What is the necessity of Unichain?

TechFlow Selected TechFlow Selected

What is the necessity of Unichain?

Unichain has the potential to become the next center of DeFi.

Author: IOSG Ventures

Introduction

For years, Uniswap has consistently driven innovation to make swaps more user-friendly and fair. We've seen the launch of Uniswap Mobile, the Fillers Network in UniswapX, ERC-7682 for standardizing cross-chain intents, and upcoming hooks in Uniswap V4 enabling customizable AMM pools.

On October 10, Uniswap announced its own optimistic rollup: Unichain. Designed as a one-stop liquidity hub within the Superchain ecosystem, Unichain aims to deliver near-instant swap experiences with tighter spreads, while maximizing privacy and integrity for MEV participants using TEE (Trusted Execution Environment).

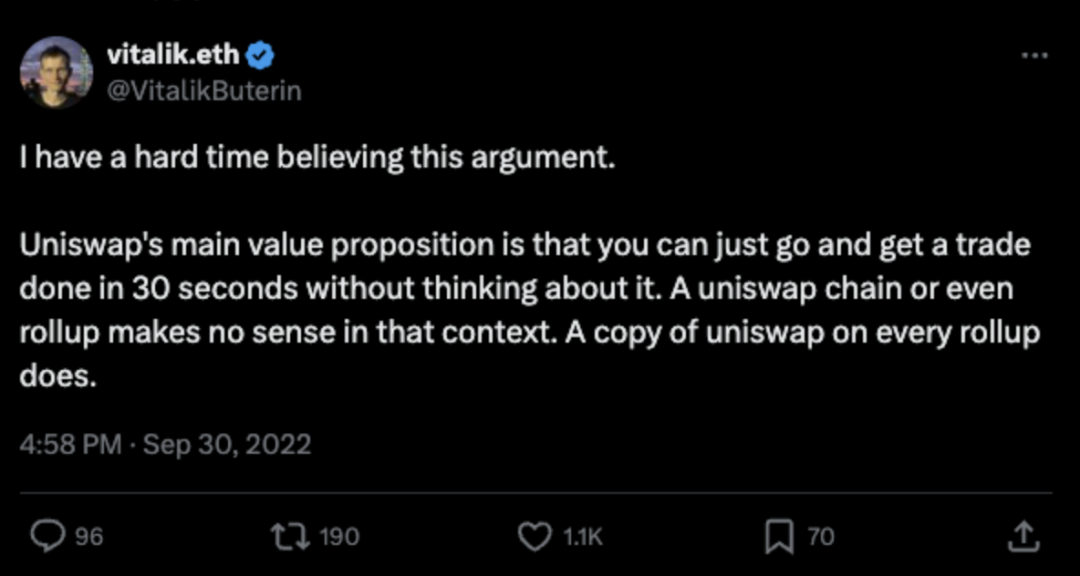

While these ambitions are impressive, users have questioned whether another L2 is necessary. Some, including Vitalik, commented that Unichain essentially means "a copy of Uniswap on every rollup." In other words, launching a Uniswap clone on a new chain may serve the same purpose as building Unichain itself.

So, is Unichain truly beneficial or redundant? This article explores Unichain’s architecture to assess its “necessity.”

1. What is Unichain?

Unichain is an optimistic rollup designed to execute near-instant transactions while leveraging TEE-based privacy technology to minimize potential impacts on LPs and swappers.

Built using the same standards as other OP chains, Unichain natively integrates into the Superchain ecosystem, benefiting from interoperability and access to shared liquidity across the network.

To achieve this, Unichain introduces four major innovations:

-

Rollup Boost and Sequencer-Builder Separation (SBS)

-

Block Building inside TEE

-

Flashblock

-

Unichain Validation Network (UVN)

1.1 Rollup Boost: Sequencer-Builder Separation (SBS)

Block building is key to addressing MEV challenges.

