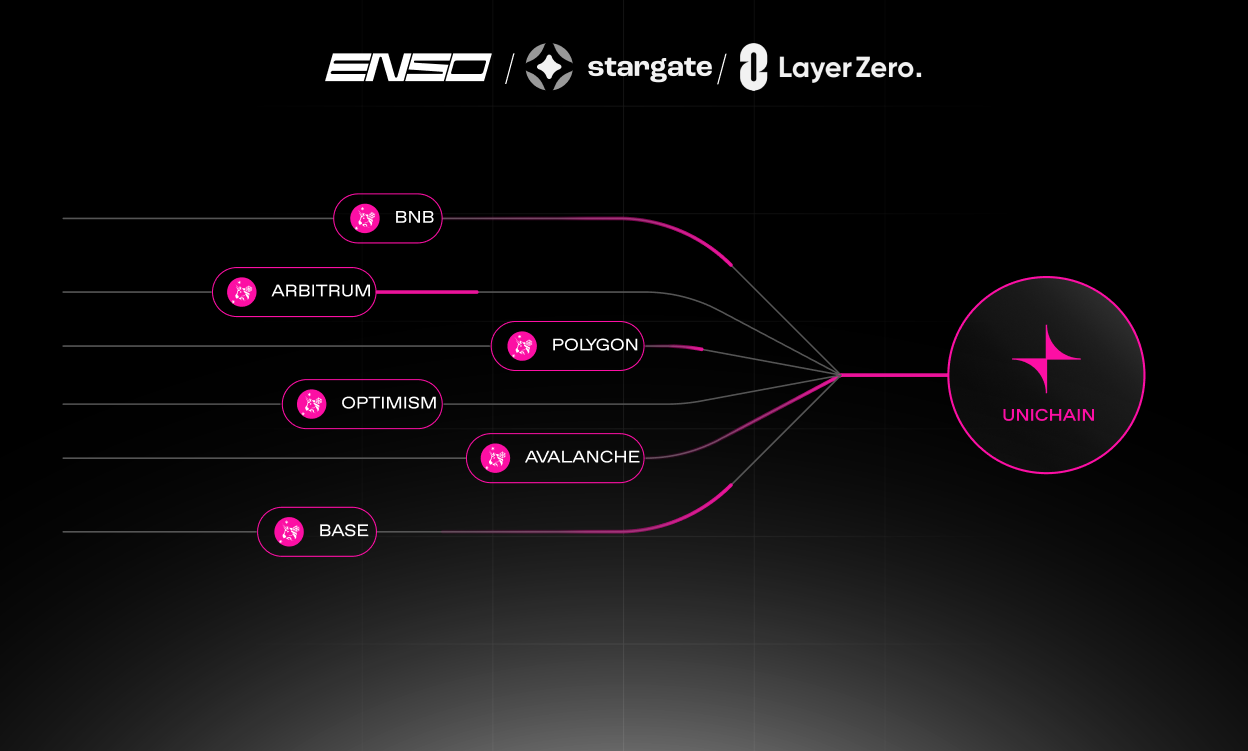

4) Cross-Chain Interoperability: Unichain participates in the Superchain ecosystem, enabling seamless interoperability with other Layer 2 networks, improving overall interoperability and scalability, and delivering a superior user trading experience. Superchain is an ecosystem composed of multiple Layer 2 networks designed to enable frictionless interaction between different networks, boosting liquidity and user experience across the entire ecosystem.

2.2 Key Features of Unichain

As an Ethereum Layer 2 solution introduced by Uniswap Labs, Unichain aims to tackle challenges related to scalability, transaction costs, and Maximum Extractable Value (MEV) on the Ethereum mainnet. Its unique design and technological innovations distinguish it from other Layer 2 solutions.

1) Significantly Lower Transaction Costs: Leveraging Optimistic Rollup technology, Unichain bundles transactions off-chain before settling them on Ethereum, achieving high throughput and low fees. Official estimates suggest transaction costs will be 95% lower than those on the Ethereum mainnet, with further reductions planned.

