What are the highlights of Uniswap's newly launched Unichain?

TechFlow Selected TechFlow Selected

What are the highlights of Uniswap's newly launched Unichain?

Unichain brings together the achievements of Uniswap, Flashbots, and the OP Stack.

Author: 100y

Translation: Luffy, Foresight News

A few years ago, I speculated that Uniswap might develop its own network, but I was skeptical due to potential user experience challenges. However, with the unveiling of Unichain, my prediction has proven incorrect.

Unichain's whitepaper is only three pages long, but upon closer inspection, it reveals itself as a masterpiece. It brings together Uniswap’s long-standing focus on UX, Flashbots’ latest MEV research, and the expansive ecosystem built on the OP Stack. Despite its brevity, the whitepaper covers complex topics such as TEE (Trusted Execution Environment), transaction ordering, and MEV taxation—concepts that may be challenging for readers unfamiliar with MEV fundamentals. Therefore, this article aims to provide a quick and simple overview of Unichain’s key features.

1. The Problem

Uniswap is the leading AMM DEX in the Ethereum ecosystem, currently deployed across 25 networks with a total TVL of approximately $4.5 billion. Although Uniswap is already one of the most successful protocols, it still faces limitations from its underlying networks.

For example, while Ethereum offers massive liquidity, it suffers from low scalability and is vulnerable to malicious MEV (Maximum Extractable Value) extraction. To address these issues, various Rollup solutions have emerged. However, most current Rollups rely on a single sequencer for transaction ordering, creating potential single points of failure such as liveness issues and censorship.

Additionally, block construction on Ethereum and most Rollup networks involves public mempools, creating an environment where users (searchers) extract MEV from other users. Moreover, the structure of the MEV value chain leads to an imbalance—value is disproportionately captured by block proposers rather than being returned to end users.

