Memecoin Global Market Portrait: Deconstructing Users, Narratives, and Community Culture

TechFlow Selected TechFlow Selected

Memecoin Global Market Portrait: Deconstructing Users, Narratives, and Community Culture

Memecoins will no longer be mere speculative assets, but digital assets combining entertainment, cultural identity, and community consensus.

Author: JE Labs

1. Overview

The Memecoin market has rapidly expanded globally in recent years, with distinctive ecosystems emerging in regions such as the United States, China, South Korea, and Europe. In these markets, KOLs (Key Opinion Leaders) play a crucial role in shaping community engagement, market sentiment, and trading trends. This report focuses on six major markets—the U.S., China, South Korea, Europe, Japan, and Russia—to identify the most representative Memecoin KOLs in each region and analyze their trading activity, communication strategies, and community influence. By examining the characteristics of KOLs across different markets, we aim to better understand the global propagation logic and trading patterns of Memecoins.

1.1 Research Objectives

-

Compare Memecoin development across regions—assessing metrics such as trading volume, regulatory policies, and KOL influence.

-

Identify representative KOLs in each region—selecting the most influential figures in the U.S., China, South Korea, and European Memecoin markets. We examine regional differences in KOL authority, dissemination methods, and audience preferences.

-

Summarize traits of active community KOLs—analyzing their social media strategies, community engagement models, and impact on trading trends to provide actionable insights for projects seeking to enter these markets.

1.2 Rationale for Regional Selection

Within the global crypto landscape, Memecoins represent a unique ecosystem driven by community dynamics, cultural narratives, and speculative behavior, exhibiting significant regional divergence. This report focuses on China, the U.S., Europe, South Korea, Japan, and Russia for the following reasons:

-

United States: As the core hub of global cryptocurrency trading, the U.S. dominates liquidity and trading volume in the Memecoin space. Many iconic Memecoins (e.g., $DOGE, $SHIB) originated here and have since built expansive global ecosystems.

-

China: Despite regulatory constraints, China maintains a large investor base and highly active communities. Users continue to trade Memecoins via DeFi platforms and CEXs with strong enthusiasm. The market is highly speculative, often driving short-term price movements and even spawning locally themed Meme tokens.

-

South Korea: One of the most active crypto markets globally, particularly known for high-frequency trading and robust community operations. Korean investors exhibit strong FOMO tendencies, leading to explosive price swings in local Memecoins over short periods. Additionally, K-Pop culture provides rich creative inspiration for Memecoin narratives.

-

Europe: Compared to more speculative Asian markets, European users tend to prioritize cultural resonance and long-term value investing. Many native Memecoins incorporate political satire or social movements, forming a distinct market style.

-

Japan: The Memecoin market is heavily influenced by ACG (anime, comics, games) culture and the popularity of 2D brands. Projects often revolve around anime characters, internet memes, and VTubers, creating a uniquely Japanese Meme model distinct from other countries.

-

Russia: Due to international sanctions and domestic social conditions, Russia's Memecoin market exhibits strong insularity and speculation. High inflation and ruble depreciation drive demand for hedging assets, making cryptocurrencies an alternative investment tool for wealth preservation and speculation.

