In the face of bear market income anxiety, how are different projects tackling their survival?

TechFlow Selected TechFlow Selected

In the face of bear market income anxiety, how are different projects tackling their survival?

The crypto industry loves to talk about transparency, but most projects only disclose data when it benefits their own narrative.

Author: @desh_saurabh

Translation: TechFlow

The Zero-Sum Attention Game

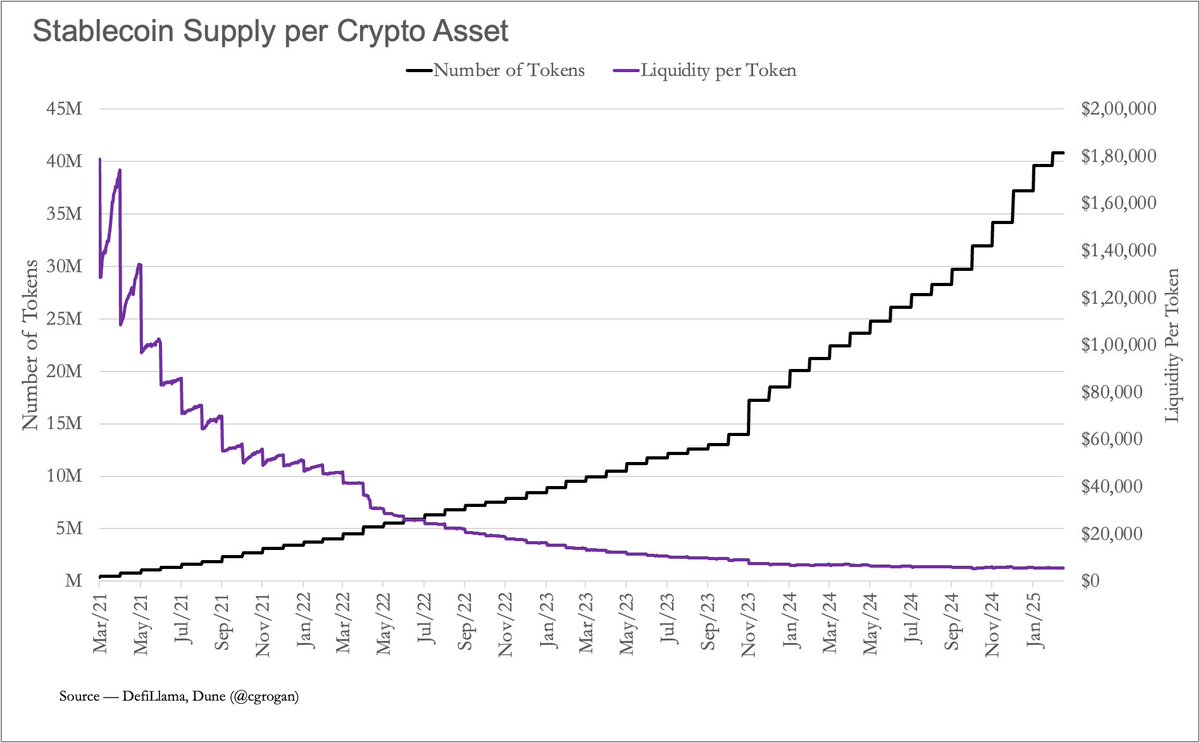

In 2021, each crypto asset had an average of about $1.8 million in stablecoin liquidity. By March 2025, however, that figure had plummeted to just $5,500.

This chart visually illustrates the decline in averages and also reflects the zero-sum nature of attention in today’s crypto landscape. While the number of tokens has surged to over 40 million assets, stablecoin liquidity (as a rough proxy for capital) has remained stagnant. The result is brutal—less capital per project, weaker communities, and rapidly declining user engagement.

In such an environment, fleeting attention is no longer a channel for growth but a burden. Without underlying cash flow, this attention quickly shifts elsewhere, mercilessly.

Revenue as the Anchor of Growth

Most projects still build communities the way they did in 2021: create a Discord server, offer airdrop incentives, and hope users keep saying "GM" long enough to generate interest. But once the airdrop ends, users leave immediately. This isn’t surprising—they have no reason to stay. This is where cash flow becomes critical—not just a financial metric, but proof of a project’s relevance. Products that generate revenue indicate real demand. Demand supports valuation, and valuation gives tokens gravitational pull.