2. Unichain

2.1 Overview

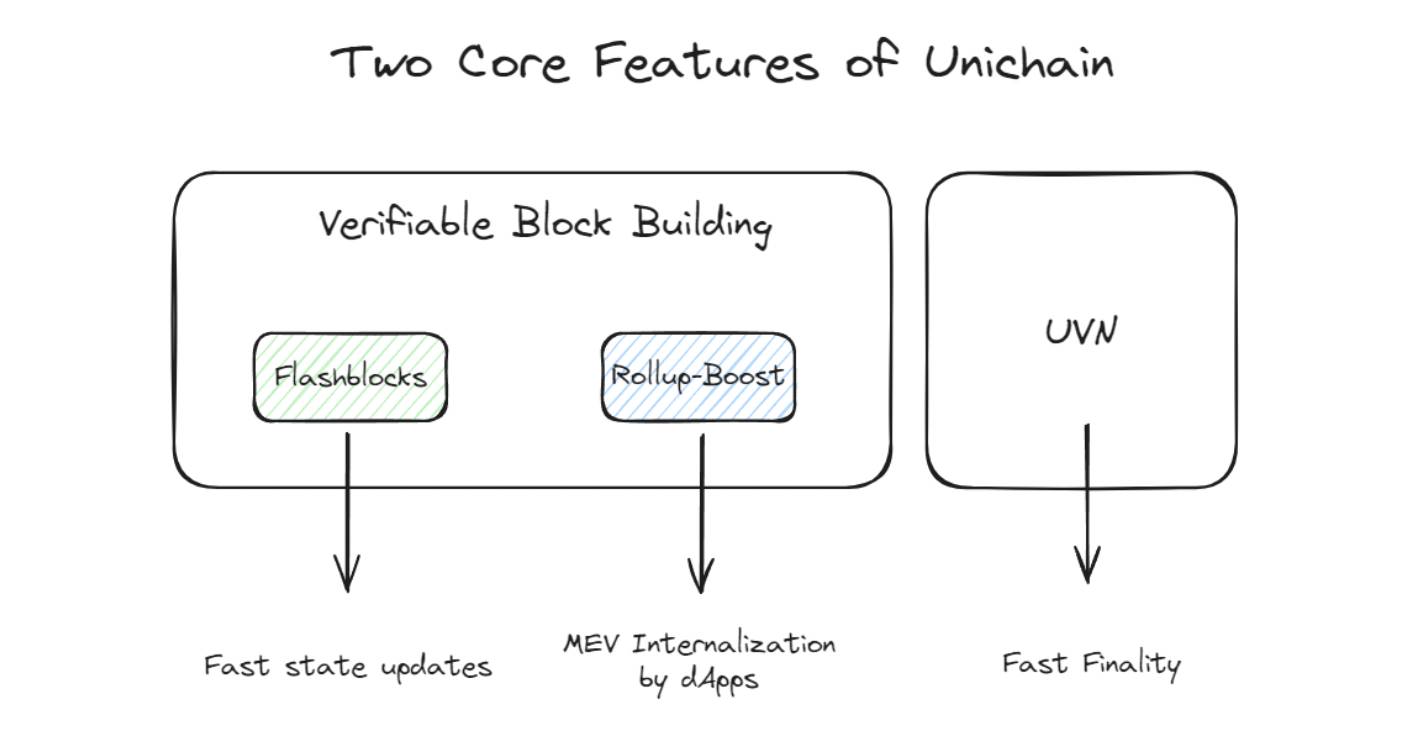

Unichain is an Ethereum Optimistic Rollup based on the OP Stack, launched by Uniswap, Flashbots, OP Labs, and Paradigm to solve the problems outlined above. Unichain delivers several key advantages through 1) verifiable block building and 2) the Unichain Verification Network:

-

Fast state updates

-

Applications capable of extracting and internalizing MEV

-

Fast settlement via rapid finality

In addition to being an OP Stack-based Rollup, Unichain also plans to participate in the Superchain ecosystem. Beyond its native fast settlement capability, this integration is expected to offer users a seamless liquidity experience across chains through cross-chain solutions within the Superchain ecosystem.

Next, let’s take a closer look at how Unichain achieves these capabilities.

2.2 Verifiable Block Building

Verifiable block building is enabled through Rollup-Boost, a feature developed in collaboration with Flashbots. Similar to MEV-Boost, Rollup-Boost acts as a sidecar software and provides two core functionalities: Flashblocks and Verifiable Priority Ordering.

