Market enters "super cycle" for stablecoins: Deconstructing the crypto payment landscape with first principles

TechFlow Selected TechFlow Selected

Market enters "super cycle" for stablecoins: Deconstructing the crypto payment landscape with first principles

Stablecoin-backed payments are one of the most impactful and adoptable use cases for cryptocurrency beyond BTC's role as a store of value.

Author: Nathan

Translation: TechFlow

The supercycle for stablecoins has arrived.

It's not just because the total supply of stablecoins has surpassed $230 billion, Circle has filed for an IPO, or because I frequently say "the supercycle is here." The deeper reason is that stablecoins are fundamentally disrupting traditional payment systems—and this disruption will continue at an exponential pace.

My view is simple: stablecoins will surpass traditional payments because they are better, faster, and cheaper.

However, the term "payments" covers a broad spectrum. Today’s payment ecosystem is dominated by traditional channels, banks, and fintech companies, each playing distinct roles within the Web2 payment framework. While stablecoins offer a more efficient and user-friendly alternative to legacy systems, the crypto-native payment infrastructure is gradually developing similar levels of complexity—making it worth a deep dive.

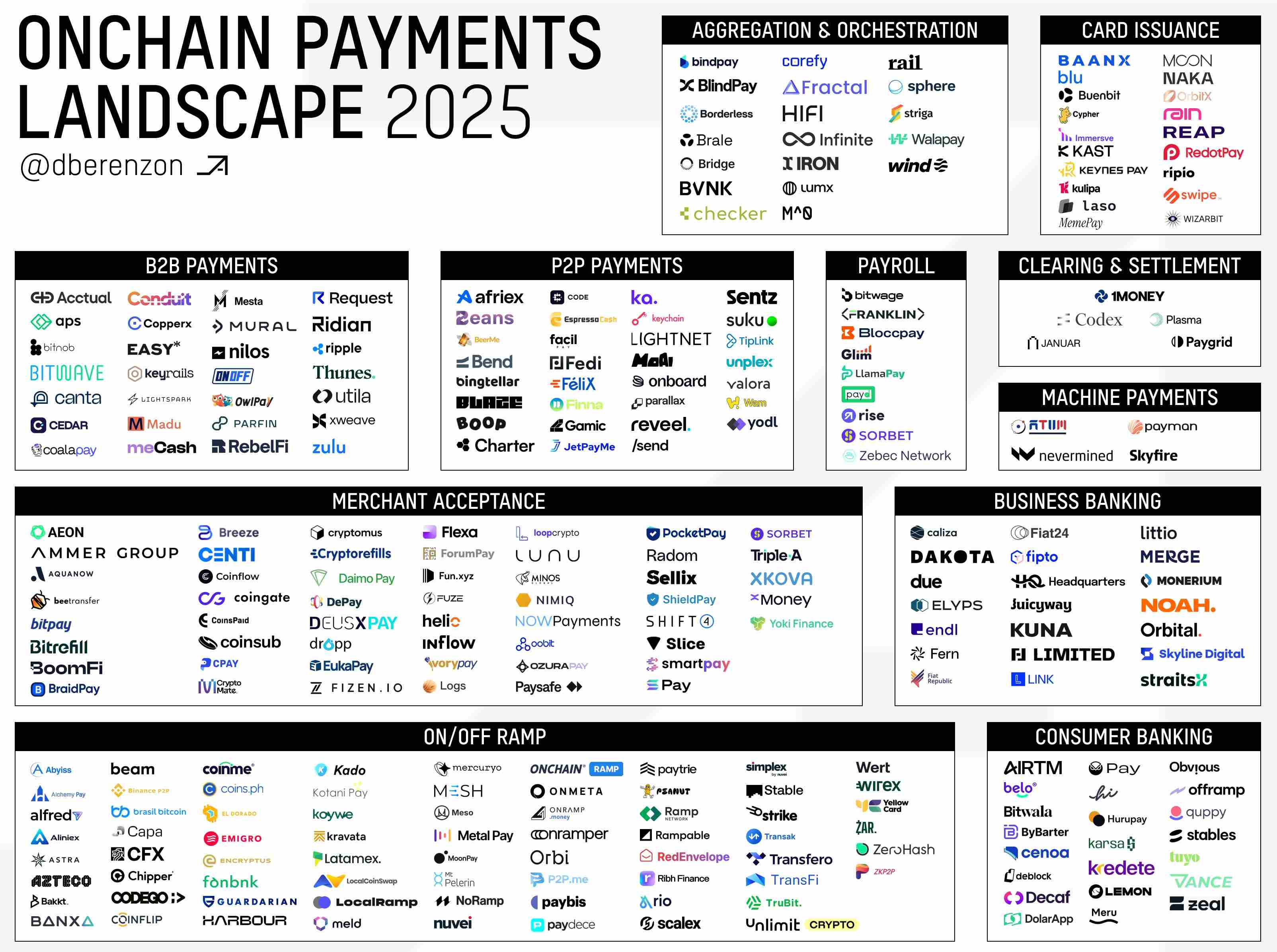

Currently, hundreds of companies are building on or around stablecoin-based payment rails.

@Dberenzon compiled an excellent overview that breaks down the on-chain payments ecosystem into nine distinct categories—you can find it below.

Related link:

