Hotcoin Research | Why Has Hyperliquid Stood Out? A Review of Top Decentralized Derivatives Protocols and Sector Analysis

TechFlow Selected TechFlow Selected

Hotcoin Research | Why Has Hyperliquid Stood Out? A Review of Top Decentralized Derivatives Protocols and Sector Analysis

This article will conduct an in-depth analysis of eight representative decentralized derivatives protocols, covering the definition and characteristics of decentralized derivatives protocols, their operating mechanisms, introductions and features of each project, comparative analysis, and future outlook for this sector.

Decentralized derivatives protocols, as a key innovation within the decentralized finance (DeFi) space, are gradually transforming the operational model of traditional financial derivatives markets. By leveraging blockchain technology and smart contracts, these protocols eliminate reliance on centralized intermediaries, offering users a transparent, secure, and globally accessible trading environment. This article provides an in-depth analysis of eight representative decentralized derivatives protocols—Hyperliquid, Jupiter, Drift, GMX, Vertex, Apex, SynFutures, and dYdX—covering the definition and characteristics of such protocols, their operational mechanisms, individual project overviews and features, comparative analysis, and future outlook for the sector. Our goal is to offer readers a comprehensive and objective perspective to better understand this rapidly evolving segment of crypto finance.

1. Understanding Decentralized Derivatives Protocols

1.1 Definition

Decentralized derivatives protocols are blockchain-based financial instruments that enable users to trade derivatives without relying on traditional centralized intermediaries. Derivatives are financial contracts whose value is derived from underlying assets (e.g., BTC) and fluctuates with the price of those assets. These protocols use smart contracts to automate trade execution, settlement, and liquidation processes, operating on public blockchain networks to ensure transparency and immutability of rules.

Unlike centralized exchanges (CEXs) such as Binance or Coinbase, decentralized derivatives protocols do not depend on a single entity to manage user funds or match trades. Instead, they achieve decentralized market operations through distributed networks and algorithms. Perpetual futures are currently the most popular product type among decentralized derivatives protocols, allowing users to leverage positions on cryptocurrency price movements without expiration dates.

1.2 Key Features

Decentralized derivatives protocols possess the following core characteristics:

-

Decentralization: No central authority controls the system; all transactions occur directly on-chain, reducing single points of failure and censorship risks.

-

Transparency: Transaction records and contract terms are stored on the blockchain and publicly verifiable, enabling anyone to audit fairness.

-

Security: User funds and data are protected via smart contracts and cryptographic techniques, minimizing risks of hacking or internal fraud.

-

Accessibility: Global users can participate using only a crypto wallet, without undergoing KYC (Know Your Customer) verification or permission from traditional financial institutions.

-

Innovation: Support for diverse financial products such as perpetuals, options, and synthetic assets enables flexible trading strategies.

These attributes have attracted not only retail traders but also increasing attention from institutional investors.

2. Operational Mechanisms of Decentralized Derivatives Protocols

The operation of decentralized derivatives protocols relies on blockchain technology and various market design mechanisms to facilitate liquidity provision, price discovery, and trade execution. Below are the common types of operational models:

2.1 Automated Market Maker (AMM)

Automated Market Makers (AMMs) replace traditional order-book matching with algorithms and liquidity pools. Users deposit assets into liquidity pools, where prices are automatically adjusted according to predefined mathematical formulas (e.g., constant product formula). The main advantage of AMMs is enabling instant trades without waiting for counterparties, making them suitable for low-liquidity markets.

-

Representative Projects: Jupiter, GMX.

-

Advantages: Simple and efficient, ideal for small trades and highly volatile markets.

-

Disadvantages: Potential slippage; less efficient price discovery compared to order books.

2.2 Order Book Model

The order book model resembles traditional financial exchanges, where buyers and sellers submit limit orders that are matched by the system. While widely used in centralized exchanges, implementing this model in decentralized environments faces challenges related to on-chain transaction speed and cost.