2.2.1 Flashblocks

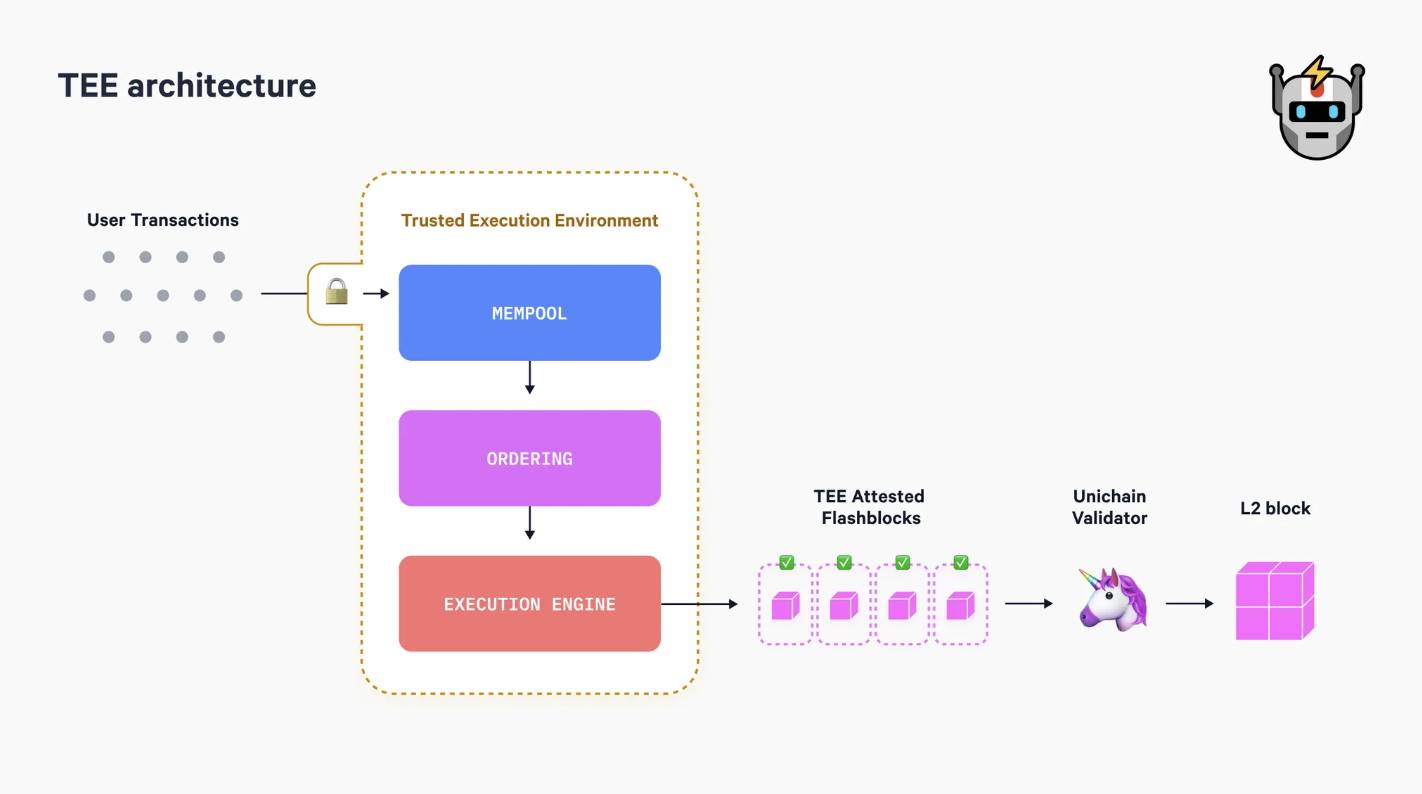

Flashblocks are a pre-confirmation mechanism issued by TEE builders (discussed in detail below). Unichain generates partial blocks, dividing each full block into four segments. A partial block is created every 250 milliseconds and sent to the sequencer.

While executing transactions, the sequencer continuously downloads these partial blocks and provides early execution confirmations to users. The sequencer guarantees that all partial blocks will be included in the final proposed block. This process accelerates state updates, reduces latency, improves user experience, and mitigates malicious MEV.

