Ethereum's decline, PVP thriving—I miss the summer of 2020

TechFlow Selected TechFlow Selected

Ethereum's decline, PVP thriving—I miss the summer of 2020

Is there still something to expect from Ethereum?

Author: Jessy (@susanliu33), Jinse Finance

Vitalik disappeared from X for over 20 days.

During this time, Ethereum's price repeatedly breached investors' psychological support levels. On March 12, the ETH-to-BTC exchange rate hit a new low of 0.022676—the lowest since June 2020. The persistent decline in ETH/BTC, coupled with whale exits from ICO-era holdings, retail panic selling, and constant FUD, has shaken market confidence.

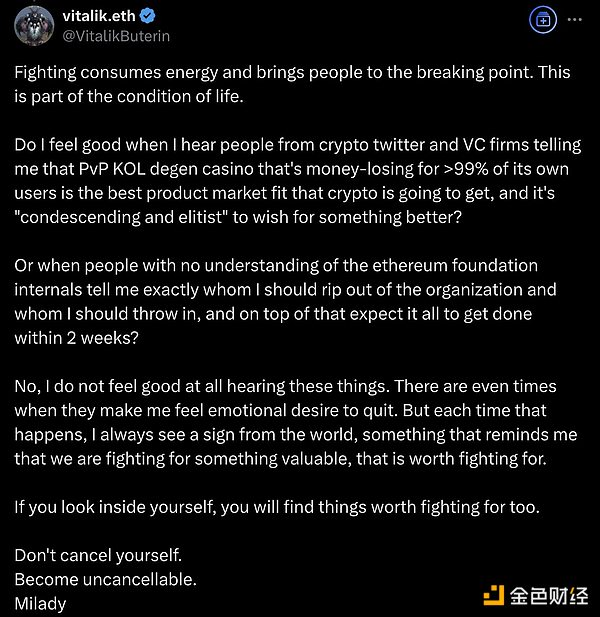

In February, a heated argument erupted within the Ethereum community, with calls for Vitalik to lower his "noble head" and pay attention to what the industry is currently focused on. In response to criticism, Vitalik stated he does not believe the current trend of PVP (player versus player, i.e., speculative gambling-like applications) represents blockchain’s best product, reaffirming his commitment—alongside Ethereum—to building better, more meaningful innovations.

While Vitalik remained absent online for these past 20+ days, Binance co-founders CZ and He Yi led meme-driven trends on X, leveraging Abu Dhabi investment into Binance to spark a wave of Meme activity on the BSC chain—an event dubbed the “White Cloth Rally.”

This cycle has been dominated by explosive growth in the Meme sector and rampant PVP culture, flooding the crypto community with gambler-like sentiment. Beyond that, a deeper sense of widespread confusion looms over the space: the kind of genuine innovation capable of driving real industry progress seems to have vanished.

The industry feels barren, and memes have become the dominant narrative. People are beginning to reminisce about the summer of 2020 when DeFi flourished on Ethereum.

Once Called “God V,” Now Just “Little V”

Once revered as “God V,” a spiritual leader whose words guided the direction of crypto development, Vitalik is now referred to dismissively as “Little V,” even told to “get out” of Ethereum.

Vitalik last became a focal point of public discourse in early February, amid rising FUD surrounding Ethereum. Responding to质疑, rational suggestions, and emotional attacks alike, Vitalik finally replied on X: he doesn’t believe PVP is the optimal product model today; his focus remains on creating better products. He also expressed fatigue toward demands for reform at the Ethereum Foundation—especially from those who know nothing about its internal workings.

Vitalik becoming the target of mass backlash was unimaginable just two years ago.

Crowds often crave powerful leaders—figures they can idolize and rely on psychologically. This drives them to engage in hero worship, magnifying an individual’s strengths until they resemble an omnipotent deity. But once such a constructed “god” fails to meet inflated expectations, the shift in public sentiment becomes swift and brutal. Blind admiration instantly turns into fierce criticism, dragging the once-revered figure down from the pedestal through ridicule and condemnation to vent disappointment and anger.

