Zero Fees + High Returns: How Haedal Is Shaping a New Era of Sui Staking with Native "One-Two Punch"?

TechFlow Selected TechFlow Selected

Zero Fees + High Returns: How Haedal Is Shaping a New Era of Sui Staking with Native "One-Two Punch"?

Haedal redefines staking with its innovative liquid staking solution.

Author: TechFlow

In 2024, the DeFi sector within the Sui ecosystem already demonstrated remarkable growth. In 2025, this momentum has not only continued but intensified.

According to DefiLlama data, in the first quarter of 2025, Sui's ecosystem TVL surpassed the $2 billion mark, achieving a staggering 341% increase from the beginning of the previous quarter. DEX trading volume within the ecosystem continues to rise, and user activity keeps reaching new highs. These impressive figures not only reflect market confidence in the Sui network but also signal that 2025 will bring a new wave of explosive growth for the Sui ecosystem.

As the ecosystem soars, application diversity and user base expand in tandem, leading to geometric growth in demand for SUI token staking.

Yet Sui users still face dilemmas regarding staking: one is how to balance liquidity with staking rewards; the other is that compared to ETH and SOL, Sui’s current annual staking yield remains relatively low.

These unavoidable challenges in Sui DeFi have become a perfect breakthrough opportunity for the Haedal team.

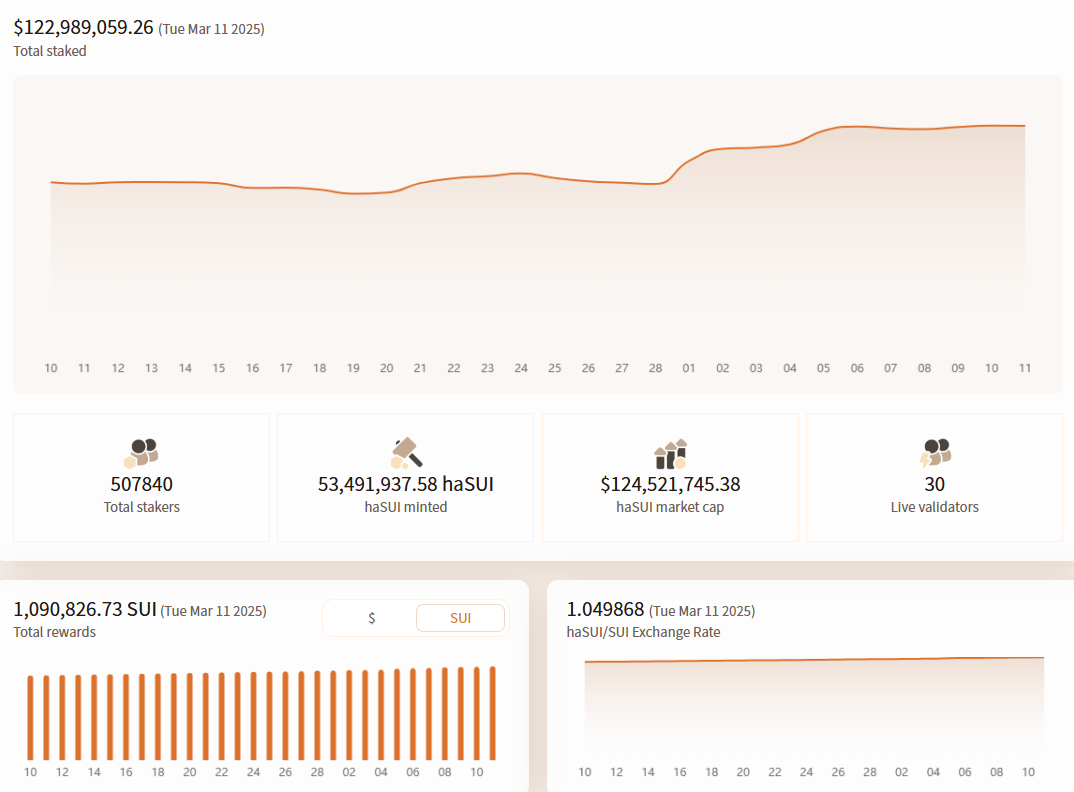

As a winning project of the Sui Liquid Staking Hackathon, Haedal redefines staking through its innovative liquid staking solution. After launch, the project quickly gained market recognition, with TVL surpassing $188 million. This achievement reflects Haedal’s deep thinking in product design and technological innovation.

