RWA: The Elephant in the Crack

TechFlow Selected TechFlow Selected

RWA: The Elephant in the Crack

RWA has the potential to reshape finance and bring real-world opportunities on-chain, perhaps offering a new solution to address the chaos in the blockchain space.

Author: Zeke, Researcher at YBB Capital

Preface

"Tokenizing real-world assets (RWA) aims to enhance liquidity, transparency, and accessibility, enabling broader access to high-value assets." This is Coinbase's definition of RWA—and a common explanation found in educational content. However, I find this statement neither clear nor entirely accurate. In this article, I will offer my personal interpretation of RWA within today’s context.

1. A Fractured Prism

The integration of crypto with real-world assets dates back over a decade to Bitcoin's Colored Coins, which added metadata to Bitcoin UTXOs to "color" them—assigning specific satoshis the attributes of external assets such as stocks, bonds, or real estate—thereby marking and managing physical assets on the Bitcoin blockchain. This protocol, resembling BRC20, marked humanity’s first systematic attempt to implement non-monetary functions on blockchains and signaled the beginning of blockchain’s journey toward intelligence. However, due to Bitcoin’s limited scripting opcodes, Colored Coins required third-party wallets to interpret asset rules, forcing users to trust these tools’ logic in defining the “color” of UTXOs. Centralized trust, combined with poor liquidity, ultimately led to the failure of this initial RWA proof-of-concept.

In the years that followed, Ethereum catalyzed a turning point for blockchain, ushering in the era of Turing completeness. While various narratives experienced their moments of hype, RWA remained all thunder and little rain—except for fiat-backed stablecoins. Why?

I recall writing in a previous article on stablecoins that there has never truly been a dollar on the blockchain. USDT or USDC are essentially digital IOUs issued by private companies; compared to the US dollar, they are theoretically far more fragile. Tether succeeded not because of decentralization but out of necessity—the crypto world desperately needed a stable value medium it could not create itself.

In the realm of RWA, true decentralization does not exist. Trust assumptions must rest upon centralized entities, whose risk management relies solely on regulation. This inherently contradicts crypto’s anarchist DNA, as public blockchains are fundamentally designed to resist oversight. The absence of effective regulation atop public chains remains the primary reason RWA has yet to succeed.

Secondly, there is asset complexity. While RWA encompasses tokenization of all physical assets, we can broadly divide them into financial and non-financial categories. Financial assets are inherently fungible, allowing a clear link between the underlying asset and its token through regulated custodians. Non-financial assets, however, present challenges magnified a hundredfold. Their solutions largely depend on IoT systems, yet even these cannot fully mitigate risks from human malice or natural disasters. In my view, RWA acts as a prism reflecting reality—but its refracted light is finite. For non-financial assets to thrive on-chain in the future, they must meet two prerequisites: fungibility and ease of valuation.

Third, compared to highly volatile digital assets, few real-world assets exhibit similar volatility. Meanwhile, DeFi protocols routinely offer APYs in the tens or even hundreds of percent, dwarfing TradFi returns. Low yields and weak incentives for participation represent another major pain point for RWA.

If so, why is the industry refocusing on this narrative now?

2. Policy From Above

As outlined above, regulatory progress from TradFi is essential for RWA to exist—only when trust assumptions are legally enforceable can the concept advance. Currently, regions favorable to Web3 development—such as Hong Kong, Dubai, and Singapore—have only recently begun establishing RWA regulatory frameworks. Thus, RWA’s journey has only just begun. Yet fragmented regulations and TradFi’s heightened risk sensitivity continue to shroud this space in uncertainty.

Below is an overview of major global jurisdictions’ RWA regulatory frameworks as of April 2025:

United States:

Regulatory Bodies: SEC (Securities and Exchange Commission), CFTC (Commodity Futures Trading Commission)

Core Regulations:

Security Tokens: Subject to the Howey Test to determine if classified as securities; subject to registration or exemptions under the Securities Act of 1933 (e.g., Reg D, Reg A+).

Commodity Tokens: Regulated by CFTC; Bitcoin and Ethereum are explicitly categorized as commodities.

Key Measures:

1. KYC/AML: BlackRock’s BUIDL fund is available only to accredited investors (net worth ≥ $1 million), requiring on-chain identity verification (e.g., Circle Verite).

