Hyperliquid: 9% of Binance, 78% centralized

TechFlow Selected TechFlow Selected

Hyperliquid: 9% of Binance, 78% centralized

DEX does not need to be fully decentralized, but rather more transparent than CEX.

Author: Zuo Ye

At first, no one paid attention to this trade—it was just a farce, a "pulling the plug," an extinction of an idea (decentralization), and the disappearance of an L1. Until this disaster became relevant to everyone.

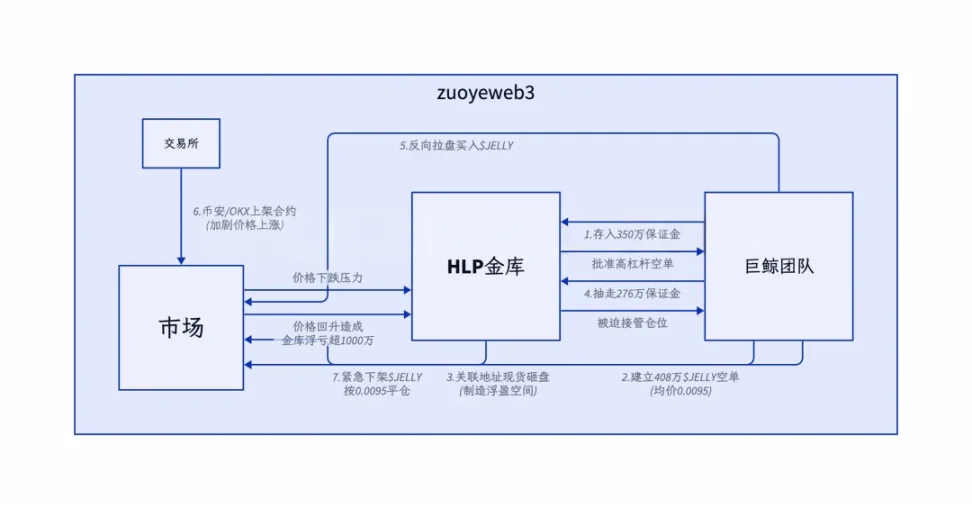

On March 26, Hyperliquid suffered a bloodbath triggered by a meme token attack, using the same tactics as the previous 50x whale: whales pooled funds and exploited perceived "loopholes" to target the HLP treasury.

Image caption: Attack process. Source: @ai_9684xtpa

This was originally a story between attackers and Hyperliquid. In reality, Hyperliquid absorbed losses from the whale's counterparty trades—PVP turned into PVH. A $4 million loss is merely a minor irritation for the Hyperliquid protocol.

But when Binance and OKX quickly listed $JELLYJELLY perpetual contracts, it felt like kicking someone while they're down. The logic is similar: if Hyperliquid can absorb whale-induced losses through capital scale, then exchanges like Binance can use even deeper liquidity to continuously bleed Hyperliquid dry—until it hemorrhages fatally into a death spiral akin to Luna-UST.

In the end, Hyperliquid chose to betray its decentralization principles by voting to delist $JELLYJELLY—"pulling the plug"—admitting it couldn't afford to lose.

Looking back, Hyperliquid’s response is standard behavior for CEXs. We can conclude that after Hyperliquid, on-chain ecosystems will gradually accept this "new normal." Whether something is centralized or not matters less; transparent governance becomes more important.

DEXs don’t need full decentralization—they only need to be more transparent than CEXs, striking a balance between crypto culture and capital efficiency, just enough to keep the lights on.

9% of Binance: Crypto Culture Surrenders to Capital Efficiency

Pulling the plug is cowardly. Front-running is evil. Getting caught market-making is stupid.

According to data from The Block, Hyperliquid has consistently captured around 9% of Binance’s futures trading volume over the past two months. This is the real reason behind Binance’s aggressive reaction—to strangle threats at birth. Hyperliquid has already outgrown its cradle.

Business is war. Just as Binance aggressively seized wallet market share during OKX DEX’s decline, today Binance and OKX are teaming up against Hyperliquid under the invisible hand of Hayek—proving that the perpetuals market is now tri-dominated.

Reviewing recent industry highlights, on-chain protocols are struggling. Sticking strictly to decentralization is hard: Polymarket admitted large holders manipulated UMA oracle results, leaving the community dissatisfied; Hyperliquid ultimately "pulled the plug" under pressure from Binance, drawing criticism from Bitget CEO and BitMEX co-founder Arthur Hayes in turn.

They’re all right—but Hyperliquid prioritized capital efficiency and protocol security over absolute decentralization. Personally, I’d say Hyperliquid is less decentralized than Coinbase. At least Coinbase operates under strict regulation, whereas Hyperliquid is essentially a No-KYC CEX masquerading as a Perp DEX.