Haedal: From Dark Horse to Market Leader

Within the thriving Sui ecosystem, Haedal stands out as a leading force in the DeFi space.

Data shows that even amid unfavorable market conditions, Haedal maintains a TVL of $120 million, firmly holding the top position in the Sui LSD sector. Over $150 million worth of active liquidity in its issued liquid staking token, haSUI, circulates across major DEXs and DeFi protocols.

Through strategic partnerships with leading Sui DeFi projects such as Cetus, Turbos, Navi, Scallop, and Mole, Haedal has built a highly collaborative DeFi ecosystem. haSUI has become one of the most active LST assets on these platforms, especially after the launch of Hae3, where the protocol’s innovative revenue distribution mechanism enables win-win-win outcomes for users, partners, and the platform.

Beyond returns, Haedal consistently prioritizes security and long-term ecological sustainability. It employs multi-signature mechanisms and real-time risk monitoring systems to safeguard user assets, while engaging top-tier security auditors like Certik and SlowMist for regular reviews. As of March 2025, Haedal’s smart contract system has passed five professional audits, processed over $1 billion in asset flows, and maintained a zero-security-incident record.

Multidimensional Products to Enhance Sui Staking Yields

As mentioned earlier, the issue of low staking yields in the Sui ecosystem makes many users reluctant to stake:

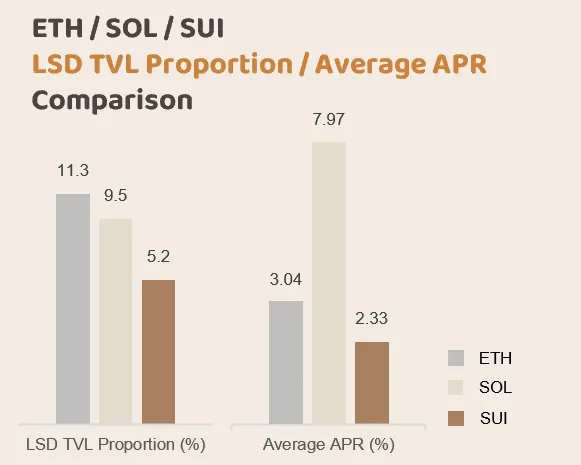

Currently, the average APR for LSTs in the Sui ecosystem is around 2.33%, with direct staking APR from many validators falling below this level.

In contrast, Lido offers an APR of approximately 3.1%, while Jito reaches as high as 7.85%. For holders of native Sui tokens, such returns are insufficient to incentivize moving their tokens from centralized exchanges into Sui’s on-chain environment.

So how can Sui staking become more attractive? Haedal tackles this by focusing on both "cost reduction" and "revenue enhancement."

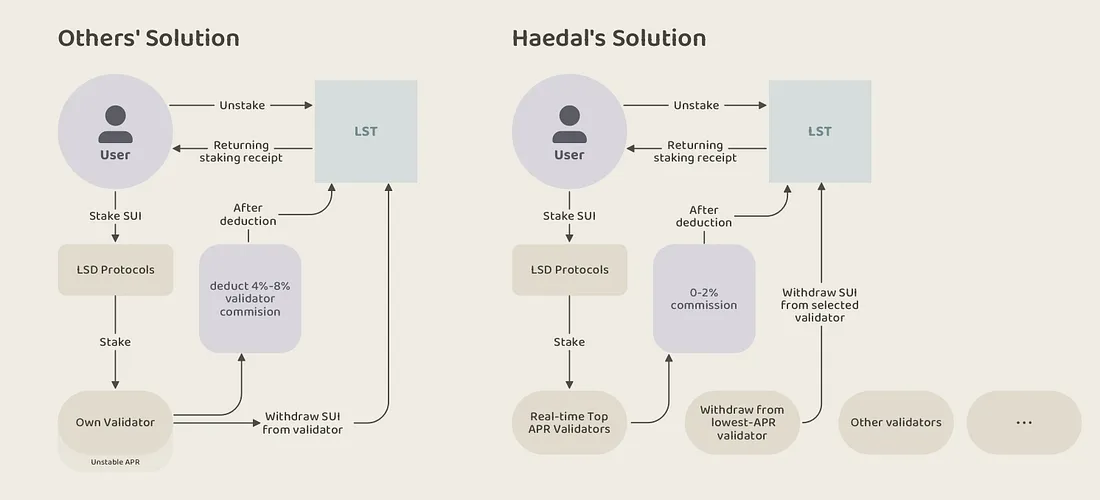

First, reducing costs: Most LSTs on Sui are validator-based, meaning each LST token is tied to a specific validator.

