Here You Go! These OKX Products Help You Easily Navigate Volatile Markets

TechFlow Selected TechFlow Selected

Here You Go! These OKX Products Help You Easily Navigate Volatile Markets

The essence of trading is not predicting the market, but selecting the right tools to respond to different market conditions.

The market is unpredictable—prices rebound right after you sell in despair, and plunge again just as you start buying the dip. False breakouts and fake breakdowns alternate endlessly, wrecking traders' mental health. So how can you trade elegantly and profitably amid such volatility? These OKX strategies are essential to understand!

First, clarify your trading style—are you a short-term hunter or a steady arbitrage player? Short-term traders can leverage tools like futures contracts, grid trading, and options to quickly enter and exit positions, capturing arbitrage opportunities from market fluctuations. On the other hand, conservative arbitrageurs might prefer Dual Currency Earnings, Shark Fin products, or dollar-cost averaging (DCA) strategies to steadily accumulate returns during sideways markets—and even achieve low-buy, high-sell outcomes effortlessly. Next, stop relying on "guessing the market," and instead use structured strategies to generate profits. Whether employing grid trading combined with the Martingale strategy for automatic buy-low-sell-high short-term arbitrage; choosing Dual Currency Earnings or Bottom-Finding & Take-Profit strategies to lock in stable returns within a range-bound market; or utilizing Shark Fin and options strategies to capture windfall gains when prices break out—while using take-profit and stop-loss features to effectively manage risk—a sound risk management framework helps you avoid pitfalls.

Next, we’ll dive deep into how these strategies work and their ideal use cases, while comprehensively analyzing the pros and cons of OKX’s seven major trading tools, helping you identify the approach best suited to your needs. No matter which strategy you choose, selecting the right tool matters more than blind execution. Only by aligning with your personal trading style can you remain calm and resilient through market swings.

1. You Want Low-Barrier Arbitrage

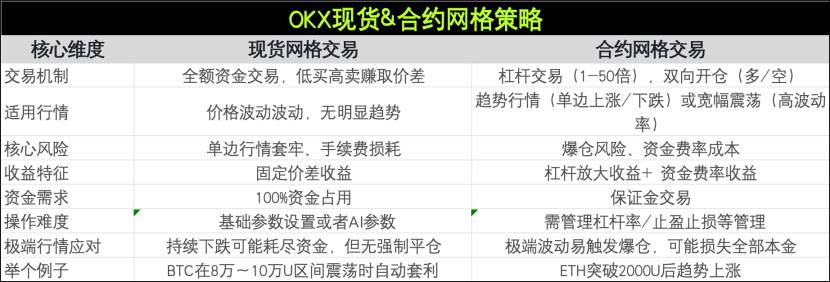

OKX Spot Grid suits conservative users, while Contract Grid fits advanced traders due to its higher capital efficiency—but it carries liquidation risks, requiring strict risk controls. You can start with any amount over 0 USDT, making entry extremely accessible. Grid trading is an automated quantitative strategy that divides a predefined price range into multiple levels, automatically buying low and selling high to capture profits from market volatility. Depending on usage scenarios, Contract Grid further breaks down into long, short, and neutral modes to adapt to different market trends. Both OKX Spot and Contract Grid support either custom parameters or AI-generated settings, allowing users to get started instantly with just one click—extremely convenient.

2. You Want to Profit from Buying the Dip and Catching the Rebound

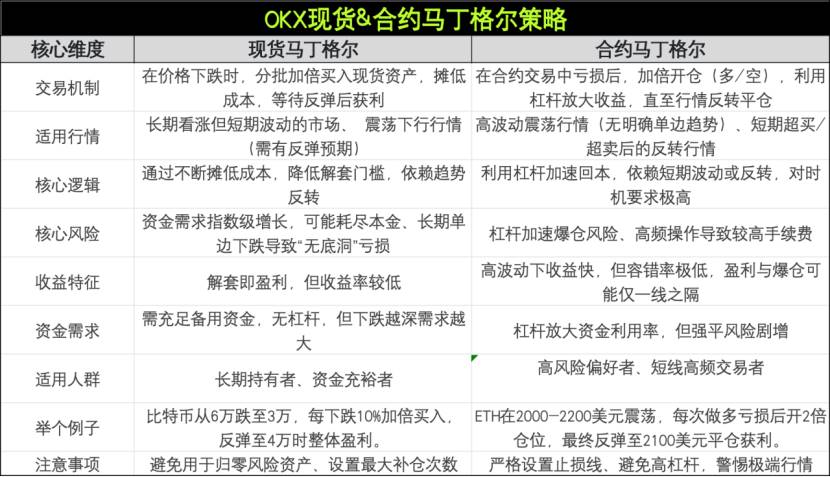

OKX offers both Spot and Futures Martingale strategies. As a high-risk approach, Martingale is essentially a “doubling-down against the trend” strategy—beginners should proceed with caution! Experienced traders must pair it with solid trend analysis and rigorous risk management. The Martingale strategy, formally known as Dollar Cost Averaging (DCA), is a position-sizing method built on the principle of “averaging down after losses, resetting upon profit.” Its core feature is doubling the trade size after each loss, under the assumption that given sufficient capital, a single winning trade will eventually recover all prior losses and yield a net gain.