While revenue may not be the end goal for every project, without it, most tokens won’t survive long enough to become foundational assets.

It's important to note that some projects operate very differently from the rest of the industry. Take Ethereum, for example—it doesn’t need additional revenue because it already has a mature and sticky ecosystem. Validator rewards come from roughly 2.8% annual inflation, but thanks to EIP-1559’s fee-burning mechanism, this inflation can be offset. As long as burns and issuance balance out, ETH holders avoid dilution.

Newer projects don’t enjoy such luxuries. When only 20% of your token is in circulation and you’re still searching for product-market fit, you essentially function like a startup. You need to earn revenue and prove sustainable profitability to survive.

Protocol Lifecycle: From Explorers to Giants

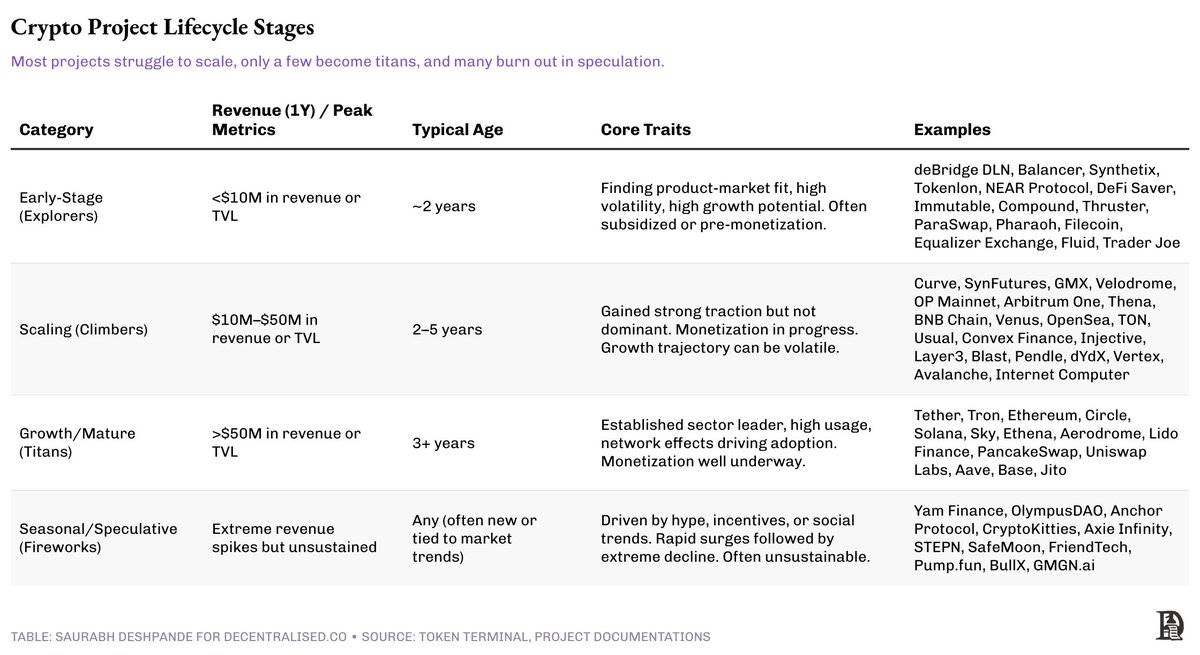

Like traditional companies, crypto projects exist at different stages of maturity. At each stage, the relationship with revenue—and whether to reinvest or distribute it—changes significantly.