While this isn’t inherently problematic, it doesn't guarantee that the chosen validator offers the highest APR. Moreover, most validators charge 4%-8% commissions, further reducing the final APR for LSTs.

To address this, Haedal introduces dynamic validator selection, continuously monitoring all validators on the network and selecting those with the highest net APR (typically charging 0%-2% commission) during staking. When users unstake, Haedal selects validators with the lowest APR for withdrawal. This dynamic approach ensures haSUI consistently maintains the highest native APR across the entire ecosystem.

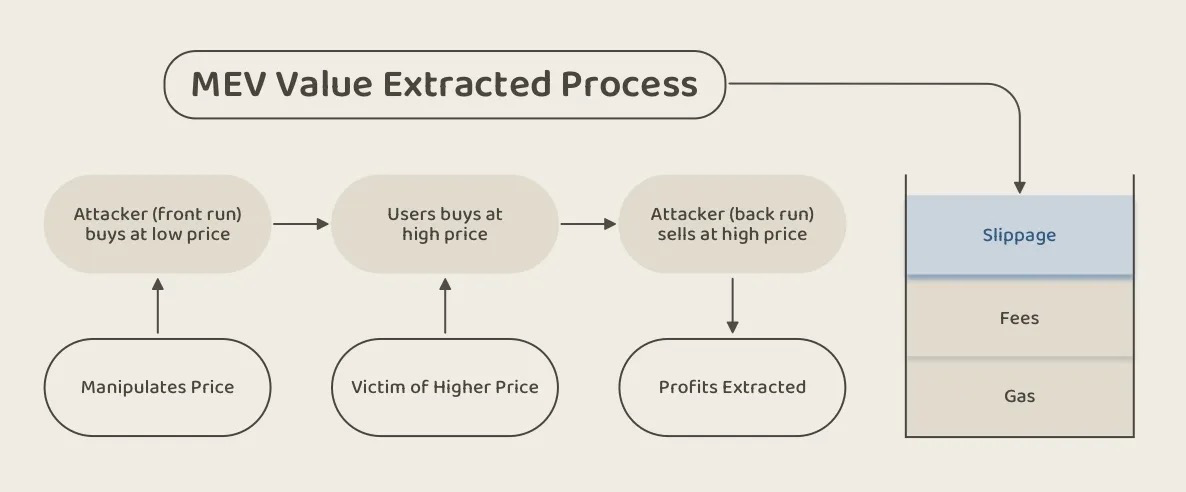

This cost-reduction improvement allows for higher APR to some extent, but still cannot overcome fundamental systemic constraints — MEV costs.

The Sui ecosystem views MEV as a symptom of immature DeFi. If treated as a fixed transaction cost, MEV could make on-chain trading fees ten or even a hundred times higher than those on centralized exchanges, making it difficult to compete with centralized products. Additionally, MEV-induced slippage degrades user experience.

Figure: Sandwich attacks severely impact trading experience and outcomes

Therefore, Haedal launched Hae3 — a suite of products designed to boost staking income from multiple angles.

