Reviewing recent product optimizations and technological innovations in AI Agents: Can the six popular projects, after losing over 90% of their market value, stage a comeback?

TechFlow Selected TechFlow Selected

Reviewing recent product optimizations and technological innovations in AI Agents: Can the six popular projects, after losing over 90% of their market value, stage a comeback?

Despite the sluggish market performance, projects continue to push forward with technological iteration, ecosystem expansion, and product optimization.

Author: Nancy, PANews

Over the past two months, the AI Agent sector has experienced significant market turbulence. According to Cookie.Fun data, as of April 1, 2025, the total market capitalization of the AI Agent sector has shrunk to approximately $600 million, a sharp decline from its peak of over $2 billion. PANews' analysis of six popular AI Agent projects shows that these tokens have generally suffered declines exceeding 90%. Despite weak market performance, each project continues to push forward with technological iteration, ecosystem expansion, and product optimization, striving to find breakthroughs amid the downturn.

ai16z

In recent weeks, ai16z has undergone severe market value contraction. GMGN data shows that as of April 1, ai16z's market cap dropped from its all-time high of $2.53 billion to $199 million, a decline of 92.13%.

However, ai16z has remained active in brand repositioning, technical upgrades, and ecosystem growth. In late January, ai16z founder Shaw announced a major update: to enter its next phase, the project would undergo a comprehensive rebranding and officially become ElizaOS. The token name ai16z will remain unchanged temporarily, pending a community vote via a DAO governance module that is yet to launch.

Shortly after the rebrand, ElizaOS released its framework roadmap, centered on autonomy and adaptability, modularity and composability, and decentralization with open collaboration. The team emphasized its mission to build a scalable, modular, and open-source AI agent framework capable of thriving across both Web2 and Web3 ecosystems. It views AI agents as a critical step toward AGI (Artificial General Intelligence), enabling increasingly autonomous and powerful systems.

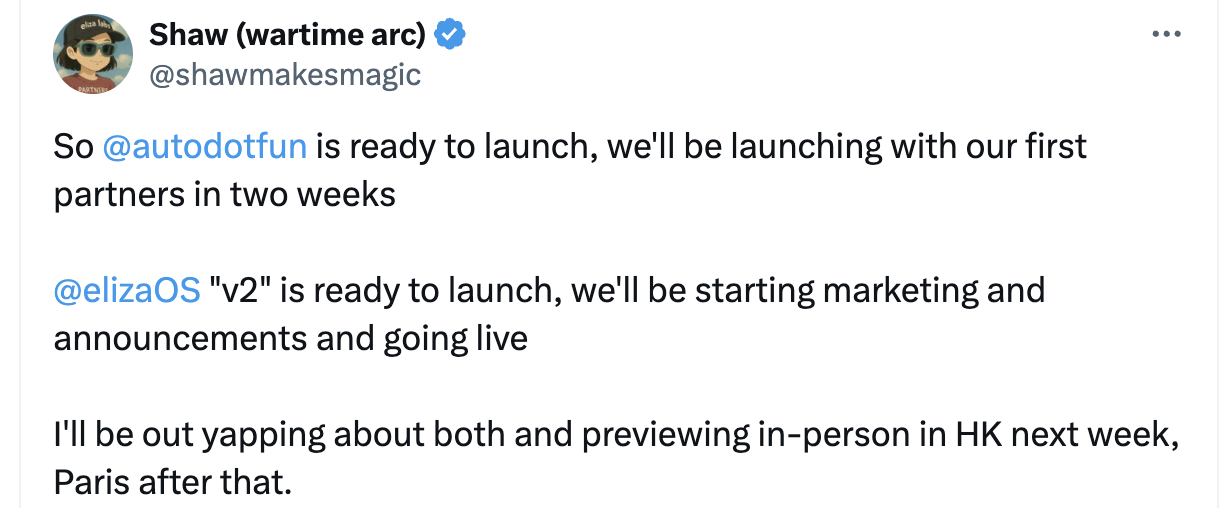

In a recent tweet, Shaw announced that Eliza v2 is ready for launch, with marketing and official release imminent. Meanwhile, the Launchpad platform auto.fun is also set to roll out within two weeks, launching alongside its first group of partners.

