Ethereum's Growing Pains: From ETF Outflows to On-Chain Weakness, Can ETF Staking Revive the Market?

TechFlow Selected TechFlow Selected

Ethereum's Growing Pains: From ETF Outflows to On-Chain Weakness, Can ETF Staking Revive the Market?

Ethereum is going through a prolonged growing pain, and the ETF staking proposal is seen by the market as a key variable for Ethereum's recovery in the short term.

Author: Nancy, PANews

Ethereum is going through a prolonged growing pain—persistent price pressure, a significant decline in on-chain activity, and continuous outflows from spot ETFs. These signs are gradually eroding market confidence in its growth potential. Meanwhile, as the U.S. crypto regulatory landscape quietly shifts, several ETF issuers have recently submitted proposals to the SEC seeking approval for Ethereum staking via ETFs. For Ethereum, currently lacking clear demand catalysts, this development is seen by the market as a key variable that could help it emerge from its downturn in the near term.

Severe ETF Outflows, Staking Approval Expected as Early as This Month

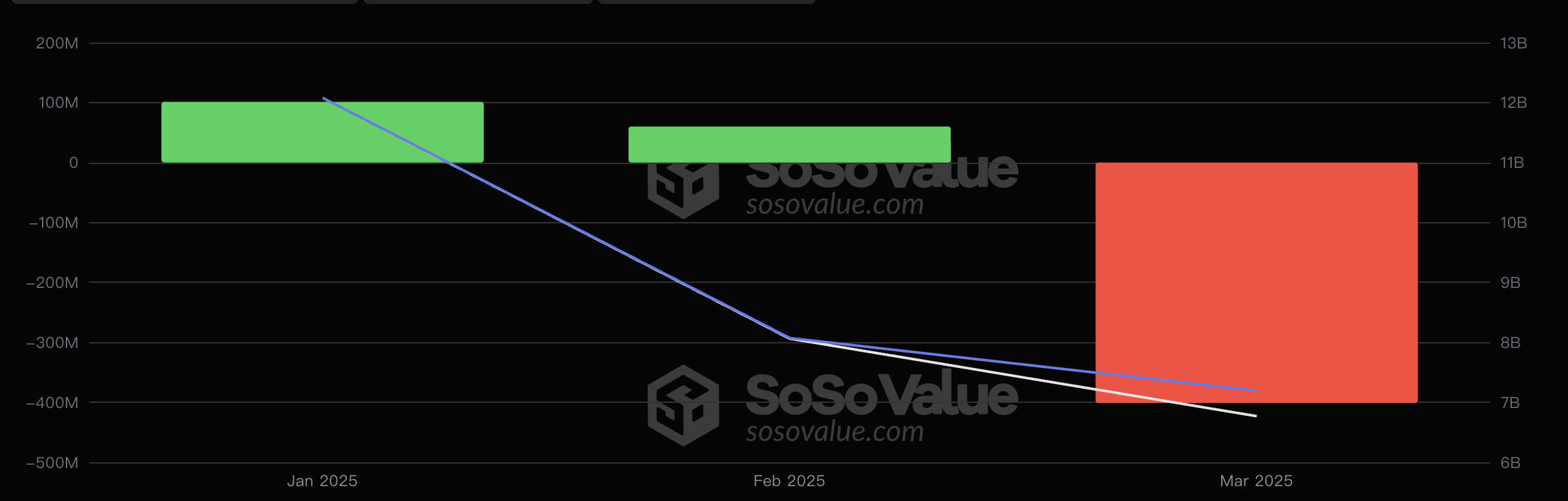

Currently, U.S.-listed Ethereum spot ETFs continue to suffer capital outflows, further undermining market sentiment. According to SoSoValue data, while U.S. Ethereum spot ETFs saw a cumulative net inflow of about $160 million in January and February, they experienced over $400 million in net outflows in March alone, resulting in a year-to-date net outflow of nearly $240 million. In contrast, despite significant outflows in recent months, Bitcoin spot ETFs still recorded a total net inflow exceeding $790 million this year, with March's net outflow shrinking by 74.9% compared to February.

