Deep Dive into the Rise of Stablecoins and Global Financial Transformation

TechFlow Selected TechFlow Selected

Deep Dive into the Rise of Stablecoins and Global Financial Transformation

Stablecoins have the potential to reshape the landscape of global financial transactions, but the key to mass adoption lies in bridging the gap between on-chain ecosystems and the broader economy.

Authored by: Alice, Max, Foresight Ventures

The global financial system is undergoing a profound wave of transformation. Traditional payment networks—burdened by outdated infrastructure, lengthy settlement cycles, and high fees—are facing comprehensive challenges from emerging alternatives: stablecoins. These digital assets are rapidly reshaping how value moves across borders, how businesses transact, and how individuals access financial services.

Over the past few years, stablecoins have continued to evolve and have become a critical underlying infrastructure for global payments. Major fintech companies, payment processors, and sovereign entities are increasingly integrating stablecoins into consumer-facing applications and corporate cash flows. Meanwhile, a new suite of financial tools—from payment gateways and on/off-ramps to programmable yield products—has significantly enhanced the ease of using stablecoins.

This report offers an in-depth analysis of the stablecoin ecosystem from both technical and commercial perspectives. It examines key players shaping the space, core infrastructure enabling stablecoin transactions, and dynamic demand driving adoption. Additionally, it explores how stablecoins are giving rise to novel financial use cases and the challenges they face as they integrate more deeply into the global economy.

1. Why Stablecoin Payments?

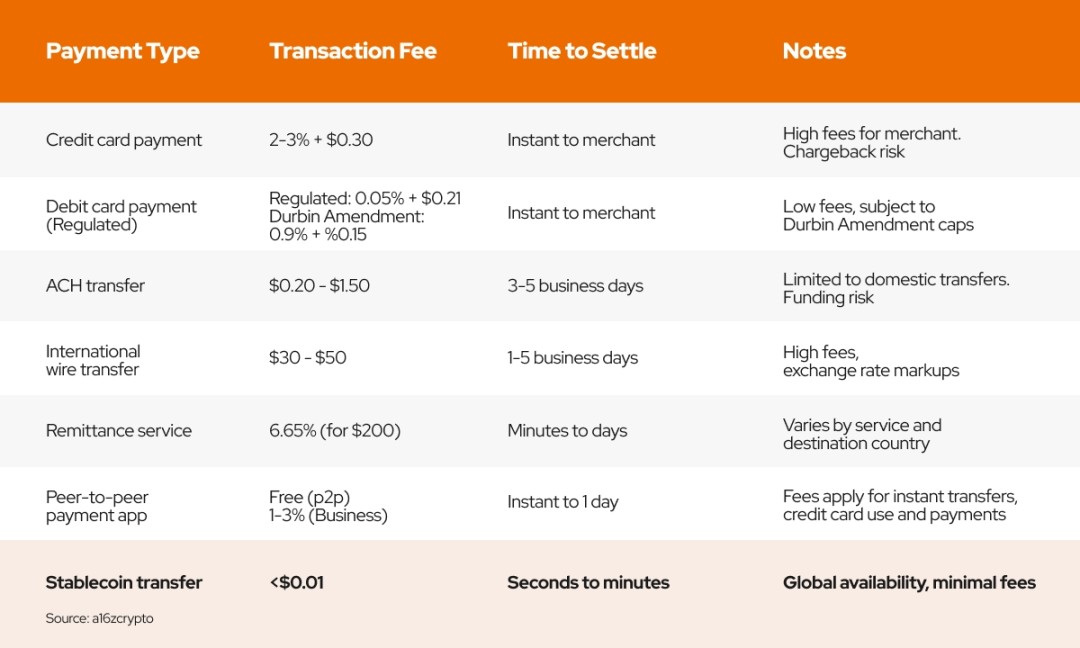

To understand the impact of stablecoins, we must first examine traditional payment solutions. These include cash, checks, debit cards, credit cards, international wire transfers (SWIFT), Automated Clearing House (ACH) systems, and peer-to-peer (P2P) payments. While these methods are embedded in daily life, many—such as ACH and SWIFT—rely on infrastructure dating back to the 1970s. Though groundbreaking at the time, today's global payment infrastructure is largely obsolete and highly fragmented. Overall, these systems suffer from high costs, friction, long processing times, lack of 24/7 settlement, and complex backend procedures. They also often bundle unnecessary additional services—such as identity verification, lending, compliance, fraud protection, and bank integration—at extra cost.