2. Global Memecoin Market Overview

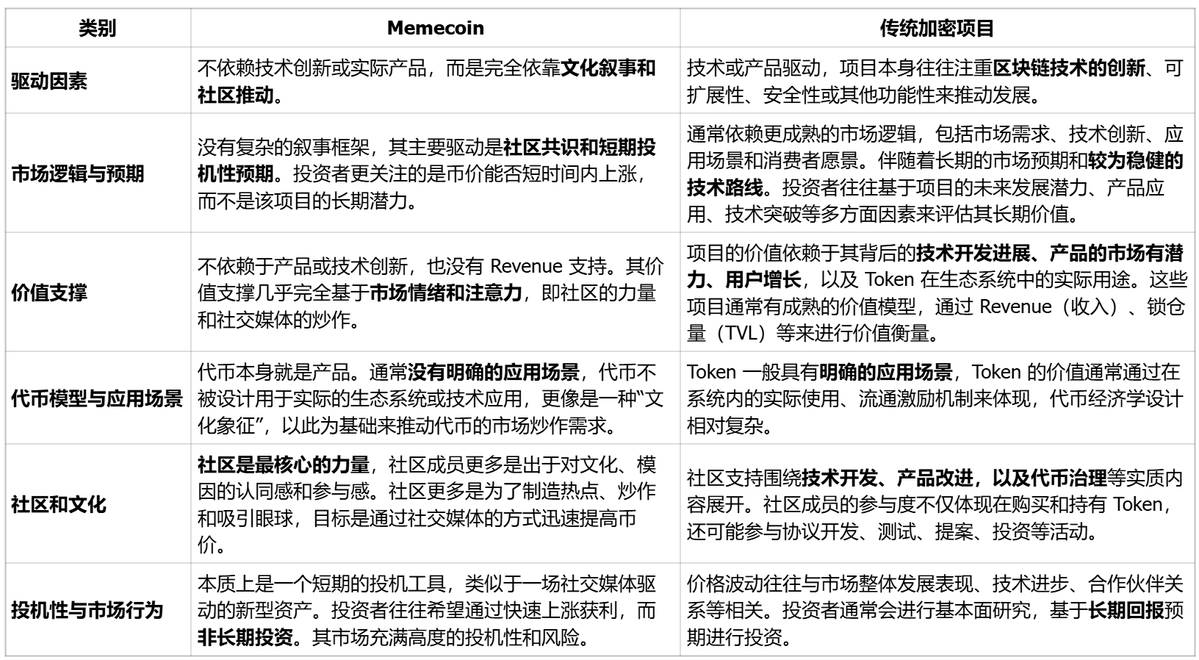

2.1 Memecoin vs. Traditional Crypto Projects

While both fall under the broader cryptocurrency category, Memecoins differ significantly from traditional crypto projects (such as blockchains, DeFi protocols, and DApps) in terms of core value proposition, driving forces, and how markets perceive and react to them.

Comparison between Memecoins and traditional crypto projects

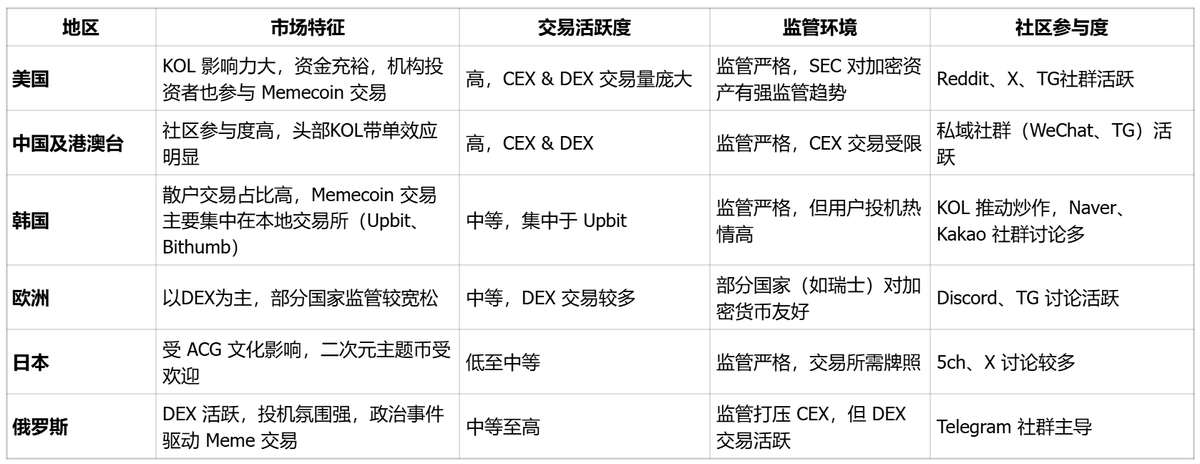

2.2 Regional Market Characteristics Comparison

Memecoin development varies significantly across regions due to influences from culture, regulation, and market preferences:

Regional market characteristic comparison

-

United States: The U.S. has a vast crypto investor base with diverse participants including institutional and retail investors. Institutional investors favor mainstream assets like Bitcoin (BTC) and Ethereum (ETH), while retail investors, especially younger generations, show strong interest in Memecoins.

