Behind Sun's Dispute with FDT: $456 Million in Aid to Fill the TUSD Gap, but Funds Suspected of Being Misappropriated?

TechFlow Selected TechFlow Selected

Behind Sun's Dispute with FDT: $456 Million in Aid to Fill the TUSD Gap, but Funds Suspected of Being Misappropriated?

Market confidence in stablecoins has thus been tested.

By TechFlow

The crypto market never lacks disputes, and conflicts involving key figures can directly impact asset prices.

On the evening of April 2, 2025, Justin Sun posted on X, claiming that First Digital Trust (FDT) had "effectively gone bankrupt and is unable to honor customer funds."

He strongly advised users to immediately protect their assets and called on Hong Kong regulators to intervene to safeguard the financial hub's reputation.

Shortly after the post, FDUSD’s price dropped sharply.

According to CoinMarketCap data, FDUSD fell as low as $0.8811 within 24 hours (on April 2, 2025), with its total market cap shrinking by approximately $130 million—reflecting market concerns over FDUSD’s reserve adequacy.

Binance, the main trading platform for FDUSD, responded quickly.

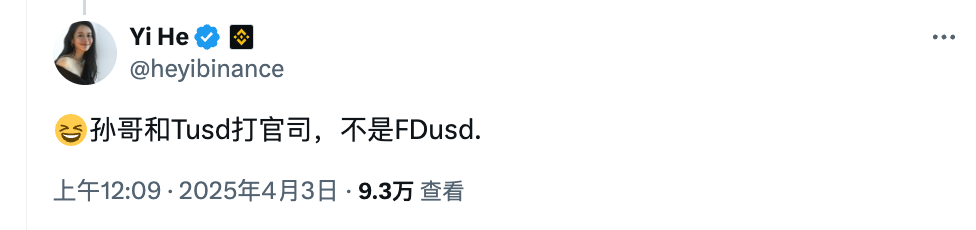

Sisi pointed out in a community post that FDUSD could still be redeemed at a 1:1 ratio; meanwhile, Cathy He (Yi Jie) also posted a clarification stating that Justin Sun’s legal dispute involved TUSD, not FDUSD, attempting to distinguish between the two controversies.

After these posts and responses, FDUSD partially recovered, trading at $0.989 at the time of writing—still below its $1 peg.

FDUSD, TUSD, FDT… these similar-looking acronyms are easily confusing.

What exactly happened behind this dispute that caused an asset to de-peg?

FDUSD and FDT

Some may be unfamiliar with FDUSD and the company FDT.

FDUSD is a dollar-pegged stablecoin launched in June 2023 by First Digital Labs (hereinafter “FDT”), part of Hong Kong-based First Digital Limited. As a trust company, FDT manages FDUSD’s reserves to ensure price stability, making it suitable for transactions, remittances, and DeFi applications.

After Justin Sun’s post, FDT issued a response, signaling that FDUSD remains secure: "First Digital is fully solvent. Every dollar backing $FDUSD is fully, safely, and reliably backed by U.S. Treasury bills. The exact ISIN numbers for all FDUSD reserves are listed in our attestation report with clear documentation."

FDT also stated that Justin Sun’s recent allegations against First Digital Trust are entirely false, emphasizing that the dispute relates to TUSD, not $FDUSD.

With both sides contradicting each other, how did TUSD suddenly enter the picture?

FDT Misappropriated TUSD Reserves? Justin Sun Bailed It Out with $456 Million

Behind this dispute lies a more complex web of grievances involving another stablecoin, TUSD (TrueUSD), and FDT’s role within it.

Despite their similar names, TUSD and FDUSD are entirely different stablecoins issued by separate entities.