Monthly Net Flows of Ethereum ETFs YTD

Robert Mitchnick, Head of Digital Assets at BlackRock, believes that gaining approval for staking could be a "huge leap" for Ethereum ETFs. He recently stated that demand for Ethereum ETFs has been lackluster since their launch in July last year, but could shift if certain regulatory hurdles are resolved. While Ethereum ETFs have been deemed “underwhelming” compared to the explosive growth of Bitcoin-tracking funds, this perception may stem partly from a key limitation: these ETFs currently cannot earn staking rewards—a major component of investment returns in the ETH ecosystem. ETFs are highly attractive instruments, but without staking, they’re not ideal for today’s ETH market. Achieving this isn’t simple—it won’t happen just because a new administration flips a switch. There are many complex challenges to overcome. But if solved, we could see a dramatic uptick in activity around these ETF products.

Since February, multiple issuers—including 21Shares, Grayscale, Fidelity, Bitwise, and Franklin—have filed proposals to enable staking within Ethereum ETFs. Among them, 21Shares was the first to submit such an application, which the SEC formally accepted on February 20. Under SEC procedures, an initial decision must be made within 45 days of filing Form 19b-4—whether to approve, reject, or delay. Counting from February 12, the initial decision deadline for 21Shares’ proposal falls on March 29, potentially extending to March 31 due to weekends. A final ruling is expected no later than October 9—within 240 days.

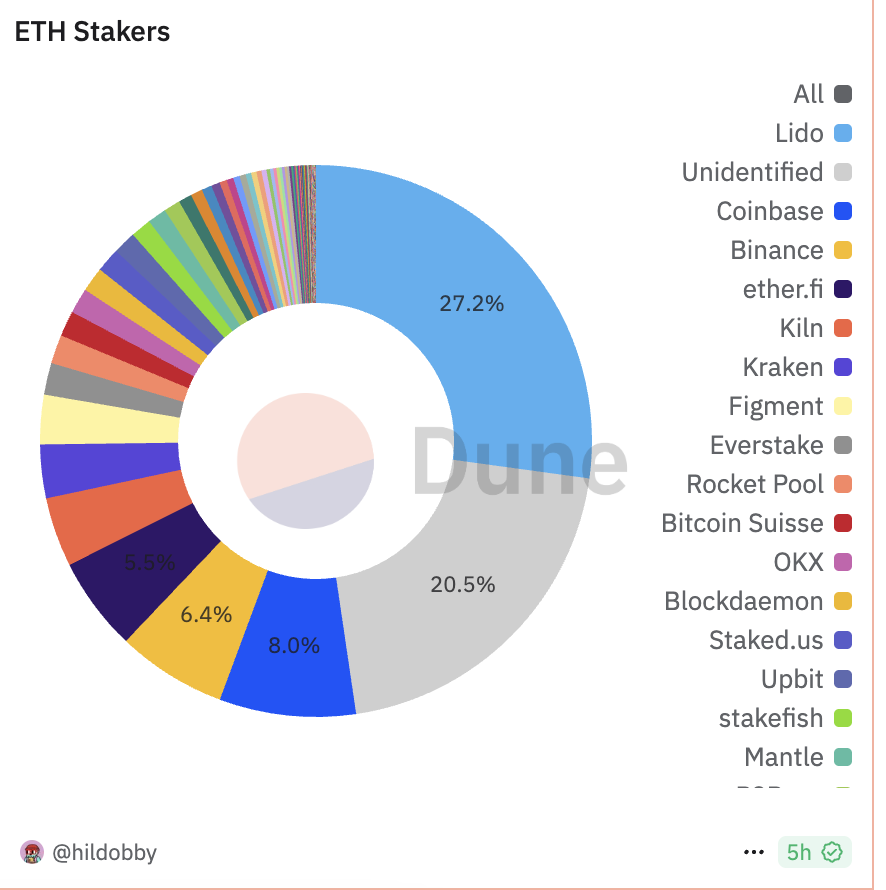

Market participants view the introduction of staking functionality into Ethereum ETFs as offering multiple potential benefits. First, in terms of return on investment, Ethereum’s current annual staking yield stands at approximately 3.12%. Unlike Bitcoin spot ETFs, which rely solely on price appreciation, Ethereum ETFs with staking can generate additional income, making them more appealing to institutional investors and possibly reversing weak demand. Second, locking up ETH through staking reduces circulating supply, alleviating selling pressure and potentially supporting price appreciation. Dune data shows that as of March 24, over 34.199 million ETH were staked on the Beacon Chain, representing 27.85% of total supply. If ETFs join staking, this ratio would rise further. Third, ETF participation in staking increases the number of validators on the Ethereum network, enhancing decentralization and mitigating community concerns about centralization risks posed by liquid staking protocols like Lido. As of March 24, Lido alone accounted for 27.28% of all staked ETH, according to Dune.

