Ethereum's largest DApp goes independent? The final straw for ETH?

TechFlow Selected TechFlow Selected

Ethereum's largest DApp goes independent? The final straw for ETH?

Is Unichain a bearish or bullish factor for Ethereum?

By Mu Mu

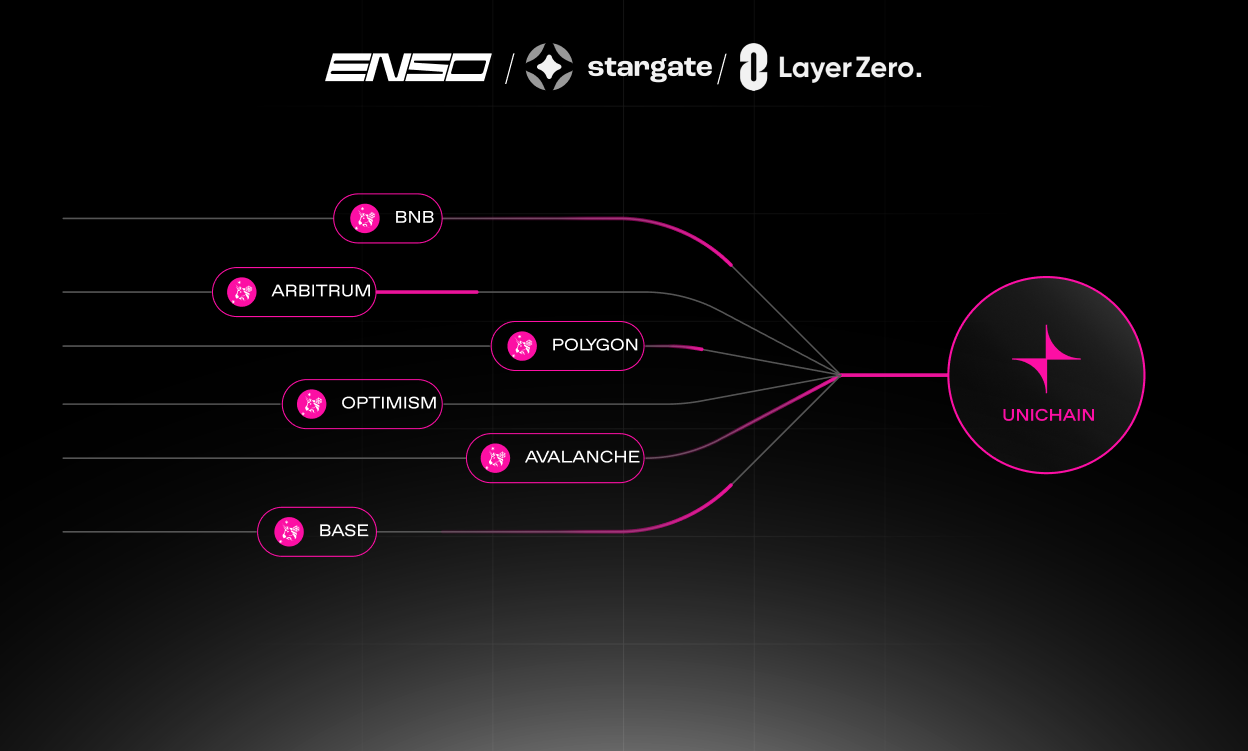

Recently, Uniswap Labs officially announced the launch of Unichain, an Ethereum Layer2 network built on OP Stack, along with its testnet rollout. As a cornerstone of the Ethereum ecosystem and the DeFi space, this major development from Uniswap has drawn significant attention across the crypto community. Prominent figures like Vitalik shared their views, but perhaps the most eager audience consists of long-time Ethereum FUDers who’ve started countdown analyses predicting ETH’s demise following what they call the “exodus of Ethereum’s largest DApp”...

Is Unichain Really Uniswap 'Abandoning' Ethereum?

According to official statements, the primary goal of launching Unichain is to address key challenges in DeFi—such as cost, efficiency, and the need for seamless cross-chain swaps amid fragmented liquidity. In simple terms, the Uniswap team aims to enhance user experience and strengthen its product competitiveness by customizing a dedicated Layer2 network.