2.2.2 Verifiable Priority Ordering

2.2.2.1 Priority Ordering

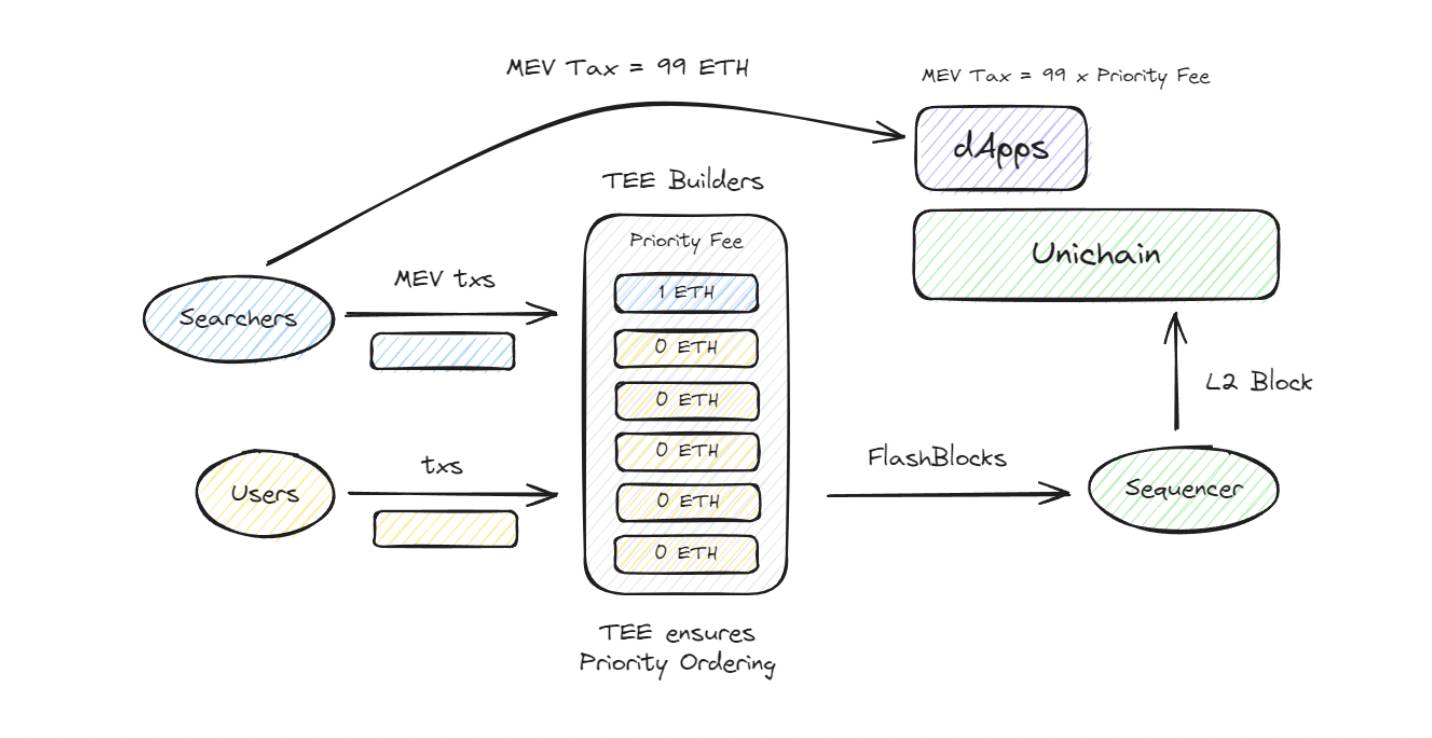

Priority Ordering is a block-building mechanism proposed by Dan Robinson and Dave White of Paradigm. It assumes that block proposers order transactions solely based on priority fees, without engaging in censorship or delaying transactions. This model is only feasible when there is a single or trusted block proposer. In competitive environments like Ethereum L1, where multiple proposers build blocks, priority ordering is not viable.

The purpose of private orders is to allow DApps on the mainnet to impose an MEV tax on interacting transactions, thereby capturing a portion of MEV value. This value can then be used internally by the DApp or redistributed to users. An MEV tax is a fee imposed by a smart contract on transactions, which can be set according to the transaction’s priority fee. Let’s consider an example.

Suppose 100y DEX on Unichain L2 wants to directly capture MEV value from arbitrage opportunities occurring on its exchange. Knowing that blocks on Unichain are built using priority ordering, any MEV value from a transaction is entirely determined by its priority fee. 100y DEX sets an MEV tax equal to 99 times the transaction’s priority fee.

If there’s a $100 ETH arbitrage opportunity, how much priority fee would a searcher be willing to pay at most? The answer is 1 ETH. Setting a 1 ETH priority fee results in a 99 ETH MEV tax, making the total cost exactly 100 ETH. If the searcher sets a higher priority fee, the total cost exceeds 100 ETH, resulting in a loss. Thus, 100y DEX can capture up to 99 ETH out of the 100 ETH MEV value.

For regular users who do not extract MEV, priority fees will naturally be much lower, meaning 100y DEX won’t extract value from their transactions. Instead, it only captures MEV value represented by elevated priority fees. This setup enables applications to directly extract MEV, opening up numerous new potential use cases.

2.2.2.2 Verifiable? Using TEE

The key here is ensuring that the entity responsible for block building actually uses the priority ordering mechanism. To achieve this, Unichain implements two measures: 1) It separates the sequencer from the block builder, similar to the PBS model; 2) It requires block builders to use TEE (Trusted Execution Environment), enabling anyone to verify whether priority ordering is being followed.

