What should you buy when the market crashes?

TechFlow Selected TechFlow Selected

What should you buy when the market crashes?

Crypto VCs are betting on these types of projects.

Original: Steven Ehrlich, Unchained

Translation: Yuliya, PANews

Global financial markets have recently experienced significant turbulence, and the cryptocurrency sector has been no exception. However, as often said in investment circles, market reversals frequently create rare buying opportunities for forward-looking investors. In such volatile conditions, understanding the strategic moves of professional investors becomes particularly important.

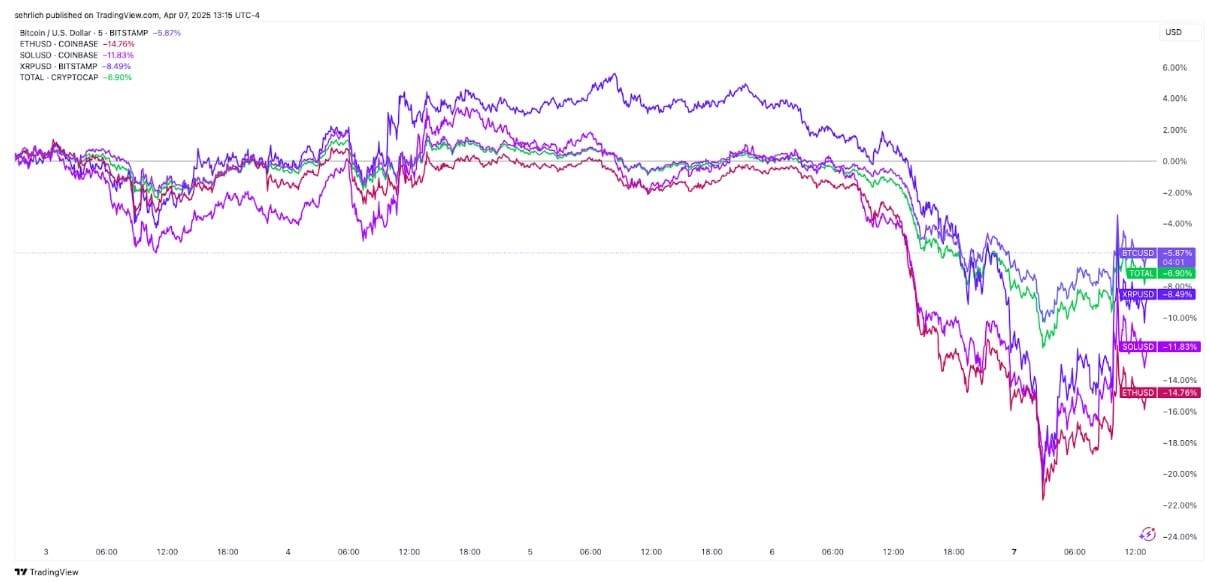

Cryptocurrencies continued to decline alongside broader markets after President Trump announced sweeping and indiscriminate global tariffs last Wednesday. At the time of writing, Bitcoin had dropped 5.86% since then—even after a partial recovery from its initial plunge below $75,000 (the first time since the November 5 election). Other large-cap cryptocurrencies such as ETH, Solana, and XRP also underperformed during this period, trailing behind the market leader.

In this environment, market fear has clearly intensified. The Cboe VIX index, which measures expected stock market volatility, hit 60 for the first time since the onset of the pandemic, while the Deribit Bitcoin Volatility Index (DVOL), the closest equivalent to VIX in crypto, rose nearly 30% over the past week.

Under these circumstances, it’s natural for investors to seek safety—i.e., buying U.S. Treasuries. Yet there's a well-known adage in investing: "Be greedy when others are fearful, and fearful when others are greedy." This suggests now may be the ideal time to acquire blue-chip assets at a discount. To understand how professional capital is positioning itself in the crypto market during this volatile period, two major venture capitalists who requested anonymity shared insights into their firms’ strategies, offering key perspectives on which categories and sectors may outperform in the coming weeks and months.

