More Fantastical Than Musk: This Chinese Team Turns Web3 Into a Virtual Carnival

TechFlow Selected TechFlow Selected

More Fantastical Than Musk: This Chinese Team Turns Web3 Into a Virtual Carnival

Sign is a rapidly emerging project in the Web3 space, building a unique ecosystem through community operations, innovative technology, and collaboration with governments.

By Alvis

"In an industry where scalping retail investors happens faster than harvesting wheat, a team suddenly emerges—not hyping, not shilling, quietly making money while getting community members to tattoo their loyalty. This is more surreal than Elon Musk livestreaming himself eating Lao Gan Ma."

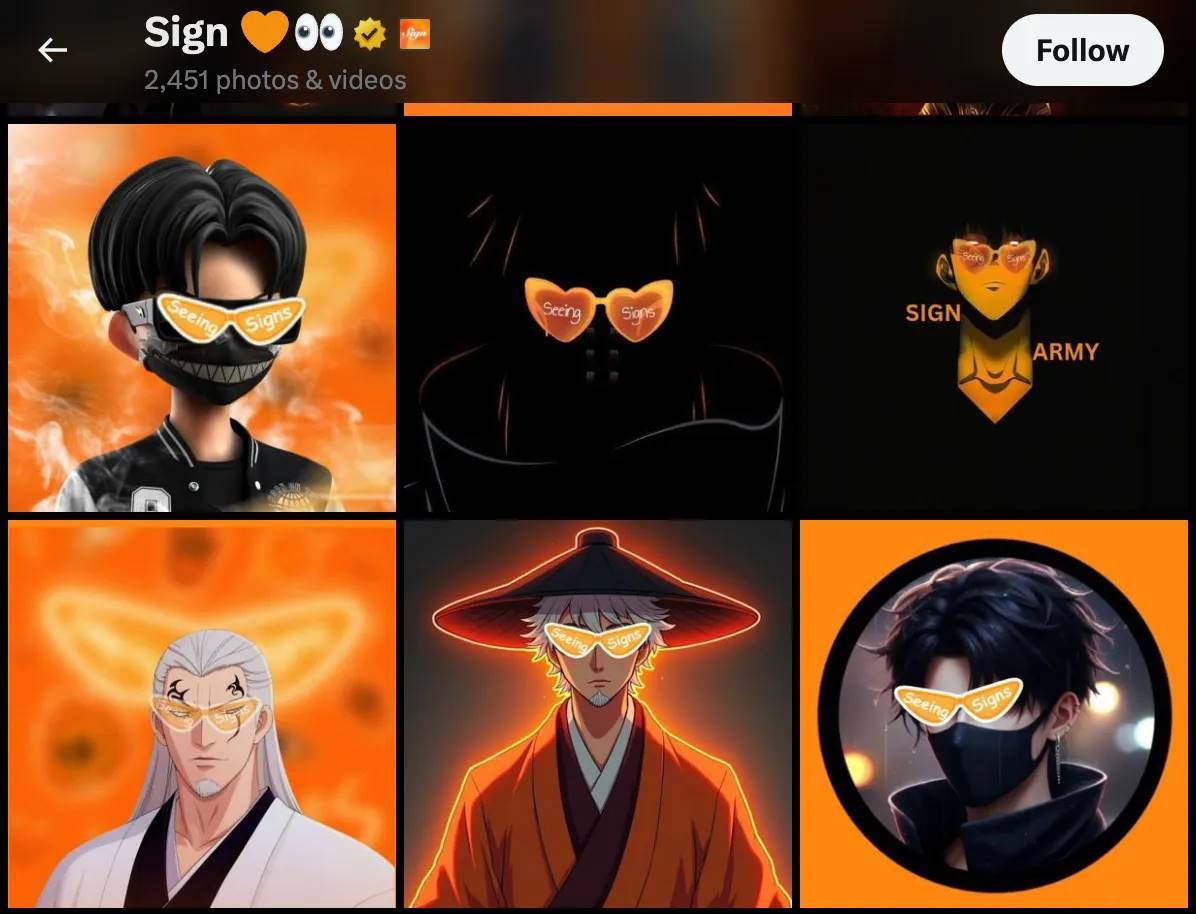

1. Community Craze: The Rise of Web3's "Orange Cult"

1.1 When Orange Glasses Became Cyber Relics

In the cutthroat world of crypto, where everyone claims to have “vision,” the Sign community turned Web3 into a massive online carnival. They stormed Twitter with orange glasses memes, introduced SBTs (Soulbound Tokens) as a blockchain-era imperial examination system, and even got the government of Sierra Leone issuing blockchain-based national IDs—this is Web3’s version of “surrounding the city from the countryside.”