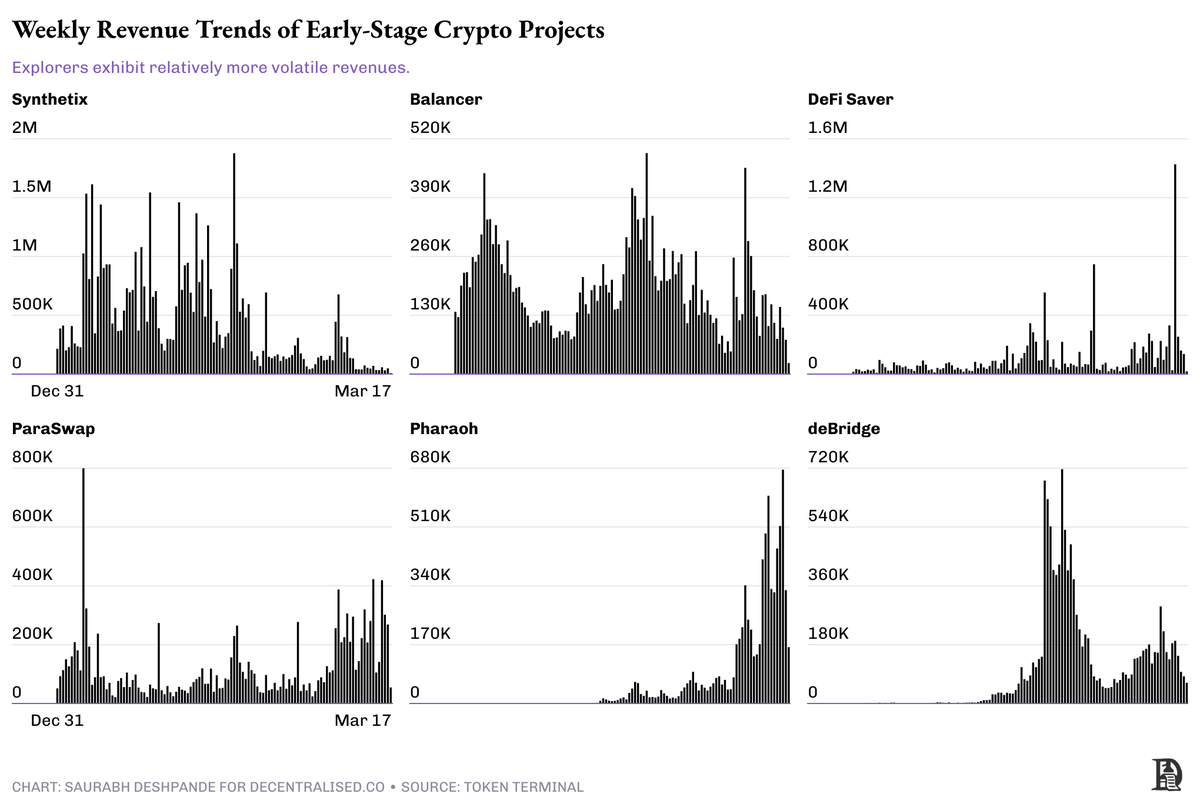

Explorers: Survival First

These are early-stage projects, often with centralized governance, fragile ecosystems, and a focus on experimentation over monetization. Any revenue generated tends to be volatile and unsustainable, reflecting market speculation rather than genuine user loyalty. Many rely on incentives, grants, or venture funding to survive.