https://x.com/dberenzon/status/1889717634800758858

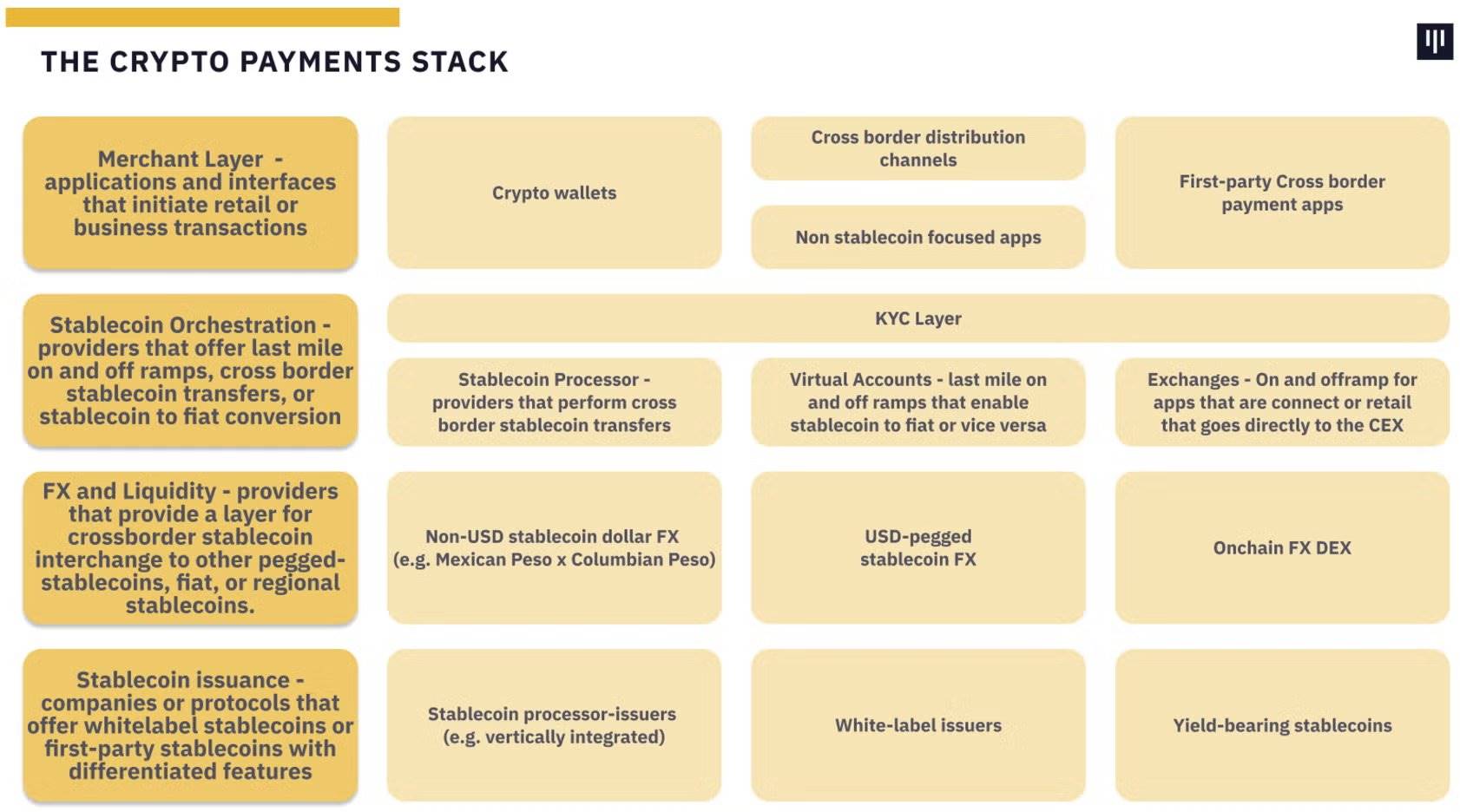

Dmitriy offers a detailed, technical perspective, while other institutions like Pantera take a higher-level approach in their report "The Trillion Dollar Opportunity", dividing the payment stack into four layers.

In this article, I’ll provide another way of deconstructing the payment system from a crypto-native, first-principles perspective. That said, frameworks like Dmitriy’s or Pantera’s still offer valuable categorizations from different vantage points.