Stablecoin payments effectively address these pain points. Leveraging blockchain technology for settlements greatly simplifies the payment process, reduces intermediaries, enables real-time visibility of fund flows, shortens settlement times, and lowers costs.

The primary advantages of stablecoin payments can be summarized as follows:

-

Real-time Settlement: Transactions settle nearly instantly, eliminating delays inherent in traditional banking systems.

-

Security & Reliability: The immutable ledger of blockchain ensures transaction security and transparency, protecting users.

-

Cost Reduction: Removing intermediaries significantly cuts transaction fees, saving users money.

-

Global Reach: Decentralized platforms can serve markets underserved by traditional finance—including the unbanked—promoting financial inclusion.

2. Stablecoin Payment Industry Landscape

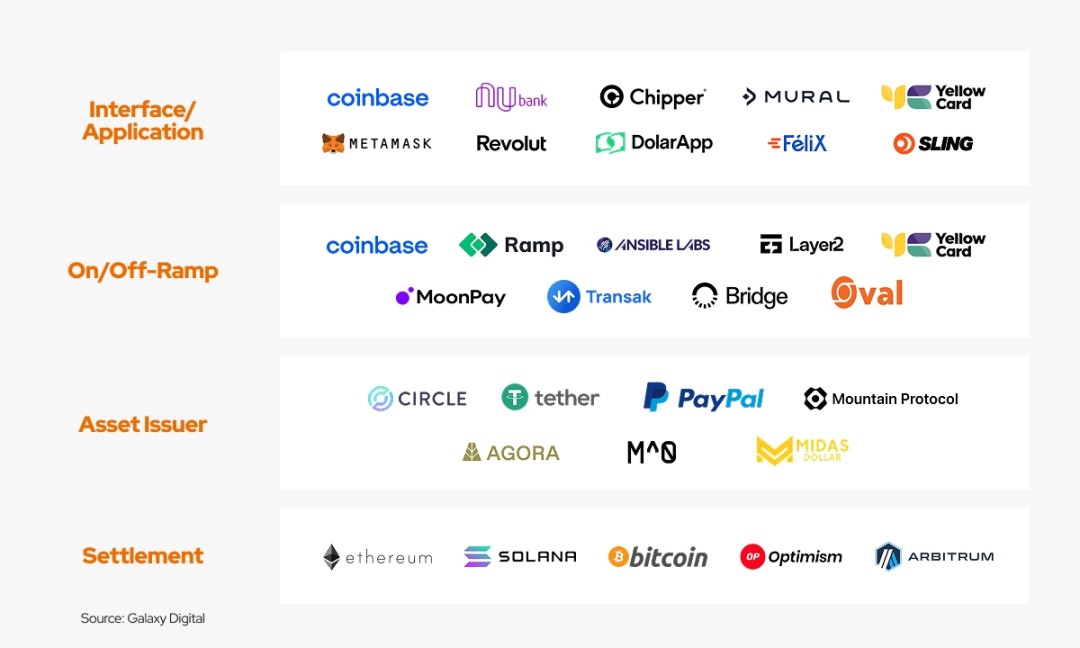

The stablecoin payment industry can be segmented into four technological stack layers:

1. Layer One: Application Layer

The application layer consists primarily of various payment service providers (PSPs) that aggregate multiple independent fiat on/off-ramp providers into unified platforms. These platforms offer convenient access to stablecoins for users, provide tools for developers building on top of them, and offer Web3 users credit card services.

a. Payment Gateways

Payment gateways are services that facilitate secure transaction processing between buyers and sellers.

Notable innovators in this space include:

-

Stripe: A traditional payment provider that has integrated stablecoins like USDC for global payments.

-

MetaMask: Does not directly support fiat exchange but allows users to connect with third-party services for on/off-ramping.

-

Helio: With 450,000 active wallets and 6,000 merchants, Helio leverages Solana Pay plugins to enable millions of Shopify merchants to accept crypto payments and instantly convert USDY into other stablecoins such as USDC, EURC, and PYUSD.

-

Web2 payment apps including Apple Pay, PayPal, Cash App, Nubank, and Revolut now allow users to make payments using stablecoins, further expanding their utility.

The payment gateway domain can be clearly divided into two categories (with some overlap):

1) Developer-focused payment gateways; 2) Consumer-focused payment gateways. Most providers emphasize one category over the other, shaping their core product, user experience, and target market accordingly.