Hae3: Extracting Value from Ecosystem Transaction Flows

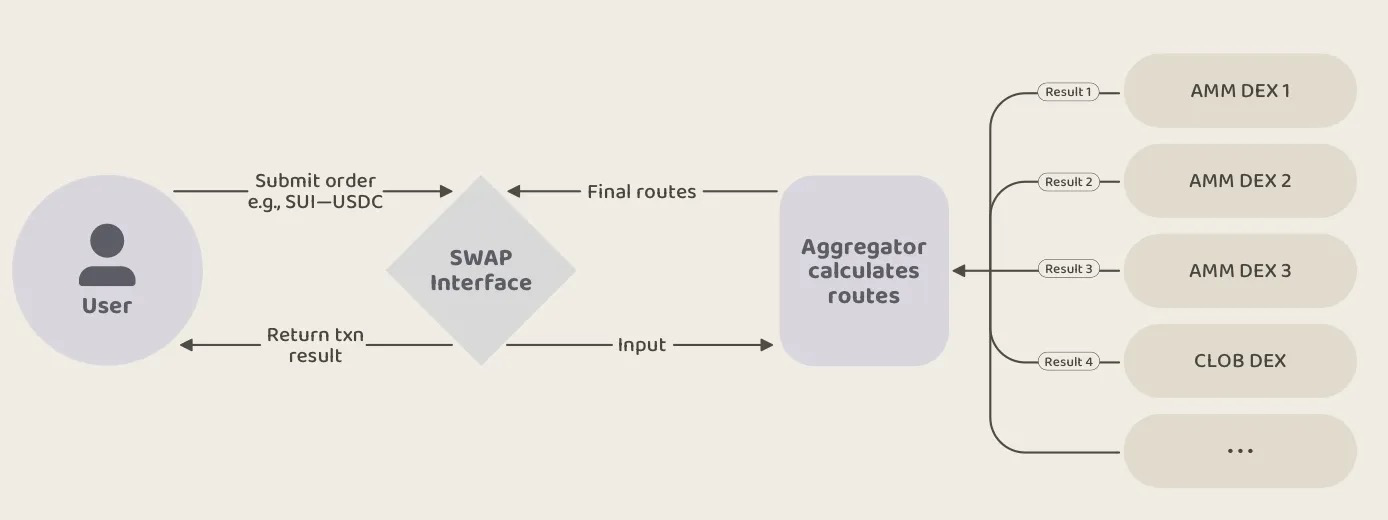

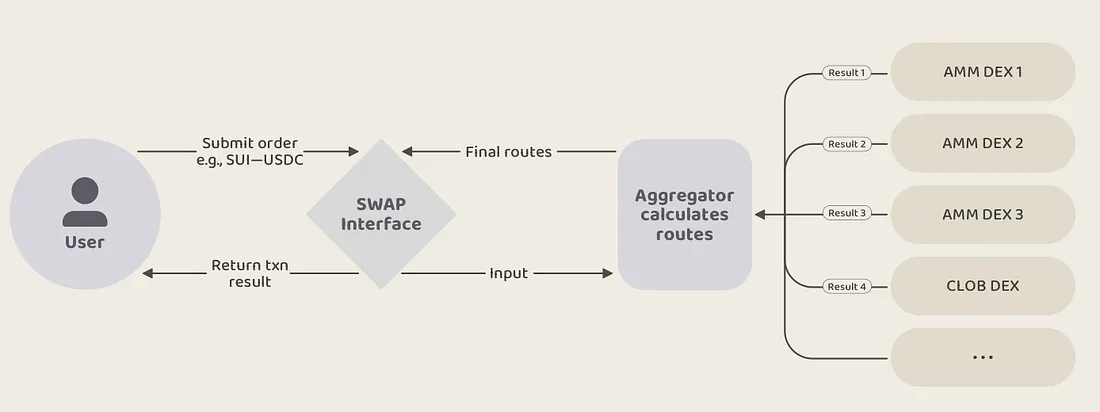

Currently, most transactions on Sui are initiated through aggregators (a common trend across most ecosystems). After a user initiates a trade, various AMM DEXs (like Cetus) and CLOB DEXs (like Deepbook) provide quotes based on pool or order book status. The routing system then calculates the optimal path and executes the trade.

How can we generate additional yield for users within this process while building a complete system? Hae3 offers two powerful yield-enhancing products — HMM and haeVault — along with a mature DAO community, haeDAO.

-

HMM: Efficient Market Making, Amplified Returns

Trading remains the purest and most classic profit model in markets. Haedal clearly understands this well. Through the Haedal Market Maker (HMM) system, Haedal unlocks a new source of yield for stakers while preserving base staking returns.

HMM features three core functionalities:

-

Concentrated liquidity based on oracle pricing: Unlike DEXs that determine prices based on pool states, HMM always uses oracle pricing. The oracle updates prices at high frequency (every 0.25 seconds), ensuring liquidity in aggregators stays aligned with the “fair market price.”