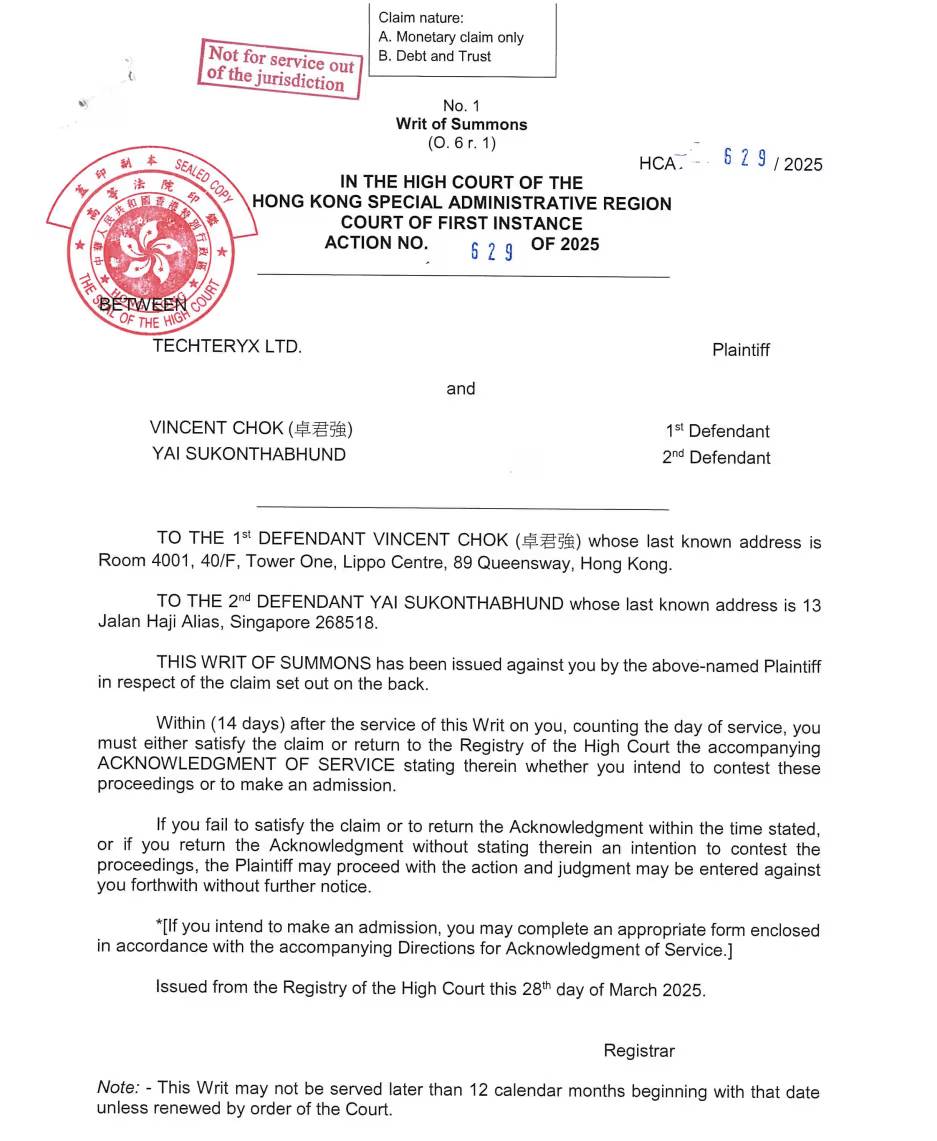

TUSD is currently issued by a company called Techteryx, and here’s the connection: FDT previously served as the custodian of TUSD’s reserves, managing its funds.

According to a CoinDesk report, after acquiring TrueUSD from TrueCoin in December 2020, Techteryx appointed Hong Kong-based trustee First Digital Trust (FDT) to manage its stablecoin reserves.

However, Justin Sun’s allegations and subsequent disclosures suggest serious issues in FDT’s management of TUSD’s reserves.

As reported exclusively by Sing Tao Daily (exclusive article), FDT CEO Vincent Chok (Cheuk Chi Keung) has been accused of involvement in fraud worth up to $9.5 billion (approximately HK$74 billion). The core of the accusation stems from FDT’s alleged misconduct while managing TUSD’s reserve funds.

Between 2023 and early 2024, a major shortfall emerged in TUSD’s reserves because FDT allegedly transferred $456 million (approximately HK$3.5 billion) without authorization to Dubai-based firm Aria Commodities DMCC for high-risk resource development investments.

These investments were highly illiquid, rendering TUSD’s reserve funds unredeemable in a timely manner and triggering a liquidity crisis.

Sing Tao also reported that Vincent Chok was accused of receiving $15.5 million (approximately HK$120 million) in secret commissions through an entity named “Glass Door.”

This act has been labeled as “fraudulent misrepresentation and misappropriation of funds,” directly causing a severe shortfall in TUSD’s reserves.

Techteryx (TUSD’s issuer) subsequently filed a lawsuit through U.S. law firm Cahill Gordon & Reindel in Hong Kong courts to recover damages and mitigate losses.

Documents from Techteryx show that due to TrueUSD’s reserves being trapped in unredeemable investments, its balance sheet showed a $456 million gap between 2023 and early 2024.

During TUSD’s liquidity crisis, Justin Sun played a pivotal role.

As revealed by Sing Tao, between 2023 and early 2024, Justin Sun provided emergency funding to TUSD, helping to quarantine 456 million TUSD tokens and ensuring retail users could continue redemptions—preventing broader market panic.

This move temporarily stabilized TUSD but also brought tensions between Justin Sun and FDT into the open.

Justin Sun’s assistance was not free. According to CoinDesk, the funds were injected as a loan—the $456 million gap was no small sum.

In response to the accusations, FDT CEO Vincent Chok swiftly denied all claims, stating that FDT acted only as a trustee intermediary, strictly following instructions from Techteryx, and bore no responsibility for independently evaluating investment decisions. Chok added that Aria refused early redemption due to anti-money laundering (AML) and know-your-customer (KYC) issues, which might have contributed to the liquidity crisis.

Summary of Relationships Among Parties and Assets

Based on publicly available information, here’s a clear picture of the dispute and the relationships among the assets and parties involved:

-

TUSD, a stablecoin issued by Techteryx, once entrusted FDT with managing its reserves,

-

but FDT was accused of diverting $456 million into high-risk investments, leading TUSD into a liquidity crisis.

-

Justin Sun stepped in with emergency funding to temporarily stabilize TUSD, but this left him at odds with FDT. His public accusation that FDT was “bankrupt” triggered FDUSD’s de-peg and sparked market panic.

-

In terms of asset relationships, although both FDUSD and TUSD were managed or formerly managed by FDT, they are entirely distinct stablecoins. FDUSD is FDT’s flagship product, claimed to be backed by U.S. Treasuries, whereas TUSD is issued by Techteryx, with FDT serving solely as custodian.

The positions of the various parties are now clearer:

FDT maintains its innocence, accusing Justin Sun of defamation and planning legal action to defend its reputation; Justin Sun is calling loudly for regulatory intervention, aiming to expose FDT’s issues; Techteryx is pursuing litigation to recover losses.

Binance, as the primary exchange for FDUSD, moved quickly to clarify and calm the market.

Yet, the full truth behind this dispute remains unclear.

The issues raised by Justin Sun about FDT may only be resolved through ongoing litigation and regulatory investigations. Market confidence in stablecoins has been tested, and investors may need to reassess reserve transparency and operational compliance in stablecoin projects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News