TUSD Operator Loses Nearly $500 Million, Is FDUSD Issuer the Culprit?

TechFlow Selected TechFlow Selected

TUSD Operator Loses Nearly $500 Million, Is FDUSD Issuer the Culprit?

When can stablecoins truly become stable?

Author: J1N, Techub News

Who would have thought that by 2025, stablecoin troubles would still be going strong.

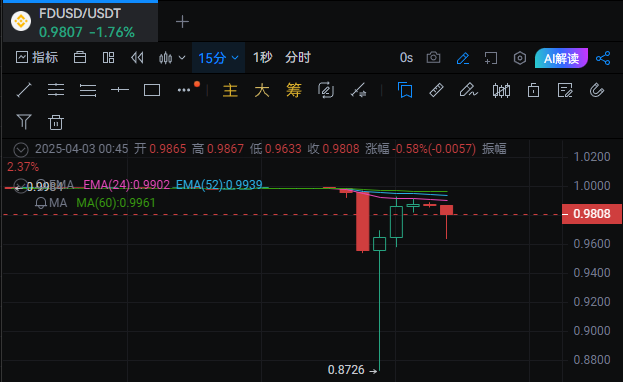

In the evening, CoinDesk published a report stating that TUSD had suffered nearly $500 million in missing assets due to First Digital Trust—the custodian of its reserves and also the issuer of FDUSD—misappropriating those funds. After the report was released, concerns arose that FDUSD's reserves might have been similarly misused, causing FDUSD to temporarily depeg to around 0.88 USDT. However, after both He Yi and First Digital Trust issued clarifications denying the allegations, FDUSD stabilized and recovered from the significant depegging.