Store of Value: Bitcoin and Ethereum

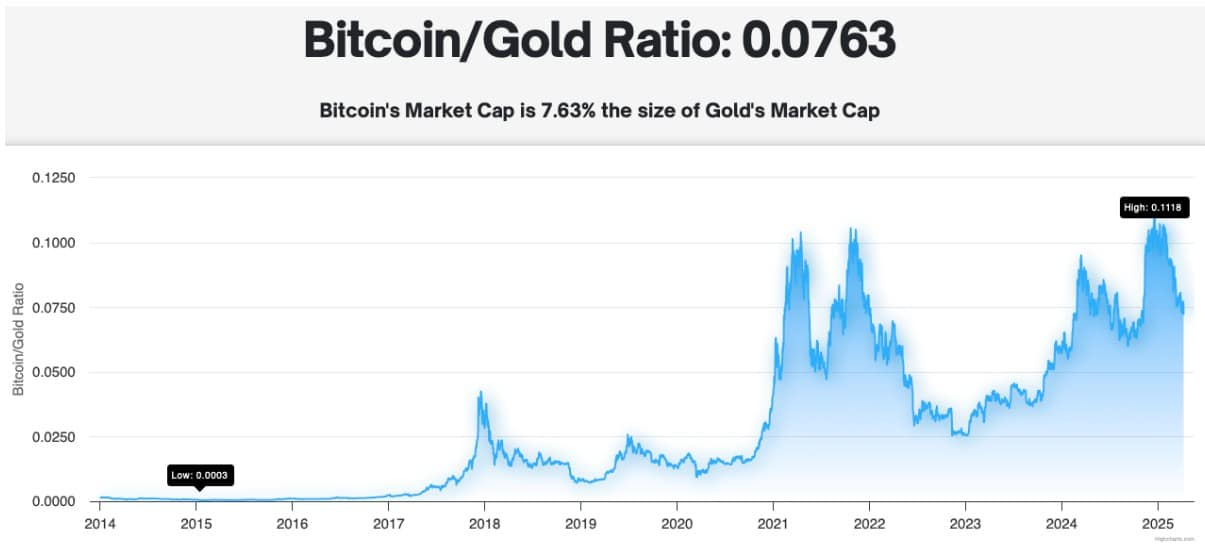

While not surprising, both respondents identified Bitcoin as their top choice. Gold has recently reached new highs and is widely regarded as a symbol of safe-haven assets. Meanwhile, Bitcoin is increasingly exhibiting characteristics of a “digital store of value.” Despite recent price swings, Bitcoin still has substantial room for growth compared to gold when examining market capitalization.

Gold currently has a market cap of approximately $20.4 trillion, whereas Bitcoin’s stands at just $1.64 trillion. One investor noted: "For Bitcoin to reach parity with gold in market cap, it needs to increase by at least 12 to 15 times. In the current environment, this is the most straightforward and confident bet."