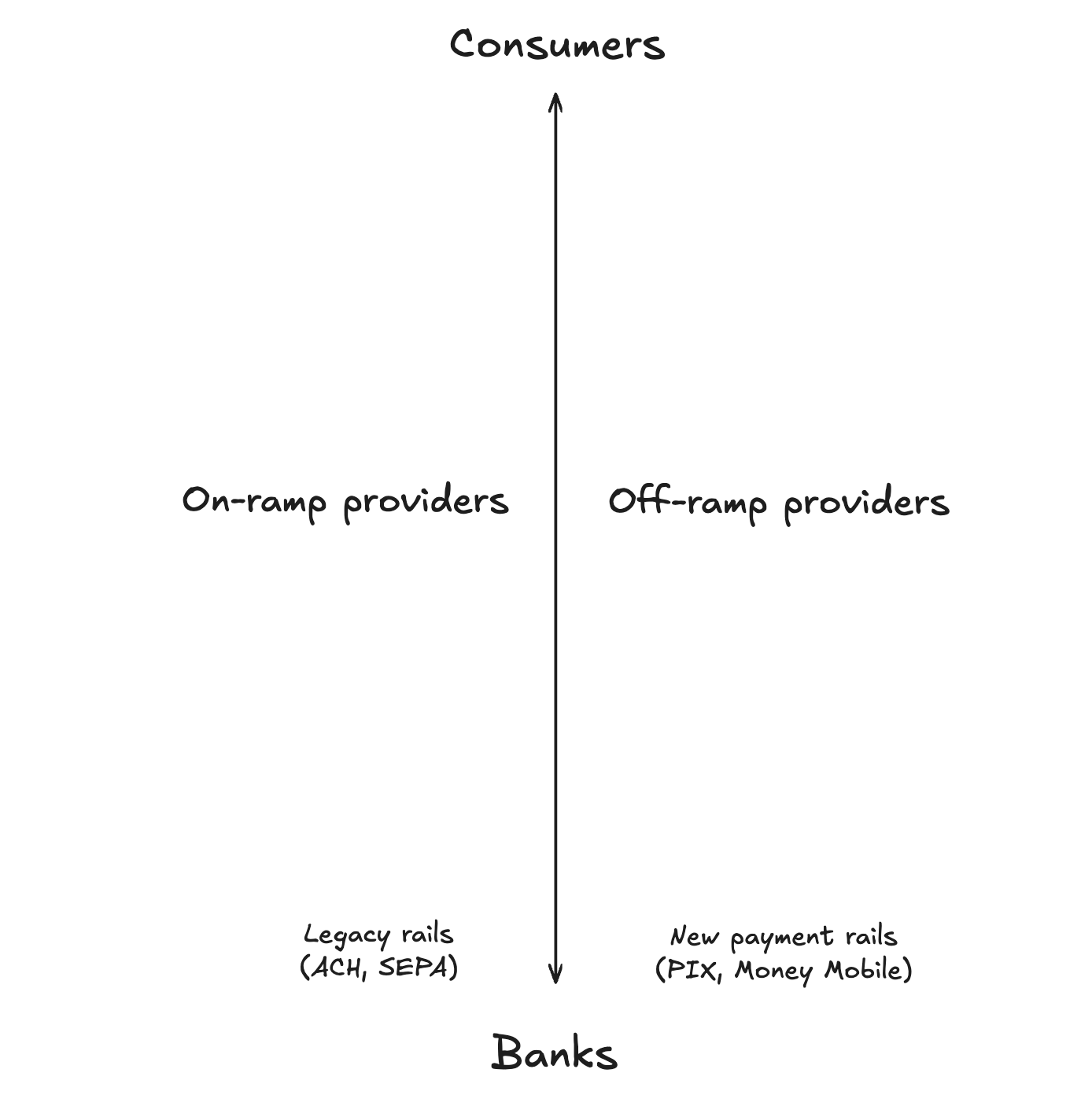

To provide context, I see the payment system operating along a vertical axis—with one class of users at the top and another at the bottom. Moreover, since the ultimate goal of any payment system should be serving billions of users, this analysis focuses on everyday retail consumers who may not even realize they’re using cryptocurrency.

Crypto Payment Stack

From first principles, stablecoins are tokens on blockchains representing a fiat currency unit—most commonly the U.S. dollar. There are several types of stablecoins:

-

Fiat-backed (e.g., USDT)

-

Crypto-backed (e.g., DAI)

-

Synthetic (e.g., USDe)

Fiat-backed stablecoins currently dominate in scale. These are backed 1:1 by highly liquid assets such as U.S. Treasuries, cash, and other cash equivalents held by custodians. Therefore, at the base of the payment stack are traditional banks and payment systems.