Vitalik has fully experienced both the deification and dethroning process within the crypto community. Once, his words and ideas charted the course for the entire industry. Vitalik enjoyed sharing his thoughts—concepts like SBTs and Network States were either proposed or strongly advocated by him. Thanks to his active promotion, these ideas gained rapid traction among projects and briefly became major industry trends.

Especially during bear markets, project founders rushed to build in areas Vitalik endorsed. When he showed interest in Web3 social, entrepreneurs flocked to the space—only for most initiatives to fizzle out after a short-lived boom.

When the bull market arrived, none of the directions Vitalik had highlighted during the bear market saw breakout adoption at scale. Confusion and uncertainty have become common sentiments across the ecosystem.

Without true innovation or compelling new narratives, the kind of vibrant energy seen during Ethereum’s DeFi Summer hasn't reappeared anywhere in crypto.

Blockchain infrastructure is largely complete—highways have already been built—but there are no vehicles to drive on them. The core challenge facing the blockchain industry today isn't infrastructure anymore. It's about what transformative products blockchain can offer that change human life or reshape society. What is the answer?

If the answer is payments, Bitcoin provided that vision back in 2008. If it's decentralized finance, Ethereum delivered that in 2020. And arguably, the most practical application so far is stablecoins, which are actively transforming traditional systems in cross-border payments and beyond.

Is there nothing else? This cycle, asset launch platforms have boomed across various chains—but this is merely innovation in issuance mechanisms, repackaging the same casino-like fundamentals under new skins. Another much-hyped area is blockchain-AI integration, which raised massive funding, only to see its bubble burst with the sudden emergence of Deepseek. A deeper issue here is that the narrative remains centered on AI. Blockchain may help AI agents gain on-chain identities or enable economic systems, but ultimately serves in a supporting role. This isn’t a natively crypto-born use case.

In this desolate landscape, casinos are considered crypto’s best product. Despite many urging Vitalik and Ethereum to embrace more “casino-style” gameplay, he refused: “If I look inside myself, I will find things worth fighting for.”

Vitalik once enjoyed being elevated to godlike status. But now that he's been pulled off the pedestal, people see his humanity. To some, this means stubbornness, arrogance, and unwillingness to listen. Yet these very traits enabled him to create Ethereum.

The Childhood Passion That Made Time Fly Can Still Change the World

Jung once said: “What made time fly and brought you joy as a child—that is your life’s calling.”

For Vitalik, what’s worth fighting for was evident in his early years. At age 4, he received a computer from his father. While other kids played games, he became obsessed with Excel, quickly writing automated calculation programs. At 7, he created a “Rabbit Encyclopedia” filled with charts and mathematical formulas, soon recognized as gifted in math and programming. By 10, his mental arithmetic speed exceeded peers by more than double. At 11, he joined an accelerated program for gifted children, studying advanced mathematics, coding, and economics...

Programming itself brings Vitalik joy, but using technology to transform the world is his mission. Compared to many speculators in crypto, he has always been relatively conservative.

In 2018, when Ethereum crashed and faced community backlash, Vitalik warned against letting Ethereum devolve into a speculative tulip mania. Then, as now, he considered stepping away: “Should I drop Ethereum and work for Google?”

Doubts about Ethereum resurface every time prices fall. Each wave of criticism and abuse makes Vitalik contemplate leaving.

Yet Vitalik has always held firm to his principles—his dedication to technology and vigilance against bubbles remain unchanged. These very convictions once sparked transformative innovation in the crypto world.

Looking back at crypto history, the most impactful innovations over the past decade largely emerged on Ethereum—the “world computer”: widespread adoption of smart contracts, platforms enabling DeFi breakthroughs like liquidity mining, Layer-2 scaling solutions such as Rollups and Plasma, experiments in DAO governance models, and more.

Today, institutions ranging from the Trump family’s DeFi project, Sony’s Layer2, to Deutsche Bank’s Layer2 are building Web3 applications and infrastructure solutions on Ethereum. In terms of technical resources, developer support, on-chain capital, and client security, the Ethereum ecosystem remains mature and leading.