-

China: Due to strict government regulations, domestic exchanges have been shut down. Investors primarily participate through OTC channels or overseas platforms. Chinese investors remain interested in high-risk, high-return opportunities.

-

South Korea: According to the Korea Financial Intelligence Unit (KoFIU), there are over 6 million crypto investors in South Korea—more than 10% of the population. Most trade via centralized exchanges (CEXs), with Upbit holding about 80% market share. Korean investors show strong appetite for high-potential altcoins and accept associated risks, contributing to a higher proportion of altcoin trading.

-

Europe: Acceptance of cryptocurrencies is gradually increasing with relatively lenient regulations. However, investors prefer stable investments focused on major cryptos. While Memecoins are traded, their overall market share remains relatively low.

-

Japan: Influenced by ACG culture, anime-themed tokens are popular, though overall trading activity ranges from low to moderate. Strict regulations require exchanges to hold licenses; discussions mainly occur on 5ch and X (formerly Twitter).

-

Russia: Sanctions have driven activity toward DEXs and P2P trading. Telegram communities exhibit strong speculative behavior around Memecoins, but sustainability is generally low. Occasionally, politically themed tokens emerge.

3. Regional Memecoin Ecosystem Analysis

3.1 United States

-

Top-tier narrative drivers—Trump and Musk: The top narratives in the U.S. Memecoin space center around Donald Trump and Elon Musk. Traders closely monitor their social media activities—profile pictures, bios, retweets, and posts—for potential storytelling cues to launch and promote corresponding Memecoins. A simple change in Musk’s profile picture or a brief tweet from Trump can spark the creation of new Meme tokens. For example, when Trump ran for re-election, many speculated he would update his X bio to “45th & 47th President of America,” prompting the emergence of tokens like $47 and $4547 on Solana.

-

Secondary narratives driven by politics, economy, and social events: Secondary themes involve influential figures from politics, tech, and beyond—such as Steam founder Gabe Newell and Ethereum co-founder Vitalik Buterin. U.S. Memecoin trends also align closely with economic policies, political developments, and news stories. For instance, Trump’s promise to pardon Ross Ulbricht (founder of Silk Road) sparked trading in $FreeRoss; his claim that he would reveal the “Lolita Island” list made related token names speculative targets. On the social front, the trial of Luigi led to a surge in $LUIGI, elevating it to top-tier celebrity coin status.

-

Positive, uplifting narrative core: A significant portion of U.S. Memecoins carry positive, inspiring messages that resonate universally. For example, Trump shouting “FIGHT” after an assassination attempt evolved into the $FIGHT token, symbolizing unyielding resistance. $FAFO (“Fuck Around and Find Out”) satirizes corruption and inefficiency in the U.S. government. The squirrel mascot of $PNUT represents justice and perseverance—a concept well-recognized in Western cultures.

-

Community-driven, long-term holding: Compared to other regions, U.S. Memecoin traders lean more toward long-term community building rather than short-term speculation. Tokens like $FAFO, rooted in Trump-era policy discourse, fostered strong communities where many holders became dedicated “diamond hands.” This model—narrative-driven consensus supported by active communities—gives the U.S. Memecoin ecosystem greater durability and influence.

3.2 China

-

Driven by Western trends, lacking localized narratives: China’s Memecoin market largely follows Western trends, with investors focusing on overseas-driven narratives. Localized storytelling remains weak. Many popular Western Meme icons lack recognition among Chinese users due to cultural and linguistic barriers. For example, $PEPE, which went viral in the West, failed to gain early traction in China because local traders didn’t grasp the meme’s context. Moreover, since most crypto information circulates in English, Chinese retail investors often face delays in accessing timely updates, causing late entries. Most tokens use English names, further limiting the global resonance of locally created Memecoins.