3. You Want Earnings Without Monitoring the Market

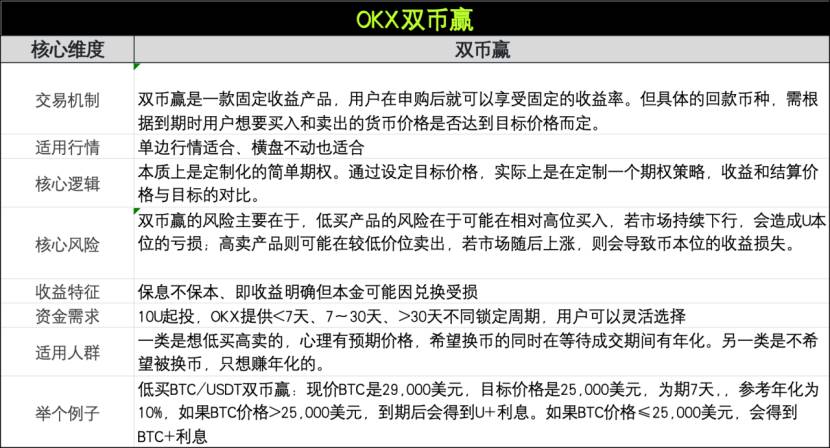

Dual Currency Earnings suits those uncertain about market direction but still seeking returns—ideal for hodlers and those avoiding frequent trading. It's a structured product developed by OKX offering “guaranteed interest, not principal,” enabling users to earn extra yield while targeting a specific buy/sell price for cryptocurrencies. By subscribing to Dual Currency Earnings, users can trade major pairs like BTC-USDT or ETH-USDT, earning stable returns on either asset. However, note that upon exercise, one asset may convert into the other. To address this, OKX has launched BTC/ETH denomination-based Dual Currency Earnings, supporting subscriptions in BTC or ETH, enabling smart swaps between the two assets. Compared to USDT-denominated versions, it offers new ways to generate yield, zero-fee conversion between two major cryptos, continuous interest accrual, and immunity from being converted into USDT and missing bull moves—helping users hold crypto with peace of mind.

4. You Don’t Want to Lose Principal

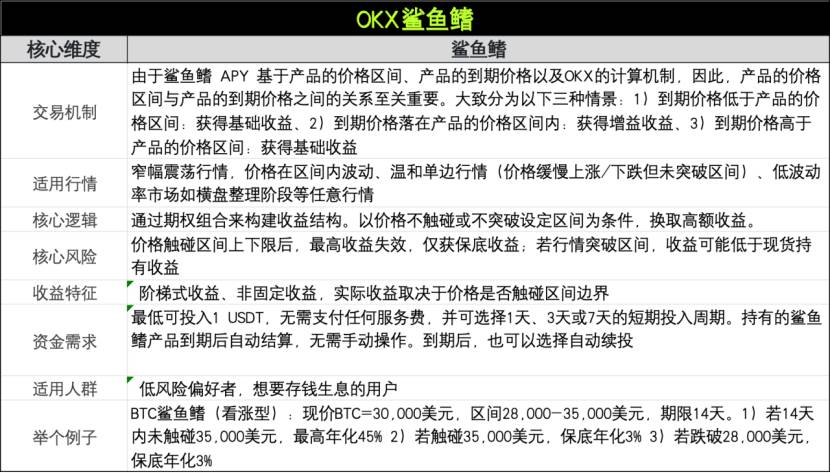

OKX Shark Fin suits users who don’t mind variable returns as long as they protect their principal. Its key advantage is delivering guaranteed base returns while still allowing participation in market movements for potential floating/extra gains. By tracking cryptocurrency price movements, it enables users to earn annualized yields in assets such as USDT, BETH, and OKSOL during volatile periods. If market conditions meet expectations, additional upside rewards unlock. OKX Shark Fin offers flexible investment terms of 1, 3, or 7 days—no need to monitor the market, simply select based on your outlook and liquidity plans to easily earn steady returns. OKX provides both bullish and bearish Shark Fin products. Users can simultaneously purchase both types to cover bidirectional volatility—increasing cost but diversifying risk. Additionally, participating when the fear index spikes can be advantageous, as platforms often offer higher maximum annualized rates during high-volatility periods. Overall, Shark Fin works well as a “cash management tool,” using idle funds to generate returns during confirmed consolidation phases—though position sizing should still be strictly managed.