As previously noted, stablecoins are disrupting traditional payments because they truly are better, faster, and cheaper. This advantage creates higher profit margins for fintech and payment companies, while delivering superior experiences to end users. Thus, consumers sit at the top of the payment stack.

The current structure of the payment system looks like this:

Next, let's examine the primary use cases within the payment system. One high-retention use case we’ve already seen in crypto is “off-ramping” (off-ramping). While on-ramping is also popular, the ability to easily spend crypto—especially stablecoins—remains the dominant demand. In our framework, on- and off-ramping providers occupy the middle layer.

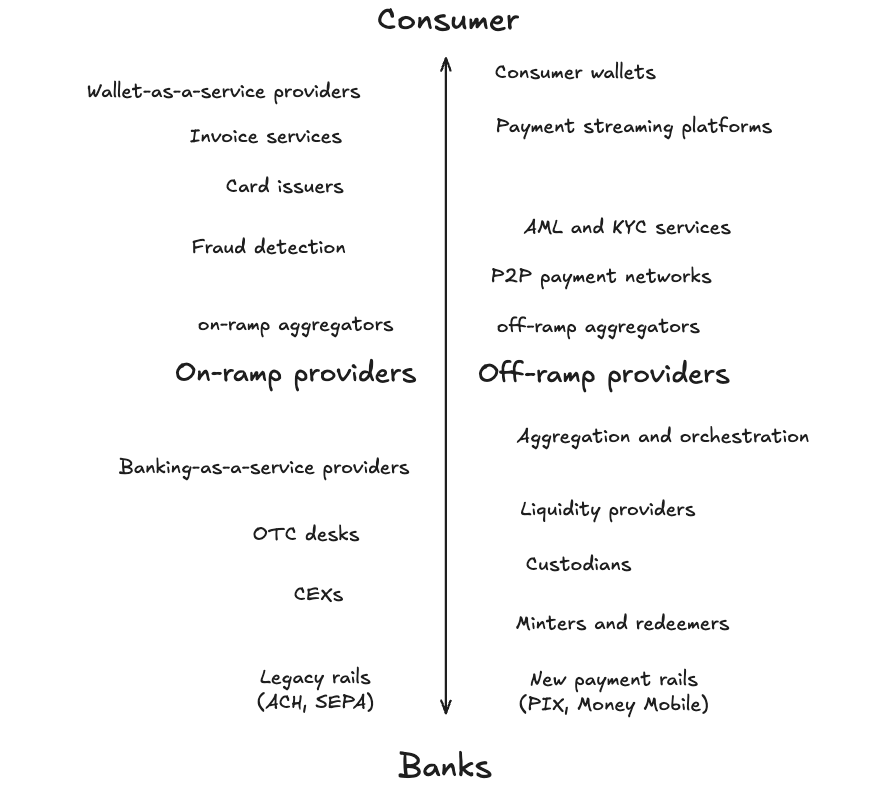

Everything above these providers serves consumer-facing applications or tools that support consumers—I call this the "Consumer-Facing Layer." Conversely, everything from on-/off-ramping down to traditional banking integrates stablecoins into existing financial systems, which I refer to as the "Financial Integration Layer."