Root Cause: TUSD’s Massive Shortfall, Covered by Justin Sun

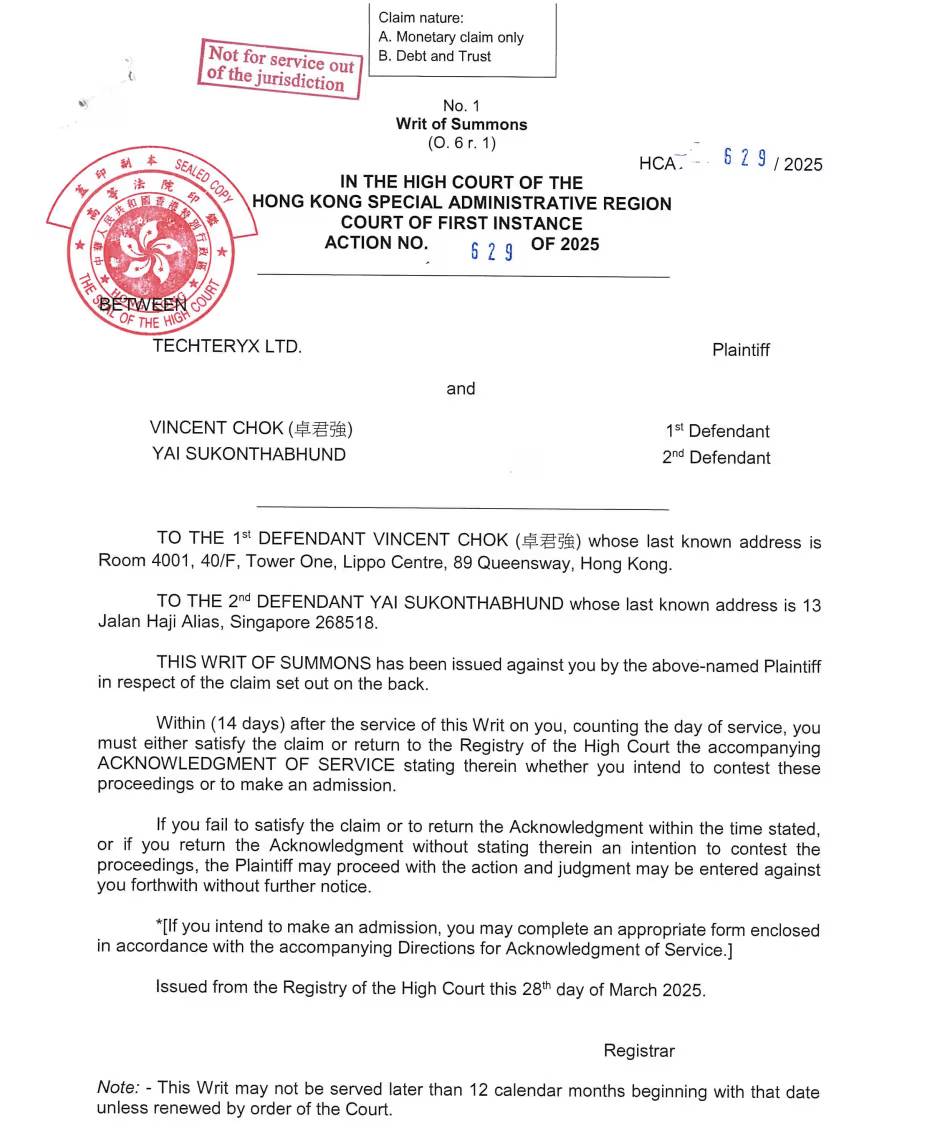

According to CoinDesk, citing sources, documents submitted by TUSD operator Techteryx to Hong Kong courts revealed a nearly $500 million shortfall in TUSD’s reserve funds. In response, Justin Sun provided emergency funding to cover the gap via a loan.

