Bitwise CIO: Bitcoin risk has significantly decreased, now is the best buying opportunity in history

TechFlow Selected TechFlow Selected

Bitwise CIO: Bitcoin risk has significantly decreased, now is the best buying opportunity in history

The remarkable thing about Bitcoin is that, over time, it slowly but steadily eliminates every survival risk.

Author: Matt Hougan, Chief Investment Officer at Bitwise

Translation: TechFlow

I first heard about Bitcoin in February 2011.

At the time, I was working at ETF.com, managing a young team of financial analysts to run the world’s first ETF data and analytics service. We held weekly meetings to discuss market developments. In February 2011, when Bitcoin first crossed the $1 mark, one of my analysts announced this historic “dollar threshold.” He then led an engaging discussion on what Bitcoin was, how it worked, and what it might become in the future.

If I had invested $1,000 in Bitcoin after that meeting, it would be worth $88 million today. Instead, I left the office for coffee.

I share this story because everyone—everyone—has this feeling. We all wish we had bought Bitcoin earlier.

But what we forget in these stories is that Bitcoin carried enormous risks back then.

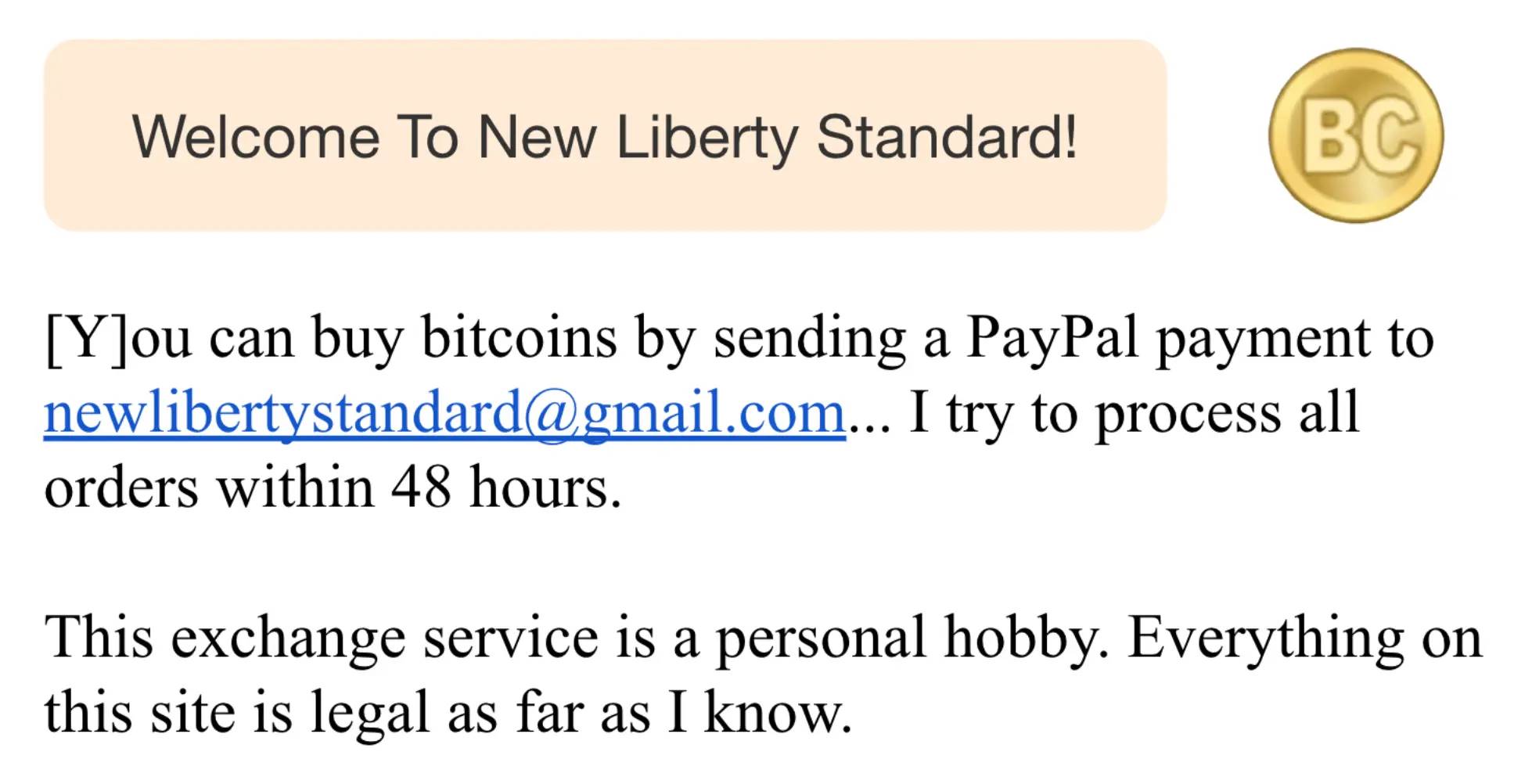

For example, on the day of my "$1 meeting," the largest cryptocurrency exchange in the world was New Liberty Financial. Here are their terms of service:

In hindsight, it's easy to say I should have bought $1,000 worth of Bitcoin. But at the time, that meant sending $1,000 to a random PayPal address. Add in custody, regulatory, technological, and government risks—and putting $1,000 into Bitcoin in 2011 was a massive gamble.