However, operational simplicity and regulatory compliance considerations may reduce the attractiveness of proposed ETF staking designs to institutional investors. Take 21Shares’ staking application as an example: ETH holdings are custodied by Coinbase and use a “point-and-click staking” model—allowing direct staking via a simplified interface without transferring assets to third-party protocols (such as Lido or Rocket Pool), thus reducing security risks associated with asset movement. Notably, all staking rewards go to the ETF trust itself and become revenue for the issuer, rather than being directly distributed to investors. According to Dune data, decentralized LSD platforms like Lido and ether.fi remain the dominant choice for ETH staking, surpassing centralized exchanges like Coinbase and Binance. At present, none of the Ethereum spot ETF issuers have explicitly committed to sharing staking rewards with investors. However, under potential regulatory easing and increasing competition, such mechanisms cannot be ruled out in the future.

Beyond distribution models, Ethereum spot ETFs also face efficiency challenges related to staking mechanics. Due to strict entry and exit limits on Ethereum’s staking protocol—only 8 validators allowed to enter and 16 to exit per epoch, with each epoch lasting 6.4 minutes—the flexibility of ETFs is constrained. During periods of high market volatility, investors' inability to exit promptly could amplify sell-side pressure. For instance, current U.S. Ethereum spot ETFs hold roughly $6.77 billion worth of ETH. At an ETH price of ~$2,064, this equates to about 3.28 million ETH. Based on current queue dynamics, full staking would take approximately 57.69 days, while complete unstaking would require 28.47 days. This queuing mechanism fails to meet investor liquidity needs, and liquid staking solutions—which bypass these delays—are excluded from current ETF staking frameworks.

The upcoming Pectra upgrade (EIP-7251), which raises the maximum stake per validator node from 32 ETH to 2,048 ETH, is expected to significantly improve staking efficiency by shortening queue times and lowering technical barriers. However, during the latest 153rd Ethereum core developer consensus (ACDC) call, developers decided to postpone setting a mainnet activation date for Pectra, potentially delaying it beyond May.

Therefore, compared to the timing of staking approval, issues surrounding reward distribution and operational efficiency are more critical factors influencing demand for Ethereum spot ETFs.

On-Chain Activity Remains Weak—ETF Staking Alone Can't Solve Ecosystem Challenges

Even if Ethereum spot ETFs gain staking capabilities, their impact on circulating supply and market sentiment will likely be limited, failing to address deeper structural challenges facing Ethereum’s ecosystem—intensifying competition, Layer-2 (L2) fragmentation, and growth bottlenecks. Persistent weakness in on-chain activity, accelerating L2 user migration, and rising competition from high-performance blockchains are collectively eroding Ethereum’s market dominance.

In terms of impact, Ethereum’s current staking rate is around 27.78%, while U.S. Ethereum spot ETFs hold about 2.84% of total ETH supply. Even if all ETF-held ETH were staked, the overall staking rate would only increase to approximately 30.62%—a modest 2.84 percentage point rise. This small change has minimal effect on ETH circulation and is insufficient to drive meaningful price momentum.

In comparison, other PoS chains exhibit much higher staking rates: Sui at 77.13%, Aptos at 75.83%, and Solana at 64.39%. While Ethereum still has room for staking growth, the relatively small size of ETF holdings means they lack the scale to become a dominant buying force. Thus, the symbolic value of ETF staking outweighs its practical market impact.

