Unichain's ultimate goal: to become the central hub for omnichain DeFi liquidity

TechFlow Selected TechFlow Selected

Unichain's ultimate goal: to become the central hub for omnichain DeFi liquidity

Everything You Need to Know About Unichain

Author: Chen Mo

Core Thesis: Unichain aims to become the central liquidity hub for cross-chain DeFi, with a super app building application-specific chains to recapture value generated by its own protocol.

Built on OP Stack, its core innovations include:

-

Verifiable Block Building: Co-developed with Flashbots to enable fast transaction processing, MEV capture, and user transaction protection.

-

Unichain Validation Network (UVN): Mitigates centralization risks of a single sequencer by enabling "verifiable sequencing" and faster economic finality.

-

Intent-driven interaction model: Users only specify their needs and intents; the system automatically selects optimal paths for cross-chain execution, abstracting away underlying chain complexities.

-

Super apps can build application chains, enabling native tokens to capture protocol-specific value.

Research Report

1/5 · Verifiable Block Building

Unichain’s verifiable block building relies on Rollup-Boost, co-developed with Flashbots. It addresses three key issues:

-

Reduces MEV risks

-

Increases transaction speed

-

Provides trustless revert protection (reducing user costs from failed transactions)

How It Works

-

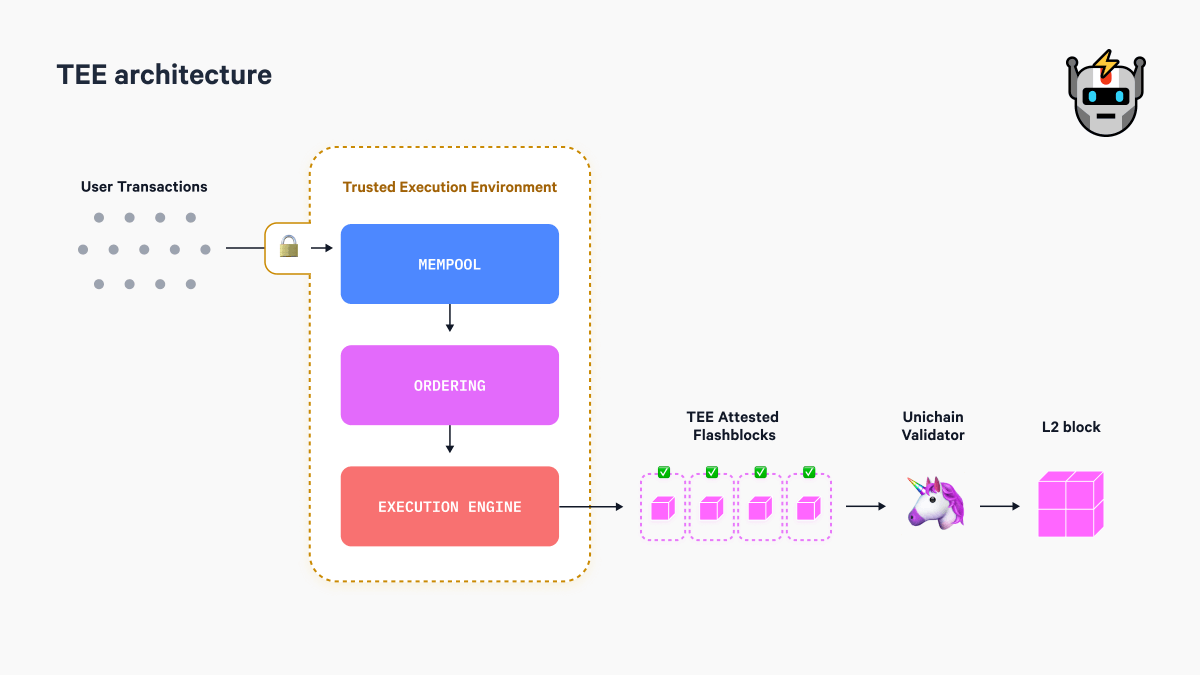

Unichain separates the roles of block building and sequencing. A Verifiable Block Builder handles block construction within a Trusted Execution Environment (TEE)—a secure hardware environment that executes programs without exposing internal data, generating cryptographically verifiable proofs. This allows external parties to verify that blocks are built according to predefined rules.