Note that there are significantly more players in the Consumer-Facing Layer than in the Financial Integration Layer. Building in the latter requires licenses, structured operations, and compliance overhead, whereas the former can leverage services and relationships already established below. While the Consumer-Facing Layer may have further sub-layers, my focus here is on components that play the most critical roles based on functionality and dependency.

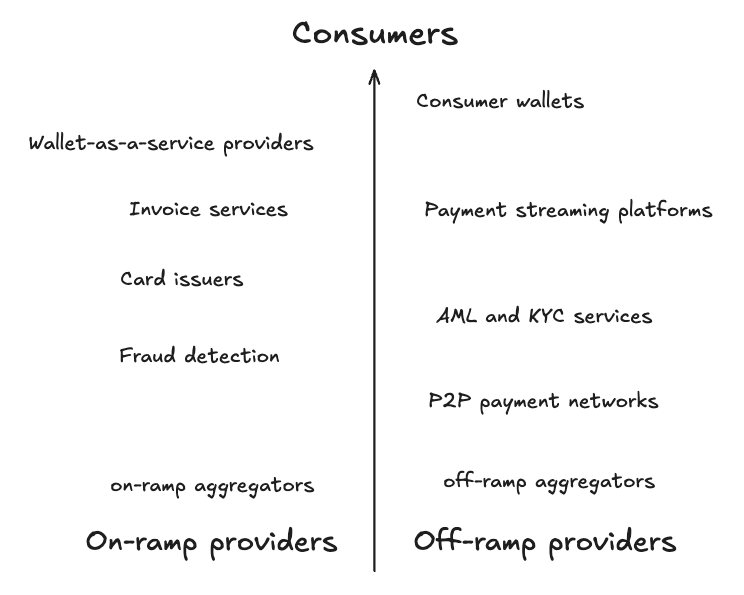

Consumer-Facing Layer

From the consumer’s perspective, the journey into the crypto payment system begins with a wallet. Consumer wallets are more than storage tools—they serve as gateways for saving, spending, and earning crypto. Features include debit card integration, virtual banking functions, and peer-to-peer transfers, all designed to meet diverse user needs. Today, there are countless wallet options, some global, others tailored to specific regional markets.

Building a wallet is complex. It requires integrating multiple services while minimizing risks of hacks—which is why many companies turn to Wallet-as-a-Service (WaaS) providers. These deliver audited, battle-tested solutions with pre-integrated on-/off-ramping and card issuance capabilities.

For consumer wallets to function effectively, they rely on various business-to-business stablecoin payment service providers. Key components include:

-

Billing & invoicing platforms: These allow individuals or businesses to invoice employers in fiat or crypto. They generate invoices, receive funds, perform currency conversions if needed, and deposit proceeds into wallets.

-

Payment streaming platforms: As companies become increasingly global, these platforms enable seamless, recurring payments via stablecoins—particularly useful for employees in countries without local banking access.

-

Card issuers: With cash usage declining, crypto cards are essential. By partnering with networks like Visa or Mastercard, card issuers enable wallet providers to issue branded debit or credit cards, enhancing day-to-day usability.

Compliance plays a crucial role in this layer. To protect consumer wallets, many platforms integrate strict Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, along with on-chain fraud detection services. These providers are vital in ensuring security and regulatory adherence within the Consumer-Facing Layer.

In addition, the Consumer-Facing Layer includes peer-to-peer (P2P) payment networks. These operate somewhat independently of the broader payment system, directly connecting individuals and businesses for crypto-fiat trades. P2P solutions serve as alternatives to traditional channels and have gained significant traction in emerging markets. However, they are less efficient and settle far smaller volumes compared to the overall payment ecosystem.

Finally, on-/off-ramp aggregators sit at the bottom of the Consumer-Facing Layer. They consolidate multiple on-/off-ramp providers into a single, easy-to-integrate API, allowing wallet providers to automatically select the optimal option based on speed, cost, and regional availability.