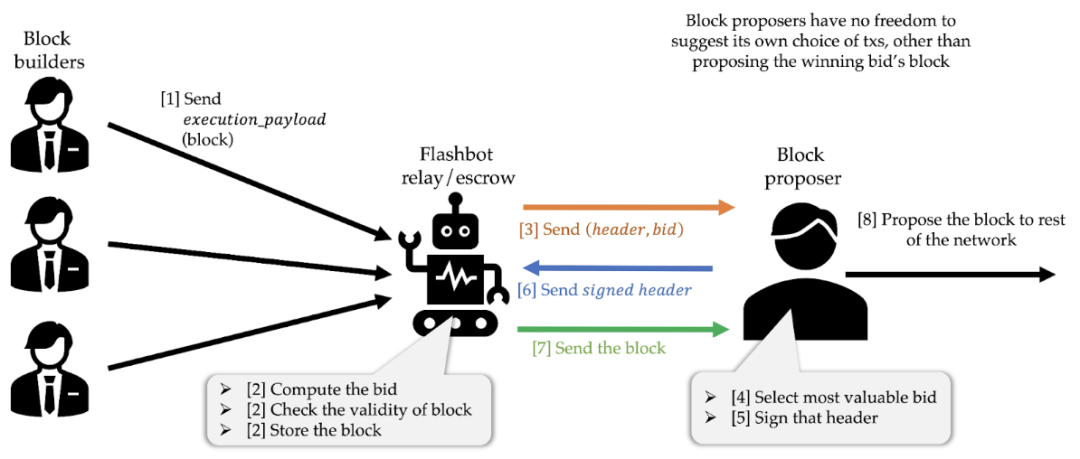

Prior to MEV Boost, Ethereum faced censorship risks and poor UX. Users suffered from high fees and front-running due to intense competition among searchers for profitable order inclusion. To address this, Flashbots developed MEV-boost.

MEV Boost introduced relays that separate block builders from proposers, allowing specialized builders to submit the most profitable blocks to proposers for signing. This design decentralizes MEV extraction and democratizes MEV profits between validators and professional builders.

Rollup Boost follows a similar concept. An SBS-enabled L2 uses a system called the "Block Builder Sidecar" to decouple block building from the sequencer’s execution engine.

In short, the system consists of four main components:

-

OP-node

-

OP-geth

-

Sidecar / Blockbuilder Sidecar

-

External block builders

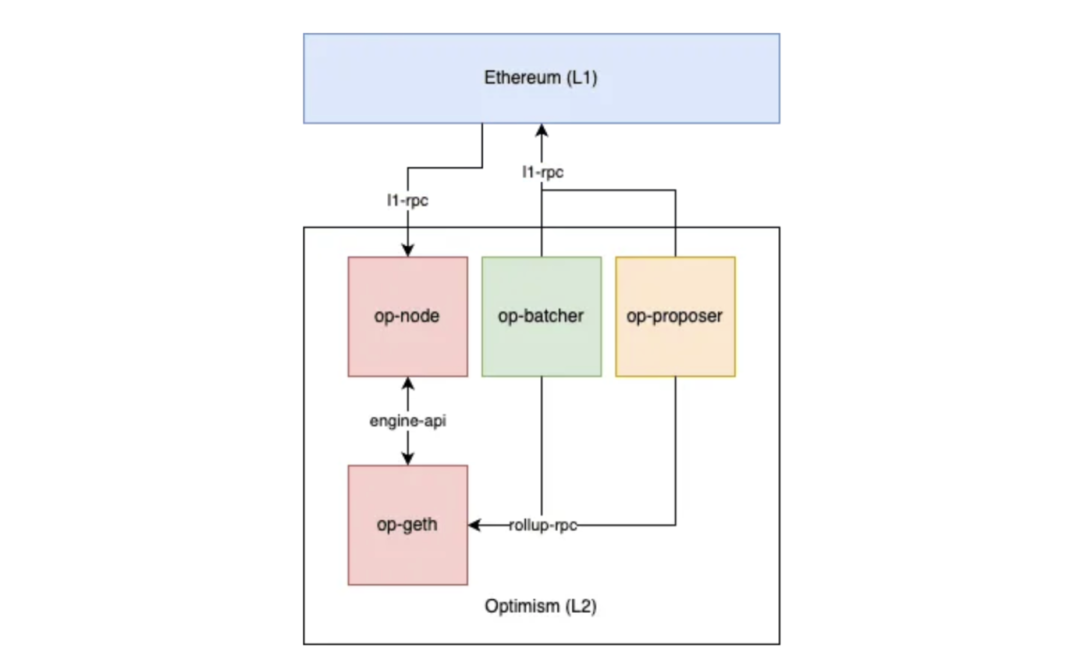

The diagram below shows the Optimism architecture, where the sequencer node (also known as op-chain) comprises Op-geth and Op-node.