5. You Want to Earn Both Price Appreciation and Yield

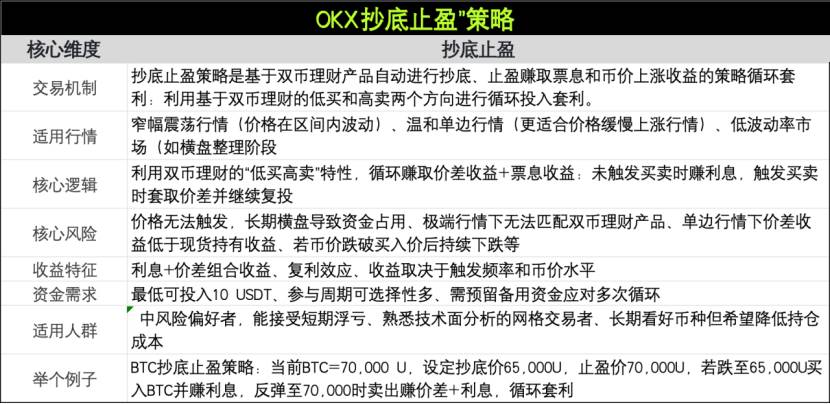

OKX’s Bottom-Finding & Take-Profit Strategy is a cyclical arbitrage mechanism that automatically buys the dip and takes profit via Dual Currency Products, aiming to earn both coupon income and capital gains from rising coin prices. For USD-denominated returns: deposit USDT, use Dual Currency Products to buy low; once the purchase executes, set a take-profit order to capture both price differences and interest earnings. Currently, this strategy supports only BTC and ETH, but the system flexibly matches user-defined target prices, minimum annualized returns, and maximum holding periods. Moreover, OKX offers two modes: Basic and Advanced. The Basic mode uses fixed absolute prices (e.g., $75,000), suitable for clear support/resistance levels but less flexible. The Advanced mode sets prices dynamically based on percentage drops (e.g., 5% below current market price), better suited for scenarios without precise price points but expected volatility ranges—offering greater flexibility.

Choose the Right Tool Based on Market Conditions

The essence of trading isn’t predicting the market—it’s selecting the right tool for each market phase. During choppy markets, blindly chasing rallies or panic-selling only leads to account blowups—not massive wins, but catastrophic losses. Smart traders don’t fight the market; they use tools to turn every fluctuation into opportunity. For example, OKX Spot Grid suits passive traders who want volatility profits without active monitoring, while Contract Grid is an advanced weapon—high capital efficiency, but demands disciplined risk control. Dual Currency Earnings frees hodlers from “losing while holding”—delivering extra yield regardless of price direction. Shark Fin, meanwhile, is a blessing for conservative investors: whether returns are big or small, preserving capital comes first.

There are three types of market participants: Type 1 relies on luck—wild swings between huge gains and devastating losses. Type 2 relies on knowledge—technical analysis plus disciplined execution. Type 3 leverages tools—turning complex trading into systematic, automated processes to maximize returns. The first two battle emotions and experience—the third represents the triumph of the “tool user.” With diverse strategies and structured products, OKX empowers you to move beyond emotional trading and let tools execute your plan precisely. For instance, USDT-based Dual Currency Earnings suits those who want steady yield while waiting for an entry point, whereas grid trading fits users aiming to consistently harvest profits from market noise.

“The market never loses money—retail traders do.” Harsh as it sounds, it reveals a truth: the gap between speculation and real trading is wider than the distance between bull and bear markets. If you're still trading based on gut feelings, your opponent may already be calculating every move with precision strategies. Choosing the right tool is the first step toward turning the market into your ATM. OKX offers a rich suite of strategic tools—from conservative arbitrage to high-risk plays—there’s something for everyone. Instead of relying on luck, use tools to shift the odds in your favor.

Disclaimer:

This article is for informational purposes only. The views expressed are those of the author and do not represent the position of OKX. This content does not constitute (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. We make no guarantees regarding the accuracy, completeness, or usefulness of the information provided. Holding digital assets—including stablecoins and NFTs—involves high risk and may experience significant price volatility. You should carefully consider whether trading or holding digital assets is appropriate for your financial situation. For personalized guidance, please consult your legal/tax/investment professional. You are solely responsible for understanding and complying with applicable local laws and regulations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News