-

Automatic rebalancing and market making: HMM automatically rebalances its liquidity based on asset conditions, capturing market volatility and potentially turning impermanent loss into “impermanent gains” via a “buy low, sell high” strategy.

-

Anti-MEV: HMM is naturally resistant to MEV attacks, ensuring trading profits aren’t eroded by frontrunning or sandwich attacks.

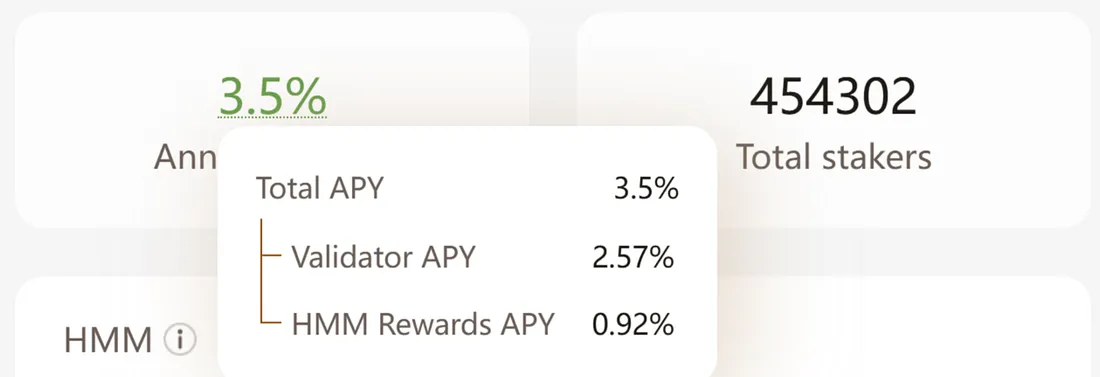

After two months of testing, HMM has captured approximately 10–15% of total DEX trading volume, with haSUI APR steadily rising to a stable 3.5%, significantly outperforming other LSTs on Sui. Of this, HMM contributes an additional 0.92% APR to haSUI.

-

haeVault: Enabling Ordinary Users to Earn Professional Market-Making Returns

Beyond extracting value at every stage, Haedal provides ordinary users with an additional income stream: professional on-chain LP participation.

Liquidity providers (LPs) are certainly familiar to users experienced in on-chain operations. Adding liquidity to popular trading pairs is standard practice for seasoned DeFi users.