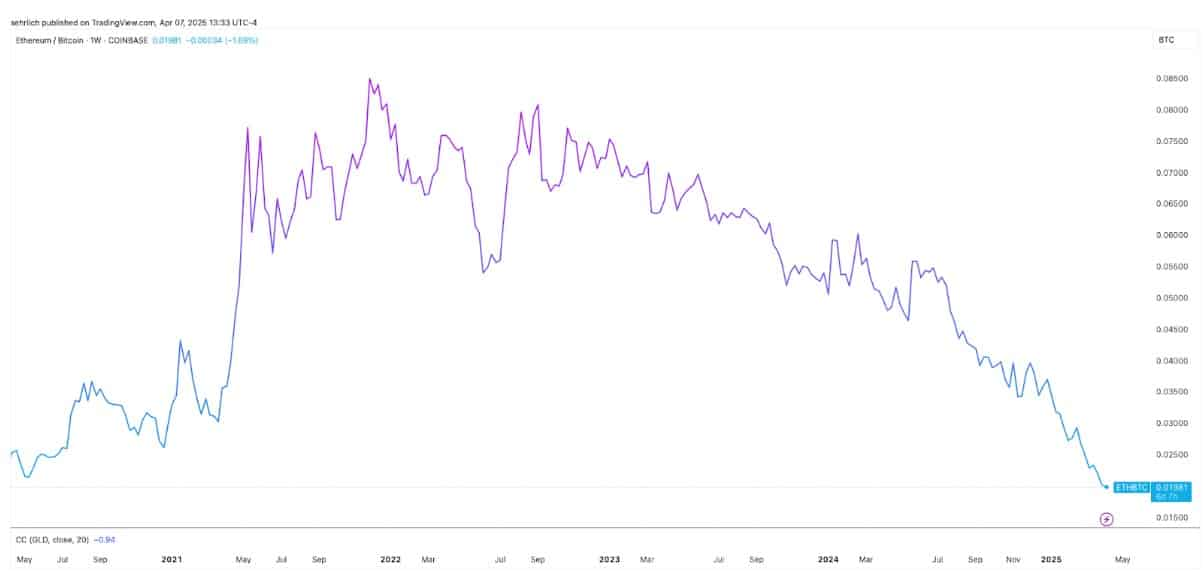

Ethereum is also considered a noteworthy asset, even though its price performance has significantly lagged behind Bitcoin in recent years, and its BTC-to-ETH ratio is now at its lowest level since the early days of the pandemic.

One respondent mentioned that after Ethereum transitioned from proof-of-work (PoW) to proof-of-stake (PoS) in 2022, its monetary policy became deflationary, allowing it to partially inherit Bitcoin’s “store of value” narrative. Although network usage has weakened recently and inflation has ticked up, from a valuation standpoint, its current price is near historical lows.

Another investor stated: "Ethereum is so low right now—it's actually a great buying opportunity."

Solana and DeFi Opportunities

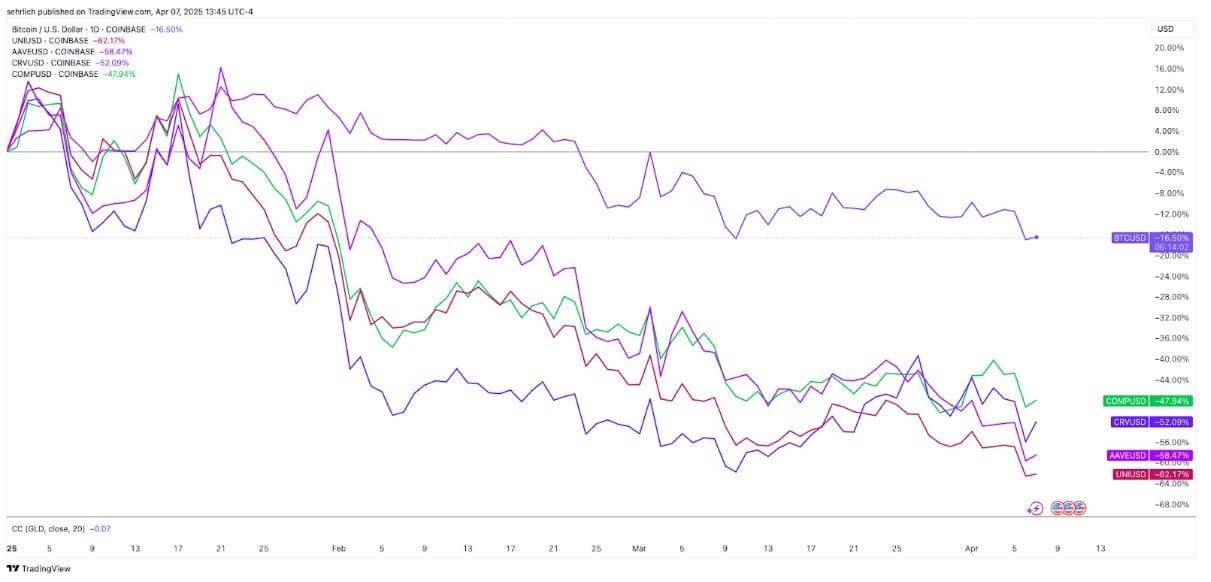

Decentralized finance (DeFi) tokens have broadly suffered steep declines this year, with native tokens of exchanges and lending protocols like Uniswap, Aave, Curve, and Compound down nearly 50% year-to-date. Nevertheless, both investors believe this sector could stage a strong rebound amid ongoing macro tightening.

One pointed out that during periods of low stablecoin yields, DeFi may actually see capital inflows, as there remain ways to achieve relatively high returns through looping strategies in on-chain lending and borrowing. "It's similar to what happened in 2021," he added.

Two projects worth watching are Raydium and Hyperliquid. The former is a traditional automated market maker exchange built on Solana, similar to Uniswap; the latter focuses on perpetual contracts, a type of cash-settled derivative.