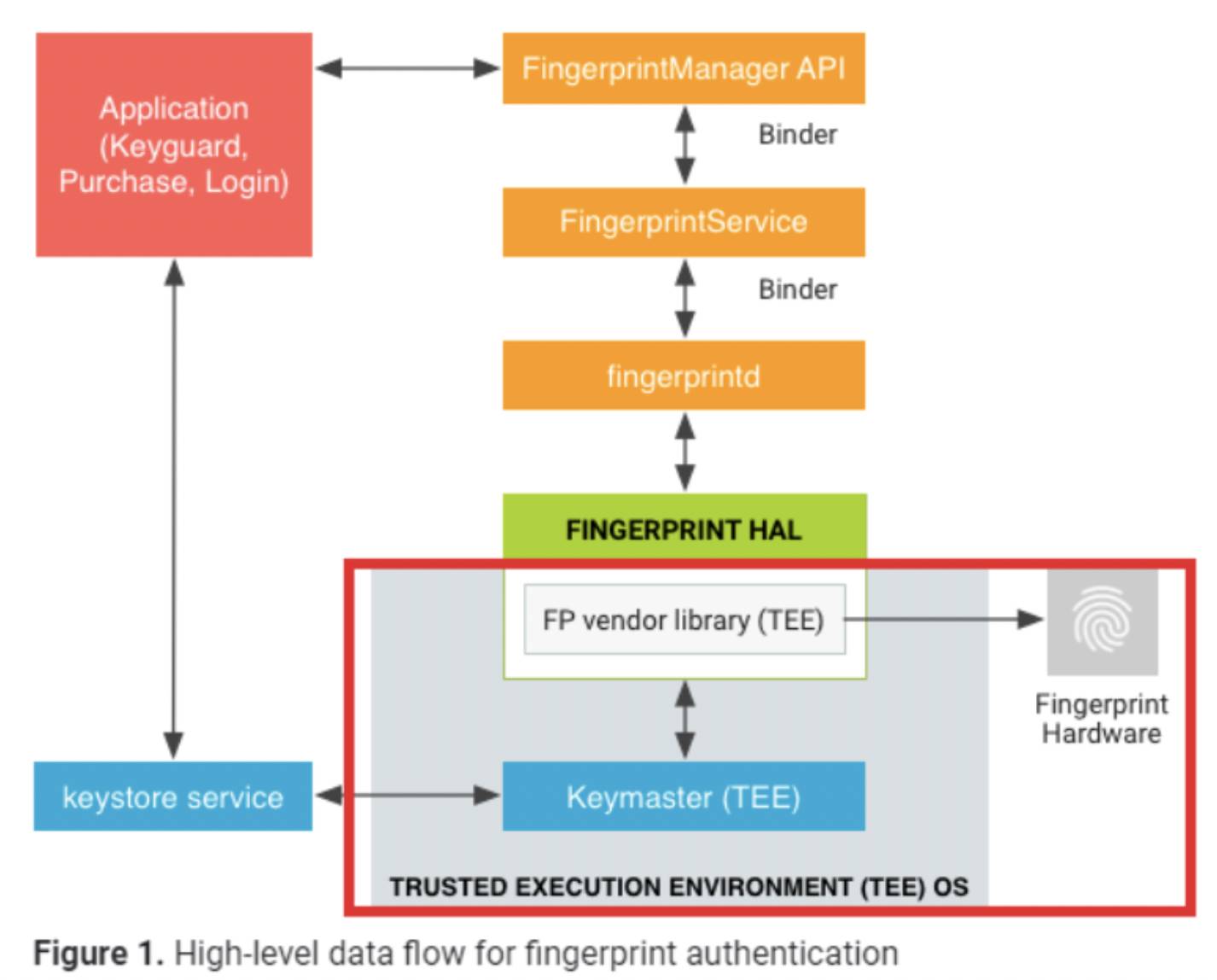

TEE is a secure area within hardware (e.g., CPU) that operates independently from the rest of the system to safely process sensitive data. TEE ensures trusted code runs securely even if the external environment is compromised, such as ARM’s TrustZone or Intel’s SGX.

This design prevents even the operating system or programs with administrator privileges from accessing the secure zone. To ensure the code running inside the TEE is trustworthy, attestation programs are used. This verification guarantees the TEE remains secure and untampered. For instance, in Intel SGX, a hash is generated representing the code and data inside SGX, and a hardware-managed private key proves the integrity of the code.

Unichain’s block-building process takes place within the TEE of TEE builders. Thanks to the properties of TEEs, these builders can first submit a proof demonstrating to users that they are indeed using the priority ordering mechanism. This combination of features ensures that applications on Unichain can reliably capture a share of MEV revenue.