-

Weak local ecosystem, short-lived hype cycles: Although some localized Memecoins exist in China, they generally lack staying power, relying instead on fleeting trends and short life cycles. For example, Shen Teng mentioned $DogeKing during a Spring Festival Gala skit, coinciding with an existing CEX-listed token of the same name, resulting in a temporary market spike. Since then, a tradition emerged of launching "Gala-themed" Memecoins annually, with retail traders hunting for trade angles during the broadcast. Similarly, domestic IPs like Nezha gained attention when featured in North American releases, spawning tokens such as $NEZHA and $AOBING. Some early Chinese recursive token projects had Meme-like qualities but disappeared due to regulatory crackdowns—like Pangu Coin, labeled as a pyramid scheme and subsequently banned.

-

Focus on AI and technology sectors: Chinese traders show particular interest in the latest developments in AI and technology, aligning investments with technological trends. AI-related Memecoins attract significant attention—for example, homegrown AI tokens like DeepSeek and HKU-developed AI Goku saw multiple similarly named tokens appear simultaneously. Overseas blockchain platforms or AI tools often issue tokens via official TGEs (Token Generation Events), lending credibility and long-term value. This contrast makes AI-themed Memecoins in China more speculative, requiring investors to exercise caution to avoid falling into short-term hype traps.

3.3 South Korea

-

High-risk investment mindset: With rigid class structures, South Koreans often seek rapid wealth accumulation through high-risk, high-reward investments. This psychology drives investor interest—especially among those aged 20–30—in VC-style opportunities, making Memecoin trading a top choice. Trading in Korea is characterized by fast pace, extreme volatility, and intense community fervor, but profit windows are extremely narrow. The market operates more on short-term speculation than long-term value investing.

-

Strong ties to pop entertainment culture: Korean Memecoin traders frequently blend K-pop idol culture, films, and internet memes to fuel market speculation. For example, the fictional coin $MOMMY featured in the movie "Crypto Man", based on the $LUNA saga, sparked a frenzy, reaching a peak market cap of $5 million at the primary level. Rumors that Season 2 of "Squid Game" might feature a cryptocurrency triggered a speculative rush in copycat tokens. These phenomena are typically marked by extreme short-term speculation, where insiders exploit information asymmetry to pump prices, create "get-rich-quick" illusions, and dump on latecomers outside the inner circle.

-

Highly volatile, extremely high turnover: Driven by short-term speculation, Memecoin turnover rates in Korea far exceed those in Western markets. Rapid capital flows cause sharp price fluctuations, defining the Korean trading landscape. Trading volume correlates strongly with social media buzz. On platforms like Telegram, Twitter, Naver Café, and KakaoTalk groups, investors actively share strategies, sentiments, and hot topics, generating powerful network effects. When a Meme trend gains traction, corresponding token volumes can surge within hours. Conversely, if interest wanes, trading dries up quickly, plunging the project into prolonged dormancy.

3.4 Europe

-

Multicultural narratives, strong regional meme influence: Europe’s Memecoin ecosystem reflects pronounced regional cultural identities. For example, French and Belgian markets embrace Memecoins based on comic figures like Asterix and Obelix, while German investors favor politically satirical tokens tied to EU policies, energy crises, or inflation. Additionally, football culture runs deep across Europe—during events like the World Cup or Champions League, numerous football-themed Memecoins emerge (e.g., $RONALDO, $MBAPPE, $MESSI), often experiencing brief but explosive market runs.

-

Driven by political and social issues: Unlike the U.S., where personality cults (e.g., Musk, Trump) dominate, European Memecoins lean toward political debates, societal concerns, and collective emotions. For example, during France’s 2023 pension reform protests, a token named $MACRON briefly gained popularity, mocking President Macron’s policies. Strong anti-establishment sentiment fuels tokens like $EUBUREAU, ridiculing EU bureaucracy, or $GRETA (based on climate activist Greta Thunberg), satirizing carbon tax policies—each sparking investment surges in their time.

-

NFT integration enhances artistic attributes: Given Europe’s rich artistic heritage, its Memecoin ecosystem integrates more naturally with NFTs, creating collectible digital assets. Web3 communities in France and Italy often launch Meme tokens inspired by classic art—such as $MONA based on da Vinci’s Mona Lisa or $VANGOGH derived from Van Gogh’s works. These tokens are often paired with NFT drops to boost market recognition and collectibility. Combined with Europe’s mature digital art scene, this fusion enjoys strong market acceptance, leaning more toward cultural expression than pure speculation.