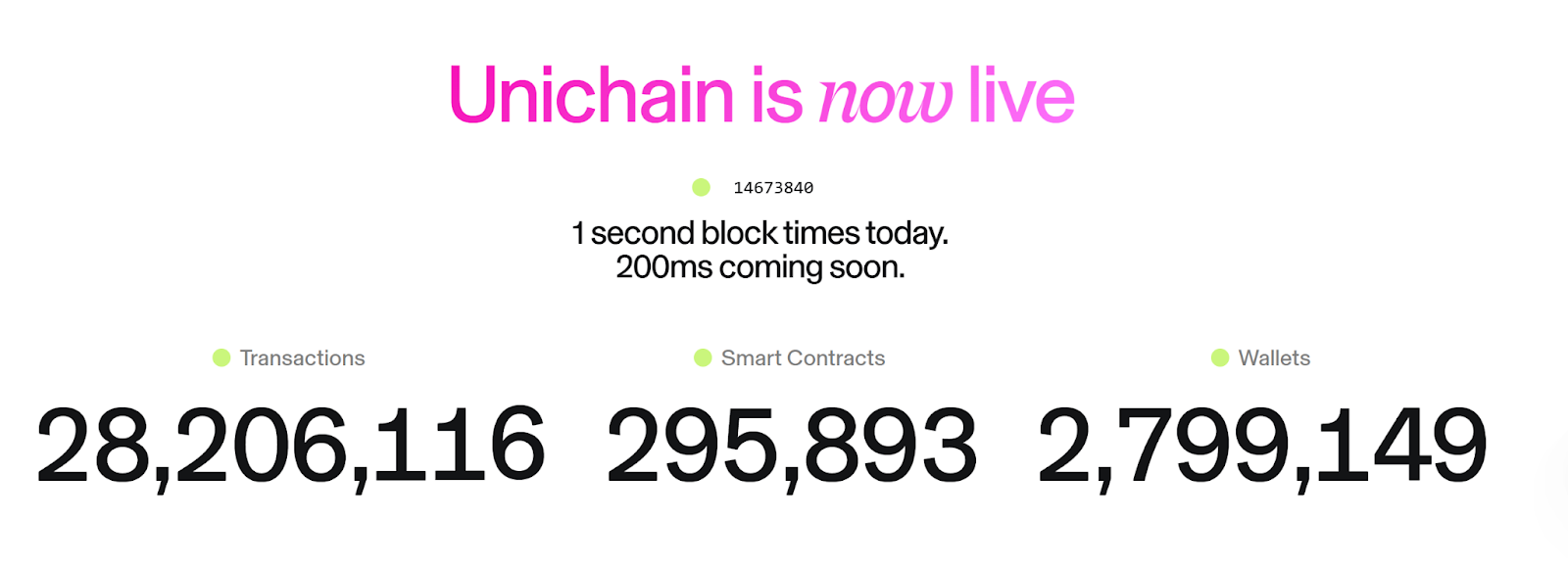

2) Faster Transaction Speeds: Unichain has a block time of 1 second, with plans to reduce it to 0.2–0.25 seconds. In comparison, Ethereum’s block time is 12 seconds, and most Layer 2s operate at around 2 seconds. This speed enhances user experience and plays a crucial role in improving market efficiency.

3) Enhanced Security and Decentralization: Through the Decentralized Validation Network (UVN), Unichain strengthens security and decentralization. Node operators stake UNI tokens and are selected into active validator sets based on their stake weight, performing independent validations and earning rewards.

4) Internalized MEV for Improved User Experience: Unichain allows applications to directly extract and internalize MEV, reducing value extraction by external actors and enhancing both user experience and protocol economics.

5) Strengthened Cross-Chain Interoperability: By joining the Superchain ecosystem, Unichain leverages cross-chain solutions to deliver seamless liquidity experiences, significantly boosting interoperability.

6) Modular Design and Open-Source Ecosystem: Unichain adopts a modular architecture, allowing developers to add new functionalities as needed, making the system more decentralized and user-friendly. Being open-source, other chains can also adopt its technology, fostering broader ecosystem development.