2.3 Unichain Verification Network

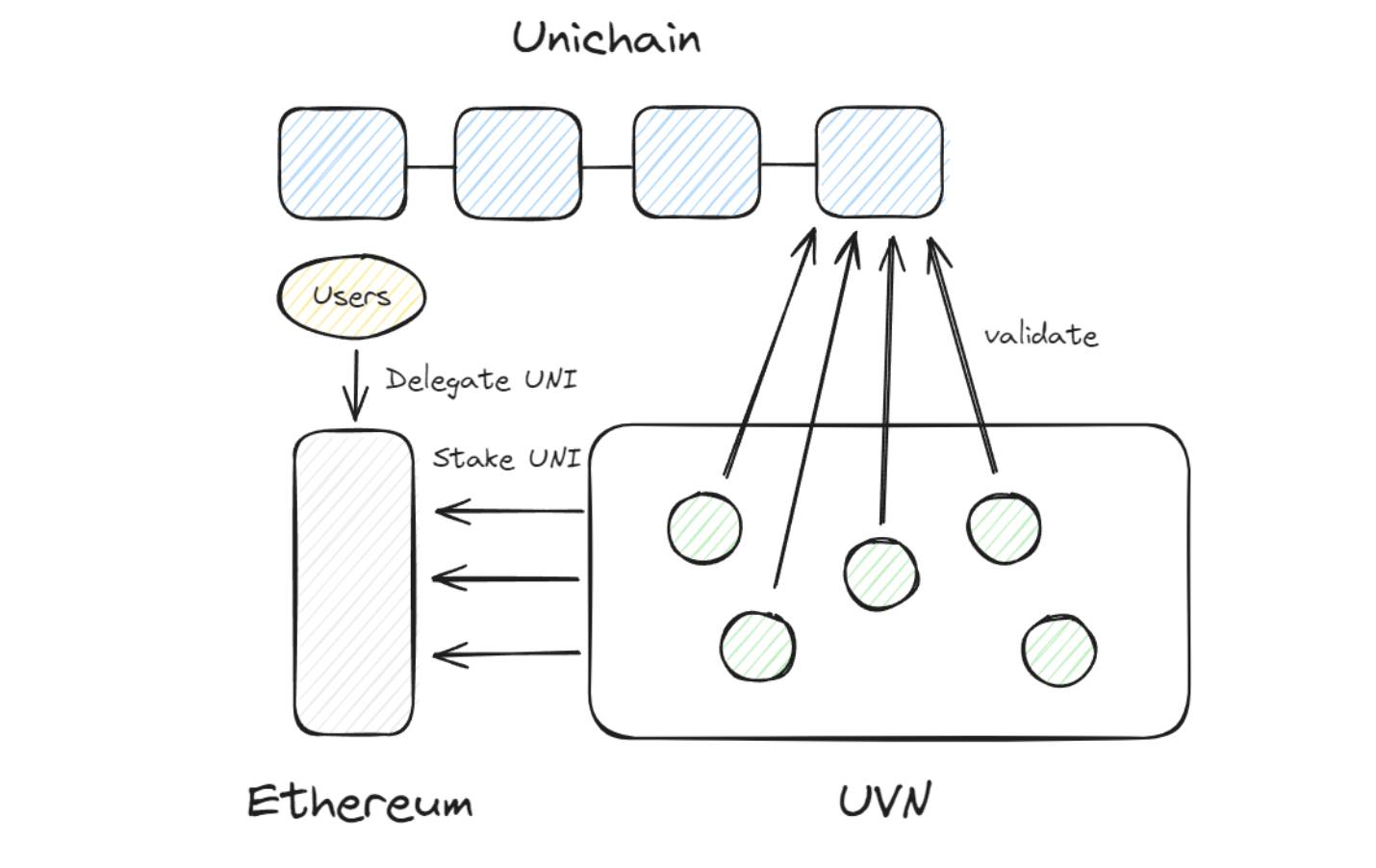

The Unichain Verification Network (UVN) is a decentralized network of node operators responsible for verifying Unichain’s latest state and providing fast finality, enabling seamless cross-chain transactions through economic security. This concept is similar to AltLayer’s MACH, which leverages EigenLayer for rapid finality.

To become a decentralized node in Unichain, participants must stake UNI on the Ethereum mainnet. At each epoch, the nodes with the highest staked UNI balance are selected into the active validator set and participate in validation by running the Reth Unichain client. Additionally, similar to other networks, UNI holders can choose to delegate their stake.

3. Final Thoughts

As a DApp, Uniswap has already achieved strong product-market fit, and I am highly optimistic about its transition to a dedicated L2. However, since liquidity fragmentation remains a challenge, attention should be paid to how the Uniswap team delivers a seamless cross-chain trading experience between Ethereum L1 and Unichain L2.

From an investment perspective, the fact that the UNI token will now serve as the staking token for UVN is particularly interesting. Given the strong performance of staking protocols like EigenLayer, Symbiotic, and Karak, we can expect significant amounts of UNI to be staked in UVN, which could greatly enhance the value accrual of the UNI token.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News