Sun Yuchen's political gamble: $90 million to knock on the door of the White House

TechFlow Selected TechFlow Selected

Sun Yuchen's political gamble: $90 million to knock on the door of the White House

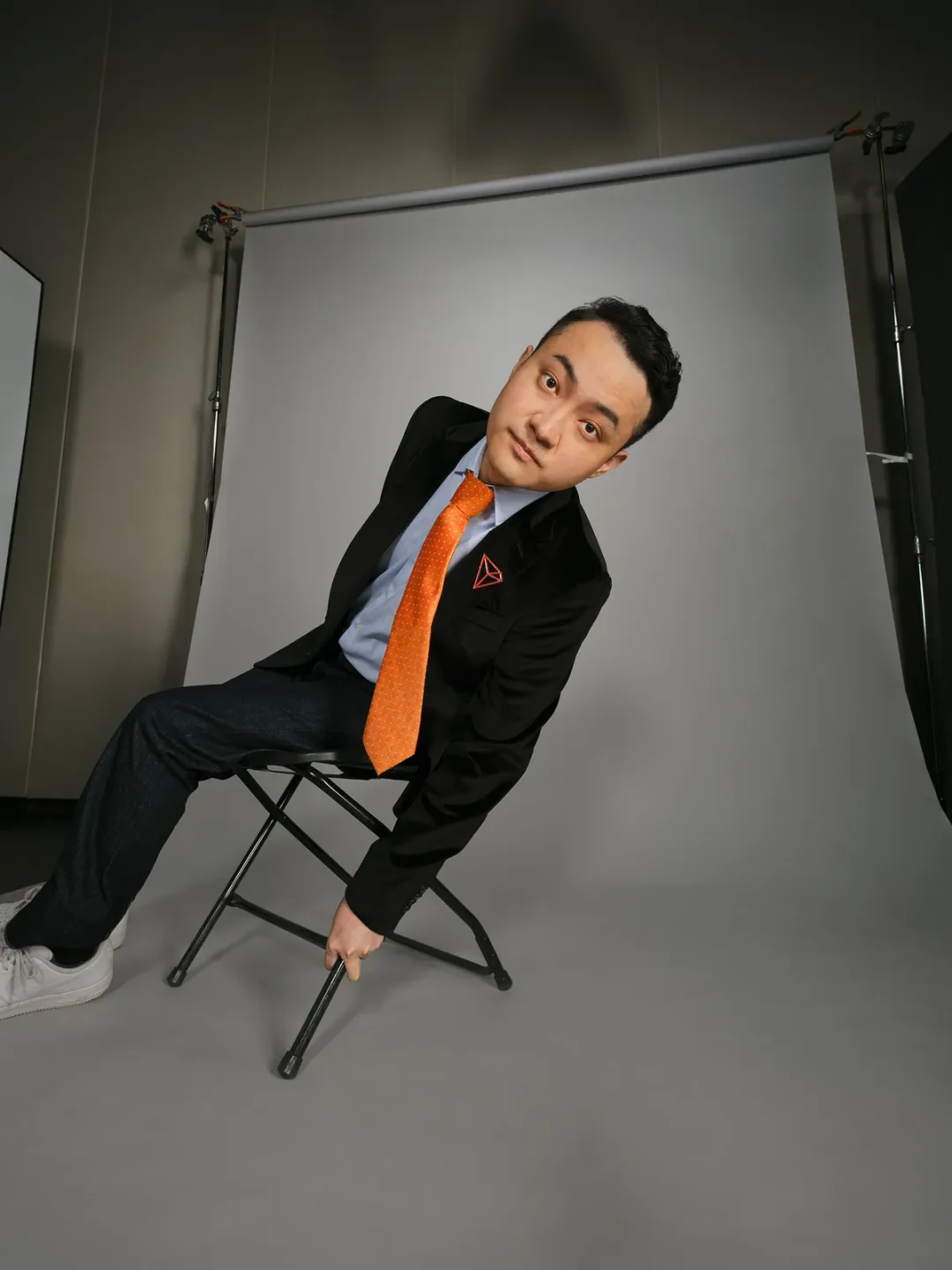

Despite being repeatedly accused of plagiarism, fraud, and market manipulation, he amassed a huge fortune through cryptocurrencies.

By Zeke Faux, Muyao Shen, Bloomberg

Translated by Chopper, Foresight News

The Chinese-born cryptocurrency billionaire stepped off his Airbus A330, bent down and placed his palm on the tarmac in Los Angeles, as if to confirm personally that he had truly arrived in the United States. Then he stood up and raised a fist in celebration. It was May 16, and the nationwide victory tour of Donald Trump’s biggest crypto backer had just begun.

Sun Yuchen’s excitement is understandable. For years, federal investigations threatening his business kept him from setting foot in the U.S. Now, after spending over $90 million buying two Trump family cryptocurrencies, he has returned as both guest and business partner of the president.