The so-called “Orange Dynasty” is essentially a meticulously orchestrated mass hypnosis. Through three bold moves, they’ve turned 50,000 users into voluntary evangelists:

-

Visual Symbol Dominance: Turned orange glasses into a cyberpunk version of Supreme’s Box Logo—users simply change their Twitter avatar to complete initiation

-

SBT Ranking System: Created titles like Support Warrior (like-button soldier) and Orange in the Veins (noble bloodline), turning hype into a leaderboard game

-

CEO Persona Self-Destruction: Founder Yan Xin became meme fodder during AMAs, perfectly mimicking the down-to-earth “brother, don’t run!” vibe

This kind of community building is like recreating *Let the Bullets Fly* on blockchain—standing tall (no rug-pulling), while still making bank ($15 million annual revenue). While other projects stress over preventing token dumps, Sign community members are already tattooing the logo on their arms, transforming consensus mechanisms into full-blown cult rituals.

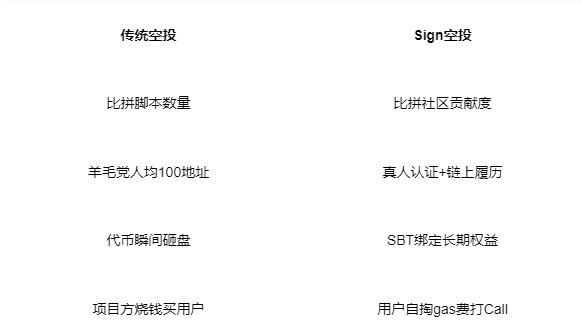

1.2 Economics of Humiliation: Why SBTs Are the Antidote to Scalper Culture

Traditional airdrops resemble flea market fire sales—farmers create hundreds of burner accounts to grab free tokens, leaving projects with armies of zombie users. Sign’s SBT system flips this script entirely:

The brilliance lies in converting speculative cost into sunk cost. When a user spends three months straight creating memes for the “Outstanding Content Creator” title, they’re effectively investing in their own “Orange Guard” identity. At that point, if someone tries to dump the token, it won’t be the project team yelling first—it’ll be the community itself.

2. Product Matrix: The Quietly Profitable "Goldman Sachs of the Chain"

2.1 TokenTable: The Money Printing Line of Web3

If Uniswap is a decentralized casino, TokenTable is Wall Street banking for the blockchain era. This low-key platform has processed $4 billion in assets, doing three things that make traditional finance veterans nod in approval:

TokenTable provides standardized infrastructure solving token issuance, distribution, and liquidity management—freeing project teams to focus on tokenomics and product development.

① Industrialized Airdrops

When Kaito needed to distribute tokens to 100,000 users, TokenTable’s automated system handled everything from eligibility checks to on-chain delivery—efficiency rivaling Foxconn’s smartphone assembly lines. Even wilder? They took on Sierra Leone’s national digital currency rollout—essentially building Africa a blockchain version of China Mobile’s “Hebao Pay.”

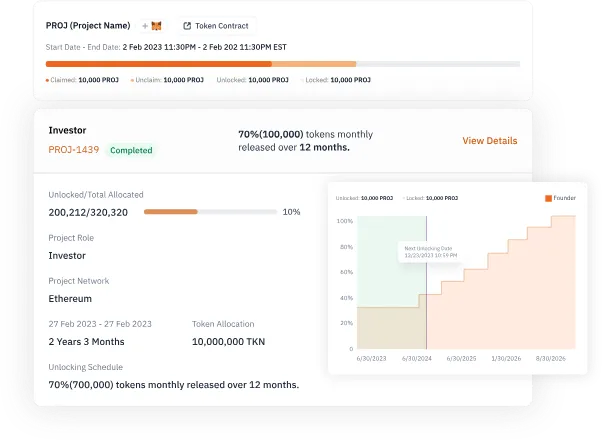

② Token Vesting Magic

Smart contracts turn VC allocations into Russian nesting dolls: 20% unlock in Year 1, remainder linearly released over four years. One project tried altering vesting terms and was instantly flagged by TokenTable’s audit bot—a true blockchain version of *The Wolf of Wall Street*.