Moreover, we must critique Hyperliquid within its dual identity—as both a CEX and a Perp DEX. Every issue Hyperliquid faces today, CEXs have faced before. Even Arthur Hayes’ BitMEX, which criticizes Hyperliquid’s lack of decentralization, might have destroyed the entire crypto industry in March 2020 without pulling the plug.

Decentralization vs centralization is a classic trolley problem: pursuing full decentralization sacrifices capital efficiency; embracing centralization risks alienating free-flowing capital.

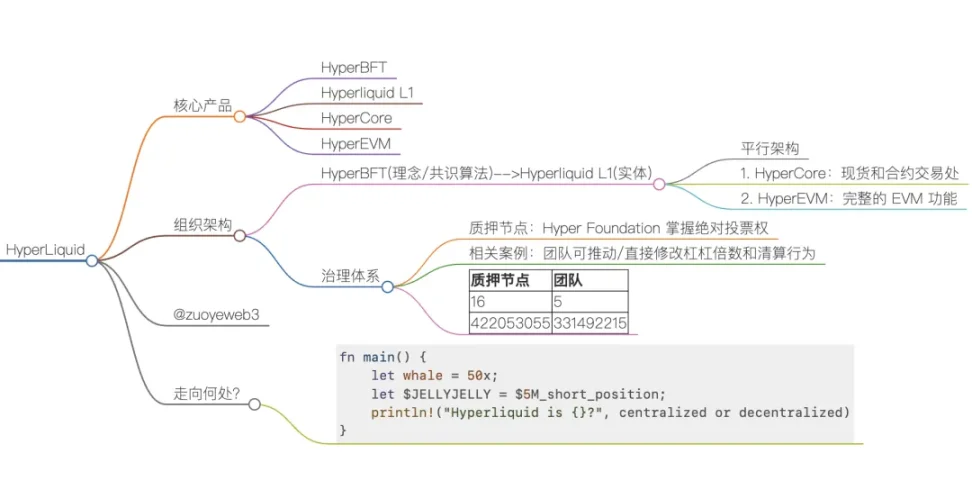

Image caption: Hyperliquid organizational structure. Image source: @zuoyeweb3

Hyperliquid is built upon one consensus and two business pillars:

-

The consensus is the HyperBFT algorithm and its physical manifestation—the Hyperliquid L1;

-

The businesses are HyperCore, a customized spot and derivatives exchange running atop the L1 (largely controlled by Hyperliquid), and parallel to it, HyperEVM—an EVM-compatible chain in the traditional sense.

Within this architecture, cross-chain interactions between L1 and HyperCore/HyperEVM, as well as interplay between HyperCore and HyperEVM, represent potential attack vectors. Hence, structural complexity necessitates high-level control by the project team.

In the Perp DEX landscape, Hyperliquid’s innovation isn’t architectural—it lies in adopting a "slightly centralized" approach: tokenizing GMX-style LP shares, combined with listing and airdrop strategies to sustainably incentivize market participation, successfully capturing market share from CEX-dominated derivatives markets.

Not defending Hyperliquid—but this is the nature of Perp DEXs: absolute decentralized governance cannot respond swiftly to black swan events. Efficient crisis response requires a decision-maker with authority—a "sword-bearer."

Just as LooksRare failed to dethrone OpenSea but Blur succeeded, centralization exists in layers. Hyperliquid’s centralization mainly concerns protocol changes. This article isn’t about debating degrees of centralization, but highlighting how capital efficiency automatically pushes next-gen on-chain protocols toward slightly more centralized models.

78% Centralized: An Inevitable Tokenomic Choice

Hyperliquid’s uniqueness lies in trading on-chain structure for CEX-like efficiency, tokenomics for liquidity, and custom tech stacks for security.

Beyond architecture, Hyperliquid’s true vulnerability lies in the sustainability of its tokenomics. As mentioned, Hyperliquid upgrades GMX’s LP tokenization model—users earn protocol revenue, fueling more liquidity and supporting the token price.

However, this requires strong control by the founding team to maintain stable protocol revenues—especially dangerous in leveraged derivatives markets where amplified gains also mean amplified risks, a key difference from spot DEXs like Uniswap.