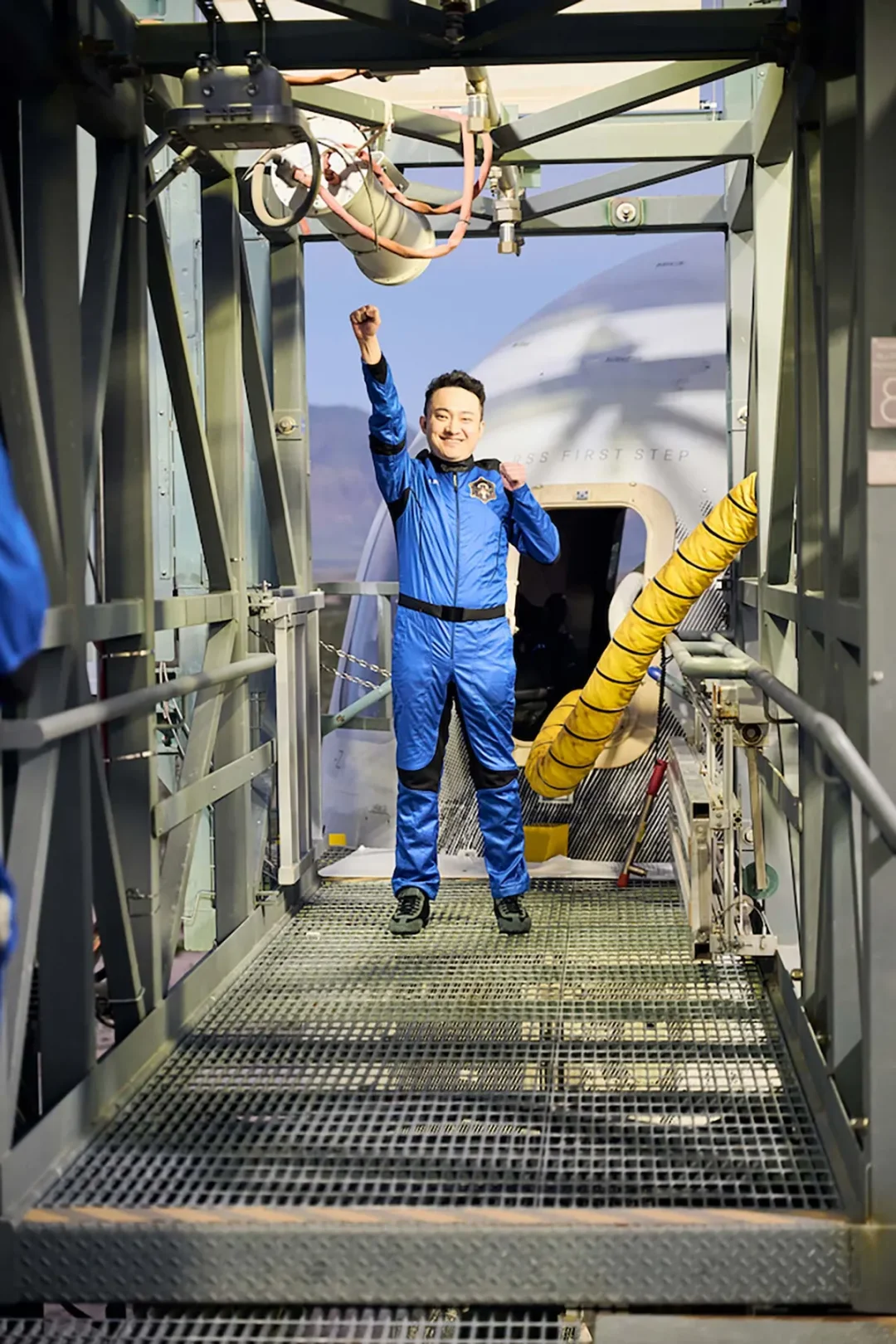

Sun Yuchen embarks on his long-awaited space journey on August 3 | Source: Blue Origin

His itinerary includes several highlights. One stop is Blue Origin, Jeff Bezos’ rocket company, where Sun will finally prepare for liftoff after winning a $28 million auction for a seat four years ago. Another is the Bitcoin Conference in Las Vegas, where he posed with the president’s son and a Tennessee senator pushing key crypto legislation. In Washington, he visited one of Trump’s crypto advisors and presented a replica of a conceptual artwork—a banana taped to a wall. The original piece was created by artist Maurizio Cattelan, which Sun previously bought at Sotheby’s for $6.2 million.

The climax of the trip is a dinner hosted by the president himself at Trump National Golf Club in Virginia. Entry was determined by an auction based on who bought the most Trump meme coins—Sun topped it with about $15 million in purchases. Outside the club, dozens of protesters braved the rain holding signs; one shouted, “Hope you choke on your steak!” Wearing a bowtie and escorted under an umbrella by assistants, Sun entered the venue trailed by three photographers capturing the moment for social media promotion. His rewards included a gold Trump watch and the opportunity to speak after the president.