For those unwilling to pick individual tokens, Solana itself may be a solid option. "Solana is somewhat like an index fund for DeFi. There are many interesting DeFi projects developing on it."

EigenLayer and Near: The Next Infrastructure Wave

Both investors believe that last year’s popular “AI + blockchain” trend was largely overhyped. One bluntly stated, “Most were essentially vaporware.” However, he noted this is common in early-stage sectors—the 2017 ICO boom was similarly inflated. "The first wave usually consists of speculative projects, but within them lies a small amount of real innovation—that’s what will matter in the coming years."

They expect the next phase of the AI narrative to center around “AI agents,” such as autonomous travel booking bots. The key question is: How can we ensure funds deposited into such agents aren’t misused? One solution is securing them using Ethereum’s own security layer.

However, Ethereum isn't suitable for every application due to high transaction costs and the need for some apps to operate cross-chain. EigenLayer emerged in this context, providing a “shared trust layer” that allows applications to leverage Ethereum’s security without being fully deployed on its mainnet.

"Once your app runs on EigenLayer, its funds are secured by Ethereum," said one investor. He specifically highlighted that Near could also benefit from this trend.

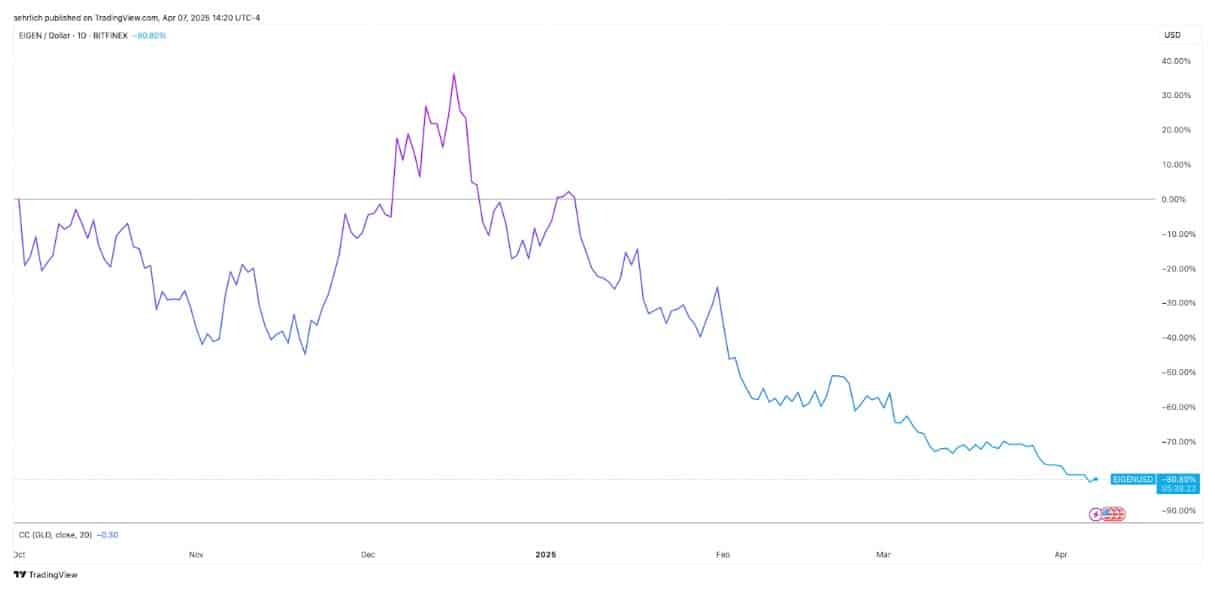

EigenLayer was once one of the most anticipated projects in the market, but its token launched in October last year near the peak of the bull run, followed by a price drop of over 80%. But if the current narrative gains traction, this could mean investors can buy in at a steep discount. One investor added: "EigenLayer’s market cap is still under $1 billion—this is exactly the kind of moment to buy and hold."

Overall, although the crypto market is still digesting macroeconomic and policy-related uncertainties in the short term, for institutional investors, this is precisely the critical moment to reposition portfolios and prepare for the next upward cycle. From store-of-value assets to infrastructure and DeFi platforms, and emerging AI-integrated applications, the direction of capital allocation is gradually becoming clear.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News