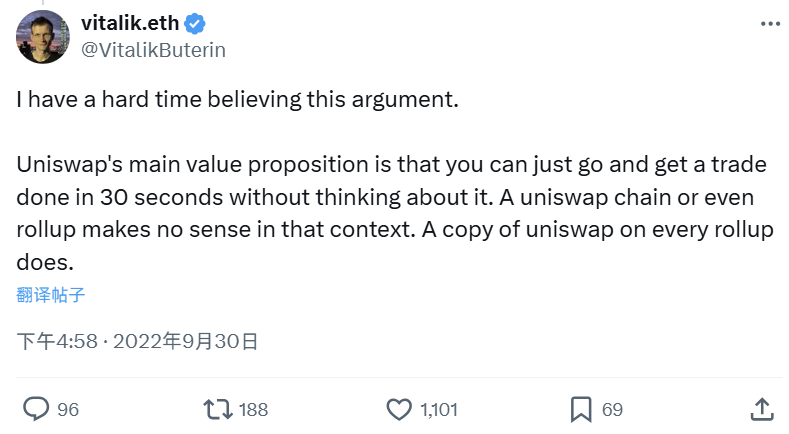

Reactions from various KOLs have been mixed. While some expressed support, others—including notably Vitalik—voiced opposition. In fact, as early as 2022, Vitalik commented on social media against the idea of Unichain, stating: "Uniswap's main value proposition is that you can complete a trade within 30 seconds without much thought. In such a scenario, having a Uniswap-specific chain—or even a rollup—makes no sense; instead, it makes far more sense for every rollup to host its own Uniswap instance."

Overall, critics like Vitalik argue that Uniswap should remain focused on being a successful application deployed across Ethereum’s mainnet and all Layer2s, rather than diverting resources into building (or reinventing) a new chain. However, two years ago, Layer2 solutions were not yet mature—if Unichain had been proposed then, it would likely have meant creating a standalone appchain, not a Layer2. Hence, strong opposition from Ethereum community KOLs at the time was understandable.

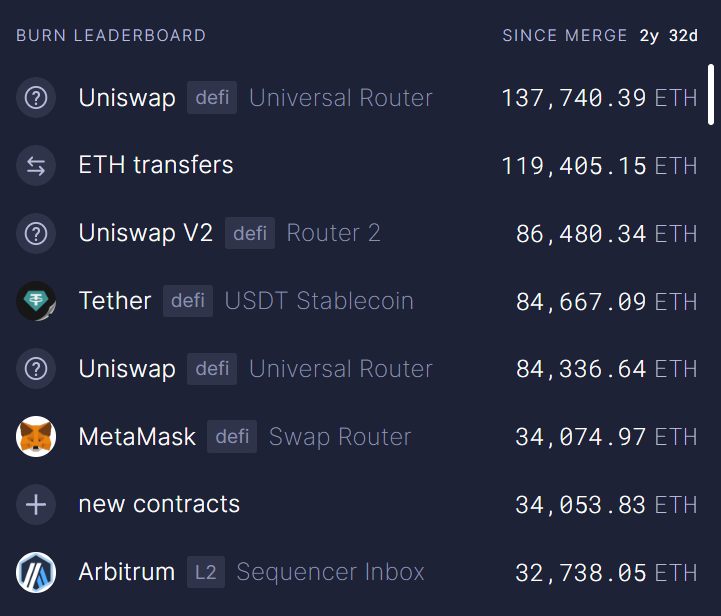

Compared to internal community criticism, those outside the Ethereum ecosystem—longtime skeptics who frequently publish ETH FUD analyses—seem to have found fresh ammunition here. Building upon previous narratives about Layer2s draining Ethereum, they now claim UniChain represents Uniswap’s “defection” from Ethereum, arguing that the DApp responsible for the largest share of gas fee burns will soon take away Ethereum’s last source of revenue, pushing ETH transaction fees into irrelevance and ultimately leading to Ethereum’s “death.”

Top burners since The Merge – Source: Ultrasound Money

Clearly, two years later, Unichain’s launch has sparked widespread discussion beyond just the Ethereum community. The divergence from Vitalik’s stance is seen by some as a direct rebuttal to his earlier position. Yet compared to constructive debate within the community, these external FUD voices are largely driven by the fact that Ethereum has made many enemies over the years. Once-dismissed Layer2 approaches are now gaining traction among major corporations and institutions. The success of Layer2s has effectively blocked alternative paths for cross-chain projects and high-performance public chains. Only if Ethereum stagnates can these competitors gain market share—that’s one fundamental reason why ETH FUD continues to circulate relentlessly.

Hayden Adams, founder of Uniswap, recently responded to the controversy: "Zero-sum thinking is a big problem in crypto. Don’t side with high fees—scaling via L2s benefits Ethereum."