Before more than 200 formally dressed meme coin investors, Sun stammered through a few minutes on the theme of “Trump’s support for the crypto industry.” “About… 100 days ago, they were chasing everyone in crypto,” he said, awkwardly smiling, “Now I’m here in America, and soon everyone else will come too.”

Critics of Sun’s relationship with Trump see it as inherently corrupt. White House spokesperson Anna Kelly responded that Trump “acts solely in the best interest of the American public, with no conflicts of interest.” But Sun’s very presence acts like a living billboard, signaling that the president sees no issue with his family accepting money from those seeking favors.

Previously, Sun faced fraud litigation from the SEC. Months after he began investing in Trump’s cryptocurrencies, the case was put on hold pending settlement talks (the SEC declined to comment). While both sides deny improper dealings, individuals funneling massive funds to a sitting president’s family for goodwill has no precedent in U.S. history. As a foreign national, Sun was legally barred from contributing to U.S. political campaigns. Yet through crypto, he has already generated more revenue for the Trump family than Mar-a-Lago earns in a year—and pledged another $100 million in Trump meme coin purchases.

But Sun’s ambitions go further. His blockchain network, Tron, has evolved into a global payment system. Using dollar-pegged stablecoins, anyone can transfer U.S. dollars across borders quickly, cheaply, and anonymously. Tron now processes around $600 billion monthly—over four times PayPal’s volume. His new allies in Washington are pushing regulatory changes to pave the way for Tron’s expansion in the U.S. The Trump family even plans to launch its own stablecoin using the Tron network.

Until recently, Tron operated in a regulatory gray zone. Money-laundering experts warn it has become criminals’ preferred payment network—used by Hamas, Russian entities evading sanctions, and large-scale fraud rings in China. Sun says he assists authorities in cracking down on illegal activities on Tron but also deflects responsibility by citing the network’s decentralization and lack of control.

In August 2025, a valuation by the Bloomberg Billionaires Index sparked controversy and led to a lawsuit from Sun. In February, Sun provided personal wealth details to the index, including a $55 million art collection, a $200 million Airbus jet, and a list of crypto wallets claimed to belong to him. Based on this, Bloomberg calculated Sun held 60 billion Tron tokens, valuing his net worth at $12.5 billion.

Sun later sued Bloomberg in federal court in Delaware, alleging the report revealed “confidential information promised not to be disclosed.” Bloomberg denied this in court filings. He claimed disclosing his crypto holdings exposed him to risks of hacking or kidnapping and sought an injunction to block publication. The lawsuit stated the asset list provided in February mistakenly included “ecosystem wallets and others not owned by him.” His lawyer said Sun does not hold a majority of Tron tokens, but when asked in court documents “which assets listed previously do not belong to Sun Yuchen,” the attorney refused to answer. On September 22, the judge rejected Sun’s request for an injunction; the case remains ongoing.

At some point late at night—around 11 p.m.—Sun called this publication. Over a 90-minute conversation in Chinese, he discussed his career, U.S. government probes, and ties to the Trump family. He believes outsiders should give both him and Trump “a bit more trust” rather than rush to judgment. “Even if Trump wants to help the poor, people might twist it as vote-buying,” he said. “Blockchain tech may also be misunderstood, as if the person behind it profits from crypto projects.”

He insists Tron creates immense value for the world, and criticizing his work “is like criticizing Spider-Man for using excessive force against villains.” “Spider-Man goes to school by day and protects the world at night, right?” Sun said. “We’re essentially safeguarding world peace too, just without boasting about it.”

This has always been Sun’s style. Despite accusations of plagiarism, fraud, and market manipulation, he amassed vast wealth through crypto. Like his new presidential business partner, Sun embodies Trump’s concept in *The Art of the Deal*—the virtue of “truthful hyperbole.”