Documents submitted by Techteryx to Hong Kong courts

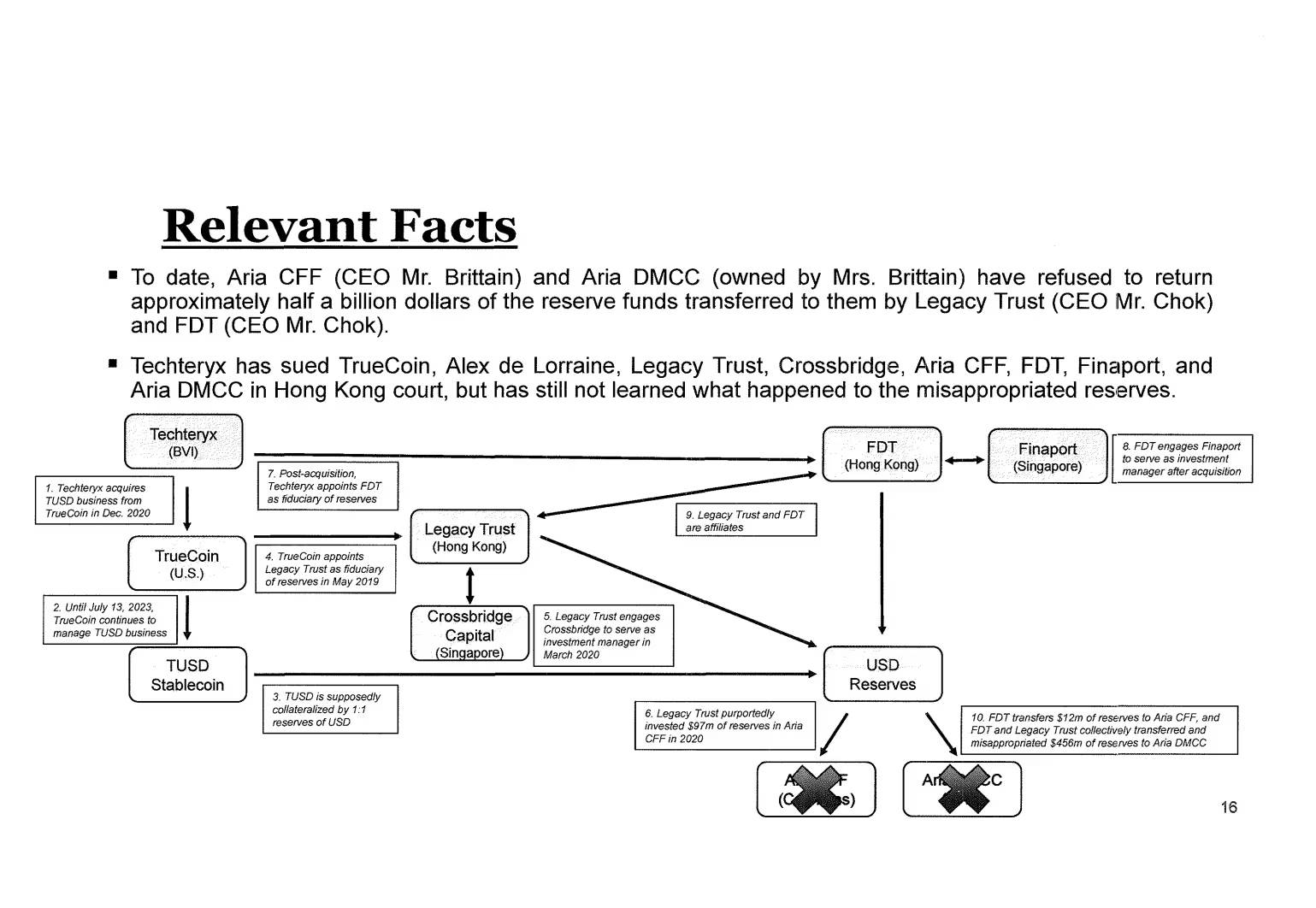

In December 2020, after Techteryx acquired TrueUSD from TrueCoin, it authorized Hong Kong-based custodian First Digital Trust (FDT) to manage its stablecoin reserves. Prior to Techteryx taking full control of TUSD operations in July 2023, day-to-day management was handled by TrueCoin.

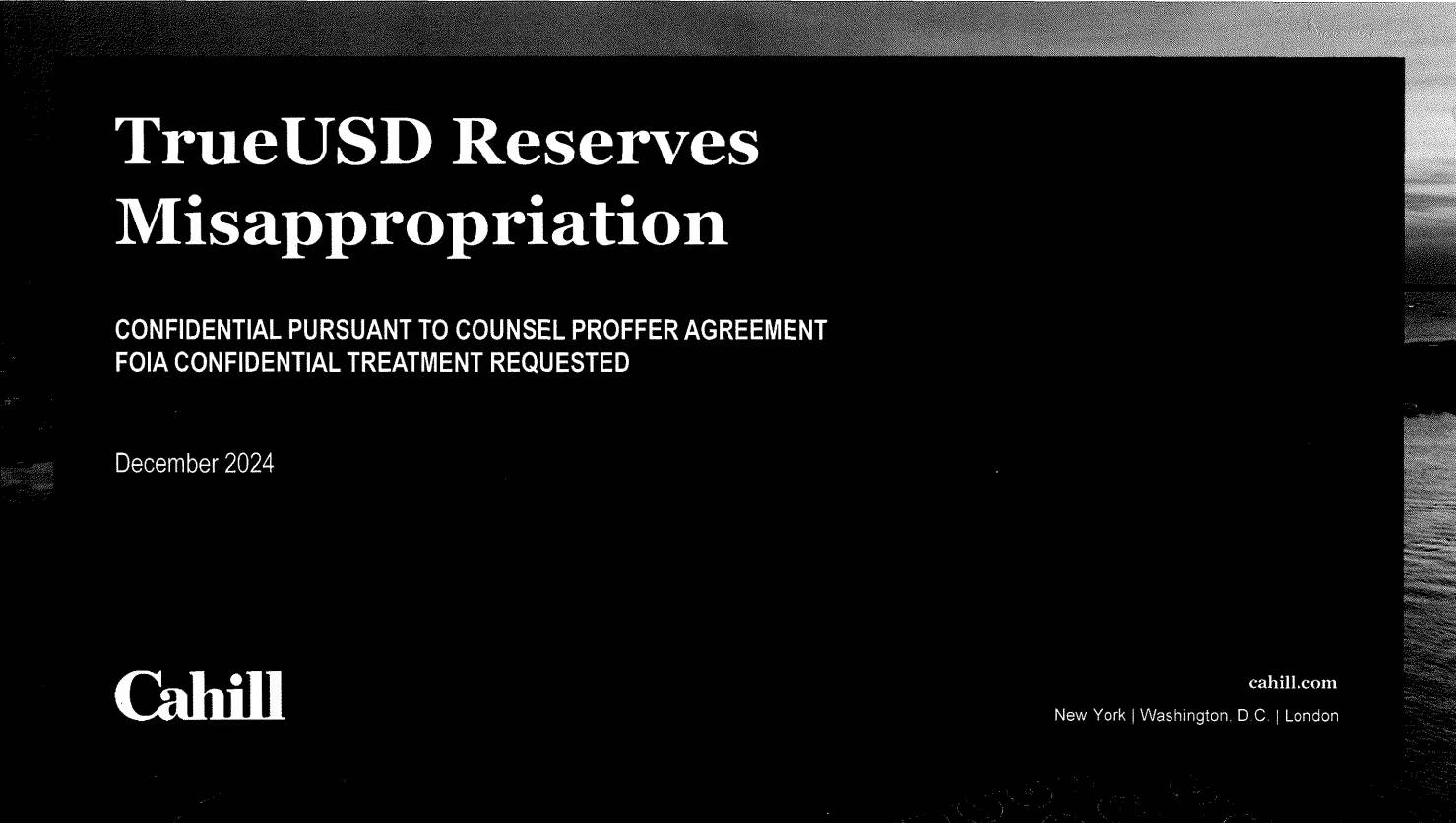

Documents from U.S. law firm Cahill Gordon & Reindel show that FDT was instructed to invest TUSD’s reserves into Aria Commodity Finance Fund (Aria CFF), registered in the Cayman Islands. However, court filings allege that approximately $456 million was improperly transferred to Aria Commodities DMCC—an unauthorized, independent entity based in Dubai.