-

Flashblocks enable pre-confirmation of transactions—essentially confirming which transactions will be included in upcoming blocks. Each block is divided into multiple Flashblocks, compressing block times to 200–250 milliseconds, significantly faster than most existing rollups. Within the TEE, strict ordering rules are enforced for transactions inside each Flashblock, ensuring transparency in execution order and reducing MEV-related unfairness.

-

The TEE enables trustless revert protection by simulating transactions during block construction, detecting and removing any that would fail. This prevents users from paying gas fees for doomed transactions.

In summary, two major improvements are made: First, block building and sequencing are decoupled, with Flashblocks constructed in a transparent, secure environment (TEE), enhancing verifiability, efficiency, and fairness while reducing MEV. Second, a “pre-confirmation” mechanism is introduced, allowing transactions to be tentatively included in a block before finalization, giving users and apps early certainty about inclusion and reducing perceived latency.

Pre-confirmation accelerates the confirmation experience but is not equivalent to finality. It means users can know in advance that their transactions will be included, reducing perceived delay. According to the whitepaper, Flashblocks target a block time of 200–250 milliseconds—meaning pre-confirmation occurs within this window. However, actual final confirmation takes longer, as blocks must be finalized, state-updated, and committed to ensure chain consistency. Thus, the pre-confirmation window is adjustable, balancing user experience against network security. Shorter windows improve speed but increase technical demands and network load. The design aims to strike an optimal balance between speed and safety.

2/5 · Unichain Validation Network (UVN)

UVN is Unichain’s decentralized validation system designed to mitigate risks inherent in single-sequencer architectures. By combining Flashblocks with TEE technology, it achieves “verifiable sequencing.”

How It Works

-

Validators are node operators in the UVN who must stake UNI to participate. Each validator has the right to validate blocks and earns rewards proportional to their staked amount.

-

Unichain divides its blockchain into fixed-duration epochs. At the start of each epoch, the system snapshots all validators’ stake balances and computes individual reward weights. Validators with the highest weighted stakes are selected into the active validator set, granting them the right to validate blocks in that epoch.

-

Active validators must run Unichain nodes online to verify blocks proposed by the sequencer.

-

Validators verify each proposed block, generate signed hashes, and submit them to the UVN’s smart contract. The contract verifies signatures and distributes rewards based on stake weight. Validators who fail to validate or sign invalid blocks lose rewards and may face slashing penalties.

In summary, the primary risks of a single sequencer include centralization-induced uncertainty, unfair transaction ordering, and threats to network security and fairness.

Prior solutions, such as Metis, introduce decentralized sequencers with incentive mechanisms. Unichain instead combines decentralized validation (UVN) with transparent sequencing (via verifiable block building), achieving both verification capability and public ordering transparency—mitigating centralization concerns. These approaches differ in trade-offs between efficiency, cost, and security, though detailed comparisons are beyond this scope.

A common issue is that a centralized sequencer controls transaction ordering, enabling manipulation for MEV extraction—such as reordering or inserting transactions to profit at users’ expense.

