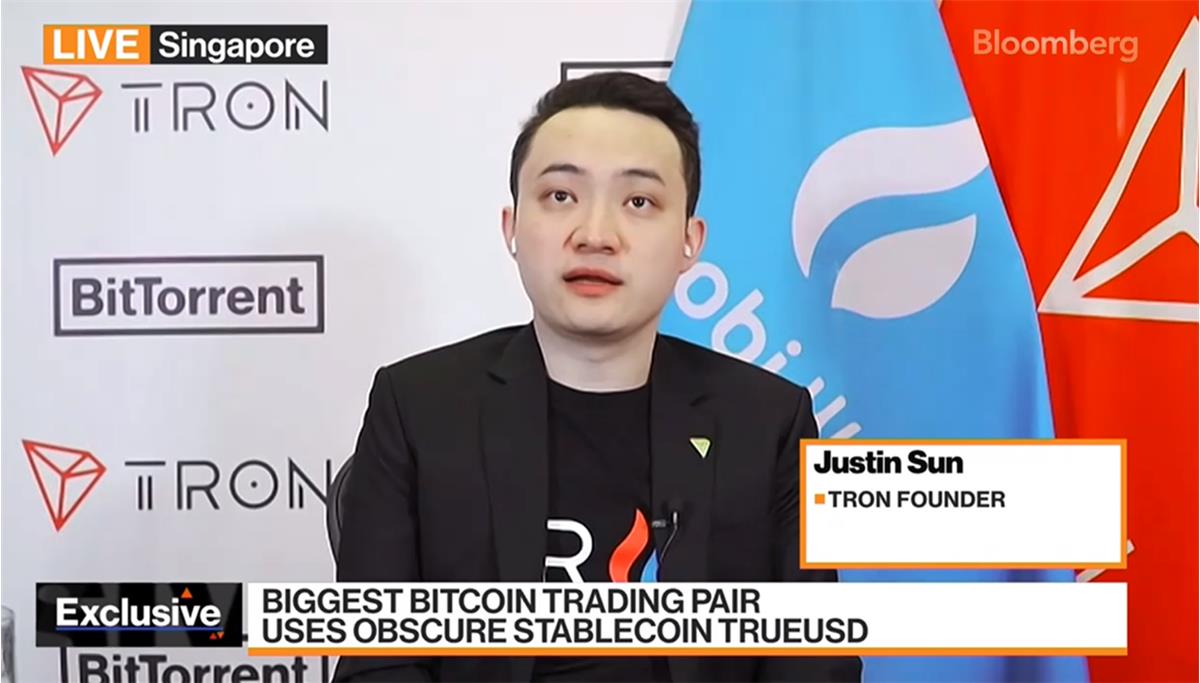

Bloomberg Connects with Justin Sun: TUSD Continues to Expand, Huobi Business Volume Grows Steadily

TechFlow Selected TechFlow Selected

Bloomberg Connects with Justin Sun: TUSD Continues to Expand, Huobi Business Volume Grows Steadily

Fire's transaction volume has grown steadily by approximately 15% against the backdrop of Hong Kong's new crypto regulations.

On April 26, Justin Sun, founder of TRON and member of Huobi Global Advisory Council, sat down with Bloomberg for an interview, addressing various topics including the status of stablecoins on the TRON blockchain, the latest developments in the SEC lawsuit, and recent performance of the Huobi exchange. During the interview, Justin Sun stated that TUSD has seen steady growth, to which he contributed significantly. Currently, the scale of USDT and TUSD on the TRON network exceeds that on Ethereum. Additionally, Sun noted that Huobi's business volume has increased by approximately 15% amid Hong Kong’s new pro-crypto regulations.

Under the pressure of U.S. regulatory actions against Binance and the U.S. banking crisis, BUSD and USDC suffered significant setbacks, making TUSD one of the biggest winners—actively adopted by Binance. To date, the circulating supply of the stablecoin TUSD has surpassed 2 billion units, reaching an all-time high. Among them, the TRON network holds the largest share of TUSD, exceeding $1.24 billion. This impressive data naturally attracted strong attention from Bloomberg.

In responding to related questions, Sun said that although he does not hold any shares in companies associated with TUSD, he has indeed provided substantial support for its growth, just as he has helped other stablecoins grow.

"Essentially all major stablecoin brands are available on the TRON network. Over the past five years, TRON has been focused on the growth of stablecoins. If you look at the data for USDT and TUSD, you’ll find that the total amount of these two stablecoins on TRON exceeds that on Ethereum. Of course, we also cooperate with Circle’s USDC. However, currently, TRON-based USDC only accounts for 1%-2% of the market share," Sun pointed out.

Sun further emphasized that users have very limited choices in the stablecoin market. Previously, only USDT, USDC, TUSD, and BUSD were highly trusted by users. For the past three years, these stablecoins were among the few options available in the market. Later, due to regulatory requirements, BUSD had to cease issuance and exit the market. As a result, the range of available stablecoins has become extremely limited, now mainly concentrated in the aforementioned three.

"At that time, USDC was severely hit by the collapse of Silicon Valley Bank, leading many people to question whether it maintained 100% reserves, causing significant price volatility. Currently, many major exchanges have started shifting their trading pairs to TUSD, attempting to diversify their exposure within the stablecoin market," he said.

Data from Nansen shows that over $1.6 billion worth of TUSD is currently held on Binance, accounting for 2.36% of the exchange’s total asset reserves, ranking sixth after USDT, BTC, ETH, BNB, and BUSD.

During the interview, Sun also addressed the latest developments regarding the SEC's civil lawsuit against him. He stated that he has no connection with Tron Foundation Limited, the entity being pursued by the SEC. His legal team is actively handling the SEC's allegations concerning violations of securities regulations.

Finally, Sun mentioned that Huobi Exchange has achieved steady growth in trading volume, benefiting from the回暖 of the crypto market driven by Hong Kong’s crypto-friendly policies.

"Many developers and traders are regaining confidence in Asia's cryptocurrency market. Since Huobi primarily focuses on the development of Asia's crypto market, we’ve recently seen growth in our business volume. Although not dramatic, it has steadily risen by about 15%. In addition, we’re seeing a rebound in cryptocurrency prices. Bitcoin surpassed $30,000 per coin last week, although prices have since pulled back. I believe this recovery of Bitcoin during the bear market can be attributed to the steady progress of Hong Kong’s new crypto policies," he said.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News