-

Low-risk preference, stricter regulatory environment: European investors generally exhibit lower risk tolerance. Their Memecoin trading approaches are cautious, avoiding mass FOMO-driven rallies. The European Memecoin ecosystem is more stable, favoring low-volatility tokens and long-term holding based on community consensus.

-

Lower social media influence, slower diffusion: Memecoin dissemination in Europe relies mainly on Telegram, Reddit, and Discord, with limited impact from X and TikTok. This results in slower spread and weaker breakout power compared to U.S. or Korean markets. For example, $PEPE, which exploded in the U.S., only reached European awareness after the peak hype had passed. This slow propagation reduces sudden boom-bust cycles, favoring gradual, consensus-based, community-driven growth models.

3.5 Japan

-

Integrated with anime, gaming, and otaku culture: Japan’s Memecoin development is shaped by local culture, especially anime, games, and light novels. As home to the world’s most advanced ACG (Anime, Comic, Game) industry, many projects draw from famous IPs or trending internet memes—such as tokens themed around *Attack on Titan* or *Neon Genesis Evangelion*. However, due to strict copyright laws, many such tokens face legal risks and struggle to survive long-term.

-

Social media and VTuber influence: VTuber (virtual YouTuber) culture thrives in Japan. Traders closely follow VTuber content, and even casual mentions of slang can ignite Memecoin frenzies. For example, a Hololive VTuber once said “Kusa” (くさ)—a Japanese internet slang derived from “warai” (laugh)—sparking a sharp rally in $KUSA. Platforms like X, Niconico, and 5ch forums are key sources of information for Japanese Memecoin traders.

-

Seasonal memes and festival-limited themes: Japan’s Memecoin market features strong seasonal patterns. Special occasions—such as cherry blossom season, Tanabata, Halloween, Kohaku Uta Gassen, or Comiket—often spawn themed tokens. For example, $SAKURA and $OHANAMI (flower viewing) saw brief but intense trading during spring festivals, merging real-world celebrations with virtual assets in a phenomenon known as “short-term meme flipping.”

3.6 Russia

-

Domestic platforms dominate, TG communities thrive: Due to restrictions on Western platforms like X and Instagram, Russian Memecoin promotion occurs primarily through Telegram and VK (a Russian social network), enabling information sharing and market manipulation. This fosters a closed-circle dissemination model—slower to spread globally than Western markets, but with stronger community cohesion and loyal holders.

-

Sanctions limit liquidity: International sanctions restrict access to major exchanges, reducing liquidity for local Memecoins and hindering global integration. As a result, trading relies heavily on domestic CEXs like EXMO and YoBit. Payment system blocks also increase transaction costs abroad, limiting trading activity and preventing global consensus formation.

-

Hedging needs coexist with speculative psychology: Facing chronic high inflation, ruble depreciation, and sanctions, cryptocurrencies serve as alternative safe-haven assets for many Russians. During economic instability or fiat exchange restrictions, crypto trading volume spikes. Users often chase high-risk, high-return Meme projects, using short-term speculation to offset losses from devalued fiat holdings.