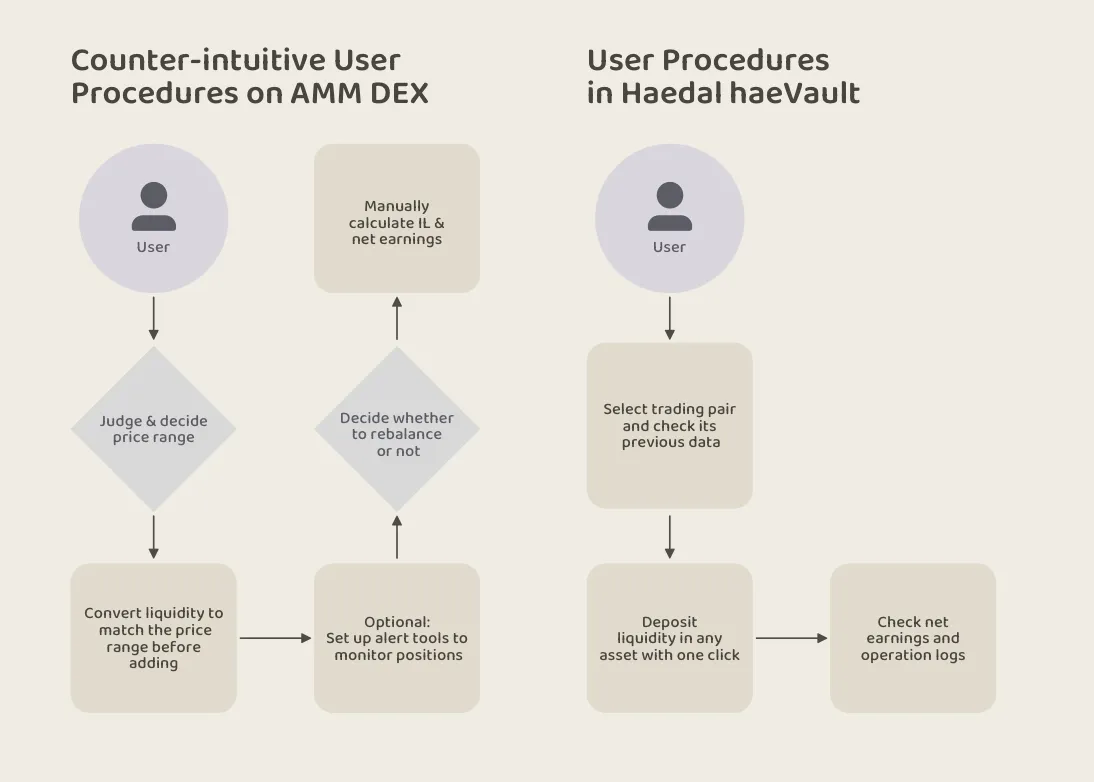

However, for the majority of ordinary users, becoming an LP involves too high a barrier. Under the CLAMM algorithm commonly used on Sui today, providing liquidity to the SUI-USDC pool requires handling several complex tasks:

-

Determine price range: Users must make subjective judgments about the appropriate price interval.

-

Adjust liquidity: Dynamically manage liquidity based on the selected price range.

-

Monitor position status: Continuously check whether their liquidity has moved “out of range.”

-

Decide on rebalancing: Determine when and if to rebalance their position.

This entire process is neither intuitive nor efficient. Risks such as impermanent loss and other potential issues deter many from committing significant capital, or lead them to provide liquidity only within extremely conservative price ranges, naturally limiting their ability to capture maximum LP returns.

For reference, the average APR for the SUI-USDC pool on Sui is about 150%, yet LPs using full-range or ultra-wide-range strategies may earn only 10%-20% APR. Some users, seeking minimal or zero impermanent loss risk, prefer lending or staking instead, which typically offer single-digit APRs.

Professional on-chain LPs, by simulating CEX-style market-making strategies, often provide liquidity within extremely narrow bands and use custom monitoring bots and programs to execute rebalancing and hedging, earning significantly higher returns than average users.

In response, haeVault offers a solution enabling ordinary users to easily participate in liquidity provision and benefit from professional-grade market-making strategies.

haeVault builds an automated liquidity management layer atop AMM DEXs. It dynamically adjusts liquidity according to price movements and rebalances positions based on key metrics. Designed with DEX LP users in mind, haeVault implements professional strategies akin to those used by CEX market makers. While CEX market makers profit from “buying low and selling high,” haeVault earns returns from transaction fee revenues generated by its active DEX liquidity.

Core features of haeVault:

-

Simple operation: Users can participate with just one click by depositing any supported asset.

-

Transparency: Users can clearly view their profit and loss metrics.

-

Fully automated management: Beyond deposits and withdrawals, no further action is required from users.

-

High returns: Leveraging professional strategies, users achieve more competitive yields compared to traditional LPs.

Unlike HMM, haeVault will be open to all users and is naturally suited to attract large-scale capital. Once haeVault accumulates sufficient TVL, it has the potential to capture a significant portion of trading fee revenue from mainstream assets on DEXs.

Currently, Haedal plans to launch the Alpha version of haeVault in the coming weeks — stay tuned.

-

haeDAO: Community Governance and Protocol-Controlled Liquidity

With the continuous growth in TVL of both HMM and haeVault, it is foreseeable that the Hae3 system will capture substantial transaction fee revenue from the Sui ecosystem.