3. Current State of the Unichain Ecosystem

3.1 Liquidity Incentive Program and On-Chain Performance

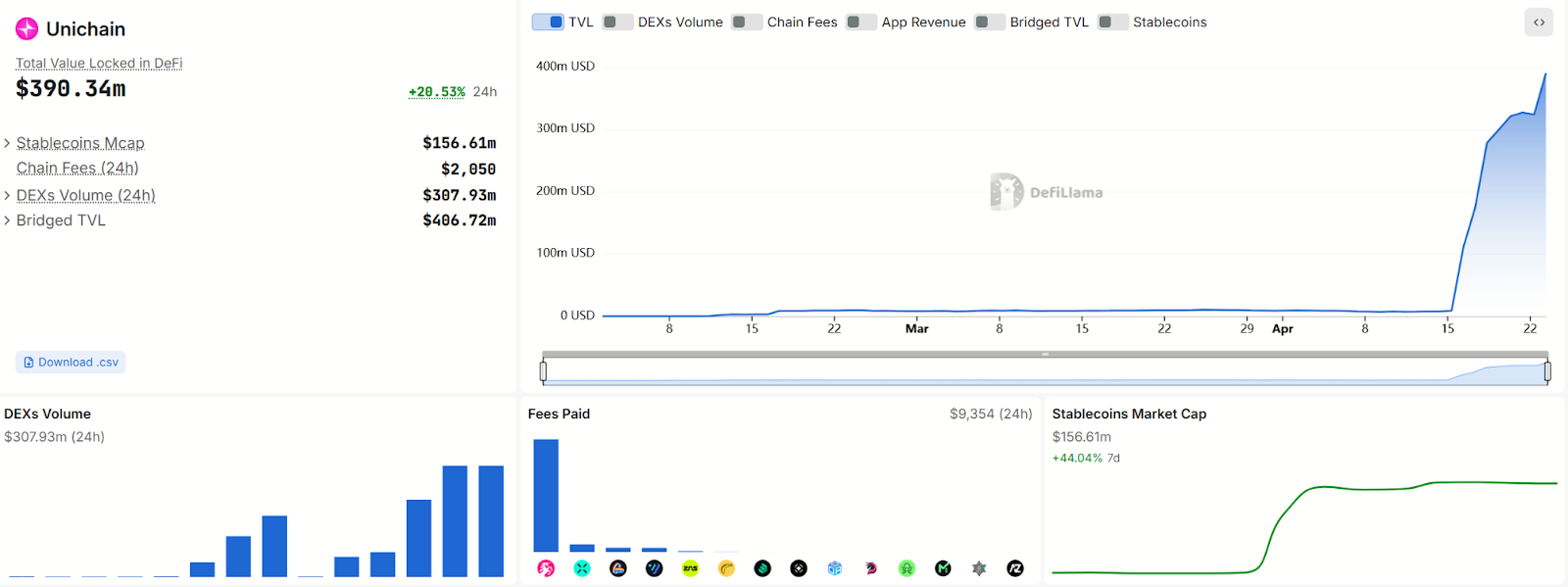

On March 21, 2025, the Uniswap community passed the “Uniswap Unleashed” governance proposal, with Gauntlet responsible for executing and optimizing the incentive program. The initiative launched on April 15, 2025, and runs for three months. During the first two weeks, 5 million UNI in total rewards were distributed across 12 different liquidity pools on Unichain. This liquidity incentive campaign drove a sharp increase in Unichain’s TVL.

Source: https://app.merkl.xyz/?protocol=Uniswap

As of April 23, 2025, Unichain’s Total Value Locked (TVL) reached $390 million, demonstrating strong momentum. Stablecoins account for approximately $156 million of this amount. The 24-hour DEX trading volume hit $307 million, on-chain fees totaled $2,050, application revenue stood at $9,354, and bridge TVL surged to $406 million, propelling Unichain to become the fourth-largest Layer 2 network by TVL.

Source: https://defillama.com/chain/Unichain

Source: https://www.coingecko.com/en/chains/layer-2

The Unichain ecosystem is rapidly expanding, attracting significant interest from developers and users alike. As of April 23, the number of smart contracts deployed on Unichain continued to rise, reaching 295,893. Wallet addresses exceeded 2,799,149, reflecting robust user growth. Transaction counts are steadily climbing, indicating rising user activity and trust.

Source: https://www.unichain.org/

3.2 Ecosystem Protocol Development

Over 100 applications and infrastructure providers have been deployed on Unichain, including major protocols such as Uniswap, Circle, Coinbase, Lido, and Morpho. These span various domains including trading, lending, stablecoins, cross-chain bridges, data indexing, and developer tools.

3.2.1 Decentralized Exchanges (DEX)

-

Uniswap V4: As the core protocol on Unichain, Uniswap V4 delivers efficient trading experiences with support for concentrated liquidity management and automated strategies.

-

Matcha: A DEX aggregator powered by 0x that combines liquidity from multiple exchanges to provide users with optimal trade pricing.

3.2.2 Lending Protocols

-

Compound: A decentralized lending protocol allowing users to deposit assets to earn interest or borrow against collateral.

-

Venus: A multi-chain lending platform offering borrowing and lending services across various assets.

3.2.3 Stablecoins and Payments

-

Circle: A global leader in fintech and issuer of the USDC stablecoin, providing a reliable payment medium on Unichain.

-

Transak: Offers fiat-to-crypto conversion services supporting users in over 160 countries worldwide.