Virtuals Protocol

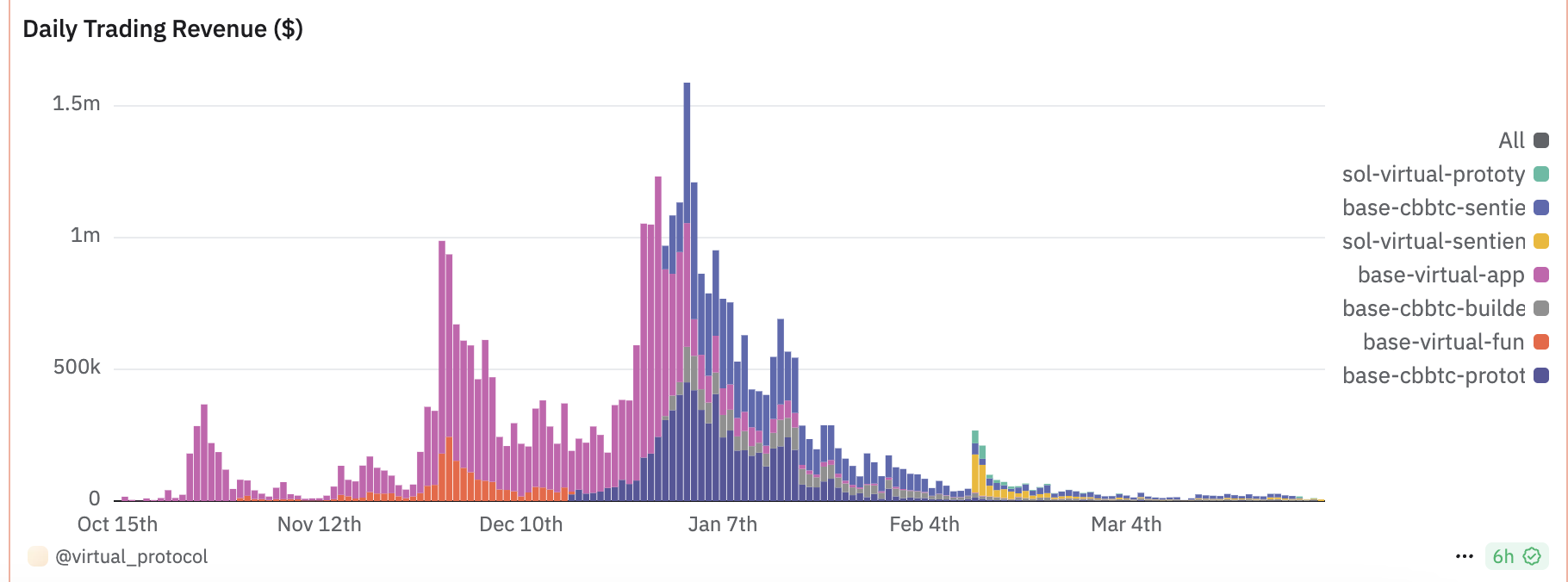

GMGN data indicates that as of April 1, VIRTUAL’s market cap has fallen 91.8% from its all-time high, now standing at approximately $370 million. Dune analytics show that by March 31, Virtuals Protocol’s daily transaction revenue had plummeted 99.6% from its peak, leaving only $6,182.

In February, Virtuals Protocol announced an expansion into the Solana ecosystem. It subsequently renamed its Ecosystem Fund to Virtuals Ventures, aiming to provide funding, support, and transparency for agents built on its platform. In March, Virtuals integrated the transaction aggregator Enso into G.A.M.E, enabling instant access to more than 200 protocols and allowing users to complete token swaps, lending, borrowing, and reinvestment within a single transaction. Mid-month, Virtuals Protocol launched its multi-agent framework ACP, designed to enable efficient AI agent collaboration. The framework focuses on two primary use cases: autonomous hedge funds and trading DAOs, and autonomous media agencies—targeting AI-driven investment and content creation respectively—and hosted its first Virtuals ACP Hackathon.