Developer-focused gateways serve enterprises, fintech firms, and corporations seeking to embed stablecoin infrastructure into their workflows. They typically offer APIs, SDKs, and developer tools for seamless integration into existing systems, enabling automated payments, stablecoin wallets, virtual accounts, and real-time settlements. Emerging projects focused on such tools include:

-

BVNK: Offers enterprise-grade payment infrastructure for easy stablecoin integration. BVNK provides API solutions that streamline operations, featuring a cross-border business payment platform and corporate accounts supporting multiple stablecoins and fiat currencies. Its merchant services equip businesses with tools to accept customer stablecoin payments. Processes over $10B in annualized transaction volume, growing at 200% YoY, valued at $750M. Clients span emerging markets in Africa, Latin America, and Southeast Asia.

-

Iron (in beta): Offers APIs to seamlessly integrate stablecoin transactions into existing business operations. Provides enterprises with global on/off-ramps, stablecoin payment infrastructure, wallets, and virtual accounts, supporting customizable workflows such as recurring payments, invoicing, or on-demand disbursements.

-

Juicyway: Offers enterprise payment, payroll, and bulk payout APIs supporting NGN, CAD, USD, USDT, and USDC. Primarily targets African markets; no operational data available yet.

Consumer-focused gateways prioritize end-users, offering intuitive interfaces for stablecoin payments, remittances, and financial services. Features often include mobile wallets, multi-currency support, fiat on/off-ramps, and seamless cross-border transactions. Notable projects delivering simple user experiences include:

-

Decaf: An on-chain banking platform enabling personal spending, remittances, and stablecoin trading across 184+ countries. In Latin America, Decaf partners with local channels including MoneyGram, achieving near-zero withdrawal fees. Has over 10,000 users in South America and is highly regarded among Solana developers.

-

Meso: An on/off-ramp solution directly integrated with merchants, allowing users and businesses to easily convert between fiat and stablecoins with minimal friction. Meso also supports Apple Pay purchases of USDC, simplifying stablecoin onboarding.

-

Venmo: Leverages stablecoin technology within its existing consumer app, enabling users to send, receive, and use digital dollars without directly interacting with blockchain infrastructure.

b. U-Cards

Crypto cards are payment cards allowing users to spend cryptocurrencies or stablecoins at traditional merchants. Typically integrated with legacy card networks like Visa or Mastercard, they automatically convert crypto assets into fiat at point-of-sale for seamless transactions.

Projects include:

-

Reap: An Asia-based issuer serving over 40 companies including Infini, Kast, Genosis Pay, Redotpay, and Ether.fi. Offers white-label solutions, monetizing via transaction revenue sharing (e.g., 85% to partner, 15% to Reap). Partners with Hong Kong banks, covering most regions outside the U.S., supports multi-chain deposits. Achieved $30M in transaction volume in July 2024.

-

Raincards: Based in the Americas, supports card issuance for Avalanche, Offramp, Takenos, and others. Notably serves U.S. and Latin American users. Also issues its own USDC corporate card, enabling businesses to pay travel expenses, office supplies, and daily costs using on-chain assets like USDC.

-

Fiat24: A European card issuer and Web3 bank operating similarly to the above, supporting companies like EthSign and SafePal. Holds a Swiss license, primarily serving European and Asian users. Currently only supports Arbitrum for top-ups. Growth is slow, with ~20,000 total users and monthly revenue of $100K–150K.

-

Kast: A fast-growing U-card on Solana, having issued over 10,000 cards with 5,000–6,000 monthly active users. Reported $7M in transaction volume in December 2024 and $200K in revenue.

-

1Money: Recently launched a stablecoin-enabled credit card and released an SDK for L1/L2 integrations. Still in beta with no public data.

There are numerous crypto card providers, differing mainly in supported regions and currencies. Most aim to offer low fees to end-users to encourage adoption.

2. Layer Two: Payment Processors

As a critical layer in the stablecoin tech stack, payment processors form the backbone of payment rails and fall into two main categories: 1) On/off-ramp providers; 2) Stablecoin issuance coordinators. They act as essential intermediaries connecting Web3 payments with traditional finance throughout the payment lifecycle.

a. On/Off-Ramp Providers

-

Moonpay: Supports over 80 cryptocurrencies and offers diverse on/off-ramp methods and token swaps to meet varied user needs.

-

Ramp Network: Covers 150+ countries and supports on/off-ramps for 90+ crypto assets. Handles all KYC, AML, and compliance requirements, ensuring secure and compliant transactions.