To distinguish between block building and proposing roles within the sequencer, a component called Sidecar is added. The Sidecar enables the OP node to receive blocks from external builders, creating a market between block builders and proposers.

The workflow is as follows:

1. The OP node sends updates to the sidecar.

2. The sidecar forwards the update to op-geth as an intermediary.

3. When the OP node requests a block from OP-geth, the sidecar intercepts the request.

4. The sidecar then forwards the request to external block builders—this creates a bidding window where external builders can compete.

5. Upon receiving a block from an external builder (the winner), the sidecar sends it to the OP node.

6. If no block is received, the sidecar forwards a locally generated block.

The main advantage of the block builder sidecar is that upgrades don’t require modifications to the OP chain client, while enabling more flexible, simplified, and censorship-resistant transaction ordering rules. However, the addition of an intermediary (sidecar) may introduce some latency.

1.2 Rollup Boost: Trusted Execution Environment (TEE) in Block Building

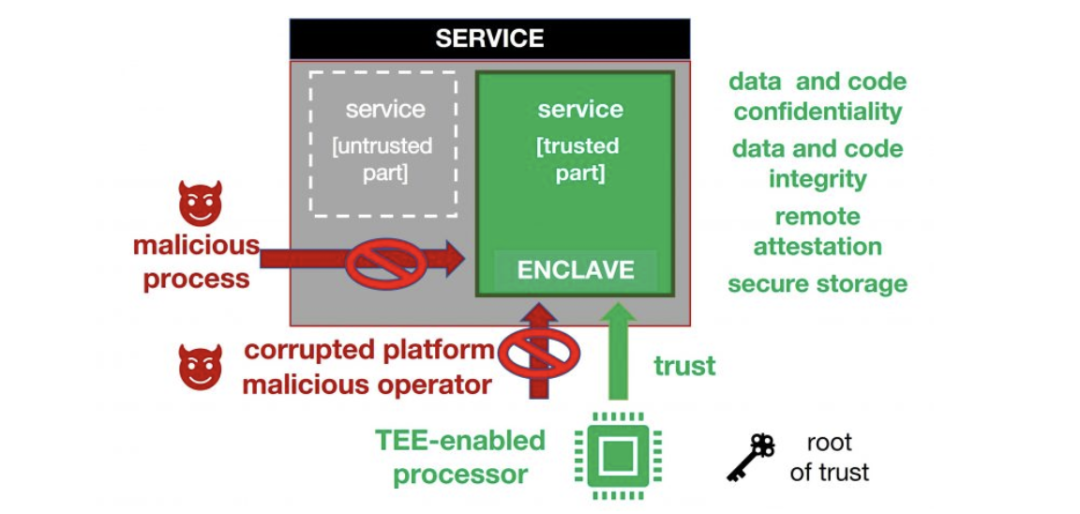

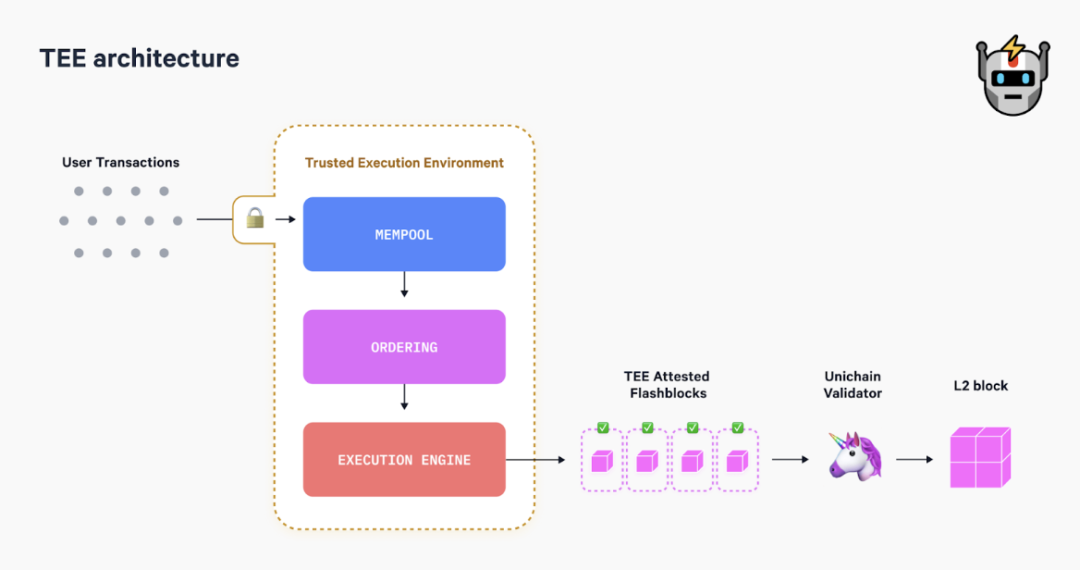

Rollup Boost goes further by incorporating Trusted Execution Environments (TEE) into block building to ensure transaction integrity. Thanks to recent hardware advancements like Intel TDX, real-time performance becomes feasible.

For those unfamiliar with TEEs, they are secure areas within a processor or hardware that enhance privacy by preventing unauthorized entities from reading internal data. At the same time, TEEs maintain high integrity because code inside them cannot be modified or replaced.