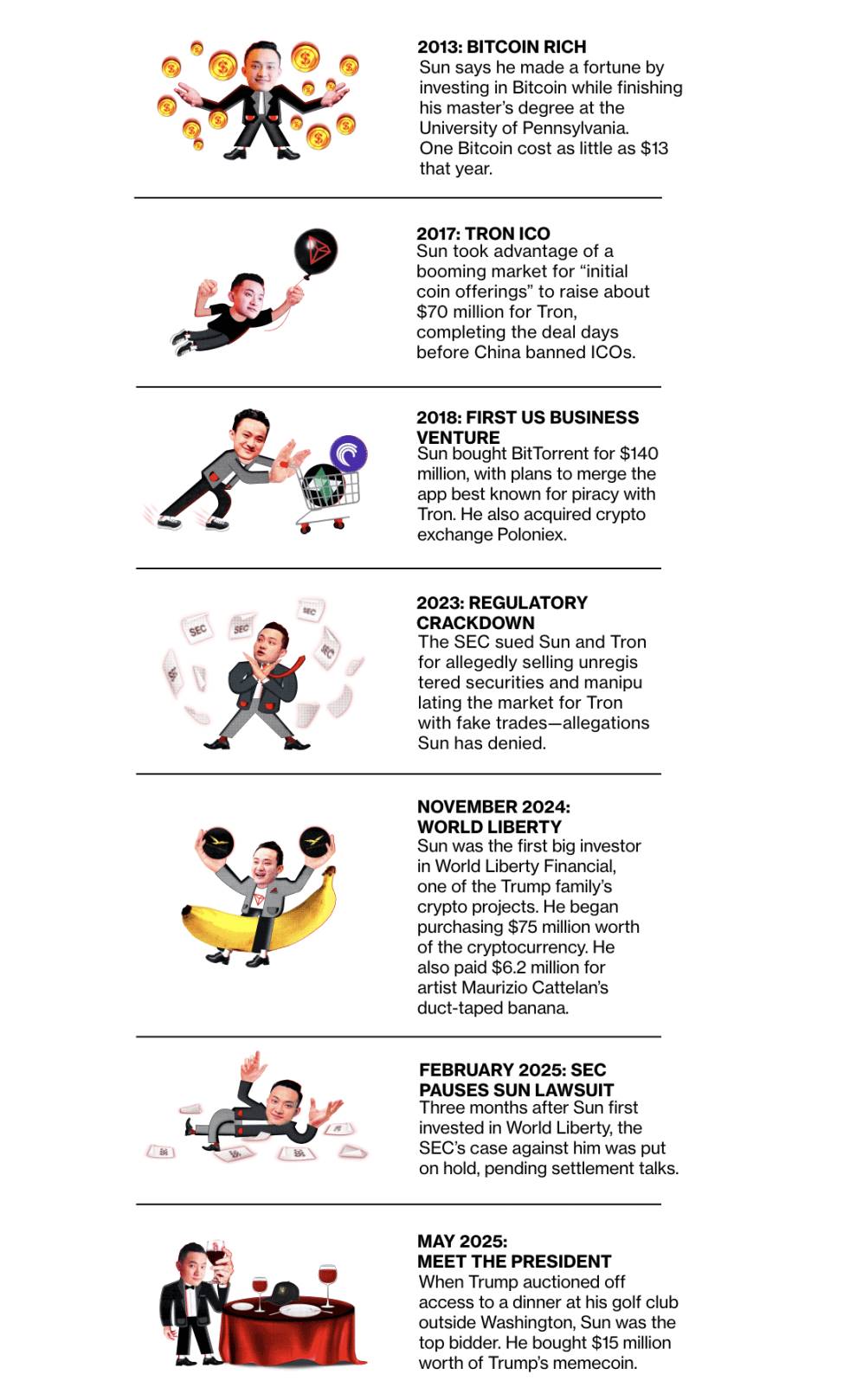

Sun Yuchen's Rise

Early cryptocurrency investments paved the way for this future billionaire to launch his own token and invest in the Trump family’s crypto ventures.

Top U.S. crypto firms Circle Internet Group Inc. and Coinbase Global Inc. have both refused to work with Sun. “Sun Yuchen has a bad reputation in the crypto community,” wrote Coinbase’s lawyer in a 2024 court filing. Last year, a Chinese podcast host labeled Sun a “scythe,” implying his trading style is ruthlessly aggressive. Sun responded: “I don’t think being ruthless is a flaw—it’s efficiency.”

Former employees described him in lawsuits as arrogant and domineering, running his company like the dictator in his favorite video game, *Tropico*. Two ex-staffers accused Sun of slapping subordinates; one said Sun repeatedly sent text messages saying “fuck your mom” (Sun denied all allegations in court filings). He required staff to address him as “His Excellency”—a title stemming from his 2021 appointment by Grenada as “Ambassador to the World Trade Organization.” The island nation reportedly sold diplomatic posts for $150,000 (Sun’s lawyers deny wrongdoing). “Everyone flatters him shamelessly,” said Cody Snider, a former engineer at one of Sun’s companies. “He’s treated like a king or god.”

Tron’s Dual Nature: Stablecoin Convenience and Criminal Tool

Sun is best known for flashy stunts designed to grab attention: commissioning Oscar-winning composer Hans Zimmer to score a Tron anthem, paying $4.6 million to dine with Warren Buffett, and running for prime minister of Liberland, a libertarian micronation (he won). In November 2024, he held a press conference in Hong Kong where he ate the $6.2 million banana, declaring it would “become part of art history.”

Thirty-five-year-old Sun was born in Xining, China. When he founded Tron in 2017, he lived in Beijing, hosted a podcast titled *The Road to Financial Freedom*, and acquired a social audio startup called "Peiwo," focused on user matching and voice chat/live streaming, which was criticized by China’s state-run Xinhua News Agency for containing pornographic content.

But Sun dreamed of becoming a tycoon like Jack Ma. “Like a devout missionary, I won’t fear snow-capped mountains ahead, nor retreat because my clothes are ragged,” he wrote in his 2014 autobiography *Brave New World*.

Tron emerged during the peak of “initial coin offerings” (ICOs), where projects raised funds by selling new crypto tokens instead of shares. At the time, any idea vaguely tied to blockchain—even deeply flawed ones—could raise significant capital. The most absurd example was “Dentacoin,” billed as the “first blockchain solution for global dentistry,” yet raised over $1 million.