2. Broadened Security Classification: Any RWA involving profit-sharing may be deemed a security. Example: SEC penalized Securitize (2024) for unregistered securities issuance via tokenized real estate platforms.

Hong Kong:

Regulatory Bodies: HKMA (Hong Kong Monetary Authority), SFC (Securities and Futures Commission)

Core Framework:

The Securities and Futures Ordinance brings security tokens under regulation, requiring investor suitability, disclosure, and AML compliance.

Non-security tokens (e.g., tokenized commodities) fall under the Anti-Money Laundering Ordinance.

Key Measures:

1. Ensemble Sandbox: Testing dual-currency settlement (HKD/offshore RMB) for tokenized bonds and cross-border real estate mortgages (in collaboration with Thailand’s central bank); participants include HSBC, Standard Chartered, AntChain, etc.

2. Stablecoin Gatekeeping: Only HKMA-approved stablecoins (e.g., HKDG, CNHT) are permitted; USDT and other unregistered stablecoins are banned.

European Union:

Regulatory Body: ESMA (European Securities and Markets Authority)

Core Regulation:

MiCA (Markets in Crypto-Assets Regulation): Effective in 2025, requires RWA issuers to establish EU entities, submit whitepapers, and undergo audits.

Token Categories: Asset-Referenced Tokens (ARTs), E-Money Tokens (EMTs), and other crypto-assets.

Key Measures:

1. Liquidity Restrictions: Secondary market trading requires licensing; DeFi platforms may be classified as Virtual Asset Service Providers (VASPs).

2. Compliance Shortcuts: Luxembourg fund structures (e.g., Tokeny’s gold token) serve as low-cost issuance channels; small RWA platforms face ~200% increase in compliance costs.

Dubai:

Regulatory Body: DFSA (Dubai Financial Services Authority)

Core Framework:

Tokenization Sandbox (launched March 2025): Two-phase process (expression of interest, ITL test group), allowing testing of security tokens (stocks, bonds) and derivative tokens.

Compliance Pathway: Partial capital and risk control requirements waived; formal license possible after 6–12 months of testing.

Advantages: Regulatory equivalence with EU, supports DLT applications, reduces financing costs.

Singapore:

Security tokens fall under the Securities and Futures Act, eligible for exemptions (small offerings ≤ SGD 5M, private placements ≤ 50 investors).

Utility tokens must comply with AML regulations; MAS promotes pilots via regulatory sandbox.

Australia:

ASIC classifies yield-bearing RWA tokens as financial products, requiring an Australian Financial Services License (AFSL) and full risk disclosure.

In summary, Western nations emphasize high compliance barriers, while Asian and Middle Eastern regions attract projects via experimental policies—yet still maintain significant regulatory hurdles. Current RWA protocols may exist on public blockchains but must integrate compliance modules to align with local frameworks. These compliant protocols cannot directly interact with traditional DeFi protocols. Moreover, a Hong Kong-compliant protocol cannot interoperate with one based in another jurisdiction. Today’s RWA landscape lacks sufficient accessibility and suffers from extreme interoperability issues—existing as isolated “islands,” far removed from the ideal vision.

Is there no path toward greater decentralization within these frameworks? Not necessarily. Take Ondo, a leading RWA protocol, as an example. The team built Flux Finance—a lending protocol allowing users to borrow using both open tokens like USDC and restricted tokens like OUSG as collateral. It issues USDY, a tokenized bearer note (a compounding stablecoin), designed with a 40–50 day lock-up period to avoid classification as a security. According to the SEC’s Howey Test, a security involves investment in a common enterprise relying on others' efforts for profit. USDY’s yield comes from automatic compounding of underlying assets (e.g., Treasury interest), passively earned without active management by Ondo—thus failing to meet the “reliance on others’ efforts” criterion. Ondo further simplifies USDY’s circulation across public chains via cross-chain bridges, creating a viable pathway into the DeFi ecosystem.

Yet such complex, one-way integration may not represent the RWA we truly desire. A key factor behind the success of fiat-backed stablecoins is exceptional accessibility—enabling low-barrier inclusive finance in the real world. To overcome the island problem, TradFi institutions and project teams must jointly explore ways to first achieve interconnectivity across jurisdictions, then enable meaningful interaction with the broader on-chain world—only then fulfilling the widely cited definition of RWA.