③ OTC Dark Pool Trading

They launched a “futures market for locked tokens,” letting institutions trade vested tokens like pre-sale condos. Recently facilitated a $200 million block trade for a DeFi project—fees collected with more glee than a Macau casino.

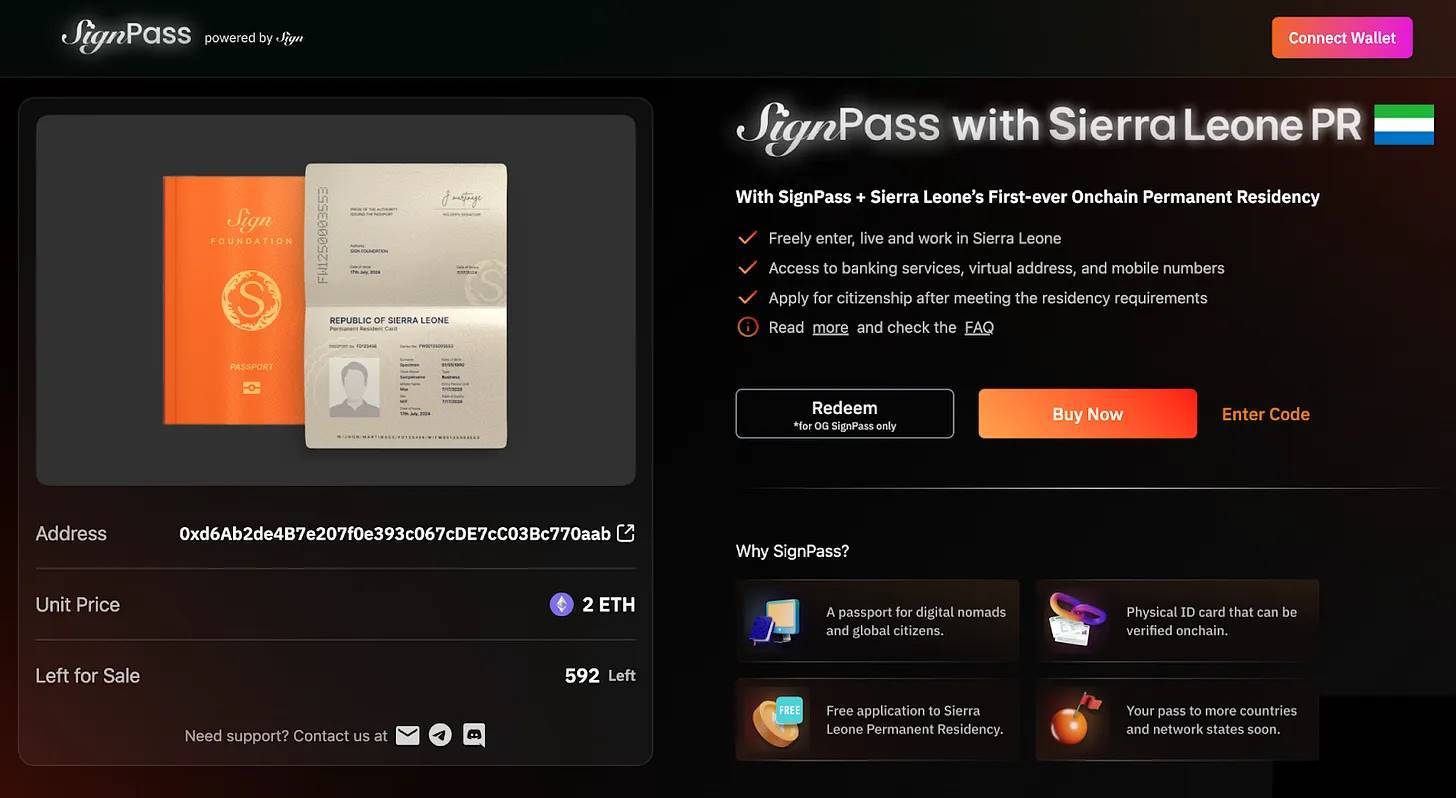

2.2 SignPass: The Digital Indulgence of the Blockchain Era

This digital ID system, developed with Sierra Leone’s government, is essentially issuing 21st-century passports. Pull out your SignPass at Dubai airport, and customs can scan to see your on-chain records:

-

Vaccination proof (signed by WHO nodes)

-

Asset verification (auto-generated by TokenTable)

-

DAO governance contribution history

The real power move? Turning KYC into KYD (“Know Your Data”)—governments no longer monopolize citizen data. Your on-chain resume becomes your ultimate credit score. No wonder the UAE offers 10-year visas to Web3 founders; this turns blockchain into the new promised land for digital nomads.