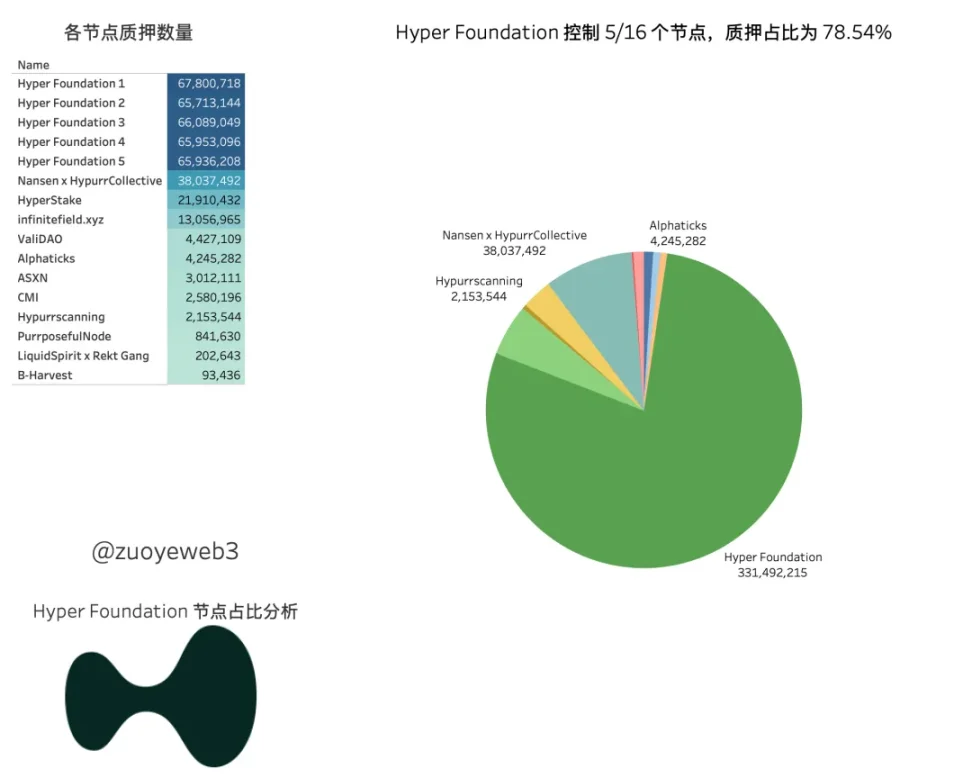

This explains the economic rationale behind Hyperliquid’s relatively centralized design. Currently, among 16 nodes, Hyper Foundation controls 5. But in terms of staked tokens, the Foundation holds 330 million HYPER, accounting for 78.54% of total node stakes—far exceeding the 2/3 majority threshold.

Image caption: Hyperliquid nodes. Image source: @zuoyeweb3

Reviewing major incidents over the past six months:

November 2024: Influencers criticized Hyperliquid for insufficient decentralization—largely accurate

Early 2025: 50x whale incident—made mistakes common to all exchanges, but on-chain transparency made it a public scapegoat

March 26, 2025: “Pulling the plug” on JELLYJELLY—fully confirmed, with the Foundation holding overwhelming voting power

Through repeated battles and confrontations, the ideal of decentralization continues to bow to the realities of capital efficiency. Hyperliquid has minimized typical misbehaviors—VC dominance, unfair airdrops, insider dumping (unlike XRP’s founder constantly selling)—preserved a functional product, and aims to profit via fees.

Compared to NFT markets, which were proven unsustainable, Perp DEXs meet a real on-chain demand. Thus, I believe Hyperliquid’s model will inevitably be accepted by the market.

Yet, just as users questioned whether Bybit profited from its own hack, we should ask: after this crisis, will Hyperliquid’s founders and team shift mindset? Will they remain principled actors under constant threat, or drift toward opaque practices and tighter rule control like traditional exchanges?

In other words, obsessing over centralization misses the point. Perhaps we should consider: does full protocol transparency invite open market hunting—an unavoidable growing pain for on-chain protocols—or does it actually hinder the broader migration to on-chain systems?

The deeper lesson is this: do we cling to the ideal of decentralization, or surrender directly to capital efficiency? Like our increasingly unstable world, the middle ground is narrowing.

Should we choose partial centralization + transparent rules + intervention when necessary, or full centralization + black-box operations + constant intervention?

Conclusion

After the 2008 financial crisis, the U.S. government bailed out Wall Street without taxpayer consent—draining retail blood to revive elite finance. That became the womb from which Bitcoin was born. Today, Hyperliquid repeats the same script—but now, the entity needing rescue is on-chain Wall Street itself.

After the Hyperliquid crisis, influencers lined up to condemn it—from Arthur Hayes to AC—all demanding Hyperliquid uphold decentralization. Yet this too is part of the ongoing on-chain battle. AC once questioned Ethena’s viability, yet today stands united with them.

Once you enter the game as a player, be prepared to become a pawn.

Whether on-chain or off-chain, we need absolute principles—and relative底线.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News