3. Assets and Yields

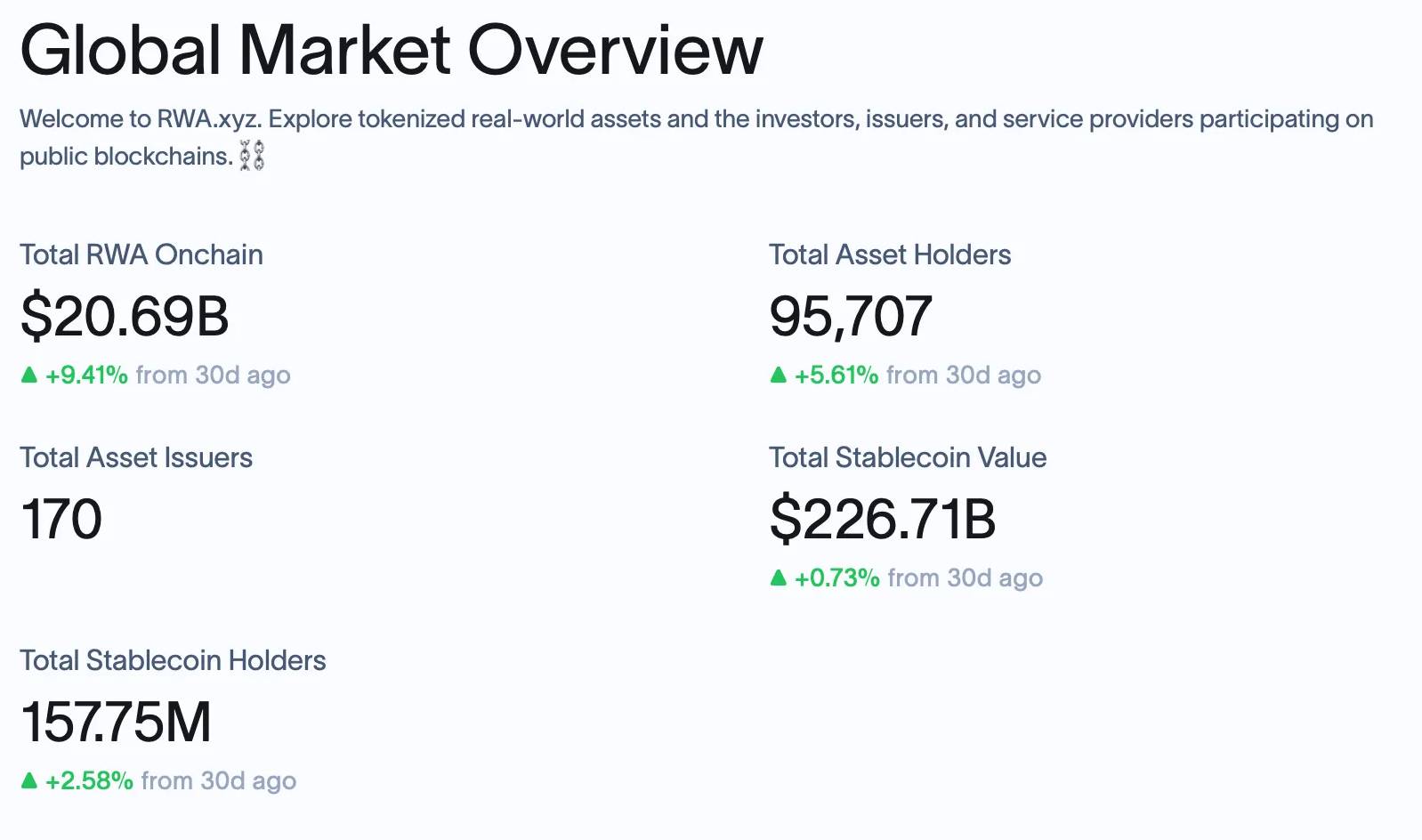

According to rwa.xyz (a specialized RWA analytics platform), the total value of on-chain RWA assets currently stands at $20.69 billion (excluding stablecoins). Its composition primarily includes private credit, U.S. Treasuries, commodities, real estate, and equities.

From an asset perspective, it’s evident that most RWA protocols do not target native DeFi users but rather traditional finance participants. Leading protocols such as Goldfinch, Maple Finance, and Centrifuge primarily serve SMEs and institutional clients. So why bring this onto the blockchain? (The following points highlight advantages specific to these protocols)

1. 7×24 Instant Settlement: One of TradFi’s pain points is reliance on centralized systems. Blockchains provide uninterrupted transaction networks, enabling instant redemptions, T+0 disbursements, and real-time clearing.