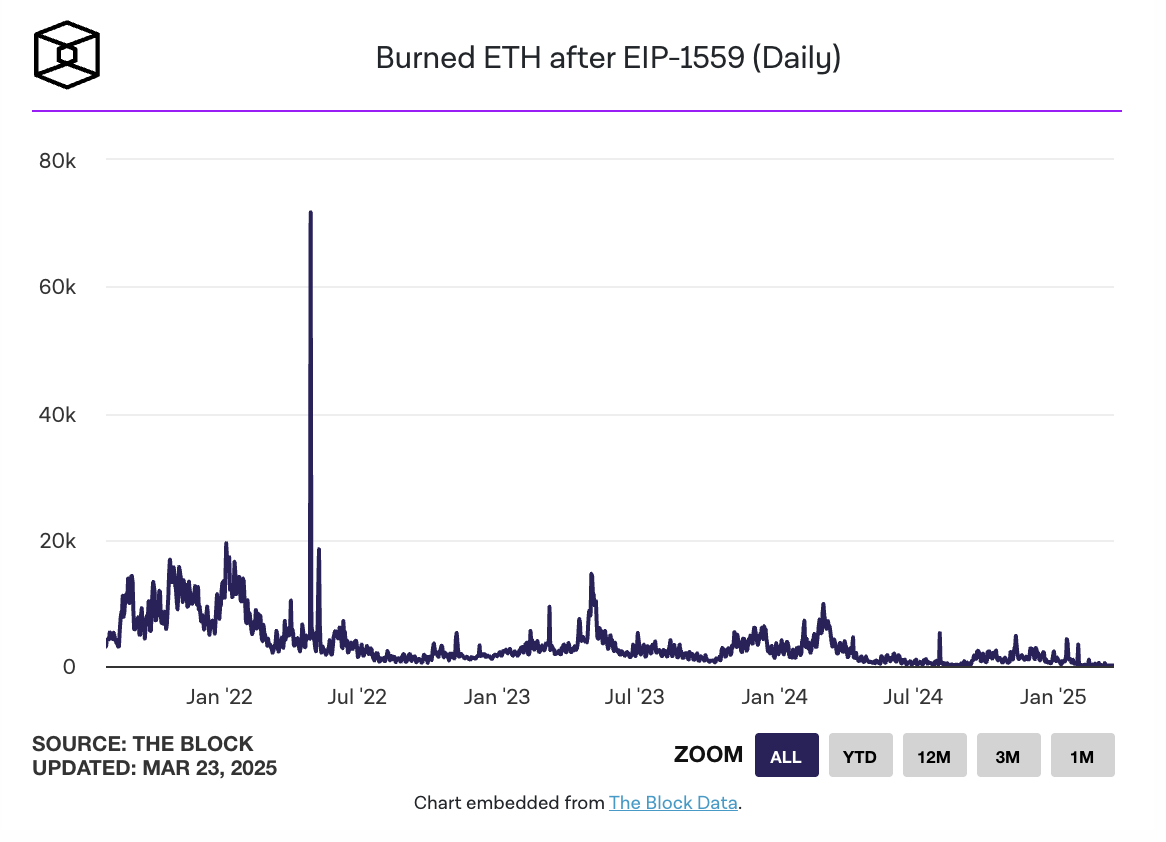

Declining on-chain metrics further highlight Ethereum’s weakening ecosystem vitality. According to The Block, as of March 22, the amount of ETH burned from transaction fees on Ethereum dropped to just 53.07 ETH (~$106,000), marking a historical low. Ultrasound.money reports that over the past seven days, Ethereum’s annual supply growth rate stood at 0.76%. Moreover, active addresses, transaction volume, and transaction count on Ethereum have all declined in recent weeks, signaling diminishing ecosystem engagement.