-

Representative Project: Hyperliquid

-

Advantages: Enables more precise price discovery, appealing to professional traders.

-

Disadvantages: High demands on blockchain performance may lead to transaction delays or high fees.

2.3 Hybrid Model

The hybrid model combines the strengths of AMM and order book systems, aiming to balance liquidity and trading efficiency. For example, a protocol might use AMM for base liquidity while optimizing price discovery via an order book.

-

Representative Project: Vertex.

-

Advantages: Highly adaptable to different market conditions.

-

Disadvantages: Higher implementation complexity; potential inconsistencies in user experience.

2.4 On-chain/Off-chain Hybrid

Some protocols execute order matching off-chain to improve speed while settling transactions and managing funds on-chain to maintain security. This approach leverages the efficiency of centralized systems while preserving decentralized trust.

-

Representative Project: dYdX (V4).

-

Advantages: Fast execution and low fees.

-

Disadvantages: Off-chain components may introduce partial centralization risks.

3. Current State of the Decentralized Derivatives Sector

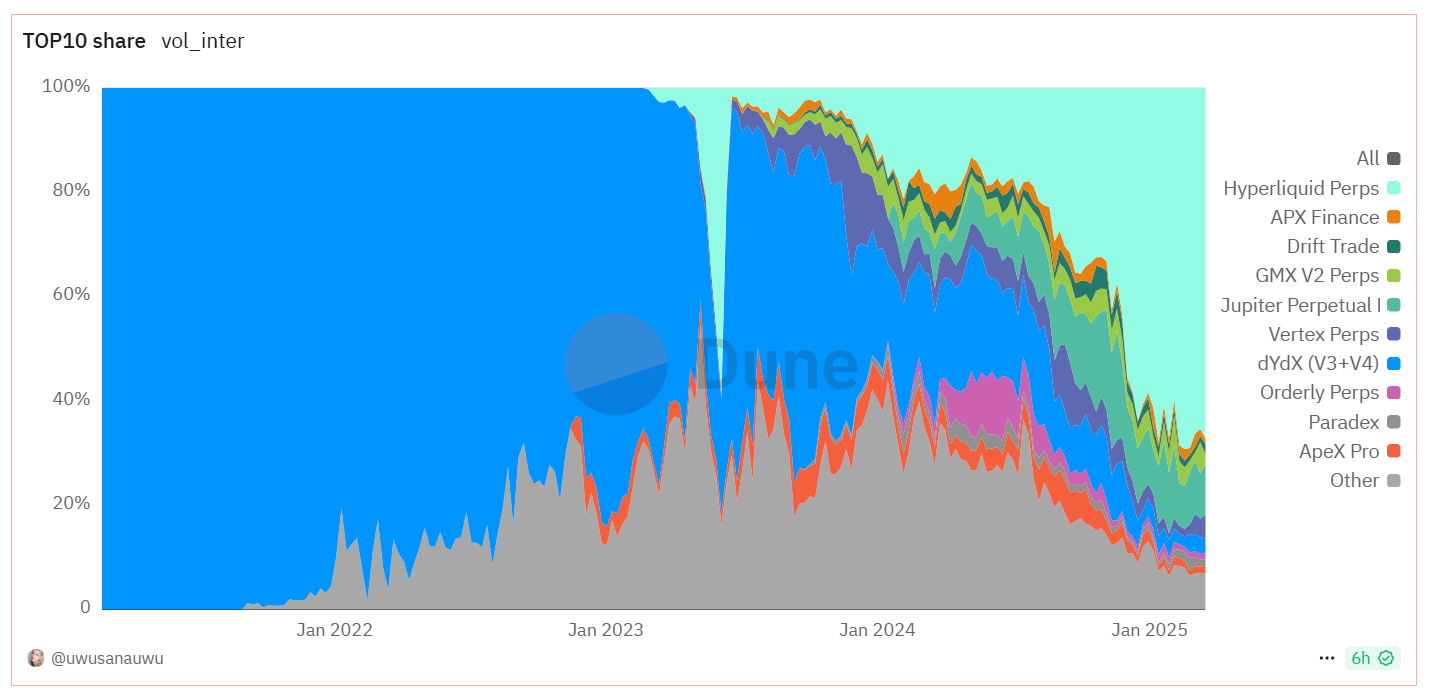

Source: https://dune.com/uwusanauwu/perps

Centralized platforms have long dominated perpetual futures trading due to high liquidity and stable trading experiences. As an early leader in decentralized perpetual trading, dYdX carved out a significant share with its innovative order book model, becoming a pioneer in the space.

With the growing adoption of DeFi, demand for decentralized trading has increased. Emerging platforms like GMX, utilizing AMM models and liquidity pool mechanisms, have delivered simple and efficient trading experiences, attracting substantial users and capital. Jupiter has emerged as a key decentralized derivatives protocol in the Solana ecosystem. In 2023, competition intensified further, with Hyperliquid gaining prominence through high-performance, low-latency trading, drawing many professional traders and gradually establishing leadership. Meanwhile, dYdX began to see declining market share, partly due to rapid competitor growth and challenges encountered during its migration to the Cosmos ecosystem.