In the context of Rollup Boost, Unichain will use TEE-based builders to reduce the risk of MEV leakage. This means when bundles or transactions are sent to a TEE block builder, the integrity feature ensures their arrival order isn't influenced by external parties attempting to extract additional MEV.

Additionally, TEE provides trustless revert protection, shielding users from failed transactions. The TEE can run simulations and detect or eliminate any reverting transactions before processing. This not only improves AMM efficiency (by avoiding failed transactions) but also enhances overall user experience, especially during high-volume periods.

To increase transparency in sequencing and block building, execution proofs will be made publicly available after block generation. These proofs are critical for verifying priority ordering—a concept explained later.

1.3 Flashblock and Verifiable Block Building

Ethereum’s average block time of 12 seconds is too slow to meet today’s expectations for acceptable transaction experience. Moreover, slow block times expose the network to more MEV opportunities and make it vulnerable to congestion under spam attacks.

L2s aim to improve Ethereum’s scalability by batching off-chain transactions and submitting proofs to verify computational correctness. To provide a smoother experience, Unichain targets a 250ms block time. Achieving this requires a system capable of low-latency block transmission and near-instant confirmation. Solana can parallelize up to 440M, but achieves such speed at the cost of some decentralization.

Previously, in most L2 block proposal processes, serialization and state root generation caused delays, making fast block times impractical.

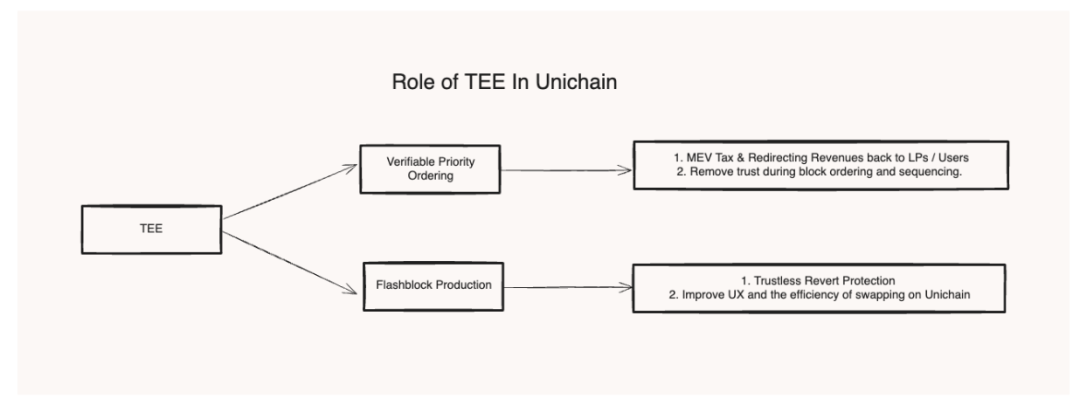

To solve this, Flashbots created Flashblock—a concept that breaks blocks into smaller shards to shorten inter-block intervals and maximize UX/LP benefits.