Tron’s purpose remained unclear. Sun alternately described it as an “entertainment system,” an “app store,” or “the internet for the people.” Critics called it a “copycat project,” borrowing heavily from other ICOs. But these controversies didn’t stop fundraising: on September 2, 2017, Tron completed its ICO, raising $70 million; two days later, China banned ICOs.

In 2019, crypto analytics firm DappReview told CoinDesk that early Tron activity centered on gambling apps, with many users being fake accounts. But Sun had cash. He first acquired Poloniex, then a U.S.-based crypto exchange, followed by BitTorrent—for $140 million—which became infamous for file piracy, planning to integrate it with Tron.

In 2018, Sun briefly stayed in San Francisco to oversee his newly acquired businesses; two years later, he moved to Singapore amid workplace abuse lawsuits from former employees. Though he tried claiming diplomatic immunity via his Grenada appointment, it wasn’t accepted, and he eventually settled under undisclosed terms. In interviews, Sun dismissed all claims as extortion attempts and said he now realizes “this kind of thing is common in the U.S.”

In 2019, Sun found Tron’s core use case: stablecoins. These crypto tokens are pegged to $1, backed by real dollar reserves. That March, he partnered with Tether—one of the earliest stablecoin issuers—to enable sending and receiving Tether on Tron.

Back then, Tether was small, secretive, and widely questioned over reserve transparency. Its founding team was bizarre: including a child star from *DuckTales* and an Italian plastic surgeon. Tether was also under investigation by the New York Attorney General, which later revealed Tether’s owner had “misappropriated reserves” to cover losses at its affiliated crypto exchange. In 2021, they repaid debts and paid an $18.5 million fine to settle.

Despite controversies, stablecoins filled a gap in crypto. Many companies wanted to settle transactions in dollars but struggled to find banking partners due to offshore operations or legal uncertainty. Stablecoins, largely unregulated, became ideal substitutes. While other blockchains supported Tether, Tron offered the fastest speeds and lowest costs—making it surge in popularity.

Today, Tron handles about $2 billion in stablecoin transfers daily, with users paying small amounts of Tron tokens as fees. Tether and similar stablecoins are central to Sun’s business—he even describes Tron as “digital dollars.” Users include ordinary people in high-inflation countries like Argentina and Nigeria hedging against currency collapse. But the ease of cross-border dollar transfers also attracts criminal groups.

The UN Office on Drugs and Crime notes that money launderers, sanction evaders, and fraudsters were early Tron adopters, making Tron “the preferred tool for Asian crime syndicates moving funds.”

The appeal for criminals is clear. Dollars flowing through the U.S. banking system face scrutiny from compliance officers who must verify identities and report suspicious activity. But like other blockchains, Tron offers anonymity—users identified only by alphanumeric strings. With Tron, a London drug dealer can send stablecoins to a cocaine supplier in Colombia without revealing identity. The system works like PayPal, but accounts resemble Swiss banks’ old numbered accounts. “There’s a reason bad actors choose it,” said Matt O’Neill, former cyber investigator for the U.S. Secret Service and now a security consultant. “They almost never worry about getting caught.”

Brad Thorne seems an unlikely expert on Tron. A bald detective with a white goatee, he spent 19 years at the Boise Police Department in Idaho, a city of about 250,000. He says he “investigates multiple Tron-related scams every week,” commonly pig-butchering schemes: scammers initiate contact via cold messages, build false friendships, promise high investment returns, and trick victims into sending crypto. These scams are often run from Southeast Asian scam compounds. UN data shows over 200,000 people trapped in such camps, forced into fraud. Other tactics include impersonating police demanding bribes, pretending to be grandchildren needing “urgent bail money,” or sextortion. Thorne says crypto makes it easier for criminals to move stolen funds: “If money goes through banks, I have a better chance of recovering it. Banks are also more likely to spot red flags and block transfers.”

Typically, stablecoin issuers comply with law enforcement requests to freeze wallets linked to crimes. But Thorne notes criminals open new wallets and move funds faster than investigators can obtain court seizure orders. “For investigators, nothing is more frustrating than seeing victims’ money on the blockchain and being completely unable to recover it,” he said.

Ricky Sanders is an independent crypto tracker who volunteers support to Ukraine’s military and police. He believes crypto companies “don’t do enough to detect and prevent criminal use of their products,” as “it’s not in their economic interest.” Operating independently across Odessa and Eastern Europe, Sanders says he’s seen drug traffickers, saboteurs, sanctioned Russian firms, and terrorists all using Tron to move funds—and tracking them isn’t hard. In February 2025, he emailed Hamas at chocolategoddezz@proton.me asking how to donate, and received a 42-character Tron wallet address in reply.

In the U.S., any provider of electronic payment services typically must follow strict rules: collect user IDs and report suspicious transactions. But decentralized blockchain networks mostly evade these requirements. Supporters argue blockchains are neutral software tools—like internet protocols—and shouldn’t be held liable for user actions.