2. Overcoming Geographic Liquidity Fragmentation: Blockchain functions as a global financial network, allowing SMEs in developing countries to bypass local intermediaries and attract foreign capital at minimal cost.

3. Reduced Marginal Service Costs: Smart contract automation means servicing 100 companies costs nearly the same as serving 10,000.

4. Serving Miners and Small Exchanges: These entities often lack traditional credit histories and struggle to obtain bank loans. Applying supply chain finance logic, they can use equipment and receivables as collateral for on-chain financing.

5. Lowered Entry Barriers: Although early successful RWA protocols targeted enterprises, institutions, or high-net-worth individuals, many are now leveraging new regulatory frameworks to fractionalize financial assets and lower investment thresholds.

For crypto, RWA’s success unlocks trillion-dollar potential. Beyond that, I believe RWAFi will eventually emerge. For DeFi protocols, integrating tokens backed by real-yield assets strengthens their foundation. For native DeFi users, it adds new dimensions to portfolio construction. Especially in today’s world—marked by geopolitical tensions and economic uncertainty—some real-world assets may offer safer, lower-risk alternatives than simply holding stablecoins. Here are some existing or potential RWA investment options: gold rose 80% from early 2023 to April 2025; Russia’s Sberbank offers deposit rates of 20.94% (3-month), 21.19% (6-month), and 20.27% (1-year); energy assets from sanctioned countries typically trade at over 40% discounts; short-term U.S. Treasury yields range between 4%–5%; Nasdaq-listed stocks, many halved in value, may have stronger fundamentals than your average altcoin; even niche assets like EV charging stations or Pop Mart blind boxes could become compelling investments.

4. The Swordholder

In the *Three-Body Problem* universe, Luo Ji uses his own life as a trigger mechanism, deploying nuclear bombs along solar orbits to invoke the Dark Forest deterrence against the Trisolaran civilization. In human society, he becomes Earth’s Swordholder.

"Dark Forest" is also how many in the crypto space describe blockchain—an inherent “original sin” stemming from its decentralized nature. In certain domains, RWA might serve as the Swordholder in this parallel world. While PFP avatars and GameFi stories have faded into myth, recall the mania of three or four years ago—we birthed projects like Bored Ape, Azuki, and Pudgy Penguins that rivaled traditional IPs. But did we actually acquire IP rights? In truth, never. NFTs are, in many ways, consumables. Blockchain’s definition of 10K PFP collections remains ambiguous. While it lowered investment barriers and created fleeting IP phenomena, ultimate control—and thus profits and direction—remained firmly in the hands of the “Trisolarans.”

Take Bored Ape as an example. The original intellectual property is explicitly owned by its issuer, Yuga Labs LLC. Per user agreements and official statements, Yuga Labs holds core IP rights including copyright and trademarks. Buyers gain ownership and usage rights to a specific numbered avatar—not the copyright itself.

In terms of governance, Yuga Labs steered Bored Ape toward the Metaverse, continuously launching sub-IPs to raise funds, abandoning its original luxury narrative. Holders had no right to information, decision-making, or revenue sharing. In traditional finance, investing in an IP usually grants direct usage rights, profit distribution, governance participation, or even development authority.

Yuga Labs is among the better-run PFP projects. Many others had even murkier rights allocation. When a sword hangs overhead, will they choose to respect their communities more?

5. Upon the Carrier

In conclusion, RWA holds transformative potential—for reshaping finance, bringing real-world opportunities on-chain, and perhaps offering a new path to address blockchain’s current chaos. Yet constrained by today’s TradFi regulatory frameworks, RWA remains akin to private protocols hosted on public blockchains—unable to reach its fullest imaginative potential. Over time, I hope a guiding figure or alliance will emerge to break through this barrier.

The brilliance an asset can emit across different carriers is unimaginable. From bronze inscriptions in the Western Zhou dynasty to land registries in Ming China, asset titling has ensured societal stability and progress. What would the final form of RWA look like? Imagine buying Nasdaq stocks during the day in Hong Kong, depositing money into Russia’s Sberbank overnight, and the next day co-investing in Dubai real estate with hundreds of anonymous shareholders worldwide.

Yes—that world running on a massive public ledger—is RWA.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News