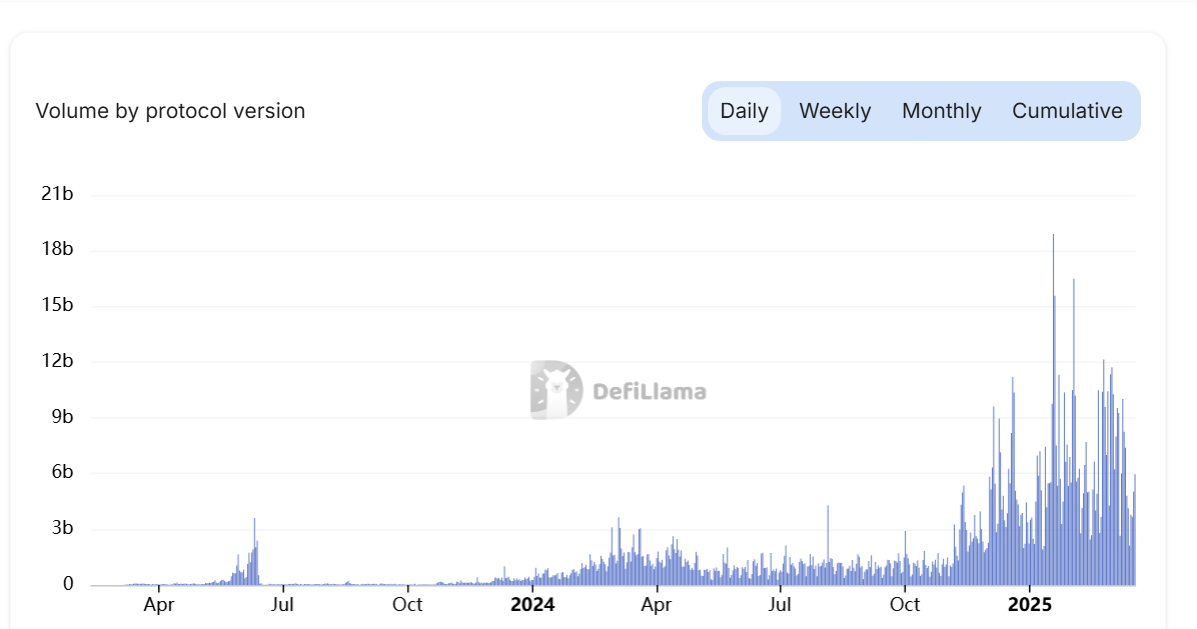

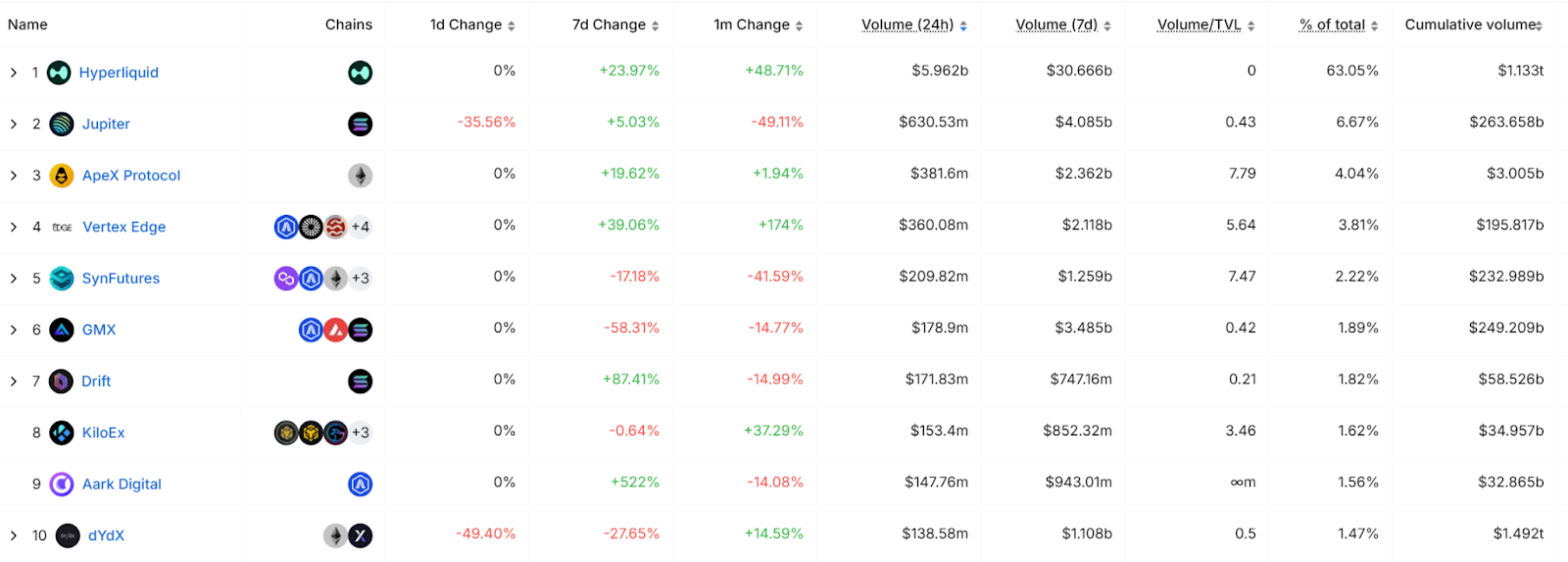

Source: https://defillama.com/perps/hyperliquid

As of March 20, the 24-hour trading volume of decentralized perpetual contracts reached $9.4 billion. Hyperliquid now holds a 63% market share among decentralized derivatives protocols, ranking 15th if compared against centralized exchanges by volume.

Source: https://defillama.com/perps

4. Analysis of Representative Projects

4.1 Hyperliquid

-

Overview: Built on its own Layer 1 blockchain, Hyperliquid operates fully on-chain using an order book model. It uses the official HLP vault to provide liquidity and support liquidations. Users can deposit funds into HLP to earn a share of trading fees, funding fees, and liquidation revenues. HLP effectively acts as a counterparty for certain trades. With a TPS capacity of up to 200,000 and latency as low as 0.2 seconds, Hyperliquid approaches CEX-level performance. The maximum leverage offered is 50x, although following a whale’s liquidation arbitrage event on March 12 that caused approximately $4 million in losses to HLP, Hyperliquid announced reduced caps: 40x for BTC and 25x for ETH.