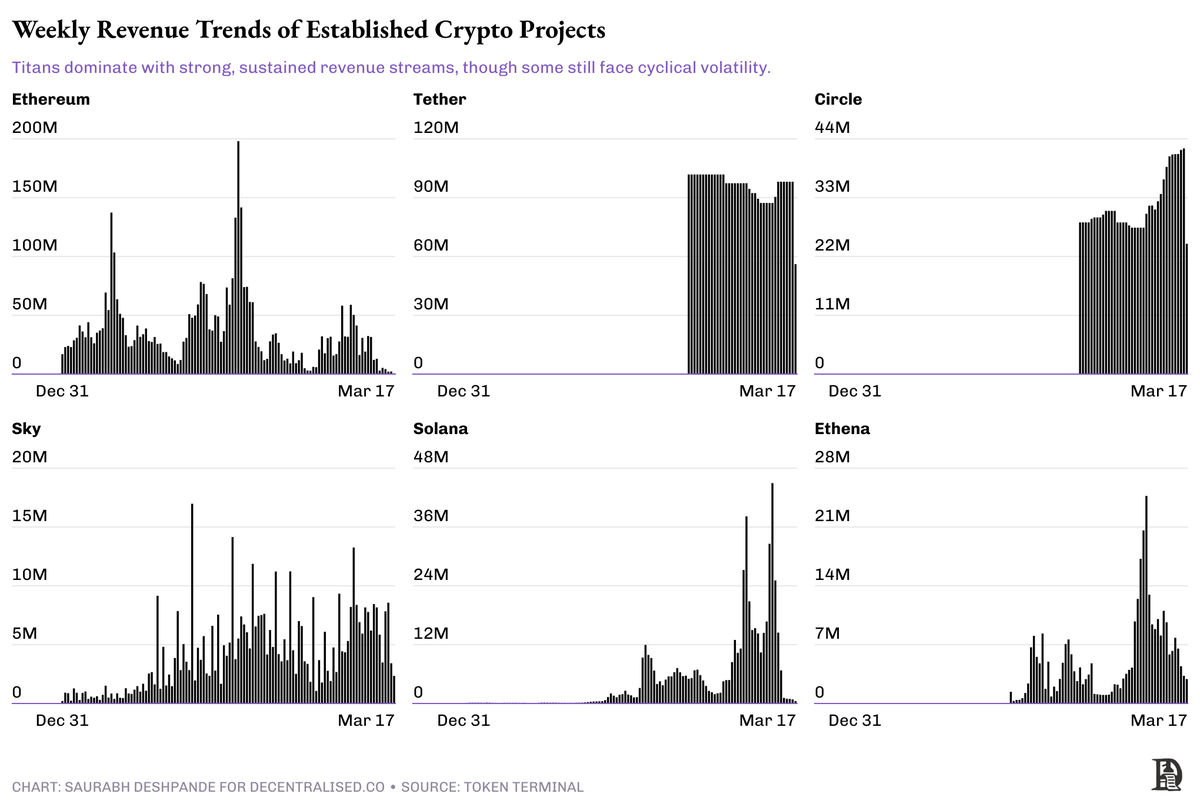

For instance, projects like Synthetix and Balancer have existed for around five years. Their weekly revenues range between $100,000 and $1 million, with occasional spikes during activity peaks. Such volatility and subsequent drawdowns are typical at this stage—not signs of failure, but manifestations of instability. The key question is whether these teams can convert experimentation into reliable use cases.