Flashblock is a pre-confirmation issued by a TEE block builder, providing partial yet rapid confirmation.

Transactions are streamed into the TEE block builder. If the L2 has SBS enabled, the block builder operates separately from the sequencer. After sequencing and bundling, transactions gradually form partially confirmed units called Flashblocks. Flashblocks are broadcast from the sequencer to other nodes every 250 milliseconds for validation.

Since delays stem from state root generation and serialization in L2s, Unichain amortizes the cost of block building by computing the state root and consensus only once across multiple partial blocks—significantly reducing latency.

In short, Flashblock is powerful because:

-

Shorter block times reduce LPs’ risk of adverse selection.

-

Flashblocks provide early execution states of current conditions, simplifying wallet and frontend integrations.

-

Fast transactions deliver superior user experience (UX).

Moreover, since TEE can enforce priority ordering within each Flashblock, applications and smart contracts can now levy MEV taxes, capture priority ordering for their benefit, and redistribute MEV back to LPs and users.

As Dan Robinson emphasized in his tweet, enabling apps and users to “control” their MEV is one of Unichain’s core features/purposes.

Even better, priority ordering can be verified via public execution proofs from within the TEE. This allows users to precisely verify how their transactions were executed—an essential mechanism for ensuring fair priority handling.

1.4 Unichain Validation Network (UVN)

Currently, most L2 sequencers are centralized, meaning a single sequencer's behavior can affect MEV fairness, block liveness, or finality. For example, if a sequencer publishes an invalid block and a fraud proof is submitted to challenge it, the resulting chain reorganization could impact network speed.

To mitigate this single point of failure in sequencing, Unichain introduces the Unichain Validation Network (UVN).

UVN adds an extra layer of finality by focusing on validating blocks through provers attesting to the canonical chain (Ethereum) when blocks are proposed. This process is akin to parallelization, where different stages of block construction can occur simultaneously within a period.

However, without further documentation, it's too early to assess its pros and cons definitively.

1.5 $UNI Token

The $UNI token is no longer just a governance token—it's now a utility token.

To become a validator, operators must first stake $UNI on the mainnet as collateral. A smart contract tracks balances and updates status via Unichain’s native bridge.

At the start of each epoch, the current staked balance is snapshotted, and fees are distributed proportionally based on stake weight. Validators with the highest $UNI stake weight are selected into the active set and earn a portion of validation rewards by publishing proofs. Validators who miss or fail to publish proofs receive no rewards, which carry over to the next epoch.

Based on limited public information, we can infer that validation rewards will be:

(L2 fees paid by Unichain users - MEV tax collected by applications - cost of submitting bundles to Layer 1)

