Four Upcoming Yield-Bearing Stablecoin Protocols at TGE: Who Will Define the New DeFi Paradigm?

TechFlow Selected TechFlow Selected

Four Upcoming Yield-Bearing Stablecoin Protocols at TGE: Who Will Define the New DeFi Paradigm?

As DeFi matures, yield-generating stablecoins will become core financial primitives, bridging the gap between cryptocurrency and traditional finance.

Text: Marco Manoppo

Translation: Golem, Odaily Planet Daily

Four Upcoming Yield-Bearing Stablecoin Protocols That Could Define a New DeFi Paradigm? (With Airdrop Program Introductions)

Before USDC and USDT were truly integrated into CEXs and DEXs, we had to short 1x BTC futures on BitMEX just to achieve delta-neutral exposure. That was essentially the most capital-efficient way at the time to gain "neutral yield" without constantly transferring funds across centralized exchanges.

But those days are long gone. Stablecoins have become safe havens in the crypto market, offering a way to preserve capital without relative volatility. They now dominate trading pairs in the crypto markets—trading pairs like XXX/ETH or XXX/BTC are rarely used anymore unless you're an experienced trader making directional bets.

These stablecoins have convinced so many users (holding over $100 billion in assets) to give up yield for instant digital dollar exposure. In hindsight, giving up yield was easier when interest rates were around 2% or lower—but everything changed after the post-pandemic rate hikes.

Beyond being excellent tools for value transfer, first-generation ("old-school") stablecoins offer little else. A new wave of stablecoin projects is changing this reality.

Imagine how incredible it would be if your dollars could automatically work for you—earning yield from reserves, market-making, restaking, lending, or even AI-driven infrastructure.

The first version of stablecoins was simply backed by U.S. Treasuries (like ONDO, Mountain, etc.). Then Ethena introduced yield-generating stablecoins supported by basis trades. Now, new stablecoin protocols are innovating in both yield sources and distribution mechanisms, delivering better experiences for users.

The next generation of stablecoins doesn't just sit idle in your wallet. They generate yield using strategies once only accessible to hedge funds, market makers, and institutional players. From DeFi-native lending pools to AI-powered financial networks, these yield-bearing stablecoins are unlocking a new form of passive income—with some associated risks.

We’re currently in an altcoin bear market, where seeking high yields in relatively stable environments has become mainstream. This article introduces four yield-generating stablecoin protocols that may soon undergo TGE.

CAP (cUSD)

CAP is a new stablecoin protocol built on MegaETH, enabling users to earn real yield without relying on common DeFi tactics such as token emissions. Instead, it leverages external yield sources like market making, MEV, and arbitrage—strategies that large players have profited from in markets for years.

The key appeal is that everyday users can now access these same profit strategies without requiring insider connections or advanced financial knowledge. cUSD (CAP’s stablecoin) is backed 1:1 by USDC/USDT, meaning it's fully collateralized and always redeemable.

Unlike other yield-bearing stablecoins dependent on DeFi liquidity incentives, CAP shifts risk onto restakers—those who stake ETH via EigenLayer to secure the protocol.

cUSD comes in two versions:

-

Interest-bearing: earns passive returns from proxy strategies.

-

Non-interest-bearing: pegged to the dollar, making it easier to use within DeFi.

CAP also plans to launch stablecoins pegged to BTC and ETH, allowing users to choose different underlying assets while still earning yield.

Key Statistics

Does Not Rely on Token Emissions

Most DeFi protocols depend on token emissions to attract liquidity, but this model is unsustainable. The top five DEXs issue approximately $462 million annually just to maintain LP engagement.

Many stablecoins rely on such incentives to maintain their peg or generate yield, creating a flywheel problem—when emissions dry up, liquidity vanishes.

CAP does not rely on token-based incentives. Instead, it derives real yield from exogenous sources such as MEV, arbitrage, and RWA. This makes CAP’s stablecoin more scalable and resilient, avoiding the liquidity drain that plagues many incentive-driven protocols. Users don’t need ongoing token emissions to earn yield, making it sustainable under any market conditions.