Beyond technological ideals, Vitalik embeds social visions into Ethereum—and beyond. His advocacy for decentralization, censorship resistance, quadratic voting, and related concepts touches upon democratic practices, internet architecture, and nonprofit-commercial hybrid organizations, extending his influence far beyond the crypto sphere.

Is Ethereum Really Doomed?

Does Ethereum still hold promise? The answer is yes.

In April, Ethereum will roll out the Pectra upgrade on mainnet—a combination of the execution-layer Prague upgrade and consensus-layer Electra upgrade. Pectra incorporates 11 key Ethereum Improvement Proposals (EIPs), aiming to improve scalability, staking flexibility, and user experience. Overall, this upgrade will enhance network performance and stability; economically, it alters Ethereum’s staking model, impacting supply-demand dynamics and pricing; at the application level, it could attract more developers and users, fostering innovation in dApps.

In the U.S., staking-enabled spot Ethereum ETFs may soon be approved. In Q1 2025, 21Shares filed an application via CBOE BZX Exchange to introduce staking functionality into its spot Ethereum ETF. Fidelity also submitted an S-1 form proposing a staking-capable spot Ethereum ETF. Grayscale has similarly applied to add staking features to its spot Ethereum ETF offering.

The Pectra upgrade is expected to shorten Ethereum’s staking withdrawal period—one of the key hurdles initially blocking approval of staking-enabled ETFs.

This upgrade could serve as the catalyst needed for regulatory acceptance of staking ETFs.

There's broad agreement in the industry: one major reason current spot Ethereum ETFs lack appeal is the absence of staking. Adding staking would allow holders to earn staking rewards—projected annual yields of 3–3.5%. Once staking-enabled spot Ethereum ETFs launch, inflows could surge significantly, potentially boosting ETH’s price.

These two developments represent tangible bullish catalysts for Ethereum this year.

But another truth remains: the upcoming upgrades, while valuable, are incremental improvements along a predictable path. They’re about widening and smoothing the highway—not revolutionary innovations or groundbreaking applications.

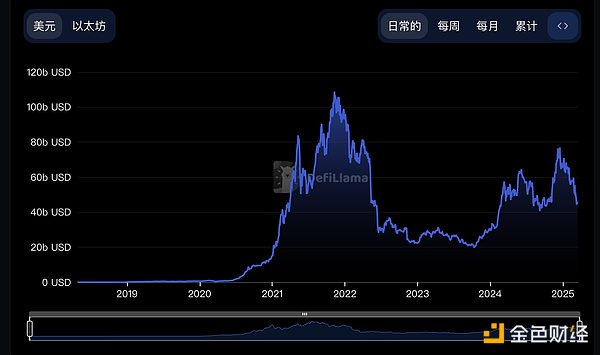

Ethereum’s use cases may have already peaked. This cycle, no mass-participation projects have emerged on Ethereum’s mainnet, nor has its price surpassed previous highs. Its peak TVL still dates back to 2021.

Once the go-to platform for smart contracts, Ethereum now faces competition from numerous newer, faster, and cheaper alternatives. This cycle, chains like Solana, Sui, and TON have each cultivated distinct ecosystems. Leading Ethereum L2s like Base have also achieved notable success.

Vitalik’s de-mythologization is actually healthy for the industry. As the space matures, Ethereum no longer dominates alone. Rising competitors foster richer ecological diversity. With broader blockchain ecosystems emerging, Ethereum’s relative importance will naturally diminish.

In an interview with Initium Media, Vitalik said: “My life is about being a bridge between all things.” Since 2015, the Ethereum Foundation has spent more on external grants than internal operations. These funds have connected countless teams, accelerating the development of diverse crypto projects. Whether through Ethereum itself or Vitalik’s personal efforts, their role has always been foundational.

Neither Ethereum nor Vitalik should bear the burden of the industry’s collective frustration over a lack of innovation.

“If you look inside yourself, you will find things worth fighting for too.” Vitalik, clear on his purpose, will return after moments of disillusionment.

And those lost and angry in the crypto community—whoever dares to look inward—will make their choice: stay and become a builder, patiently creating something new amidst the荒芜. Or leave, chasing the next hype cycle as a shrewd speculator.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News