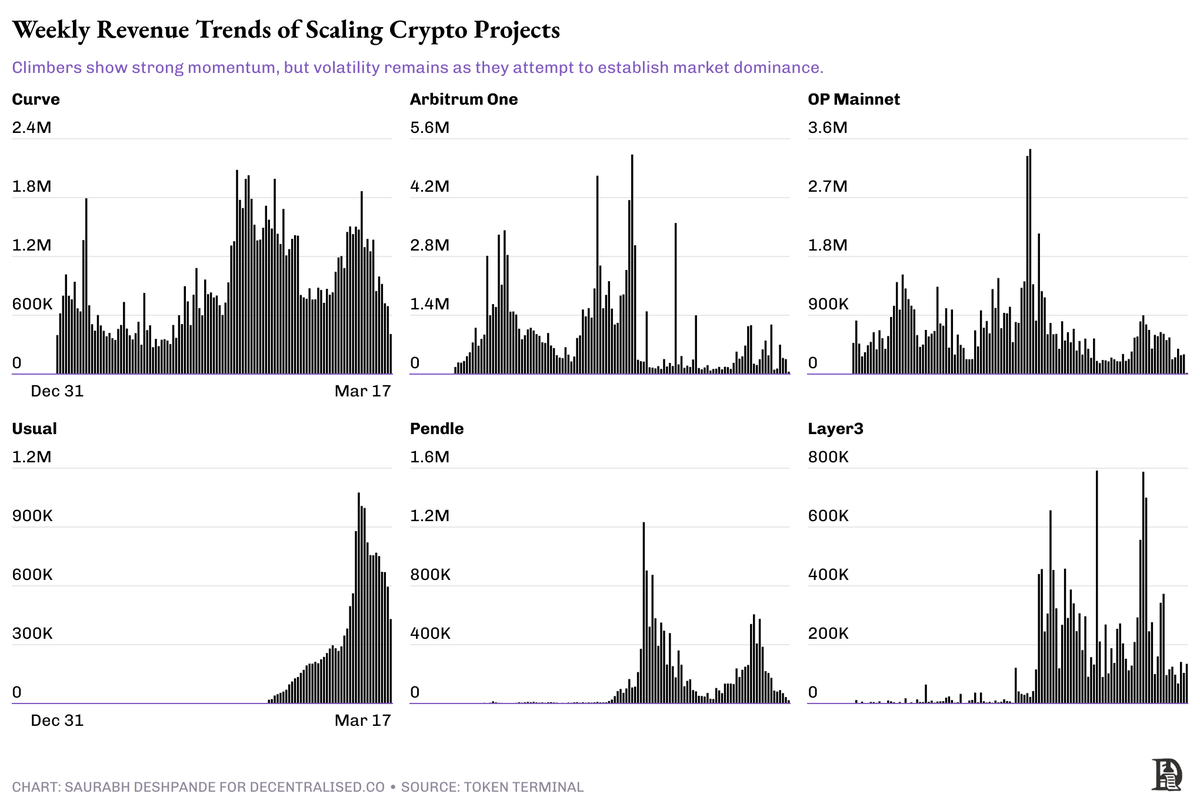

Climbers: Gaining Traction but Still Unstable

Climbers represent the next phase—projects with annual revenues between $10 million and $50 million, gradually moving away from token emissions-driven growth. Governance structures are maturing, and the focus shifts from mere user acquisition to long-term retention. Unlike Explorers, Climbers demonstrate consistent demand across cycles, not just one-off hype events. They are undergoing structural evolution—transitioning from centralized teams to community-led governance and diversifying revenue streams.

Their uniqueness lies in flexibility. Having built sufficient trust, they can experiment with distributing revenue—some begin revenue-sharing or buyback programs. Yet they remain vulnerable to losing momentum, especially if they expand too fast or fail to deepen moats. While survival is the top priority for Explorers, Climbers face strategic trade-offs: growth vs. consolidation, distribution vs. reinvestment, core focus vs. diversification?

The fragility at this stage isn't volatility—it's that the stakes become visibly real.

These projects face their hardest decisions: distributing revenue too early could stifle growth; waiting too long risks alienating token holders.

Giants: Ready to Distribute

Projects like Aave, Uniswap, and Hyperliquid have crossed the threshold. They generate stable revenue, feature decentralized governance, and benefit from strong network effects. These protocols no longer depend on inflationary tokenomics and possess solid user bases and proven business models.

Giants typically don’t try to “do everything.” Aave focuses on lending markets, Uniswap dominates spot trading, and Hyperliquid is building a DeFi stack centered on execution. Their strength comes from defensible positioning and operational discipline.

Most are leaders in their respective domains. Their efforts usually center on “growing the pie”—expanding the overall market rather than merely increasing market share.

These are the kinds of projects capable of conducting buybacks while still maintaining operations for many years. Though not immune to volatility, they possess enough resilience to weather market uncertainty.

Seasonal Players: Loud but Shallow

Seasonal Players are the most visible yet most fragile category. Their revenue may briefly match—or even surpass—that of Giants, but it’s primarily driven by hype, speculation, or short-lived social trends.

For example, projects like FriendTech and PumpFun can generate massive engagement and trading volume in a short time, but rarely convert this into lasting user retention or sustainable business growth.

Such projects aren’t inherently bad. Some may pivot and evolve. But most are short-term plays riding market momentum, not builders of enduring infrastructure.