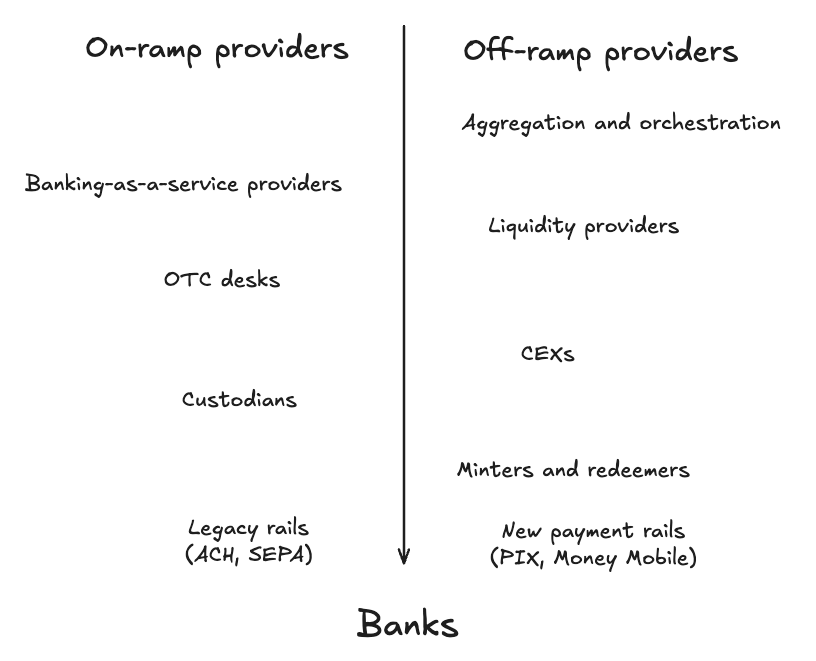

Financial Integration Layer

Entering the Financial Integration Layer brings us to the backbone of the crypto payment system.

In many other models, the next section would typically be called the "Aggregation & Orchestration Layer." However, aggregation and orchestration require foundational support beneath them. Hence, I position the Aggregation & Orchestration Layer at the very top of this category.

Beneath it lie companies and services enabling near-seamless movement between stablecoins and fiat. Here are three key layers often aggregated and orchestrated:

-

Banking-as-a-Service (BaaS) providers: These platforms offer modular financial infrastructure, enabling companies to embed virtual bank accounts, cards, and payment services into their products. BaaS providers manage compliance and backend operations, letting businesses offer bank-like features without holding their own licenses.

-

Over-the-counter (OTC) desks: OTC desks handle large-volume transactions, providing a liquidity bridge for firms lacking direct access to major exchanges or liquidity providers. They efficiently convert stablecoins to cash and vice versa, making large settlements practical.

-

Liquidity providers: Working closely with OTC desks, liquidity providers ensure sufficient capital exists globally to settle transactions. By abstracting away the sourcing of liquidity, they eliminate much of the complexity involved in converting between fiat and crypto.

In many cases, no company wants to hold or manage wallets containing millions of dollars in stablecoins (or other crypto assets). Instead, they rely on custodians to store liquidity securely and insured. Custodians sit lower in the stack because nearly every application and service depends on them to safely store stablecoins.

Centralized Exchanges (CEXs) also play a pivotal role in the Financial Integration Layer. Through partnerships with liquidity providers and minting/redeeming services, CEXs settle large-scale crypto and fiat transactions. Holding reserves of both stablecoins and cash, they effectively facilitate trades between counterparties.

Finally, at the very base of the crypto payment stack are minting and redemption services or entities. Tether operates through a limited network that mints and redeems USDT, receiving cash directly into bank accounts or stablecoins via custodians. On the other hand, Circle’s Circle Mint allows qualified companies that pass Know Your Business (KYB) checks to mint and redeem USDC.

The Full Picture

The payment system is dynamic and highly interconnected. Each layer relies on tools, services, and providers from the layers beneath it. Altogether, the crypto payment stack looks like this:

Final Thoughts

Stablecoin-powered payments represent one of the most impactful and adoptable use cases in crypto outside of BTC as digital gold.

@PlasmaFDN, as a blockchain purpose-built for stablecoin payments, is well-positioned—but I expect nearly every blockchain will eventually shift toward stablecoins and payments. To succeed, they must rethink their payment architectures, as EVM compatibility alone is no longer enough.

In conclusion, stablecoins truly represent a trillion-dollar opportunity, and those who occupy key positions within the payment stack will capture the greatest value.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News