Market Making, MEV, and RWA

Last year, market-making revenue across the market exceeded $2 billion. MEV profits alone on Ethereum reached $686 million. Most stablecoins ignore corporate bonds—a $40 trillion market. While some use U.S. Treasuries, they often depend on centralized custodians.

CAP bypasses traditional finance intermediaries, combining RWA yield streams with crypto-native strategies like MEV and arbitrage. Operators deploy capital into bonds, RWAs, and structured yield products, while restakers provide risk coverage.

This approach delivers higher, more stable returns without relying on unsustainable DeFi incentives—bridging real-world finance with DeFi.

Rewards and Airdrop Program

CAP currently does not offer a clear points system.

Resolv (USR)

Resolv is a stablecoin protocol issuing USR, a dollar-pegged stablecoin. Unlike traditional stablecoins backed by fiat reserves or Treasuries, Resolv keeps its system on-chain and hedges ETH price volatility through perpetual futures. USR is 100% backed by ETH and over-collateralized via an insurance layer called RLP (Resolv Liquidity Pool). Key features include:

-

ETH-backed: the protocol holds ETH collateral and hedges price risk using short-term futures;

-

On-chain staking: most ETH is staked to generate yield;

-

Institutional custody: part of the collateral serves as margin for futures trading.

Key Statistics

-

Total Value Locked (TVL): $545 million

-

stUSR Yield (APR): ~2%

-

RLP Yield (APR): ~1.5%

-

New Yield Source: Lagoon Finance offers ~11% base APR on WETH deposits

Yield and Profit Distribution

Users can stake USR (as stUSR) to earn rewards, while RLP holders receive additional risk-based premiums. Profits come from ETH staking rewards, futures positions, and protocol fees (0.05% for instant redemption). In case of protocol losses, RLP holders absorb them, ensuring the stablecoin remains fully backed.

Rewards and Airdrop Program

Resolv has a points system rewarding user activity. Point rewards vary by activity:

-

Base Rate: earn 15 points per day for each USR held;

-

Epoch Boost: early adopters get a 150% bonus, totaling 37.5 points per USR per day;

-

Extra Boost: users can earn additional points through various activities; details available on Resolv’s social media channels.

Latest Project Updates and Integrations

-

Instant Redemption Enabled: now available to whitelisted users, daily cap at 1 million USR.

-

Joined Superstate Industrial Council: strengthening ties between TradFi and DeFi.

-

Binance Wallet Integration: simplifies access to Resolv.

Noble (USDN)

Noble issues USDN, a stablecoin that generates yield simply by holding. Fully backed by short-term U.S. Treasuries, USDN delivers real-world yield without requiring staking or locking, all while safeguarding user funds. Key features:

-

USDN is 100% backed by U.S. Treasuries via the M^0 Protocol;

-

Fully backed by U.S. Treasuries—no algorithmic backing or risky assets;

-

Asset managers hold audited and verified collateral;

-

No restrictions—users can freely buy, sell, transfer, or redeem USDN anytime.

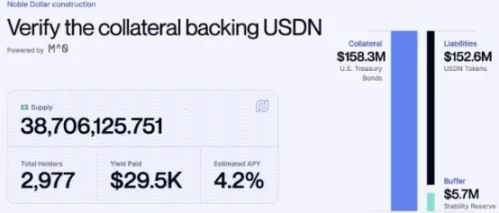

Key Statistics

-

Total Supply: 37.7 million

-

Total Holders: 2,972

-

Collateral (U.S. Treasuries): $158.3 million

-

Liabilities (Outstanding USDN): $152.6 million

-

Reserve Buffer: $5.7 million

-

Estimated APY: 4.2% (paid daily)

-

Total Yield Paid (daily): $3,216.41

Rewards and Airdrop Program

USDN offers a base APY of 4.2%, accruing from the moment you hold it. Noble rewards holders who deposit USDN into the Points Vault with points.

