TRON Merges with SRM to Target Nasdaq—Justin Sun Is Playing at a Whole Different Level

TechFlow Selected TechFlow Selected

TRON Merges with SRM to Target Nasdaq—Justin Sun Is Playing at a Whole Different Level

The remarkable "Gates' grandson" is making bold strides toward advancing into the mainstream capital market.

By: Azuma (@azuma_eth)

Sun Yuchen is charging full speed ahead toward mainstream capital markets.

Tron Goes Public in the U.S.

On the evening of June 16 (Beijing time), news first emerged that "Tron plans to seek a U.S. listing." As people were puzzled over how a tokenized entity with a crypto-native structure could navigate regulatory compliance for a public listing, multiple sources soon revealed further details.

The Financial Times reported that Tron will go public via a reverse merger with SRM Entertainment, a company already listed on Nasdaq (ticker: SRM). The deal is being orchestrated by Dominari Securities, a New York-based investment bank linked to Donald Trump Jr. and Eric Trump, sons of former U.S. President Donald Trump.

Shortly afterward, SRM Entertainment officially announced it had signed a $100 million equity investment agreement with a private investor. The funds will be used to launch a treasury strategy around TRX—similar to Bitcoin’s corporate treasury playbook. Dominari Securities will serve as the exclusive placement agent for the offering.

Under the terms, SRM will issue up to 100,000 Series B convertible preferred shares (convertible at $0.50 per share into 200 million ordinary shares) and 220 million warrants (exercisable at $0.50 per share for a total of 220 million ordinary shares). If all warrants are exercised, the strategic investment could reach $210 million, resulting in a total issuance of 420 million new shares. Compared to SRM’s current 17.24 million outstanding shares, this represents a potential dilution of up to 23.36x, reducing existing shareholders’ ownership from 100% to as low as approximately 3.94%.

In addition, SRM Entertainment announced that Tron founder Sun Yuchen has been appointed as an advisor to the company, and that it plans to rename itself Tron Inc.—confirming earlier market rumors of a reverse merger.