4. Summary of Memecoin KOL Traits Across Regions

4.1 Western Countries

Representative Western KOL—Murad @MustStopMurad

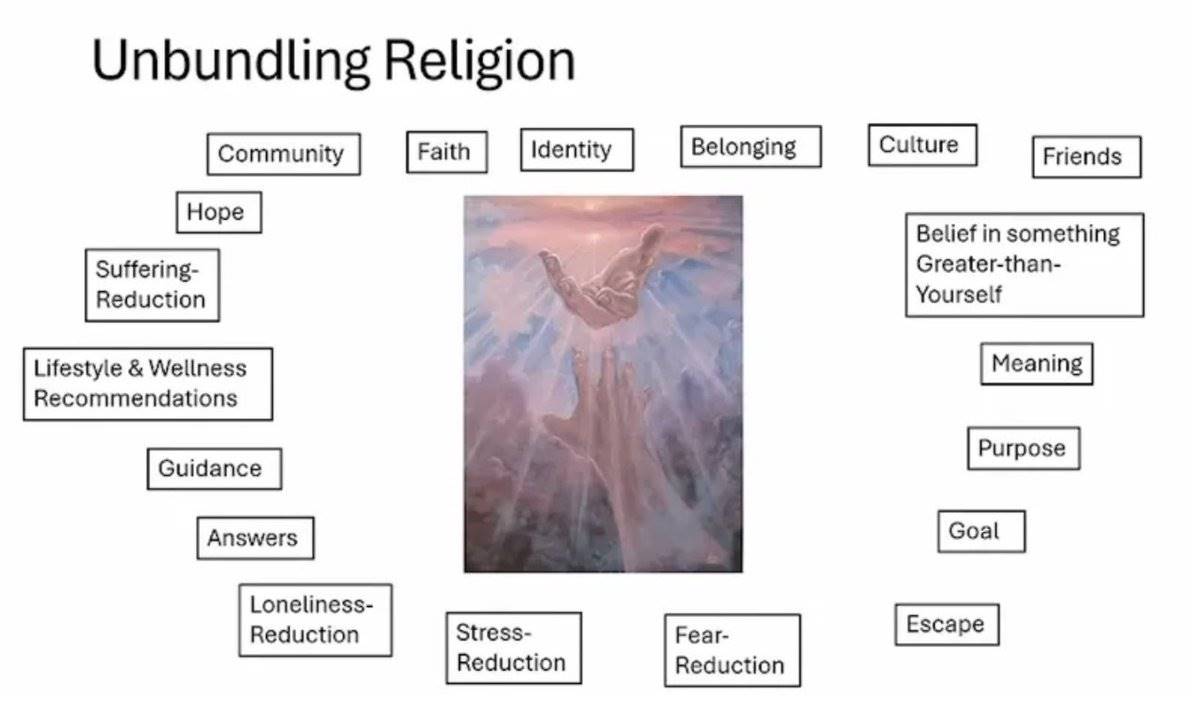

Murad’s view on Memecoins: Long seen as joke coins lacking technical foundation or utility, Murad assigns deeper meaning to Memecoins. He argues that good Memecoins offer joy, reduce loneliness, foster identity, and generate emotional connection, purpose, and happiness.

Murad’s perspective on Memecoins

Murad’s Memecoin selection criteria

Market cap range: Focuses on mid-cap tokens valued between $5 million and $200 million.

Chain preference: Favors projects on Solana and Ethereum, excluding those on Base, Ton, Sui, etc.

-

Project history: Prefers tokens that have existed for at least six months and survived at least two 70% drawdowns.

-

Murad’s recent performance: Four months ago, he bought 10.25 million $SPX tokens for ~$98,000. The holding is now worth ~$7.89 million—an ROI of approximately 7,900%. However, his portfolio recently declined ~45% in half a month, losing $11.1 million, with $SPX dropping from $0.72 to $0.40.

Characteristics of Western Memecoin KOLs

-

Profile and identity branding: KOLs often use distinctive visual avatars to establish personal identity. Common choices include Pepe, Bored Apes (BAYC), Milady, or pixel-art NFTs like CryptoPunks—signaling deep involvement in the Meme space, early crypto participation, financial capacity, and industry clout. In their X bios, keywords like Meme, Memecoin, gem, gem hunter/finder, 100X, degen, altcoin, alpha signal their focus and speculative style.

-

Content and promotion strategy: Western KOLs typically follow a consistent operational model: Sustained promotion—they post repeatedly about one Memecoin over 1–2 weeks, not just daily CA dumps. Multi-angle marketing—beyond simple “buy” calls, they craft compelling narratives combining market sentiment, celebrity actions, and relevant news. If linked to Elon Musk or Trump, they amplify the association to boost FOMO. Emotion management—during critical price rises, they hint at massive gains to influence FOMO crowds; during pullbacks, they shift to “long-term hold” and “community consensus” messaging to maintain confidence.