Documents submitted by Cahill to the Department of Justice

To return to the main point, CoinDesk reported that court documents indicate Matthew Brittain, CEO of Aria Capital Management Ltd, controls Aria Commodity Finance Fund (Aria CFF). Meanwhile, Cecilia Brittain, Matthew Brittain’s wife, is the sole shareholder of Aria Commodities DMCC, the Dubai-based independent holding entity. ARIA DMCC engages in trade finance, asset development, and commodity trading, while CFF provides financing to commodity traders including DMCC and third parties.

Hong Kong court documents further reveal that Vincent Chok, CEO of FDT, allegedly paid about $15.5 million in undisclosed commissions to an entity called "Glass Door," and separately arranged an unauthorized $15 million trade finance loan from FDT to Aria DMCC. These funds were invested by Aria DMCC into global projects such as manufacturing plants, mining operations, shipping vessels, port infrastructure, and renewable energy ventures. FDT later classified these uses as legitimate fund investments.

The plaintiff claims: “The transfers from FDT to Aria DMCC constitute blatant embezzlement and money laundering. These transactions were conducted without the plaintiffs’ knowledge, authorization, or approval.”

Techteryx attempted unsuccessfully between mid-2022 and early 2023 to redeem its investment from Aria CFF, reportedly because the Aria entities defaulted on payments and failed to meet redemption requests. At the time, although Techteryx lost $400 million in TUSD reserves, the team isolated these assets to ensure normal redemption operations continued uninterrupted, so token holders remained unaffected. It was at this moment that Justin Sun stepped in, providing emergency liquidity support to TUSD via a loan.

Vincent Chok clarified that First Digital Trust acted solely as a custodian, executing transactions strictly per Techteryx’s instructions. He claimed FDT did not participate in project evaluations or investment decisions. Chok stated: “To our understanding, one of the main reasons ARIA refused Techteryx’s redemption request was their AML/KYC concerns regarding the transaction between TrueCoin and Techteryx, as well as doubts over the true identity of Techteryx’s ultimate beneficial owners.” No party involved has suggested Aria lacks liquidity.

Aria Group CEO Matthew Brittain denied all accusations made by Techteryx against ARIA DMCC and any related entities, adding that “many false allegations have been raised in the legal proceedings.” Techteryx fully understood the commitment to investment terms, which were outlined in the subscription agreements signed upon investing in ARIA CFF and clearly listed in the offering memorandum. Matthew Brittain echoed Vincent Chok’s concerns about Techteryx’s actual ownership and referenced a prior Wall Street Journal report alleging misappropriation by TrueCoin and TrustToken:

“In September 2024, TrueCoin and TrustToken (former operators of TUSD) settled with the U.S. Securities and Exchange Commission (SEC), which accused them of falsely claiming TrueUSD was fully backed by U.S. dollars while misappropriating reserves for high-risk offshore investments. Neither TrueCoin nor TrustToken admitted wrongdoing, nor did they detail the nature of the offshore investments made with Aria companies. Instead, they agreed to pay civil penalties and disgorge over $500,000 in profits to resolve charges of fraud and unregistered securities offerings.”

Is First Digital Trust Bankrupt? Both Official Channels and Binance Deny Claims

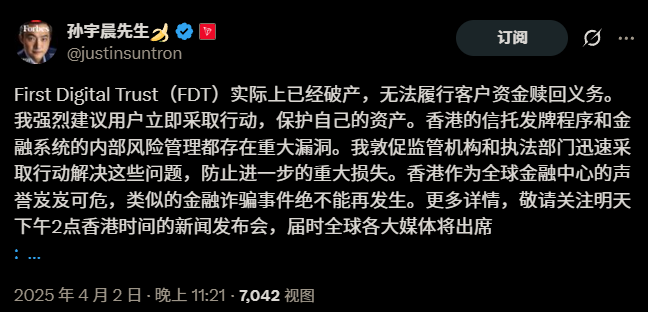

Shortly after the report surfaced, Justin Sun tweeted that First Digital Trust (FDT) was effectively bankrupt and unable to fulfill customer fund redemptions. He strongly advised users to immediately take action to protect their assets, urged regulators and law enforcement to act swiftly to prevent further major losses, and announced a press conference in Hong Kong on April 3 at 14:00.