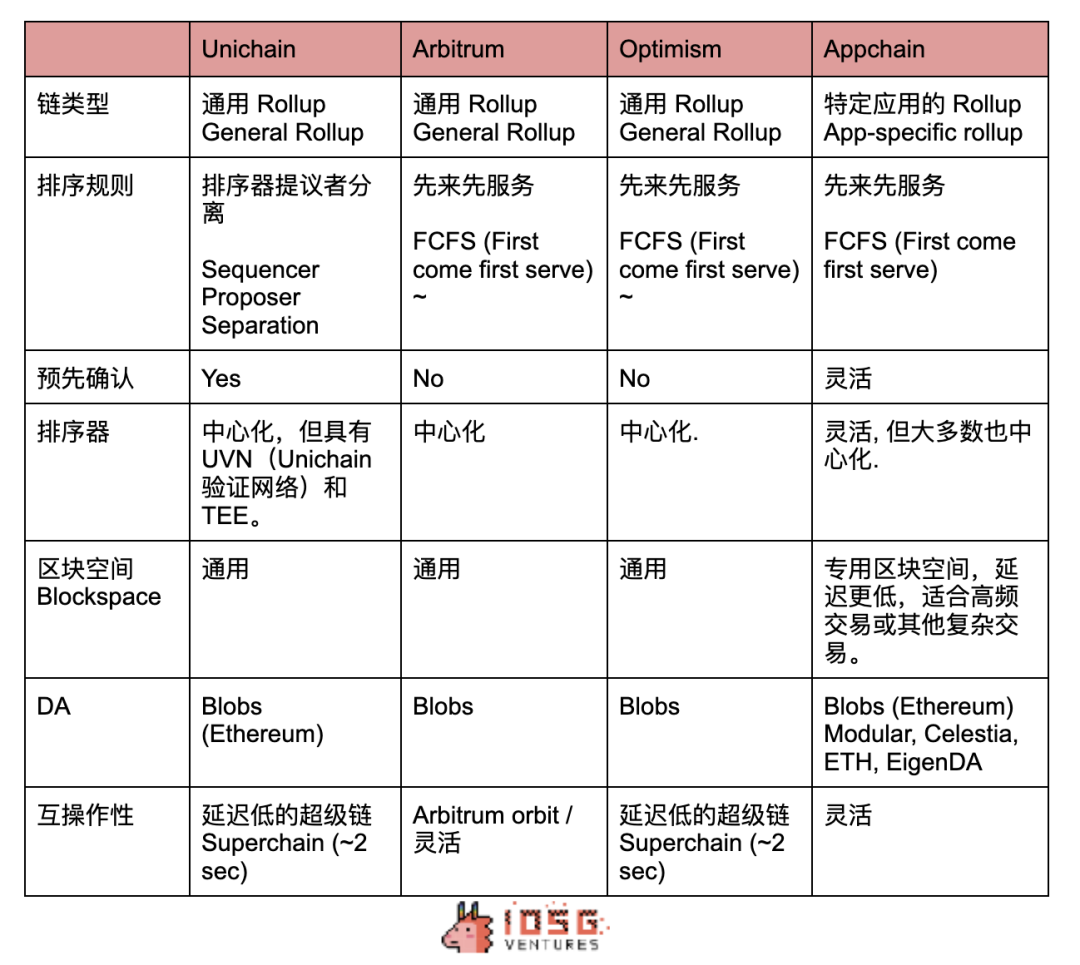

2. Unichain vs Appchain vs General Rollup

-

The key differentiators between Unichain/general rollups and appchains are MEV, pre-confirmations, and blockspace competition.

-

Appchains, with architectural flexibility, can implement various MEV mechanisms to alleviate issues like censorship risks or MEV leakage.

-

Meanwhile, Unichain mitigates and restructures MEV by ensuring transaction order remains unaffected by third parties, thanks to TEE’s integrity properties. Verifiable priority ordering also ensures fair MEV distribution and enables redistribution of MEV revenue to users and liquidity providers.

-

Most sequencers in the market are centralized, allowing them to extract maximum value from order flow. In contrast, Unichain takes a more “public good” approach, as its MEV redistribution mechanism limits the amount of MEV the original sequencer can capture.

-

Unichain is built on OpStack—the unified standard for OP chains—enabling low-latency communication (~2 seconds) across the Superchain via secure messaging and native optimistic interoperability. Appchains, on the other hand, can leverage alternative interoperability solutions, such as joining the IBC ecosystem or building L3s on Arbitrum Orbit (though less common for OpStack-based L2s).

3. Conclusion

Unichain is an intriguing concept. It not only offers users smooth transaction experiences via pre-confirmations but also minimizes MEV exploitation windows through shorter block times enabled by flashblocks. This innovation reduces adverse selection risks for LPs and benefits users and LPs alike with tighter spreads.

On the other hand, the integrity and privacy guarantees provided by Trusted Execution Environments (TEE) ensure users on-chain enjoy assured, verifiable, or application-managed MEV redistribution—thanks to priority ordering on Unichain.