-

Features:

-

No gas fees for trading, lowering user costs.

-

Proprietary blockchain architecture ensures on-chain transparency and high throughput.

-

Largest decentralized perpetual exchange by trading volume.

-

-

Suitable For: Professional traders seeking low-cost, high-efficiency trading.

4.2 Jupiter

-

Overview: Jupiter is a Solana-based DEX aggregator that also supports decentralized perpetual futures trading with up to 100x leverage. Liquidity is provided by the Jupiter Liquidity Pool (JLP), which serves as the counterparty to traders. When traders open leveraged positions, they borrow tokens from this pool. Seventy-five percent of generated fees are distributed to liquidity providers. Currently, only five assets are supported: SOL, ETH, WBTC, USDC, and USDT.

-

Features:

-

Leverages Solana's high speed and low fees to deliver a CEX-like user experience.

-

Supports diverse trading pairs and leveraged trading.

-

Deep integration with the Solana ecosystem attracts a large user base.

-

-

Suitable For: Solana ecosystem users and novice traders.

4.3 GMX

-

Overview: Deployed across Arbitrum and Avalanche, GMX is a multi-chain decentralized perpetual exchange using an AMM model with up to 100x leverage and support for 67 perpetual contracts. Liquidity is supplied through a community-owned multi-asset pool (GLP). Liquidity providers stake a single asset to receive GLP tokens representing their share in the pool. Platform revenue comes from swaps and leveraged trading, with 30% going to GMX stakers and 70% to GLP holders. GMX V2 replaces the GLP pool with isolated GM pools and introduces incentives via funding fees, borrowing fees, trading fees, and price impact.

-

Features:

-

Liquidity pool design allows users to earn yield by providing liquidity.

-

Low trading fees (0.05%-0.07%), with a portion redistributed to liquidity providers.

-

Strong TVL indicates high user confidence in its liquidity model.

-

-

Suitable For: Traders interested in earning returns through liquidity mining.

4.4 dYdX

-

Overview: Founded in 2018, dYdX initially operated on Ethereum Layer 2 powered by StarkWare. Since 2023, it has migrated to its own blockchain, dYdX Chain, built on the Cosmos SDK and Tendermint Proof-of-Stake consensus. Version 4 employs an on-chain/off-chain hybrid model: order matching occurs off-chain among validators and stored in memory order books, while settlement happens on-chain. Placing and canceling orders incurs no gas fees; fees are charged only upon trade execution, reducing overall trading costs.

-

Features:

-

V4 introduces decentralized off-chain order books with on-chain settlement.

-

Supports up to 20x leverage and 199 assets.

-

Low trading fees (0.02% maker, 0.05% taker), appealing to high-frequency traders.

-

-

Suitable For: Users seeking high-leverage and professional-grade trading experiences.

4.5 Vertex

-

Overview: Vertex is a multi-chain decentralized exchange combining a Central Limit Order Book (CLOB) with an AMM hybrid model. Its order book uses a price-time priority algorithm to ensure optimal execution regardless of whether quotes come from AMM or market makers.

-

Features:

-

Layer 2 technology reduces fees and MEV (Miner Extractable Value) risks.

-

Supports up to 20x leverage and 54 assets.

-

Focused on delivering institutional-grade trading experience.

-

-

Suitable For: Professional traders requiring efficient order matching.

5. Opportunities and Challenges for Decentralized Derivatives Protocols

As a vital branch of DeFi, decentralized derivatives protocols are experiencing rapid development. Market growth, technological advancements, and global accessibility present vast opportunities, yet challenges such as regulatory uncertainty, technical risks, and insufficient liquidity remain significant.

Opportunities

-

Market Growth Potential: As the cryptocurrency market matures and institutional participation increases, demand for derivatives trading continues to rise. Decentralized protocols, with their transparency and security, are well-positioned to attract more users and capture market share from centralized exchanges.