Tron claims to be community-controlled. It’s led by 27 representatives elected by token holders. But the Bloomberg Billionaires Index, analyzing data provided by Sun’s representatives in February 2025, found he controls over half of all Tron tokens—and publicly reported this. Sun then sued Bloomberg, while Bloomberg defended its analysis in court filings.

The harshest assessment of Tron comes from TRM Labs, a crypto-tracking firm whose tools are used by law enforcement globally. In March 2024, TRM released a study stating that “45% of illicit crypto activity occurs on Tron—the highest among all blockchains,” and noted Sun’s network is used by drug traffickers, North Korean hackers, and terrorist financiers.

Six months after the report, Sun used his wealth to turn critics into allies. He announced funding for a new initiative called the “T3 Financial Crimes Unit,” hiring TRM—with Tether’s assistance—to combat criminal activity on Tron. Ali Redbord, TRM’s global policy head, said the program helped freeze “$260 million in illicit funds.” In 2025, TRM issued a new report praising Tron for “effectively removing bad actors,” while still noting “over half of tracked criminal activity in the past year occurred on the Tron blockchain.”

Redbord argues it’s unfair to criticize Tron simply because criminals use it: “It’s just a blockchain—a piece of infrastructure.” A lawyer for Sun echoed this view in a letter: “Bad actors exist everywhere. Blockchain is merely the latest neutral technology abused by bad actors—a recurring pattern throughout tech history.”

In an interview with Bloomberg Businessweek, Sun insisted Tron “does not facilitate crime,” but instead “helps impoverished people worldwide—especially in countries with volatile currencies—easily access U.S. dollars.” “The world is deeply flawed and needs fixing,” Sun said. “I feel I’ve been trying to solve problems all along.”

He likened the T3 program to “NATO,” comparing its impact to “the Gates Foundation’s work in Africa.” He said the team has helped combat “money laundering, investment fraud, ransomware, human trafficking, and North Korean terror financing,” adding: “If left unchecked, these issues could trigger a nuclear-level catastrophe for humanity. We are the messengers of justice.”

Sun’s conflict with the U.S. government began after the 2022 crypto bubble burst. At the time, the collapse of a “$40 billion fraud scheme” led by flamboyant engineer Do Kwon triggered cascading defaults, exposing insolvency among prominent industry figures. Crypto “wunderkind” Sam Bankman-Fried’s exchange FTX also collapsed; he was later sentenced to 25 years in prison for fraud.

Regulators, previously hands-off during the boom, finally acted. Under Gary Gensler’s leadership, the SEC sued major industry players, claiming “virtually every public crypto transaction is illegal.”

Sun was one of the targets. In a 2023 lawsuit, the SEC alleged Sun “hired at least five employees to create exchange accounts using others’ identities, then engaged in self-trading of Tron tokens to fabricate demand.”

The SEC also accused Sun of violating disclosure rules. He paid rappers like Soulja Boy, adult film star Kendra Lust, and actress Lindsay Lohan to promote Tron, but these celebrities did not disclose they were compensated.

In an interview with Bloomberg Businessweek, Sun called Gensler “essentially a tyrant” who “fabricated charges entirely to attack crypto companies.” He speculated Gensler “might want to advance his career through high-profile cases,” adding: “He doesn’t care whether people are good or bad—he’s just spraying bullets wildly.” Gensler declined to comment.