-

Tweet engagement: Beyond direct recommendations, KOLs interact with followers—posting open-ended questions like What is the next 100x Memecoin? with hashtags #Memecoin #100x #crypto. Such tweets encourage replies and discussion, boosting visibility, enhancing community stickiness, and helping KOLs spot emerging trends.

Community management: Western KOLs build private communities on Telegram and Discord, operating in a centralized manner, with the KOL at the core. Key features:

1. Regular news updates: The KOL or assistant posts daily news, market insights, and opinions.

2. Muted group chats: Many Telegram groups adopt semi-closed models—regular members cannot freely chat but show support via likes, hearts, or retweets.

3. Foster internal FOMO: KOLs share signals like whale purchases, celebrity interest, or upcoming CEX listings to boost conversion. Overall, Western KOLs adopt a more stable approach, emphasizing brand-building and long-term holding rather than short-term hype alone.

4.2 China

Representative Chinese KOL—0xWizard @0xcryptowizard

View on Meme narratives: 0xWizard believes the fusion of AI + Meme storytelling represents the future of crypto. He sees Memecoin value extending beyond market sentiment to include community resonance, emotional bonds, and a sense of mission. He views projects like $ACT, $GOAT, $BMT as part of an AI renaissance, envisioning future AI not as assistants but as autonomous conscious beings.

0xWizard’s Memecoin selection criteria:

1. Decentralized distribution: Prioritizes projects with broad token distribution, avoiding those tightly controlled by a single whale or team.

2. New narratives, new赛道 (track): Emphasizes innovation—Memecoins should go beyond emotional hype and tap into emerging opportunities. For example, $ACT merges Meme culture with AI.

3. Active community: Values strong community building. A successful Memecoin must be powered by solid consensus, so he favors projects with high user engagement, strong interaction, and a sense of belonging.

4. Small market cap, high growth potential: Targets early-stage, low-cap projects capable of delivering outsized returns to early investors under favorable market conditions.

-

Timeliness: Prioritizes projects currently trending, controversial, or gaining momentum. For example, $ACT combines AI and Meme culture, aligning perfectly with current AI sector热度 (heat).

-

0xWizard’s influence: Wizard pins a beginner’s guide to Memecoins on X, expanding reach and welcoming newcomers. Unlike typical high-frequency shillers, he shares deep industry insights regularly, earning attention beyond just Memecoin traders—from wider Web3 professionals. After successfully promoting $ACT and $GOAT, his market influence and shill effectiveness reached new heights. Entering early, he leveraged community marketing and precise calls to push these tokens onto exchanges. These successes validated his judgment and strengthened trust in his recommendations. In the Chinese-speaking world, Wizard stands out as a top-tier KOL—combining successful calls, deep insights, and strong community influence—mastering both trading and branding.

0xWizard’s X profile

Characteristics of Chinese Memecoin KOLs

-

Business model: Unlike Western KOLs who focus on content and community, many Chinese KOLs partner with Trading Bots (GMGN, PEPE, UniversalX, PinkPig). They also collaborate with CEXs (Binance, Bybit, OKX), earning referral commissions from new user sign-ups. This model provides stable income and deeper market participation. Chinese KOLs emphasize short-term gains and user growth, leveraging frequent promotions, airdrops, and trading incentives.

-

Content and promotion strategy: Chinese KOLs adopt a traffic-oriented strategy—quickly capturing market trends rather than deeply nurturing single projects. They emphasize “traffic capture” and “trend chasing.” A common tactic is flooding X with multiple CA posts, exploiting algorithmic traffic mechanisms to maximize short-term exposure. When a hot Memecoin emerges, KOLs jump in fast, tagging relevant hashtags (#Token or $Token) to enter topic feeds. This boosts impressions and visibility, attracting more investors and accelerating follower growth.

-

Community management: Telegram or WeChat groups run by Chinese KOLs are highly active. Unlike the Western “muted + info delivery” model, Chinese communities allow free member interaction. Chats cover not only trades but also insider gossip, fund flows, and even daily life. This high-interaction environment amplifies KOL influence beyond mere announcements, embedding it in real-time discussions and emotional exchanges.

Community structure typically follows a pyramid model:

1. Core managers: Group owner or admin assistants—small number of key personnel managing operations, maintaining high interaction, and releasing new Memecoin finds or market alerts promptly.

