Bybit led March inflows and reclaimed the second-largest trading volume globally

TechFlow Selected TechFlow Selected

Bybit led March inflows and reclaimed the second-largest trading volume globally

Bybit saw $3.61 billion in fund inflows in March, reclaiming the position of second-largest globally by trading volume.

Dubai, UAE, April 1, 2025 — The world's second-largest cryptocurrency exchange by trading volume, Bybit, has made a strong comeback, recording a net inflow of $3.61 billion in March and reclaiming its position as the second-largest exchange globally. This surge in capital inflows underscores the effectiveness of Bybit’s rapid recovery strategy and its unwavering commitment to user security and transparency.

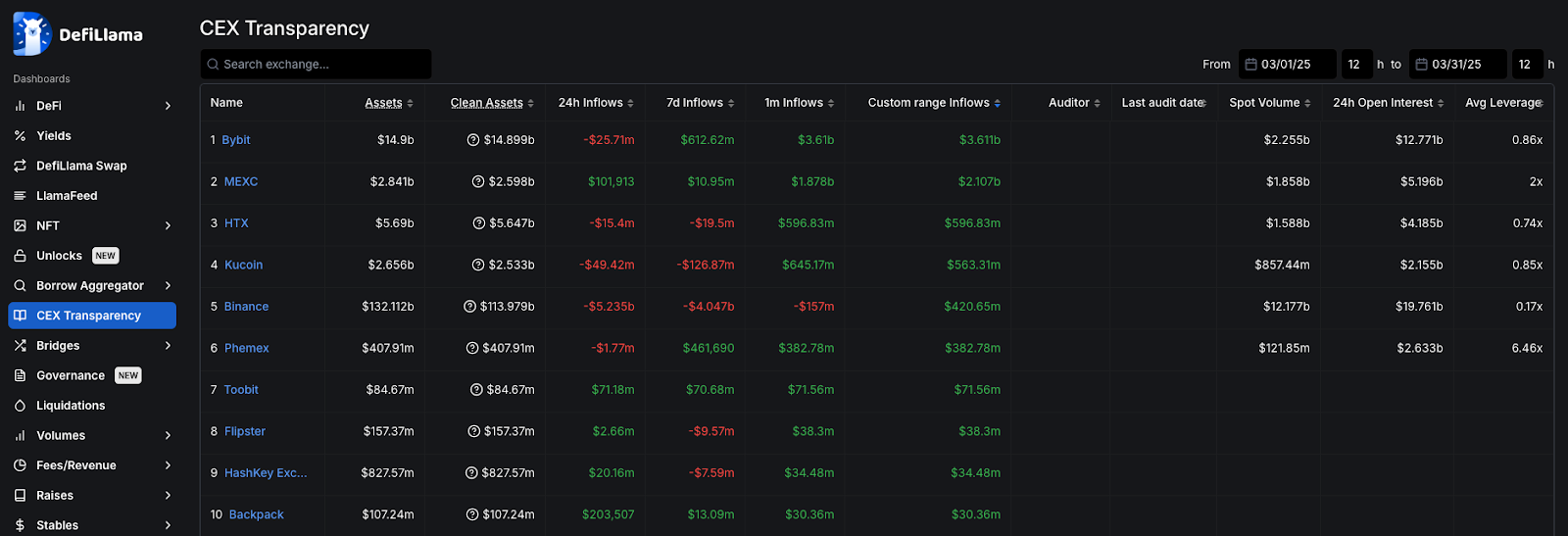

Top-Ranked Capital Inflows for One Month

According to data from DeFiLlama, Bybit ranked first among centralized exchanges (CEX) in terms of capital inflows over the past month, adding $3.61 billion in March alone. As of March 31, 2025, Bybit’s total value locked (TVL) reached $14.9 billion. Across all timeframes—7-day ($612.62 million) and 1-month ($3.61 billion)—Bybit consistently demonstrated strong performance, reflecting high levels of user confidence in the platform.

Bybit has endured one of the most challenging periods in the history of the crypto industry, setting new benchmarks in security rebuilding, operational and financial resilience, and user trust—all highlighting its exceptional ability to recover quickly.