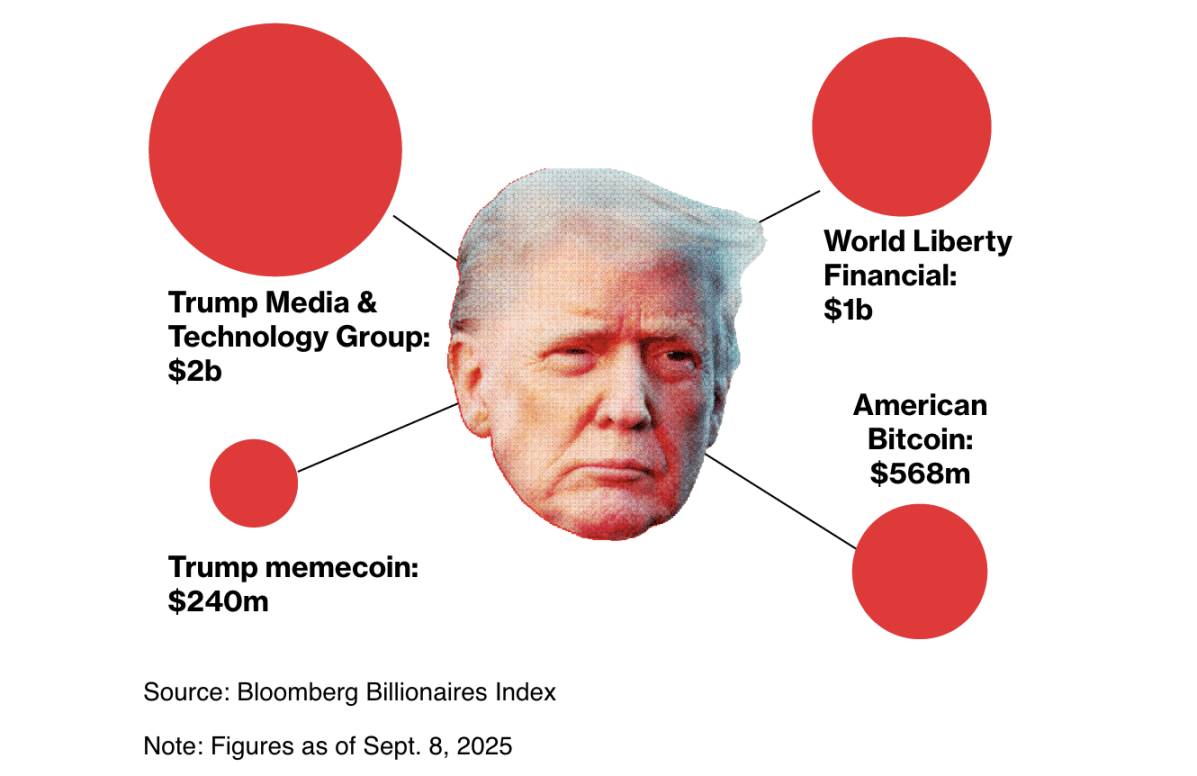

The Returns on Investing in the Trump Family

Fears that “cryptocurrencies and stablecoins are being exploited illegally” have reached the highest levels of the U.S. government. In 2024, former Ohio Democratic Senator Sherrod Brown said at a Senate hearing: “North Korea, Russia, Hamas—they’re all turning to crypto because it’s easier to move money in the dark.” Though he didn’t name Tron specifically, his criticism targeted the entire industry.

The U.S. crackdown on crypto has become an existential threat to the sector, sparking internal debate over how to respond. Sun’s friend and Binance co-founder Zhao Changpeng agreed to travel from the UAE to the U.S. and plead guilty to criminal charges related to “exchange misuse,” while Binance paid a $4 billion fine to settle. Companies like Coinbase chose a “lobbying counterattack,” targeting Brown directly—spending over $40 million supporting his opponent, ultimately leading to Brown’s defeat.

Amid this regulatory storm, Sun left Singapore in 2024 for Hong Kong. He rented a penthouse in a waterfront hotel while his lawyers fought the SEC in court (his lawyers say his location and travel choices reflect personal preference, not legal concerns). Weeks before the U.S. presidential election, Trump opened a new door for those eager to get close to power.

Trump once expressed skepticism toward crypto, saying in 2021: “They might be scams—who knows what they are?” But things changed after “a small group of Bitcoin investors donated about $20 million to his campaign.” In July 2024—four months before the election—Trump spoke at the Nashville Bitcoin Conference, promising to “fire SEC Chair Gensler” and “ease crypto regulations.” “If Bitcoin is going ‘to the moon,’ I want America to lead,” he said, drawing applause.

Weeks later, Trump launched his own cryptocurrency. His level of seriousness mirrored how seriously he promoted gimmicks like guitars and sneakers during his campaign—meaning, not very serious. The project, called “World Liberty Financial,” was described by Eric Trump as aiming to “promote financial independence,” though its mechanics remained vague. Trump’s 18-year-old son Barron, newly enrolled in college, was listed as the company’s “Chief DeFi Visionary Officer,” despite having zero experience in decentralized finance.

The project was driven by two longtime internet grifters who met the Trumps through the son of one of Trump’s golf buddies. One, Chase Herro, previously marketed “colon cleanse weight-loss products” and a “$149-per-month get-rich-quick course,” once calling himself an “internet asshole” in a speech and saying in a YouTube video: “Regulators should kick people like me out.” The other, Zachary Folkman, ran a service called “Date Hotter Girls.” Their only other known crypto project failed after a hack.

The offering terms were unattractive: even if profitable, token holders wouldn’t receive dividends; and once fundraising hit $30 million, 75% of proceeds would go to the Trump family. Essentially, investing in World Liberty Financial amounted to giving money directly to the Trumps.

The Trumps planned to sell $300 million in World Liberty Financial tokens, but by mid-November 2024—after Trump won the presidency—only a few million dollars had been sold, far below the threshold triggering payments to the family. That’s when Sun stepped in. On November 25, he announced a $30 million purchase, was named a “World Liberty Financial advisor,” and later added another $45 million. His involvement triggered a wave of follow-on investments, ultimately selling all tokens—totaling about $550 million—potentially delivering $400 million to the Trump family.

Trump’s Crypto Wealth, Source: Bloomberg Billionaires Index, data as of September 8, 2025

“This gentleman saw an opportunity most people couldn’t,” Folkman, co-founder of World Liberty Financial, said at a Hong Kong crypto conference in February 2025, pointing to Sun beside him. “Once he jumped in, everything started snowballing.”