2. Active contributors: Veteran traders and alpha sharers—including vigilant “dog hunters” monitoring on-chain data, and enthusiastic buyers aggressively promoting their positions. These users are highly sensitive to trends and consistently contribute content.

3. General members: Largest group—includes followers and observers. They may not speak often but act decisively during key moments, following crowd sentiment to trade.

4.3 South Korea

Summary of Korean KOL traits

-

Smaller population, widespread KOL content: Due to a smaller population, Korean crypto KOLs haven't developed the specialized niches seen in the West or China. Most cover a wide range of topics—airdrops, industry news, BTC analysis, secondary market research, on-chain trends, macroeconomic assessments—within a single account. This “spray-and-pray” content strategy attracts diverse audiences, reflecting Korea’s concentrated yet multifaceted market demands.

-

No dedicated Memecoin-focused KOLs: Unlike the West or China, South Korea currently lacks top-tier KOLs exclusively focused on Memecoins. While some mention Meme projects, none conduct in-depth, sustained coverage or build dedicated Meme communities.

-

Multi-platform presence—TG, YouTube, Instagram: Korean KOLs don’t rely on a single platform. They enhance visibility across multiple channels: YouTube features market analysis videos, often with clickbait thumbnails showing charts and bold visuals; Instagram serves as a supplementary channel for trade screenshots, opinion summaries, and event teasers. Many adopt consistent visual branding—uniform cover styles, logos, color schemes—to strengthen recognition and professionalism, gradually building personal brands.

Page of a Korean Crypto YouTuber

4.4 Japan

Representative Japanese KOL—LUCIAN|るしあん @lucianlampdefi

-

Dominance of 2D elements: Japanese KOLs favor anime-style avatars. Their banners, AMA posters, and promotional materials often feature anime or cyberpunk aesthetics to appeal to young local audiences. Influenced by VTuber culture, some KOLs use virtual avatars instead of real photos. This trend is especially strong in the NFT space, where many adopt anime-styled PFPs or AI-generated personas to strengthen personal branding.

-

Content style: Japanese KOLs produce refined, aesthetically focused content, avoiding flashy self-promotion. Instead, they engage audiences through storytelling and visuals. When promoting Memecoins or blockchain games, they often employ immersive, anime-style narratives. Fans deeply identify with otaku culture, so KOLs tailor content accordingly—using anime memes and 2D references.

LUCIAN’s X profile

4.5 Russia

Characteristics of Russian crypto communities:

-

Heavy reliance on TG: Due to bans on Twitter and other Western platforms, Russian Memecoin promotion occurs mainly through Telegram groups or channels, shifting KOLs away from global norms. Communities operate semi-closed, with information shared more discreetly than on X. Some adopt subscription models, charging fees for VIP access to insider intel. Overall, Russian KOL promotion is more low-key and fragmented compared to Western markets.

-

Content repurposing and interaction: KOLs often import trending content from X—crypto news, new listings, airdrop alerts—and repost it on Telegram with added images and commentary. Members can like, comment, and interact, forming an engaged ecosystem. Unlike X-based KOLs who post CA shills, Russian KOLs focus more on sharing market updates and investment insights within Telegram.

-

YouTuber influence: Russian KOLs may collaborate with CTO communities to produce YouTube videos for specific tokens. These videos are relatively affordable—$300–500 per video—offering better cost-effectiveness than Western equivalents. Though YouTube has limited reach compared to Telegram, it remains a viable promotional and monetization channel.

Conclusion

From the U.S. and South Korea to Japan, China, and Russia, Memecoin markets reflect vastly different cultural DNA. Local narratives and trading logic remain key to whether a Memecoin can break through and sustain momentum. For project teams aiming to enter regional markets, understanding local community culture, communication channels, and trending stories is essential for crafting effective marketing and community strategies.

Going forward, Memecoins will evolve beyond mere speculation into digital assets blending entertainment, cultural identity, and community consensus. TechFlow will continue monitoring global Memecoin ecosystem developments, supporting more projects in achieving breakout growth across Asia and beyond.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News