History as a mirror, stablecoin development is moving in sync with money market funds

TechFlow Selected TechFlow Selected

History as a mirror, stablecoin development is moving in sync with money market funds

The upcoming stablecoin legislation in the United States is seen as an opportunity to advance the financial system, akin to the development of money market funds (MMFs) half a century ago.

Author: Shawn, Artichoke Capital

Translation: TechFlow

Stablecoins are exciting!

The upcoming U.S. stablecoin legislation presents a once-in-a-generation opportunity to upgrade the financial system. For students of financial history, this process bears striking similarities to the invention and development of money market funds (MMFs) half a century ago.

Money market funds emerged in the 1970s as a cash management solution primarily for corporations.

At that time, U.S. banks were prohibited from paying interest on balances in checking accounts, and businesses often could not open savings accounts either.

If companies wanted to earn interest on idle cash, they had to directly purchase U.S. Treasury Bills, enter into repo agreements, invest in commercial paper, or buy negotiable certificates of deposit. This form of cash management was cumbersome and time-consuming, creating significant inconvenience for businesses.

The design principle of money market funds was to maintain a fixed net asset value per share—pegged at $1 per share.

In 1971, Reserve Fund, Inc. launched the first money market fund, marketed as a "convenient alternative" for investing temporary corporate cash balances directly into money market instruments such as Treasuries, commercial paper, bankers’ acceptances, or CDs. At launch, the fund held just $1 million in assets. [1]

Soon after, other investment giants followed suit, including Dreyfus (now part of @BNYglobal), @Fidelity, and @Vanguard_Group. Notably, nearly half of Vanguard’s legendary mutual fund growth in the 1980s came from its money market funds (shoutout to @awealthofcs).

Paul Volcker, during his tenure as Chair of the Federal Reserve (1979–1987), was highly critical of money market funds (MMFs). As late as 2011, he continued to criticize them.

Interestingly, many of the criticisms raised today by policymakers opposing stablecoins mirror those leveled against money market funds fifty years ago:

-

Systemic risk and threats to banking stability

Unlike insured depository institutions (e.g., banks), money market funds do not benefit from deposit insurance or access to lender-of-last-resort facilities. As a result, MMFs are vulnerable to rapid runs, which can amplify financial instability and trigger contagion. There is also concern that shifting deposits from insured banks to money market funds weakens the banking sector by eroding its low-cost, stable deposit base.

-

Unfair regulatory arbitrage

By maintaining a stable $1 share price, money market funds offer bank-like services without being subject to the same rigorous regulatory oversight or capital requirements. This ability to perform “banking functions” has long been viewed as exploiting a regulatory loophole.

-

Undermining the transmission mechanism of monetary policy

As funds flow out of banks and into money market funds, the Federal Reserve's traditional monetary tools—such as reserve requirements imposed on banks—become less effective, potentially weakening the implementation of monetary policy.

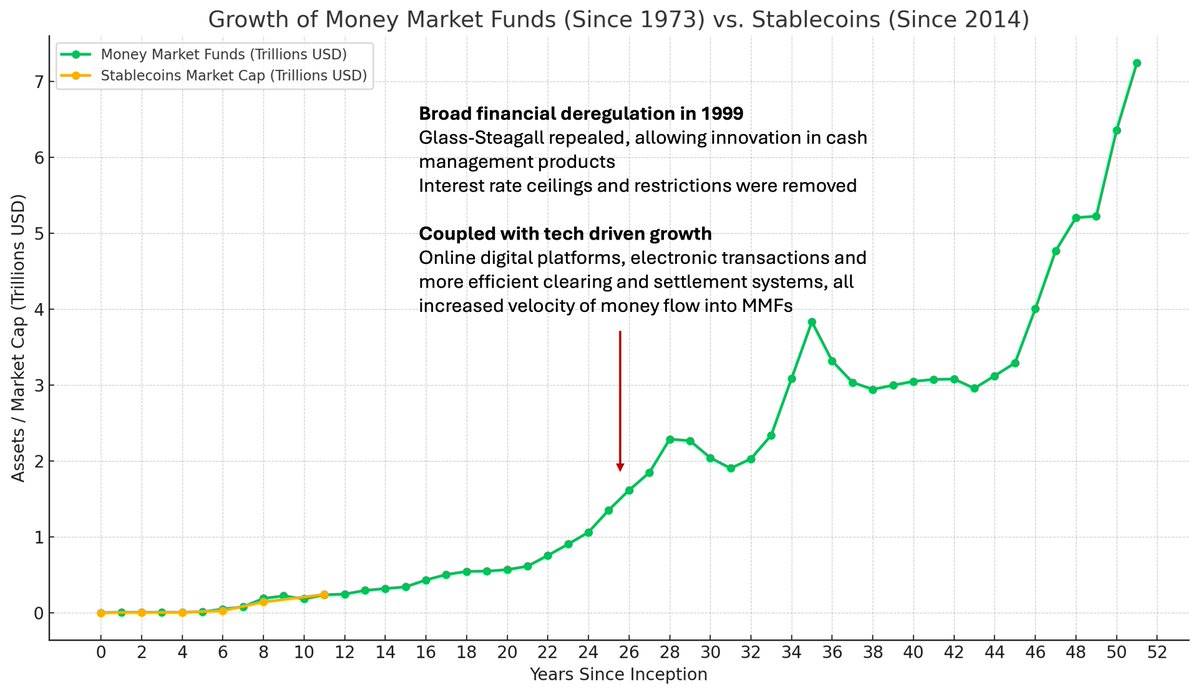

Today, money market funds hold over $7.2 trillion in financial assets. In comparison, the U.S. M2 money supply (which broadly excludes money market fund assets) stands at $21.7 trillion.

The rapid growth of money market fund AUM in the late 1990s was driven by financial liberalization—the repeal of the Glass-Steagall Act and the passage of the Gramm-Leach-Bliley Act, which unleashed a wave of financial innovation.

At the same time, advances in electronic and online trading systems during the internet boom accelerated the pace at which money flowed into these funds.

Notice a pattern?

(It's worth noting that regulatory debates around money market funds have never truly ended. The U.S. Securities and Exchange Commission (SEC) adopted new reforms for money market funds in 2023, including higher minimum liquidity requirements and eliminating managers’ ability to restrict investor redemptions.)

[1] Unfortunately, Reserve Fund met its end following the 2008 financial crisis. Some debt securities issued by Lehman Brothers held by the fund were written down to zero, causing the fund to break the buck and triggering a wave of redemptions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News