I’m sharing this story now for two reasons:

1) To help you move past the pain of missing Bitcoin the first time;

2) To convince you that things are different now.

In fact, I believe that today—right now—is the best time in history to buy Bitcoin on a risk-adjusted basis.

We’ve just eliminated the last existential risk

Every investment involves a trade-off between risk and return. A lottery ticket could turn $1 into $1 billion, but your expected return is zero.

In its early days, Bitcoin was somewhat like a lottery ticket: massive upside potential, but equally massive risk.

For instance, when Bitcoin first launched, there was no guarantee it would succeed. Yes, the white paper was brilliant. Yes, logic suggested it could work. But before Bitcoin, there had been multiple attempts to build electronic cash systems—all of which failed. (For example, read the paper titled "How to Make An Electronic Mint: Cryptographic Traceability for Anonymous E-Cash," written by the National Security Agency in 1997.)

Beyond the technology itself, early Bitcoin faced other major risks. For years, trading was risky—early exchanges were either unreliable or illiquid and poorly managed. That changed when Coinbase launched at the end of 2011.

For a while, custody was also a risk—until well-known blue-chip firms like Fidelity began offering self-custody and institutional custody solutions.

In Bitcoin’s early days, there were also legitimate concerns about money laundering, criminal activity, regulatory standards, mining centralization, and more.

The remarkable thing about Bitcoin is that over time, it has steadily eliminated each of these existential risks.

The launch of spot Bitcoin ETFs in January 2024 provided regulatory clarity for U.S. institutional investors looking to enter the space, helping us overcome another major hurdle.

Yet even after the ETFs launched, one existential risk remained in the back of my mind: What if the government bans it?

The U.S. Strategic Bitcoin Reserve

When someone asked me at a conference, "What keeps you up at night?" I always mentioned this.

I kept thinking: The U.S. confiscated private gold reserves in 1933 to bolster the treasury. Why would it allow Bitcoin to grow large enough to threaten the dollar?

To be honest, I didn’t know the answer.

When pressed on stage, I always reminded people that in 1933, the U.S. government *bought* gold from its citizens: If Bitcoin becomes big enough to challenge the dollar, I’d argue your investment would probably do quite well.

That was the best I could offer.

But earlier this month, President Trump signed an executive order establishing the U.S. Strategic Bitcoin Reserve. Just like that, the final existential risk facing Bitcoin vanished before my eyes.

Many have wondered why the U.S. would do this. Cliff Asness, founder of hedge fund AQR Capital, wrote immediately after Trump signed the order: “If cryptocurrencies are long-term competitors to the dollar, why would we promote a direct competitor to our status as the world’s reserve currency?”

The answer, of course, is that Bitcoin is better than the alternatives.

For the United States, the ideal scenario is for the dollar to remain the world’s reserve currency. But if that position ever comes under threat, we’re far better off transitioning to Bitcoin than to the currencies of rival nations.

This is something I never considered before: Of course the U.S. will embrace Bitcoin. It’s the best fallback option in the market.

What this means for investors

Anecdotally, at Bitwise, we’re already seeing the effects of this de-risking. Two years ago, Bitwise clients typically allocated about 1% of their portfolios to Bitcoin and other crypto assets—an amount they could afford to lose.

Given the non-zero probability that Bitcoin could be banned or otherwise fail, that made sense. Today’s environment is different. We’re increasingly seeing allocations of 3%. As more people recognize the massive de-risking we’ve seen in Bitcoin, I expect this number to rise to 5% or even higher.

Risks and Important Information

Not investment advice; risk of loss: Before making any investment decision, each investor must conduct their own independent review and investigation, including an assessment of the merits and risks of the investment, and must make investment decisions (including determining whether the investment is suitable for the investor) based on such review and investigation.

Cryptographic assets are digital representations of value that may serve as a medium of exchange, unit of account, or store of value, but they do not have legal tender status. Cryptographic assets may sometimes be exchanged globally for U.S. dollars or other currencies, but currently they are not backed by any government or central bank. Their value is entirely determined by market supply and demand forces and is significantly more volatile than traditional currencies, stocks, or bonds.

Cryptographic asset trading involves significant risks, including sharp market price fluctuations or flash crashes, market manipulation, cybersecurity risks, and the risk of losing principal or the entire investment. Additionally, regulatory controls or investor protections in cryptographic asset markets and exchanges differ from those applicable to equities, options, futures, or foreign exchange investments.

Trading cryptographic assets requires understanding of the cryptographic asset market. When attempting to profit from cryptographic asset trading, you must compete with traders around the world. Before engaging in substantial cryptographic asset trading, you should possess appropriate knowledge and experience. Cryptographic asset trading may result in substantial and immediate financial losses. Under certain market conditions, you may find it difficult or impossible to liquidate positions quickly at reasonable prices.

The views expressed represent assessments of specific market conditions at a particular point in time and are not predictions of future events or guarantees of future outcomes, and are subject to further discussion, refinement, and revision. The information in this article is not intended to provide accounting, legal, tax, or investment advice and should not be relied upon as such. You should consult your accounting, legal, tax, or other advisors regarding the matters discussed in this article.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News