That said, the narrative framing Unichain as Uniswap “abandoning” Ethereum is fundamentally misguided. Although developing a Layer2 may superficially resemble launching a new chain, unlike dYdX’s full migration to become an independent appchain within the Cosmos ecosystem, Unichain remains firmly rooted in the Ethereum ecosystem. Ethereum’s mainnet will still be Uniswap’s primary battleground. Most DeFi capital resides on Ethereum, where large holders prioritize “security” and “stability”—a key reason why Ethereum maintains an irreplaceable moat. Unlike dYdX users whose interactions demand high frequency and immediacy, Uniswap’s core use case benefits from being anchored in Ethereum’s secure and stable environment—an advantage that helped establish it as critical DeFi infrastructure.

In the foreseeable future, Uniswap on Ethereum mainnet will continue to aggregate the deepest liquidity, catering to large, secure swaps. Meanwhile, small-volume, high-frequency trades will shift to Layer2s like Unichain.

To illustrate simply: imagine Ethereum as a massive farmers’ market, and Uniswap as the most popular stall located in a high-traffic area. As business grows, the vendor rents an additional standalone storefront near the market entrance—one with extra storage space, air conditioning, and a more comfortable shopping experience. Both locations serve different customer needs simultaneously.

Thus, the “defection” theory doesn’t hold water. There’s no departure happening—Uniswap still wants to be the brightest star in Ethereum’s ecosystem.

Why Build Unichain at All?

It seems that since the initial proposal of Unichain two years ago, Uniswap has made a difficult but deliberate decision. From Vitalik’s and some in the Ethereum community’s perspective, Uniswap is already successful—so why complicate things? But from Uniswap’s own community and developer standpoint, there are compelling reasons to move forward:

1) Scaling Optimization to Meet Challenges and Competition

Despite its success, Uniswap faces growing challenges and competition in a multi-chain (including multi-Layer2) world. Outside Ethereum mainnet, many chains host dominant local DEX brands—such as PancakeSwap, QuickSwap, etc.—that lead their respective DEX markets. Additionally, fragmented liquidity across existing Layer2s limits what Uniswap can achieve as merely a top-layer application.

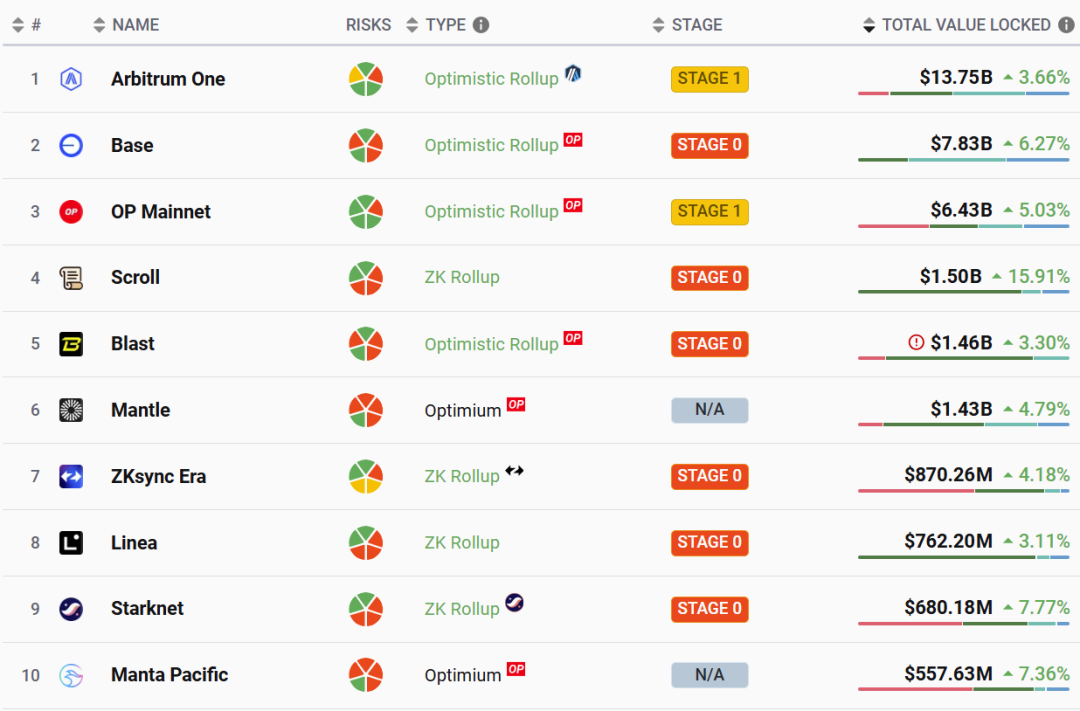

Choosing OP Stack and joining the Optimism Superchain reflects strategic thinking. Among the top Layer2s by TVL, OP Mainnet, Base, and Blast collectively hold tens of billions in liquidity. With teams like SNX, Mantle, and even corporate giants like Sony adopting the Superchain, this network enjoys continuous funding and talent inflow. As “homogeneous” chains with aligned development paths and shared technology, interoperability becomes easier to achieve. Uniswap Labs has stated it’s working with OP Labs to enable native cross-chain interoperability, aiming to solve fragmentation across Layer2s and deliver seamless cross-chain swap experiences.