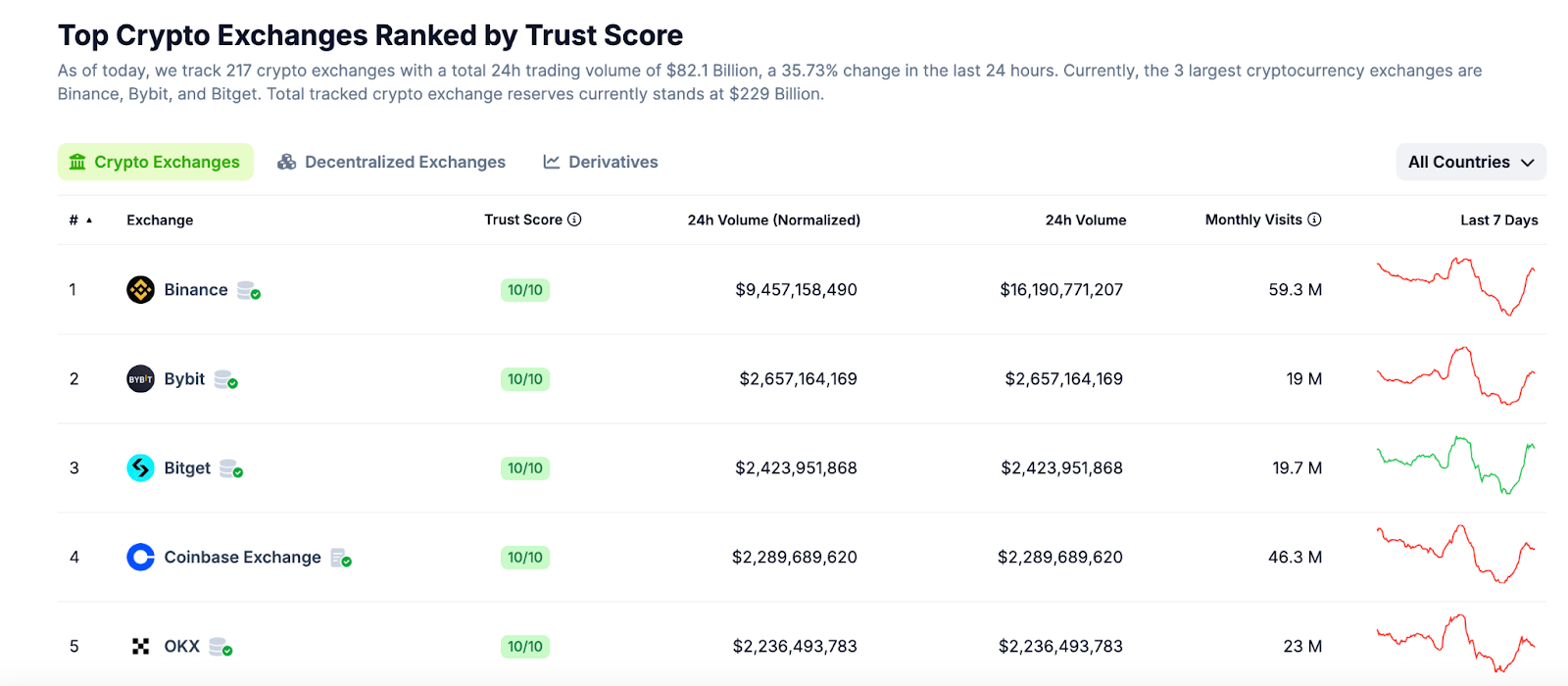

Bybit Reclaims Second Place in Global Trading Volume

Following a security incident, Bybit introduced the Retail Price Improvement (RPI) mechanism, significantly boosting spot trading volumes and further solidifying its leadership in retail liquidity. Designed specifically for retail users, RPI orders have brought unprecedented liquidity to key trading pairs such as BTC/USDT and ETH/USDT. Data shows that between February 27 and March 3, Bybit achieved triple the liquidity of market leaders across 12 major trading pairs.

Throughout this period, Bybit maintained full platform functionality, ensuring seamless withdrawals, participation in new token launches, and access to multiple reward programs. These strategic initiatives not only restored user trust but also accelerated market re-engagement, reinforcing Bybit’s status as a top choice for global traders.

The latest CoinGecko data (as of April 1, 2025) confirms that Bybit has reclaimed the second position in global trading volume.

Business-as-Usual: New Token Listings, Innovation Upgrades, and User Rewards

Bybit’s swift recovery and strong rebound can be attributed to several factors, including an improving market environment and a more constructive regulatory climate under the new U.S. administration. More importantly, Bybit has remained focused on delivering an exceptional trading experience through continuous innovation, new product launches, reward programs, and reliable service.

Recently, Bybit listed several new tokens, including WAL, PARTI, CORN, and NEAR, alongside incentive airdrops. Additionally, Bybit Web3 launched the AI-DOL Superstar Competition—the world’s first Web3 idol contest—demonstrating the platform’s ability to drive innovation and user engagement within the DeFi space.

These new initiatives and reward campaigns have not only helped Bybit swiftly navigate the industry crisis but have also been validated by the significant capital inflows recorded in March.

“We won’t let setbacks define us. Bybit remains committed to our users and the broader crypto community, ensuring continuous innovation and platform stability. Our ability to maintain normal operations during challenging times and keep launching new programs reflects Bybit’s resilience, long-term growth commitment, and strong support from the industry,” said Joan Han, Director of Sales and Marketing at Bybit.

Furthermore, Bybit is committed to building long-term mechanisms for trust, transparency, and accountability. Users and industry stakeholders can review regular updates of Bybit’s Proof-of-Reserves. Bybit also actively leads efforts to combat illicit fund flows through its LazarusBounty program, which incentivizes individuals and groups to help identify bad actors with rewards and recognition. To date, over $2.2 million in bounties has been distributed to eligible contributors.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News