Lessons from Public Markets

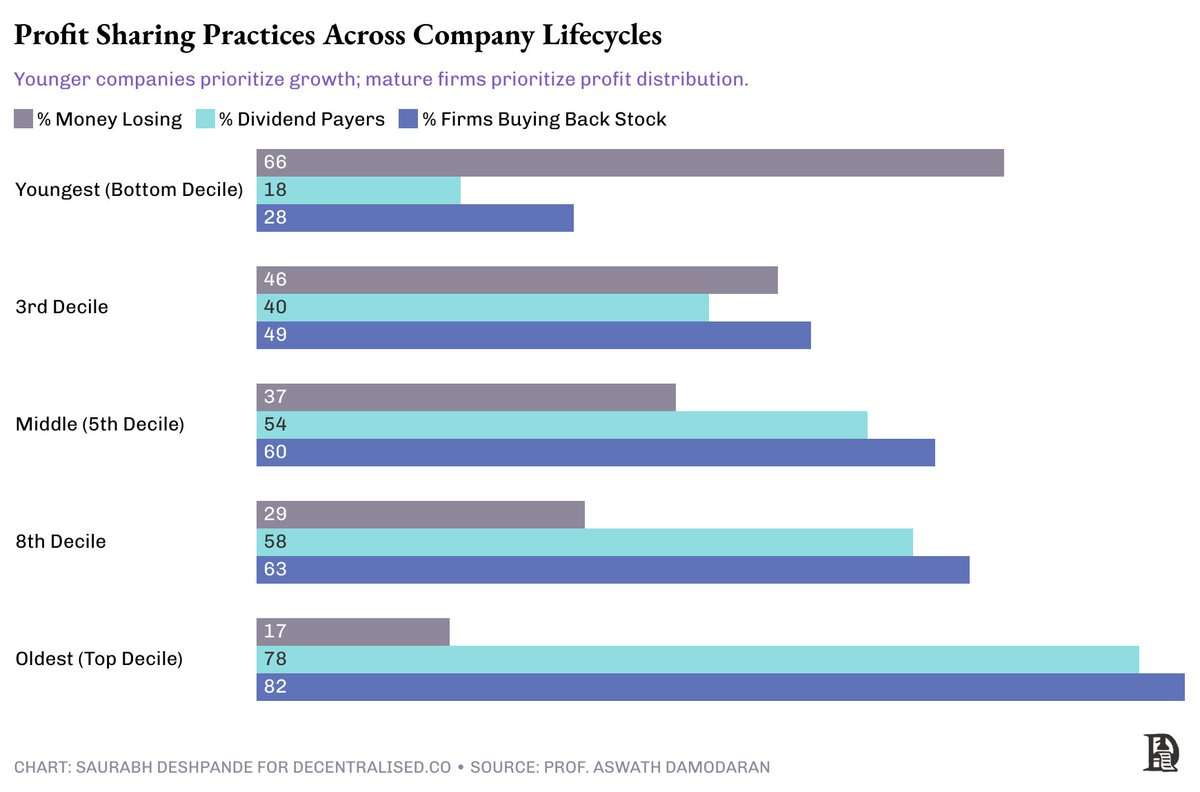

Public equities offer useful analogies. Young companies typically reinvest free cash flow to scale, while mature ones return profits via dividends or stock buybacks.

The chart below shows how companies allocate profits. As firms grow, the proportion returning value through dividends and buybacks increases.

Crypto projects can learn from this. Giants should distribute profits; Explorers should prioritize retention and compounding. But not every project clearly understands its stage.