This statement caused FDUSD to briefly depeg to around 0.88 USDT, with the BTC/FDUSD trading pair spiking to nearly 100,000. FDUSD holders rushed to sell off holdings, echoing the scene from 2022 when USDC depegged following Silicon Valley Bank’s collapse. Shortly afterward, He Yi tweeted clarification that Justin Sun’s lawsuit concerned TUSD, not FDUSD, prompting FDUSD’s price to quickly recover back to around 0.99 USDT.

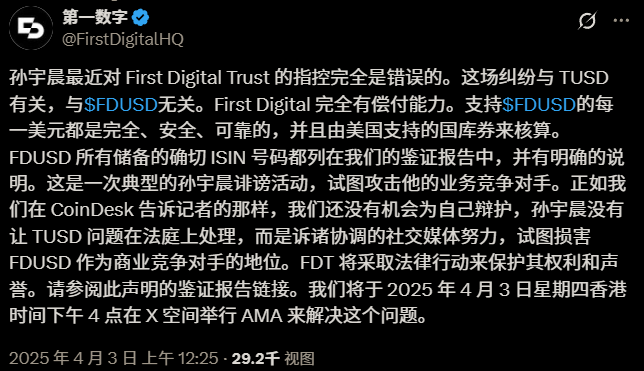

Meanwhile, First Digital Trust took to Twitter to deny Justin Sun’s claims as unfounded, accusing him of attempting to damage FDUSD’s reputation as a commercial competitor. The company said it would pursue legal action to protect its rights and reputation and announced a live AMA session on X at 16:00 Hong Kong time on April 3 to address the matter.

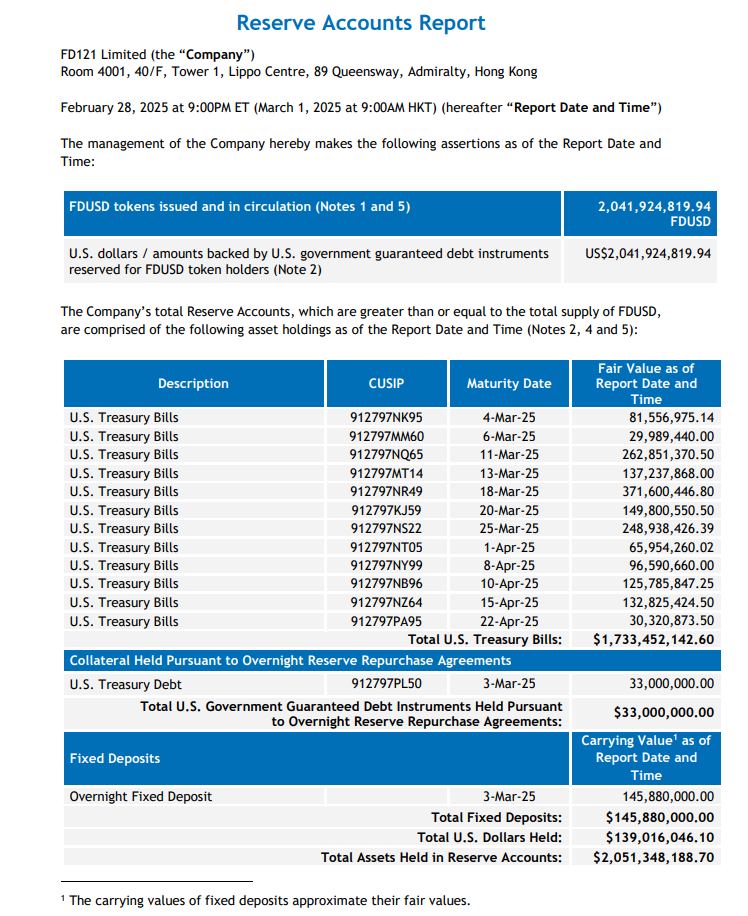

In addition, verification from Hong Kong accounting firm Moore CPA Limited shows that as of November 2024, FDT managed $501 million in TrueUSD reserves. Furthermore, First Digital released its February reserve report indicating total reserve assets of $2,051,348,188.70, with FDUSD issuance totaling 2,041,924,819.94 tokens—meaning reserve assets exceed 100% coverage of issued FDUSD, meeting the 1:1 reserve requirement.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News