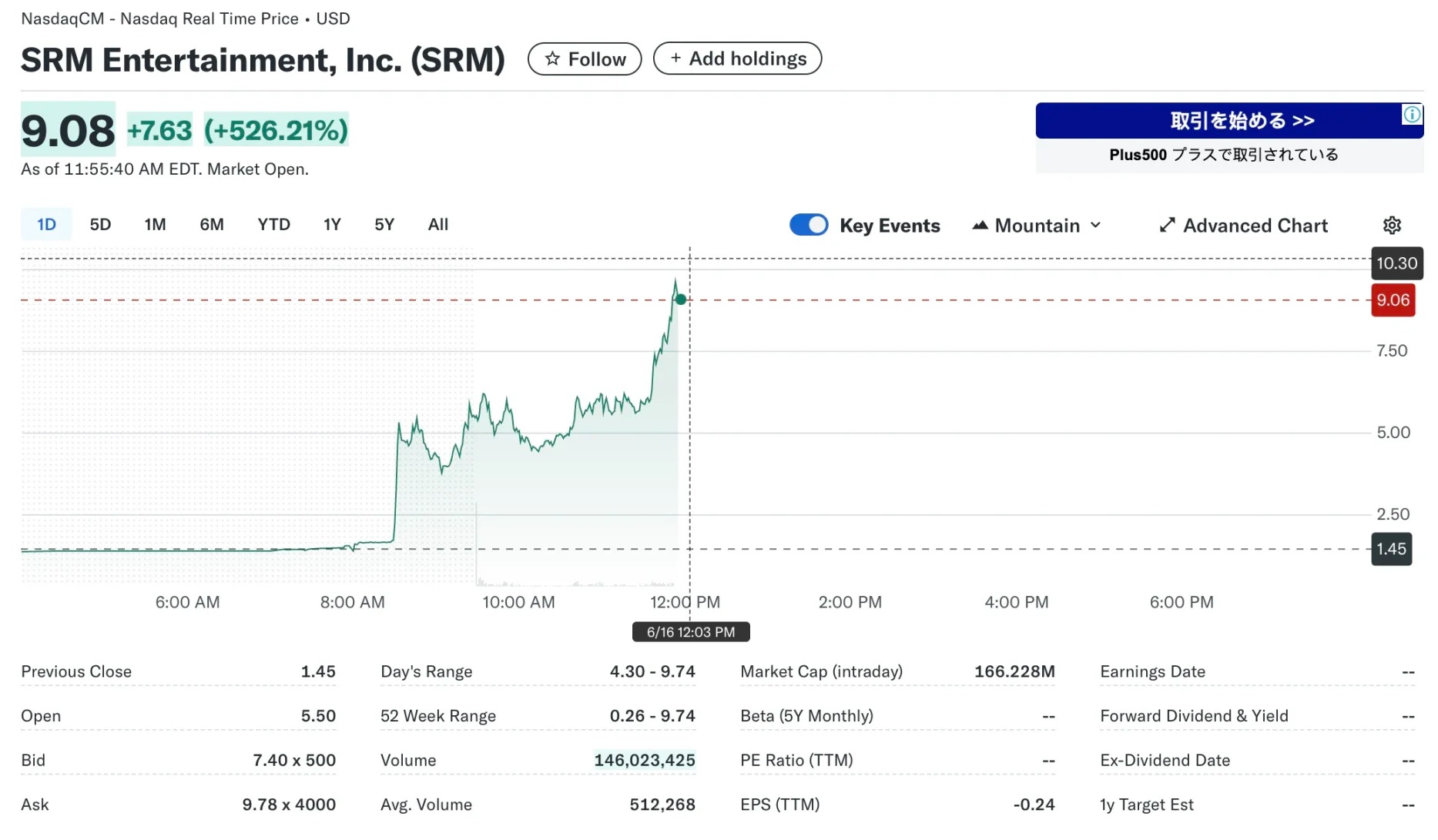

Following the announcement, both TRX’s token price and SRM’s stock price surged. According to OKX data, TRX briefly spiked to 0.295 USDT after the news broke and was trading at 0.279 USDT by 22:35 on June 16, up 2.5% over 24 hours. In U.S. markets, SRM skyrocketed after opening, reaching $9.08 by 23:55 on June 16—a staggering increase of 526.21%.

Sun Yuchen's Mainstream Ascent

It’s hard to believe that just two years ago, Sun Yuchen faced regulatory crackdowns from the SEC. Today, he not only serves as an advisor to the Trump family’s project World Liberty Financial (WLFI), but also stands as the top supporter ("number one patron") at "TRUMP"-themed banquets. Now, Tron is following in Circle’s footsteps, poised to become another crypto-native project listed on U.S. stock exchanges.

On March 22, 2023, under then-SEC Chair Gary Gensler—often dubbed the "crypto Voldemort"—the SEC filed lawsuits against Sun Yuchen and his three companies: Tron, BitTorrent, and Rainberry. The charges included unregistered securities offerings, market manipulation, and wash trading. For over a year afterward, while the case saw no major legal developments, it clearly hindered Sun Yuchen’s operations in the U.S. and other jurisdictions.

Everything changed dramatically after Donald Trump’s victory in November 2024. Under Trump’s pro-crypto policy agenda, regulatory clouds rapidly lifted. Trump himself and members of his family launched several crypto initiatives—including TRUMP and WLFI—and Sun Yuchen, ever the astute opportunist, seized this moment to reinvent his fate.

In November 2024, WLFI announced Sun Yuchen would join as an advisor—one day after he publicly revealed a $30 million investment in the project. Then in January 2025, Sun announced an additional investment, raising his total commitment to $75 million. In return, WLFI added TRX to its portfolio and made several public purchases.

In February 2025, the SEC (by now led by pro-crypto Paul Atkins, replacing Gensler), the Tron Foundation, and Sun Yuchen jointly filed a motion requesting a federal judge to pause litigation against them, signaling efforts toward a possible settlement.

In March 2025, Sun Yuchen graced the cover of Forbes’ English edition, labeled “the crypto billionaire who helped the Trump family earn $400 million.”

In April 2025, Sun Yuchen appeared alongside Eric Trump at the Token 2049 summit, further solidifying their partnership. It’s even rumored that Sun now exclusively stays at Trump-branded hotels when traveling...

Also in April, talk of a TRX ETF entered the mainstream—asset manager Canary filed an application with regulators for a staking-enabled TRX ETF.

In May 2025, the "TRUMP" themed dinner was held at Trump National Golf Club outside Washington D.C. The top 220 TRUMP token holders by weighted holdings were invited. Sun Yuchen attended as the largest holder—the undisputed "top patron"—and received a limited-edition Trump Tourbillon watch directly from Donald Trump.

In June 2025, just as the public began growing accustomed to Sun Yuchen’s close ties with the Trump family, he dropped another bombshell: “Tron going public on Nasdaq.”

Looking back at the dramatic transformation of Sun Yuchen and Tron over the past few years—especially the last half-year—it’s impossible not to marvel at how swiftly times have changed.

Once known for showing up at events claiming titles as ambassador of small nations, Sun was often joked to have more eccentric titles than Daenerys Targaryen in Game of Thrones. Now, through sheer determination, he has placed himself squarely at the center stage of American capital markets.

Whether criticized or celebrated, we cannot ignore this financial myth of our new absurd age—the Great Gatsby-Sun.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News