3/5 · Intent-Driven Interaction Model

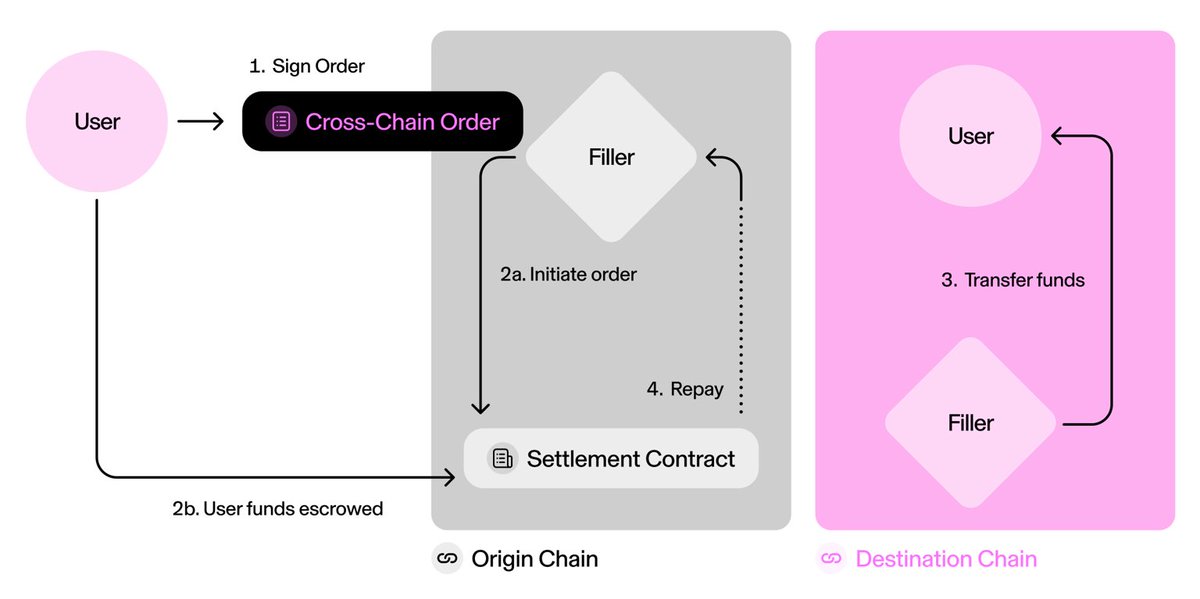

The whitepaper references intent-based cross-chain interactions (ERC-7683: Cross Chain Intents), where users express transaction goals as executable “intents.” The system then autonomously finds optimal execution paths across chains, eliminating manual multi-chain operations.

For example, a user submits an intent to transfer 100 USDC from Unichain to Ethereum Mainnet to purchase an NFT. The intent-driven model automatically identifies this goal and executes the full cross-chain workflow. This enables automated, trustless, and decentralized cross-chain transactions, minimizing reliance on third parties and human error. It also achieves the ultimate aim of chain abstraction: separating backend complexity from user experience. Users only need to express their intent—solving problems of fragmented liquidity and disjointed cross-chain experiences.

4/5 · Ultimate Goal: Become the DeFi Liquidity Hub

By joining the OP Stack ecosystem, Unichain gains native interoperability with major L2s like Base, Mode, and OP Mainnet via Superchain. This enables seamless use of intent-driven models across these chains.

For non-OP Stack chains, ERC-7683’s standardization allows Unichain’s intent model to interact broadly. Standardized interfaces—such as CrossChainOrder and ISettlementContract—enable any chain or bridge that adopts the standard to parse and execute cross-chain intents, participating in Unichain’s order settlement process.

The vision is to become a critical connectivity layer in the omnichain DeFi ecosystem, offering users broad and rapid access to liquidity.

5/5 · $UNI Value Capture

Based on current information, $UNI serves as collateral for validators in the UVN and earns rewards. Its value accrual may come from several sources:

-

Potential activation of transaction fee switch (long-debated, delayed due to regulatory and other pressures)

-

Staking rewards for node validation (earning block rewards through validation duties)

-

MEV capture and distribution: Thanks to UVN and verifiable block building, Unichain exerts control over transaction ordering, enabling large-scale MEV capture—including MEV from intent-driven cross-chain trades (e.g., optimizing execution paths to minimize cost and maximize return). This MEV value is redistributable—either rebated to users or allocated to UNI stakers.

-

Cross-chain fee capture: Unichain’s endgame is becoming the DeFi liquidity center. The key enabler is ERC-7683, which allows frictionless interaction across multi-chain liquidity, approaching true chain abstraction. Executing these cross-chain intents requires fillers and validators, who earn revenue from transaction or settlement fees.

ERC-7683

Compared to standard L2s, Unichain’s unique value capture lies in points 3 and 4. Before Unichain, MEV generated by Uniswap was captured by Ethereum validators and L2 sequencers. With Unichain, this value shifts to Unichain itself. Cross-chain fee revenue will depend on Uniswap’s omnichain trading volume and whether seamless multi-chain interoperability drives increased activity. Fees previously earned by bridges could now flow directly into Unichain. (This analysis excludes potential governance value and unpredictable ecosystem growth.) This represents a novel approach: a super app building an app chain to recapture value created by its own protocol.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News