Sun claims he “didn’t seek or expect any benefits in exchange for funding,” but he did gain repeated opportunities to “express his interests.” In December 2024, at the Abu Dhabi Bitcoin Conference, he discussed World Liberty Financial plans with Eric Trump. He also met Steve Witkoff—the golf buddy who introduced the project to Trump—who had been appointed presidential Middle East envoy. Sun said Witkoff “had to cut our meeting short due to hostage negotiations,” but they’ve “remained in touch discussing U.S. crypto policy.”

After Trump took office, Sun and the broader crypto industry got what they wanted. In February 2025, the SEC dropped lawsuits against Coinbase and several other companies; lawyers handling some cases were demoted to the SEC’s IT department. The case against Tron was also paused. Corey Frayer, Gensler’s crypto policy advisor at the SEC, said the decision was baffling because “the Tron case was one of the clearest he’d seen during his time at the SEC.”

Sun’s lawyers insist the SEC’s decision “has absolutely nothing to do with this billionaire’s investment in the Trump family project.” White House spokesperson Kelly said in an email: “The president’s actions aim to secure favorable deals for the American people, not personal gain.” Sun told Bloomberg Businessweek he’s satisfied with the shift: “It’s fairer now—at least there’s more respect. Law enforcement behaves much better than before.”

A more significant change for Tron is the U.S. government’s complete reversal on stablecoins. Previously, top officials viewed stablecoins as “a risk to financial stability.” The Trump administration now sees them as “tools to promote the dollar globally” and as “business opportunities.” In May 2025, Sun gifted the “tape banana” artwork to Bo Hines, a White House crypto policy advisor. Hines resigned in August to join Tether. The Trump family also launched its own stablecoin, USD1, via World Liberty Financial. Sun says he led this initiative and that Tron and World Liberty Financial will jointly challenge big banks.

“We can shape the world through World Liberty Financial and completely transform the financial system,” Sun said at a Dubai conference in May 2025, standing beside Eric Trump. “Those who don’t join us will eventually be left far behind.” Trump’s son echoed the sentiment: “If banks don’t embrace crypto and seize this moment, they’ll eventually die out.”

Sun Yuchen, World Liberty Financial co-founder Zach Witkoff, and Eric Trump attend a cryptocurrency conference in Dubai in May

In July 2025, with Trump administration backing, Congress passed a bill regulating and encouraging stablecoin use. At the White House signing ceremony, executives including Tether CEO Paolo Ardoino attended. The president told them stablecoins could “supercharge U.S. economic growth” and boasted of solving “so many headaches” for the industry: “I’ve saved you from so much trouble.”

There is currently no evidence that Trump “traded official acts for money or other benefits”—the current legal definition of corruption per U.S. Supreme Court rulings. But since Trump’s election, those eager to curry favor with the Trumps have clearly rushed to generate wealth for them. The Trump family has earned billions through at least four crypto projects, while the Trump administration simultaneously eases crypto regulations. Additionally, the Trumps have signed hotel development deals with nations negotiating tariff disputes with the U.S. When asked why he accepted a $400 million plane gifted by Qatar’s government, Trump replied: “I could say ‘no, no, no,’ or I could say ‘thank you very much.’”

Sun Yuchen rings the Nasdaq bell on July 24, 2025

In June 2025, Sun’s push into the U.S. market began paying off. Dominari Securities—a small investment bank listing Donald Trump Jr. and Eric Trump as advisors—used complex maneuvers to help list Tron on the Nasdaq exchange. According to the Bloomberg Billionaires Index, the move could bring Sun around $1 billion (the Trump brothers didn’t respond to requests for comment; Eric denies involvement but acknowledges Sun is a friend).

On July 24, Sun arrived in New York and rang the bell at Nasdaq’s Times Square TV studio. Dressed in a tuxedo similar to what he wore at the Trump meme coin dinner, he punched the air amid celebratory confetti marking the opening trade. He took photos in front of digital screens displaying Tron ads, then boarded a black minivan to downtown for a meeting.

Sun brought his mother—an ex-journalist from China—appearing unusually relaxed. He asked his assistant “which photo to post on social media” and handed the “Trump gold watch” to a Bloomberg Businessweek reporter, laughing about “how the president is advancing the industry.” Soon after, he would head to West Texas to board a Blue Origin rocket into space. “I love America,” Sun said. “I’ve never loved America this much.”

But Sun quickly learned an old lesson: the Trump family can swiftly turn on allies. In September 2025, online rumors spread that “Sun is dumping World Liberty Financial tokens.” The company immediately banned him from trading, freezing his stake worth $75 million. Sun denied selling, calling the move “unfair and contrary to the decentralized spirit of crypto.” But with little regulation in crypto, he had nowhere to appeal—only social media, where he pleaded for help and pledged “additional investments in the Trump family’s project.” “I’ve invested not just money, but trust and support,” Sun wrote. “Let’s work together to make World Liberty Financial succeed.” The Trump family has not responded.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News