Source: L2beat

In short, deploying a low-cost Layer2 via OP Stack allows Uniswap to join a collaborative R&D effort, share technical advancements, accelerate interoperability between Layer2s, resolve liquidity fragmentation—and also tackle issues like MEV—at the foundational level, which wasn't possible when Uniswap operated solely as a DApp.

2) A Natural Step for a Maturing DApp

DApps built on public chains inevitably face strategic decisions as they grow. Beyond scaling considerations, increasing demands from their communities and pressure to expand utility for their tokens play crucial roles—evident in how UNI’s price surged immediately after the Unichain announcement. When a project evolves from a niche tool into a large-scale community, even if the core team hesitates, community momentum often drives progress. High-quality projects typically possess ample revenue, talent, and technical reserves—making expansion and breaking through bottlenecks not only feasible but natural, opening doors to new possibilities across sectors.

For example, large brands like Uniqlo, Starbucks, or KFC start by operating within malls or online platforms. After securing market presence, they inevitably launch independent official channels—such as standalone e-commerce sites or branded mini-programs. Unlike third-party storefronts, these owned platforms give full control over user data, flexible marketing customization, and deeper personalization.

Likewise, Unichain could evolve into a unique ecosystem, leveraging differentiated advantages while sharing Uniswap protocol liquidity, potentially attracting other DeFi applications—an inspiring vision.

3) Uniswap: This Is Our Freedom

Within crypto’s values of openness and decentralization, no underlying infrastructure should lock users or funds like centralized traditional finance does—nor should developers be constrained. A multi-chain, interoperable future remains the ideal. Decentralized Ethereum cannot and will not forcibly restrict users or capital. Assets and innovation must remain freely flowing. The ecosystem thrives on diversity, competition, and merit-based evolution—where developer-driven products compete freely in an open market.

Whether Unichain marks a grand strategic move or just a modest experiment, it is ultimately the free choice of Uniswap Labs and the Uniswap community—all aimed at serving collective interests.

Good or Bad for Ethereum?

Judging from flawed FUD interpretations, Unichain accelerates Ethereum’s supposed decline. But in reality, the opposite is true: Unichain is not detrimental but beneficial—it helps resolve cross-Layer2 liquidity fragmentation, fosters ecosystem growth, and promotes broader adoption of Layer2 solutions. More enterprises like Sony are on their way.

Moreover, Unichain’s emergence, despite criticisms from Vitalik and others calling it “unnecessary,” actually validates the foresight behind Ethereum’s Layer2 roadmap and the vision of its developer community. Had there been no viable, open Layer2 options today, growing DApps might have abandoned Ethereum entirely due to high fees and poor scalability, opting instead to build independent chains—truly leaving the Ethereum ecosystem and possibly becoming so-called “Ethereum killers.”

The current outcome reflects Ethereum’s organic innovation and transformation. We’re no longer in the era of slow, expensive transactions. Applications within Ethereum’s broader ecosystem now have better internal scaling options, allowing them to scale without compromising decentralization or security.

Conclusion

Regardless, we should respect the choices made by the Uniswap community. We hope Unichain continues to pioneer new frontiers in DeFi and unlocks further possibilities.

Ethereum FUD constantly targets Layer2s for reducing or “draining” mainnet gas revenues. But ask yourself this one question: Is Ethereum’s value limited solely to collecting gas fees? Infrastructure like wallets, scaling solutions, real-world applications, and user experience—all thriving under continued innovation—this is what truly defines Ethereum’s value.

When gas fees were high, critics called it bearish; when Layer2s emerged, they claimed the approach would fail; now that Layer2 scaling works and fees drop, they accuse it of bleeding Ethereum and still call it bearish... As Uniswap’s founder said, the crypto community suffers from zero-sum bias. Some bears don’t even understand Ethereum—they oppose it purely based on ideological stance. That’s why doing your own research (DYOR) is essential to avoid being misled.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News