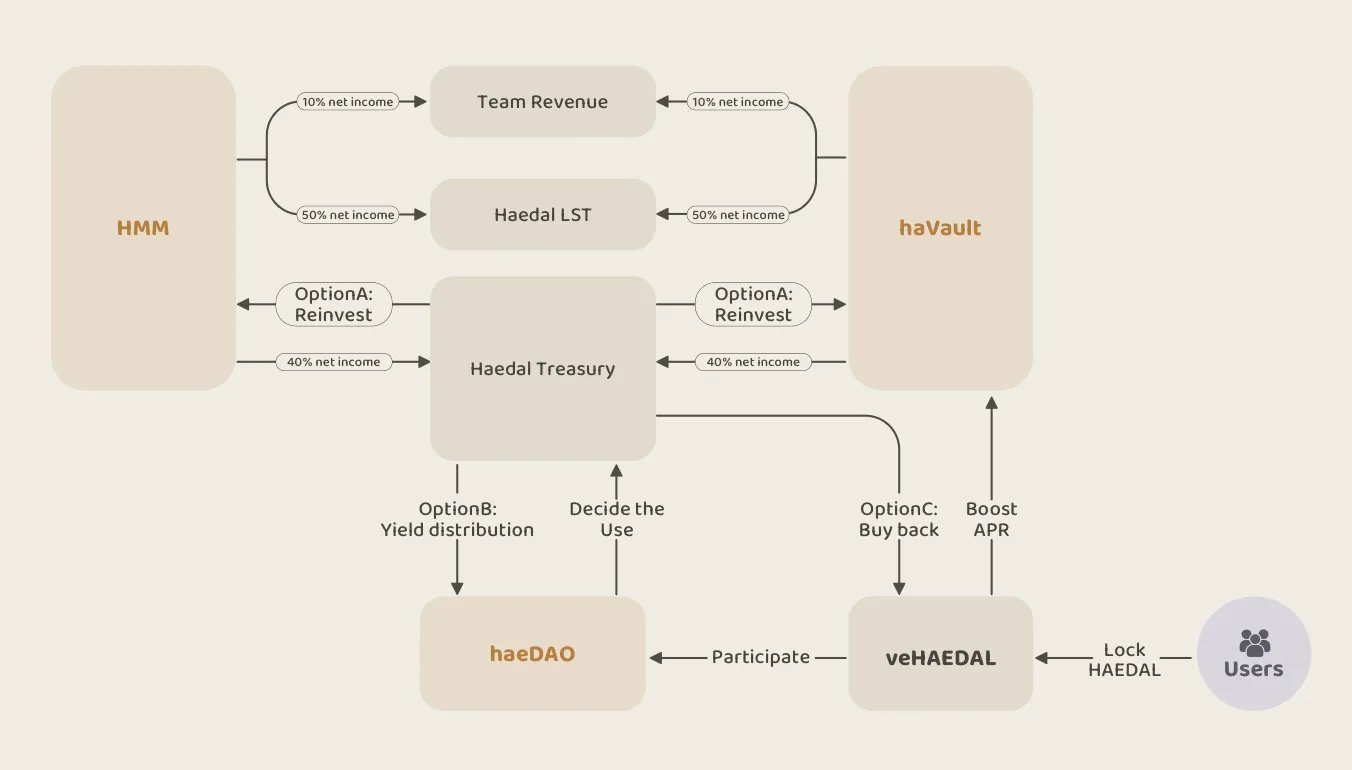

Regarding revenue distribution, Hae3 has a clear plan:

-

50%: Used to boost APR for Haedal LSTs.

-

10%: Allocated to the team to ensure long-term protocol sustainability.

-

40%: Directed to the Haedal treasury as protocol-owned liquidity.

Initially, treasury funds will be reinvested into Haedal’s own products to expand liquidity. As the products mature, Haedal will introduce haeDAO to manage the treasury, empowering both the Haedal token and the broader community.

The Haedal token $HAEDAL can be locked to become veHAEDAL (name tentative), granting full rights within haeDAO. These rights include:

-

Treasury governance: Deciding asset allocations, liquidity distribution across different product modules or protocols, and reward mechanisms.

-

Boost haeVault returns: Increasing user weight in haeVault to unlock higher annualized yields.

-

Proposal and voting power: Major protocol decisions — such as key product directions and treasury usage — will be made through DAO votes.

haeDAO is expected to launch in Q2 2025, serving as the final piece completing the Hae3 product suite. As the Hae3 economic system evolves into a self-sustaining and growing treasury, the Haedal ecosystem will achieve long-term sustainable development and expansion.

From "Efficiency" to "Ecosystem"

From its initial focus on liquid staking to now building a comprehensive product matrix including Hae3, Haedal has consistently responded to market needs through technological innovation.

With its core product suite maturing, Haedal is entering a new phase of development. Balancing product innovation with user experience, and maintaining technical leadership while deepening ecosystem collaboration, will be the team’s next set of challenges. The market will continue to watch how Haedal performs in the face of these new frontiers.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News