Earn 1 point per 100 USDN per day, with multipliers increasing based on holding duration:

-

30–59 days: x1

-

60–89 days: x1.25

-

90–119 days: x1.5

-

120+ days: x1.75

Additional rewards are unlocked when USDN TVL reaches milestones of $10 million, $50 million, and $100 million.

Latest Project Updates and Integrations

-

USDN StableSwap Launch: enables native exchange between stable assets.

-

Cross-chain Transfers: USDN is fully multichain via Wormhole NTT.

-

Audited and Transparent: backed by top-tier security firms.

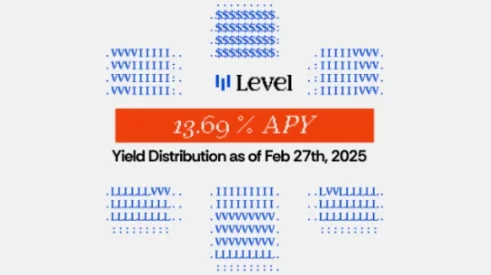

Level (lvlUSD)

Level is a decentralized stablecoin protocol issuing lvlUSD, fully backed by USDC and USDT. Unlike traditional stablecoins, lvlUSD generates DeFi-native yield by deploying collateral into lending protocols like Aave and Morpho. These yields are passed directly to users, making lvlUSD a yield-bearing stablecoin seamlessly integrated into DeFi. Key features:

-

lvlUSD is 100% backed by USDC and USDT, with reserves deployed into blue-chip DeFi lending protocols for yield generation;

-

Lending Yield: USDC and USDT deposited into lending markets such as Aave and Morpho;

-

Restaking Rewards:部分 of lending receipt tokens (e.g., aUSDC) are restaked in Symbiotic for additional rewards;

-

Full On-chain Transparency: users can verify reserves at any time.

Rewards and Airdrop Program (Level XP)

Stake lvlUSD to receive slvlUSD, which automatically accrues yield. Level also offers Level XP, a points reward system for active users. Ways to earn XP:

-

Deposit lvlUSD into XP farms

-

Hold Pendle, Spectra, or Curve LP tokens

-

Use lvlUSD as collateral on Morpho

Multiplier System:

-

LP or YT tokens earn 40x XP

-

slvlUSD earns 20x XP

-

lvlUSD earns 10x XP

-

Partner Protocol Bonus XP: users earn extra points from protocols like Resolv, Frax, Elixir, and Angle.

Recent Project Updates and Integrations

-

Expanded Lending Yield Sources: more protocols beyond Aave coming soon.

-

Restaking Integration: lvlUSD yields enhanced via restaking on Symbiotic.

-

Cross-chain Expansion: lvlUSD becoming more composable across the DeFi ecosystem.

Where Is the Future of Stablecoins Headed?

To be honest, much of the yield generated by these stablecoins doesn't necessarily come from entirely new asset classes. Aside from possibly incorporating MEV and hedge fund vault strategies, most stablecoins are competing with established players using similar types of productive assets.

But how stablecoin protocols incorporate new types of assets—tangible and intangible—depends on whether there's sufficient demand for on-chain native wealth. For example, we've seen past projects attempt to generate yield through private credit or small business loans, but results were poor. Heavy off-chain components hindered the ability to create an on-chain capital flywheel, and demand from crypto-native whales wasn't strong enough (non-crypto whales don’t need on-chain exposure to these risks).

Stablecoins still have a long way to go before becoming truly secure stores of value. The next generation aims to change the game by offering real yield from what are considered productive assets. As DeFi matures, yield-generating stablecoins will become core financial primitives, bridging the gap between crypto and traditional finance.

Yet, it remains to be seen which other asset classes could elevate these yield-generating stablecoins to the next level. Perhaps we just need to scale up existing models rather than introduce new asset types. Only time will tell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News