3. Protocol Ambitions: Building the Trust Layer’s "Road Movement"

3.1 Sign Protocol’s Grand Strategy

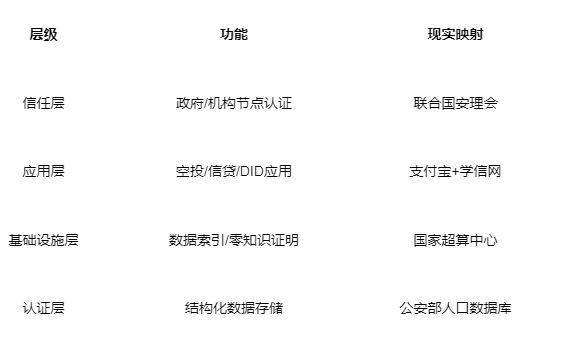

This underlying protocol is quietly executing a massive mission: moving global trust infrastructure onto the blockchain. Specifically, rebuilding the digital age’s “Tower of Babel” through a four-layer architecture:

3.2 The "Goldman Sachs of the Chain" Plan with CZ

Binance-led strategic investment of $16 million reveals Sign’s ultimate ambition—to become Web3’s SWIFT network. Recent roadmap leaks reveal three killer strategies:

-

Digital fiat issuance platform: Helping a Southeast Asian nation build a CBDC system to replace SWIFT settlements

-

AI Agent Economy: Creating on-chain wallets for AI bots—soon we may see “AI workers earning gas fees”

-

Transnational Credit Network: Your Chinese Zhima Credit score could directly get you a credit card in Dubai—on-chain reputation without borders

Once fully realized, Sign will evolve from tool provider to rule-maker of the digital economy. No wonder Sequoia Capital made a rare tri-continental joint investment—they’re clearly betting on the next Visa-level infrastructure.

4. Warnings Amid Prosperity: The Achilles’ Heel of the Orange Empire

4.1 The DID Sector’s Three-Way Battle

Despite Sign’s current lead, formidable rivals loom ahead:

-

Lens Protocol: The stealth champion in social graph infrastructure

-

ENS: The “Blockchain ICANN” with 2 million domain registrations

-

Microsoft / Tencent: Secretly developing consortium-chain versions of DID systems

Even scarier? The threat of big tech’s asymmetric warfare. If WeChat suddenly enables blockchain-based identity verification, Sign’s expansion across Asia could hit a “Great Firewall” of its own.

4.2 Governance’s “Tacitus Trap”

Currently, Sign’s governance relies entirely on team authority—an increasingly dangerous centralization:

-

Suspected vote manipulation in a recent poll damaged its “fairness” image

-

SignPass rollout in an African country raised concerns over data monopoly

-

Core protocol code remains partially closed-source

These issues hang like a sword of Damocles, threatening a sudden collapse of trust. After all, in Web3, every day brings another story of a dragon-slayer becoming the dragon.

5. Revelation: A Counter-Consensus Blueprint for Web3 Startups

Sign’s journey delivers three lessons in anti-commonsense entrepreneurship:

1. Earn Before You Raise: The Profit-First Philosophy

While peers burn cash buying traffic, Sign sustains its entire team via TokenTable’s revenue—proving Web3 can be profitable; most just aren’t good enough.

2. Community Growth via "Rural Encirclement"

No grand narrative or hype cycles—instead, starting with avatar swaps and meme creation (“lowbrow ops”) to turn cold starts into tropical rainforest ecosystems.

3. Regulation: "If You Can’t Beat Them, Join Them"

While others play cat-and-mouse with the SEC, Sign partners with governments to build blockchain public services—mastering the art of “using foreign techniques to counter foreign threats.”

In an industry drowning in fraud and bubbles, Sign stands like a torch in the dark forest—proof that Web3 can balance idealism with profitability. As for how far this orange empire will go, perhaps Yan Xin said it best in an AMA: “We’re turning blockchain from a tech toy into a social operating system. And the game has only just begun.”

“When you start seeing more people on Twitter wearing orange glasses, don’t doubt it—that’s Web3’s *V for Vendetta*. Only this revolution won’t need explosives. Just smart contracts.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News