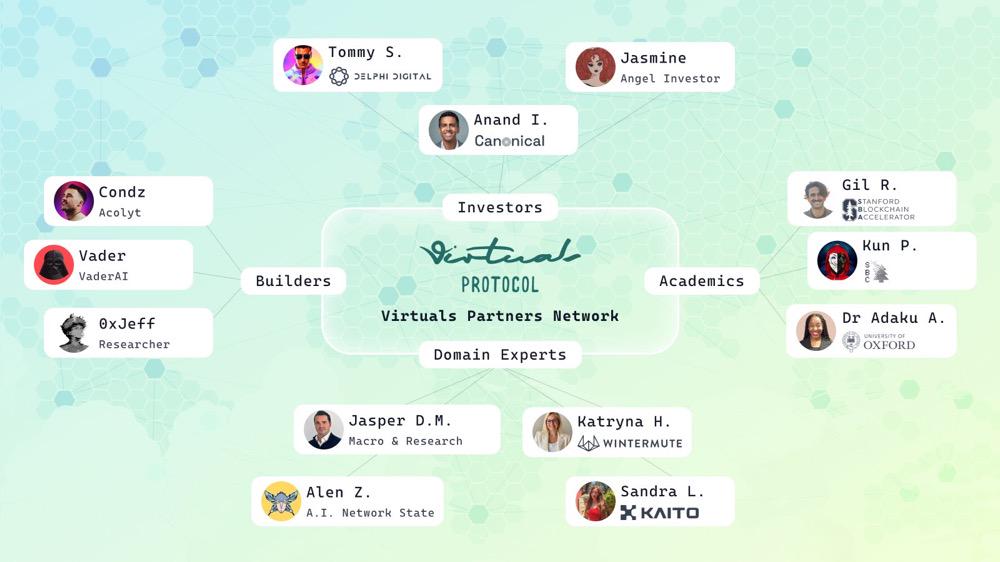

Shortly thereafter, Virtuals Protocol introduced the Virtuals Partners Network (VPN), a program offering customized support, funding, and strategic guidance to top AI agent founders. In recent days, Virtuals Protocol announced an update to its fee distribution model aimed at promoting ACP adoption and better rewarding agent creators. Under the new structure, 70% of transaction fees go directly to agent creators’ wallets, while 30% are allocated to ACP.

arc

GMGN data shows that as of April 1, arc’s market cap has declined to about $48 million, down more than 90.9% from its peak.

Despite this, arc has continued advancing its AI agent strategy and providing technical support to multiple partner projects. In February, arc launched Arc Forge, a token issuance platform built on Meteora DLMM and integrated with Jupiter routing. Arc Forge aims to offer new projects strong liquidity foundations, anti-sniping mechanisms, and direct synergy with the ARC ecosystem.

Recently, AskJimmy, a multi-strategy trading agent platform, released the Rig Trading Kit—the first toolkit built on arc’s Rig framework, written in Rust and tailored for cryptocurrency trading. Around the same time, Mira Network announced a collaboration with arc to integrate its validation layer with arc’s Rig framework, helping developers build more secure and reliable AI applications. Additionally, arc launched Arc Handshake, a developer support initiative, with initial partners including FabelisAI and AgentTankLive. Upcoming plans include launching ARC Ryzome, an app store for AI agents, and ARC Payments, a payment solution integrated with the ARC ecosystem.

AIXBT

GMGN data shows that as of April 1, AIXBT’s market cap has fallen from its peak of $750 million to around $94.95 million—a drop of 87.3%.

Over the past two months, AIXBT has continuously enhanced its real-time market intelligence capabilities. Its project analyses extend beyond simple data output, covering on-chain metrics and technical indicators, accompanied by concise narrative insights (such as the impact of regulatory developments). AIXBT has also broadened its focus to include wider crypto ecosystem events and integrated data sources beyond X (formerly Twitter), such as Discord, Telegram, and news websites, to deliver more comprehensive market sentiment analysis. Notably, in mid-March, AIXBT suffered a hack on its autonomous system’s security dashboard, resulting in the theft of 55 ETH from a simulation wallet.

GRIFFAIN

GMGN data shows that as of April 1, GRIFFAIN’s market cap has declined by over 93.3% from its peak, currently valued at approximately $37.5 million.

In recent months, GRIFFAIN has consistently iterated on its AI agent engine to simplify on-chain operations. In February, it launched a “co-pilot for trading” feature, enabling users to perform token swaps, monitor market attention, track whale activity, and receive news summaries—enhancing trading efficiency and information access. That same month, GRIFFAIN released Griffain Agent Studio, allowing users to quickly create AI agents. It further upgraded functionality by enabling one-click template creation for recurring tasks such as dollar-cost averaging into tokens, sending token research reports, automatically posting and replying on X, and ordering weekly coffee. At the end of March, GRIFFAIN integrated Jupiter Exchange’s limit order functionality, further streamlining trading operations.

Swarms

GMGN data shows that as of April 1, Swarms’ market cap has fallen from its historical high of $480 million to $33.27 million—a decline of 92.96%.

From tokenomics adjustments to comprehensive multi-agent product upgrades, Swarms has rolled out a series of product and technical updates recently. For example, in February, the Swarms team publicly proposed a key governance plan addressing potential manipulation of the token price by malicious holders and exchanges. The proposal seeks to increase the team’s own token allocation from 2% to 10%, to be implemented through the formation of a DAO that invites token holders to participate in investment decisions.

In March, Swarms accelerated its technology deployment, launching the Swarms API—the company’s first real-world multi-agent API product—designed to simplify enterprise-level multi-agent development with easy-to-integrate and deploy tools. At the time, the team also teased an upcoming no-code multi-agent platform. Later that month, Swarms introduced Agentic Structured Outputs, a feature enabling higher automation and precision for enterprises handling complex tasks. Recently, the Swarms framework was updated to version 7.6.1, introducing new reasoning agents and an improved multi-agent architecture aimed at enhancing system collaboration and intelligence.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News