-

Technology-Driven Innovation: Layer 2 solutions (e.g., Arbitrum, Optimism) and high-performance blockchains (e.g., Solana, Sui) have significantly improved transaction speeds and reduced costs. For instance, Hyperliquid achieves 20,000 TPS on its Layer 1, approaching CEX-level performance. In the future, maturing cross-chain technologies and interoperability protocols will further enhance asset mobility and market expansion.

-

Innovative Products and Services: Decentralized protocols can quickly launch diverse financial instruments such as perpetuals, synthetic assets, and options. Future developments may extend into traditional financial derivatives, broadening market reach.

-

Community Governance and Engagement: Decentralized autonomous organizations (DAOs) strengthen user involvement and loyalty. For example, dYdX empowers its community through the dYdX DAO, allowing token holders to vote on protocol upgrades. This model enhances user retention and fosters healthy ecosystem growth.

-

Global Accessibility: Without KYC requirements, any global user with a crypto wallet can access these protocols, greatly expanding market size. This feature is especially valuable in regions underserved by traditional financial services, offering financial freedom and opportunity.

Challenges

-

Regulatory Uncertainty: Divergent regulations across jurisdictions pose legal risks to protocol operations and token issuance. Balancing decentralization principles with compliance requirements increases operational complexity.

-

Technical Risks and Security Vulnerabilities: Smart contract bugs and network congestion represent major threats. For example, Hyperliquid’s recent liquidation incident resulted in ~$4 million in losses, highlighting ongoing technical risks. Network congestion can also cause delays and high fees, degrading user experience.

-

Liquidity Constraints: Compared to centralized exchanges, decentralized protocols typically support fewer assets and suffer from lower overall liquidity, especially for long-tail assets. Fragmented liquidity can result in high slippage and inefficient price discovery.

-

Intensifying Competition: As more protocols enter the space, competition grows fiercer. While Hyperliquid leads in performance, competitors like Jupiter and Vertex continue innovating. Protocols must continuously evolve to maintain their edge or risk losing users.

6. Conclusion

Decentralized derivatives protocols, as a pivotal innovation in DeFi, are reshaping traditional financial derivatives markets through blockchain technology and smart contracts, delivering transparent, secure, and globally accessible trading experiences. Among them, Hyperliquid stands out with its high-performance Layer 1 blockchain, gas-free order book model, and near-CEX trading speed and usability, emerging as the current market leader. Established players like dYdX and GMX maintain competitiveness through strong user bases and high TVL, while Jupiter and Vertex demonstrate growth potential through ecosystem integration and technological innovation. However, compared to centralized platforms, decentralized derivatives protocols still face limitations including fewer supported assets, blockchain performance bottlenecks, and liquidity constraints. Looking ahead, with advances in Layer 2 scaling, high-performance blockchains, and rising user demand, this sector is poised to challenge centralized exchanges further by launching innovative products, improving user experience, and gradually adapting to regulatory frameworks—driving continued evolution of the crypto financial ecosystem.

About Us

Hotcoin Research, as the core investment research hub of the Hotcoin ecosystem, is dedicated to providing global cryptocurrency investors with professional, in-depth analysis and forward-looking insights. We have built a "trend analysis + value discovery + real-time tracking" tripartite service framework. Through deep dives into industry trends, multidimensional evaluation of promising projects, and round-the-clock market volatility monitoring—combined with our weekly《Top Coin Selection》strategy livestreams and daily《Blockchain Headlines》briefings—we deliver precise market interpretations and practical strategies tailored to investors at all levels. Leveraging cutting-edge data analytics models and extensive industry networks, we empower new investors to build foundational knowledge while helping institutional clients capture alpha returns, jointly seizing value-growth opportunities in the Web3 era.

Risk Disclaimer

The cryptocurrency market is highly volatile, and investing inherently involves risk. We strongly advise investors to fully understand these risks and operate within a rigorous risk management framework to safeguard capital.

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

Mail:labs@hotcoin.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News