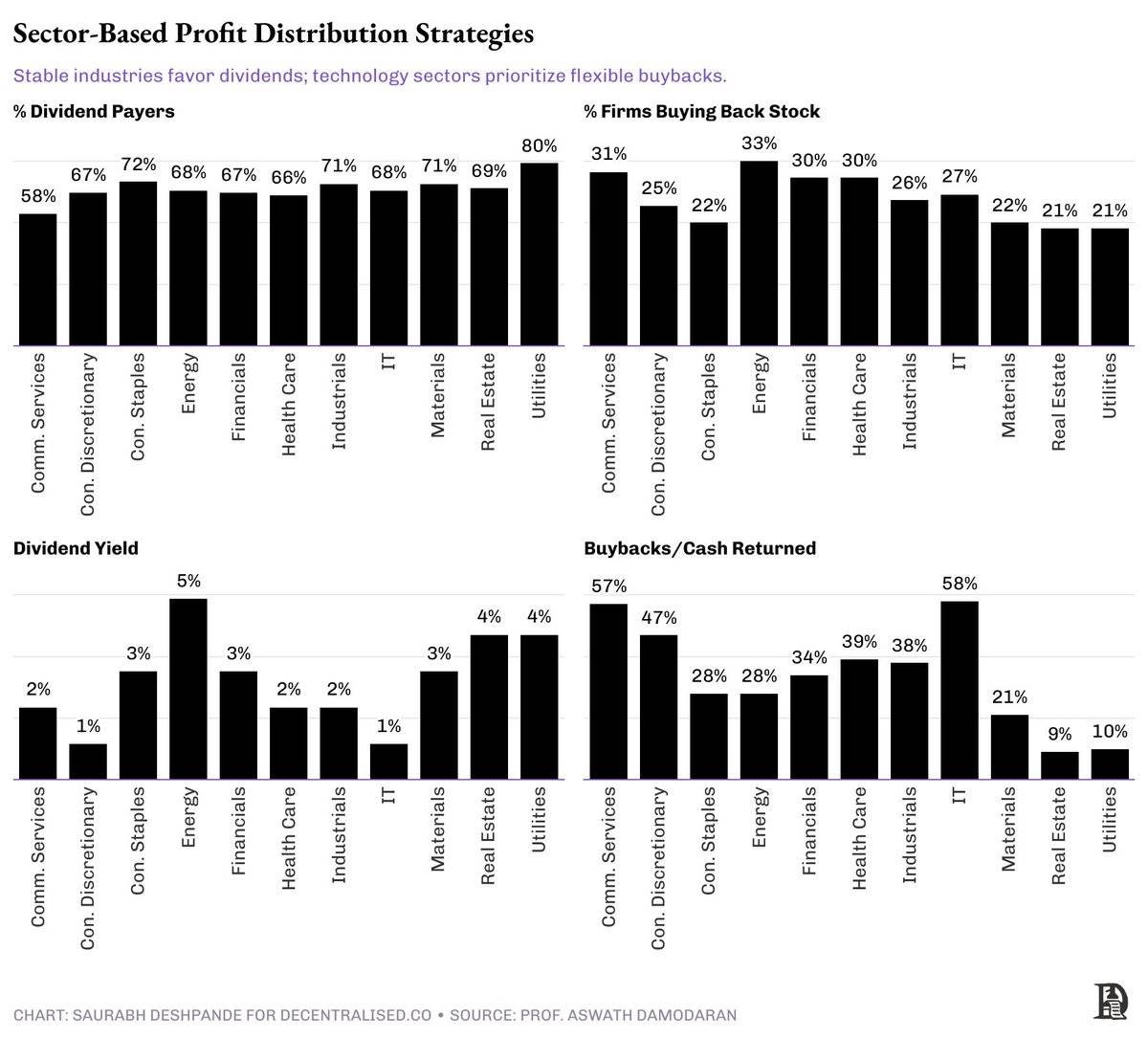

Industry characteristics matter too. Utility-like projects (e.g., stablecoins) resemble consumer staples: stable and suitable for dividends. These firms have long histories and largely predictable demand patterns. They rarely deviate from forward guidance. Predictability allows them to consistently share profits with stakeholders.

High-growth DeFi protocols are more like tech companies—the optimal value distribution method being flexible buyback programs. Tech firms experience higher cyclicality. Demand is less predictable than in traditional industries, making buybacks the preferred way to return value.

Had a great quarter or year? Return value through share repurchases.