Unichain’s validation process also protects against sequencer single points of failure, with validators playing a crucial role in rapidly finalizing blocks, while transforming the $UNI token into a productive, yield-generating asset.

However, by enabling MEV redistribution, the sequencer sacrifices its ability to capture maximum MEV, with more value being returned to LPs and users on-chain.

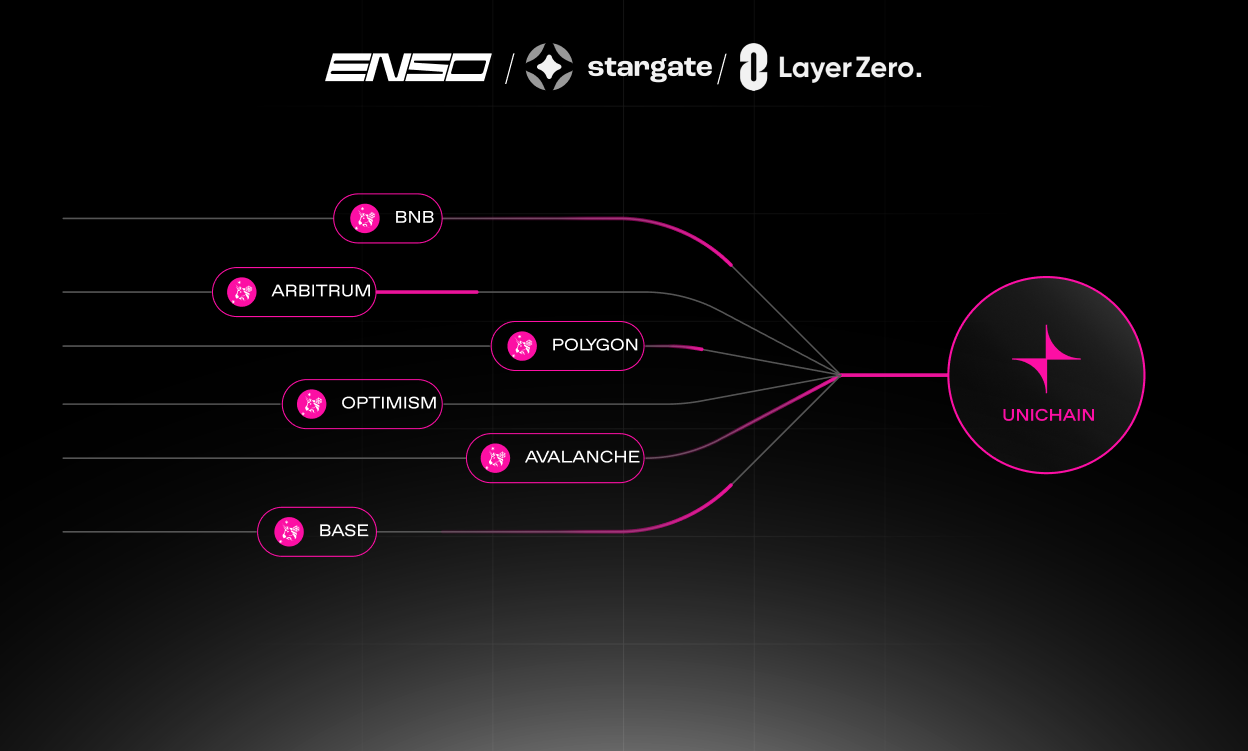

While some may argue Unichain lacks sufficient incentives for assets to migrate, I believe as the L2 ecosystem evolves, interoperability between operating chains will allow Unichain to tap into larger liquidity pools—such as those from Base.

Beyond grants (which Unichain could offer in USDC form post-Uniswap DAO approval), there’s strong incentive for new DeFi apps to build on Unichain, as they can benefit from customizable MEV redistribution strategies. Meanwhile, ecosystem assets can leverage TEE to reduce MEV leakage.

Therefore, with its speed, fair MEV redistribution, and potential interoperability advantages, Unichain has the potential to become the next center of DeFi.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News