3.2.4 Cross-Chain Bridges

-

LayerZero: A protocol enabling cross-chain messaging, allowing Unichain to seamlessly connect with over 100 blockchains.

-

Wormhole: Provides multi-chain application and bridging services, supporting large-scale cross-chain asset transfers.

3.2.5 Data Indexing and Analytics

-

The Graph: A decentralized data indexing protocol offering developers efficient query capabilities.

-

Dune: An analytics platform enabling users to query and visualize on-chain data, supported by community-contributed query templates.

3.2.6 Developer Tools and Infrastructure

-

Alchemy: A leading Web3 development platform providing reliable node services and developer tools.

-

Blockdaemon: An institutional-grade blockchain infrastructure platform offering node operation, staking services, and API access.

4. Opportunities and Challenges Facing Unichain

4.1 Opportunities

1) Continued Growth of the DeFi Market: The DeFi market has expanded rapidly over recent years, with growing demand for high-performance, low-cost Layer 2 networks. As a DeFi-optimized Layer 2 solution, Unichain is well-positioned to gain increased attention and adoption.

2) Uniswap’s Brand Influence: As the leading decentralized exchange within the Ethereum ecosystem, Uniswap boasts a vast user base and strong brand recognition. Unichain benefits directly from this reputation, helping attract more users and developers to its ecosystem.

3) Competitive Advantage Through Innovation: With cutting-edge technologies like verifiable block building and a decentralized validation network, Unichain enhances performance, security, and decentralization—giving it a competitive edge among other Layer 2 solutions and enabling it to capture greater market share.

4) Enhanced Cross-Chain Interoperability: By participating in the Superchain ecosystem, Unichain offers seamless liquidity experiences through cross-chain integration, attracting more users and capital into its ecosystem.

4.2 Challenges

1) Competition from Other Layer 2 Networks: The current market includes established Layer 2 solutions such as Arbitrum, zkSync, and StarkNet. Unichain must establish clear advantages in performance, cost, and ecosystem maturity to attract users and developers.

2) Technical Complexity: Implementing and maintaining advanced features like verifiable block building and decentralized validation involves significant complexity. Unichain must ensure the stability and security of these systems to maintain reliable network operations.

3) Migration Costs for Users and Developers: Transitioning from other networks to Unichain requires effort, including learning new tools and adapting to new environments. Unichain needs to offer sufficient incentives and support to lower migration barriers.

4) Ecosystem Development: As a nascent Layer 2 network, Unichain must cultivate a comprehensive ecosystem encompassing DeFi protocols, NFT projects, and infrastructure. This demands sustained investment of time, resources, and close collaboration with the community and partners.

5. Conclusion and Outlook

Built by Uniswap Labs, Unichain not only inherits Uniswap’s deep expertise in decentralized trading but also advances network performance, security, and decentralization through innovations like verifiable block building and the decentralized validation network. Since launching its liquidity incentive program in mid-April, Unichain has seen rapid TVL growth, quickly rising to become the fourth-largest Layer 2 by TVL. In terms of ecosystem development, Unichain has already attracted numerous DeFi protocols, with its ecosystem gradually maturing. Nevertheless, to stand out in a fiercely competitive landscape, Unichain must continuously refine its technical architecture, offer more compelling incentives, and strengthen partnerships with the community and collaborators to drive healthy ecosystem growth.

Looking ahead, Unichain has the potential to become foundational infrastructure for DeFi, catalyzing innovation and progress across the industry. By continuously optimizing technology, expanding its ecosystem, and enhancing token utility, Unichain could secure a prominent position in the DeFi space, delivering more efficient, secure, and decentralized financial services to users and developers alike.

About Us

Hotcoin Research, the core research and investment hub of the Hotcoin ecosystem, is dedicated to providing professional, in-depth analysis and forward-looking insights for global crypto investors. We have built a "triple-system" service framework combining “trend analysis + value discovery + real-time tracking,” offering deep sector trend analysis, multi-dimensional project evaluations, and round-the-clock market monitoring. Supported by our weekly《Top Coin Selection》strategy livestreams and daily《Blockchain Today》news briefings, we deliver precise market interpretations and actionable strategies for investors at all levels. Leveraging advanced data analytics models and extensive industry networks, we empower novice investors to build solid cognitive frameworks while helping institutional players capture alpha returns—jointly seizing value-growth opportunities in the Web3 era.

Risk Disclaimer

The cryptocurrency market is highly volatile and inherently risky. We strongly advise investors to fully understand these risks and conduct investments strictly within a sound risk management framework to safeguard their capital.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail: labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News