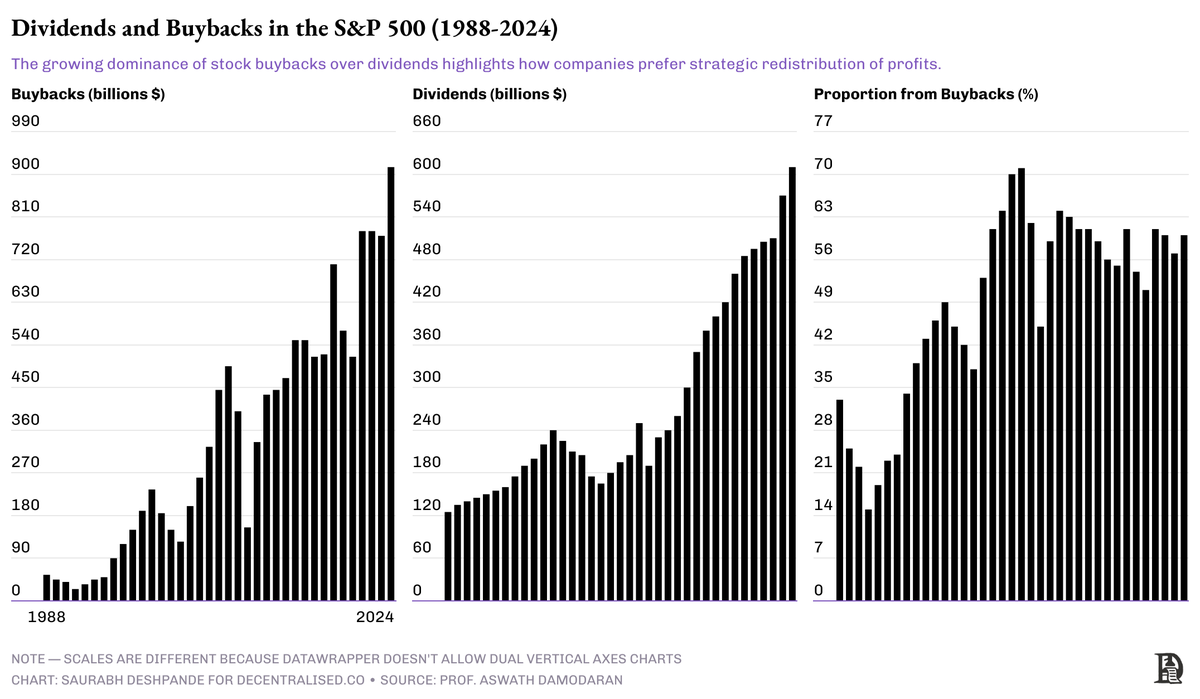

Dividends vs. Buybacks

Dividends are sticky. Once committed, markets expect consistency. Buybacks, by contrast, are more flexible, allowing teams to time value distribution based on market cycles or when tokens are undervalued. Over recent decades, buybacks have grown rapidly—from about 20% of profits in the 1990s to ~60% by 2024. In dollar terms, buybacks have exceeded dividends since 1999.

However, buybacks come with downsides. Poor communication or mispricing can transfer value from long-term holders to short-term traders. Additionally, governance must be rigorous, as management often has KPIs like boosting earnings per share (EPS). When companies use profits to repurchase outstanding shares, they reduce the denominator, artificially inflating EPS.

Both dividends and buybacks have their place. But without strong governance, buybacks can quietly enrich insiders at the expense of the broader community.

Three Pillars of Healthy Buybacks:

-

Strong treasury reserves

-

Thoughtful valuation logic

-

Transparent reporting mechanisms

If a project lacks these, it likely still belongs in the reinvestment phase—not distribution via buybacks or dividends.

Current Revenue Distribution Practices Among Leading Projects

-

@JupiterExchange stated at launch it would not directly share revenue. Only after achieving 10x user growth and securing multi-year operating reserves did it introduce the "Litterbox Trust"—a non-custodial buyback mechanism currently holding approximately $9.7 million worth of JUP tokens.

-

@aave, with over $95 million in treasury reserves, launched a structured weekly $1 million buyback program called "Buy and Distribute," following months of community discussion.

-

@HyperliquidX goes further—54% of its revenue funds buybacks, 46% incentivizes liquidity providers (LPs). To date, it has repurchased over $250 million in HYPE tokens, fully funded without venture capital.

What do these projects have in common? They all waited until their financial foundation was solid before initiating buyback programs.

The Missing Piece: Investor Relations (IR)

The crypto industry loves to talk about transparency, but most projects only disclose data when it suits their narrative.

Investor Relations (IR) should be core infrastructure. Projects need to share not just revenue, but expenses, runway, treasury strategy, and buyback execution. Only then can confidence in long-term viability be built.

The goal isn’t to claim one form of value distribution is universally right, but to acknowledge that distribution methods must align with a project’s maturity. And in crypto, truly mature projects remain rare.

Most are still finding their footing. But those doing it right—those with revenue, strategy, and trust—have the chance to become the much-needed "cathedrals" (long-term, resilient benchmarks) of this industry.

Strong investor relations act as a moat. They build trust, reduce panic during downturns, and sustain institutional capital participation.

Ideal IR practices might include:

-

Quarterly revenue and expense reports

-

Real-time treasury dashboard

-

Public record of buyback executions

-

Clear token distribution and unlock schedules

-

On-chain verification of grants, salaries, and operating expenses

If we want tokens to be seen as real assets, they need to start communicating like real businesses.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News