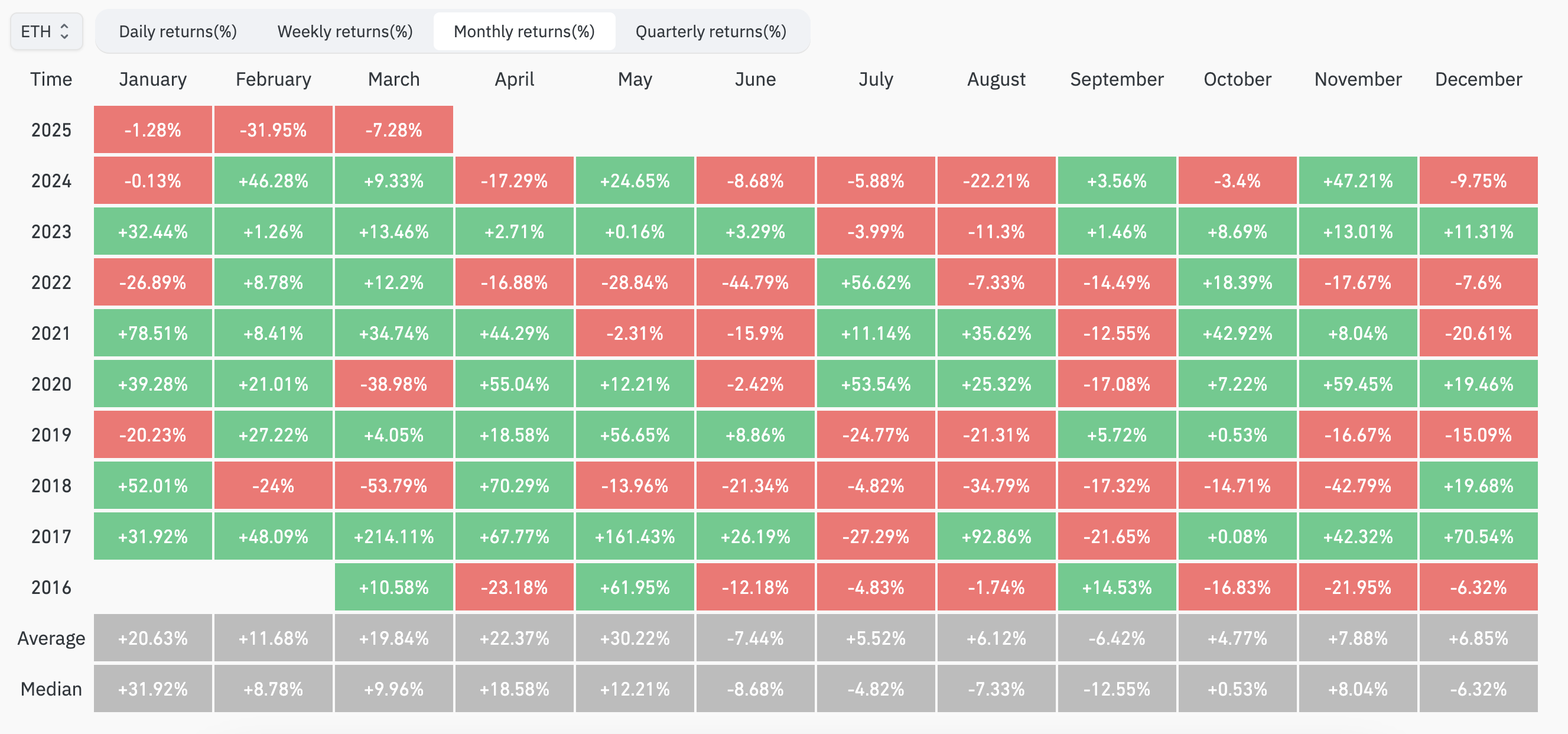

Ethereum posted its worst-ever first-quarter performance this year. Coinglass data reveals that Q1 2025 marked Ethereum’s most disappointing start in recent years, with negative returns for three consecutive months: January: -1.28% (historical average: +20.63%, median: +31.92%); February: -31.95% (historical average: +11.68%, median: +8.78%); March: -7.28% (historical average: +19.55%, median: +9.96%).

Ethereum’s struggles stem from multiple structural issues. While L2s like Arbitrum and Optimism have dramatically reduced transaction costs using Rollup technology, they have diverted traffic away from the mainnet. L2 transactions now exceed those on Ethereum’s mainnet, leading to lower Gas fees and reduced ETH burn rates. Crucially, most transaction fees generated on L2s stay within their respective ecosystems (e.g., OP tokenomics on Optimism) rather than flowing back to benefit ETH holders. Additionally, Ethereum is losing market share in high-performance application scenarios to faster alternatives like Solana.

Standard Chartered recently downgraded its year-end 2025 ETH price target from $10,000 to $4,000, citing several key points: L2 scaling undermines ETH valuation—scaling solutions originally meant to enhance Ethereum (such as Coinbase’s Base) have instead led to the erosion of ~$50 billion in market value; the ETH/BTC ratio is expected to keep falling, potentially reaching 0.015 by end-2027, the lowest since 2017; future growth may hinge on RWA (real-world assets)—if RWA tokenization accelerates, ETH could retain 80% of the secure asset market share, but this requires proactive commercial strategies (e.g., taxing L2s) from the Ethereum Foundation, which remains unlikely.

In summary, while Ethereum ETF staking could marginally influence ETH supply and investor yields, it does not directly address core challenges such as ecosystem competition, L2 fragmentation, or weak market sentiment. Ethereum must pursue deeper breakthroughs in both technology and narrative to regain momentum.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News