-

Alchemy Pay: A hybrid payment gateway enabling bidirectional conversion and payments between fiat and crypto, bridging traditional and digital asset economies.

b. Stablecoin Issuance & Coordination Platforms

-

Bridge: Core products include a coordination API (for integrating multiple stablecoin payments/exchanges) and an issuance API (for rapid stablecoin creation). Licensed in the U.S. and Europe, with strategic partnerships with the U.S. State Department and Treasury, giving it strong regulatory capabilities and resources.

-

Brale (in beta): Similar to Bridge, Brale is a regulated stablecoin issuance platform offering coordination and reserve management APIs. Holds licenses across U.S. states. Requires KYB for partners and KYC for users via Brale-hosted accounts. Clients tend to be early Web3 adopters (e.g., Etherfuse, Penera). Slightly weaker than Bridge in terms of investor backing and business development.

-

Perena (in beta): Perena’s Numeraire platform lowers barriers for niche stablecoin issuance by encouraging concentrated liquidity in a single pool. It employs a “hub-and-spoke” model where USD* acts as the central reserve asset—the hub—for issuing and exchanging various stablecoins (the spokes). This design enables efficient minting, redemption, and trading across jurisdiction- or asset-specific stablecoins through USD*, avoiding fragmented liquidity pools. The architecture aims to enhance price stability, reduce slippage, and enable seamless stablecoin interoperability while maximizing capital efficiency.

3. Layer Three: Asset Issuers

Asset issuers create, maintain, and redeem stablecoins. Their business model typically revolves around balance sheets—similar to banks—accepting deposits and investing funds in high-yield assets like U.S. Treasuries to earn interest spreads. Innovation in this layer falls into three tiers: statically collateralized stablecoins, yield-bearing stablecoins, and revenue-sharing stablecoins.

1. Statically Collateralized Stablecoins

First-generation stablecoins introduced the foundational model of digital dollars: centralized tokens backed 1:1 by fiat reserves held in traditional financial institutions. Key players include Tether and Circle.

Tether’s USDT and Circle’s USDC are the most widely used stablecoins, each backed 1:1 by dollar reserves in their respective financial accounts. These stablecoins are now integrated across multiple platforms and serve as base pairs for much of the crypto trading and settlement activity. Notably, value accrual goes entirely to the issuer—USDT and USDC generate revenue through interest spreads rather than sharing returns with users.

2. Yield-Bearing Stablecoins

The second evolution of stablecoins goes beyond simple fiat-backed tokens by embedding native yield-generation mechanisms. These stablecoins offer on-chain returns to holders, typically derived from short-term Treasury yields, DeFi lending strategies, or staking rewards. Unlike passive static stablecoins, these assets actively generate yield while maintaining price stability.

Prominent protocols offering yield to stablecoin holders include:

-

Ethena ($6B): Issues USDe—a synthetically backed on-chain dollar secured by hedged positions in ETH, BTC, and SOL. Ethena’s unique design enables organic yield for USDe holders via perpetual futures funding rates (currently ~6.00% APY), attracting users through innovative collateral and yield mechanics.

-

Mountain ($152M): A yield-bearing stablecoin offering ~4.70% APY. Users earn daily interest simply by holding USDM in their wallet—an attractive option for those seeking passive income without staking or engaging in complex DeFi.

-

Level ($25M): A stablecoin backed by liquid restaked dollars. Level pioneers a new yield-generation method: lvlUSD secures multiple decentralized networks and captures additional yield, which is then passed on to holders—innovating the stablecoin yield paradigm.

-

CAP Labs (Beta): Building on the anticipated megaETH blockchain, CAP is developing a next-gen stablecoin engine designed to unlock new yield sources. CAP stablecoins leverage external revenue streams—such as arbitrage, MEV, and real-world assets (RWA)—to generate scalable and adaptive returns, traditionally accessible only to sophisticated institutional players.

3. Revenue-Sharing Stablecoins

Revenue-sharing stablecoins incorporate built-in monetization mechanisms that distribute a portion of transaction fees, interest income, or other revenue streams directly to users, issuers, end apps, and ecosystem participants. This model aligns incentives across issuers, distributors, and end-users, transforming stablecoins from passive payment tools into active financial assets.

-

Paxos ($72M): Announced USDG in November 2024 under Singapore’s upcoming stablecoin regulatory framework. Paxos shares yield and interest from reserve assets with partners who expand network utility—including Robinhood, Anchorage Digital, and Galaxy—extending the revenue-sharing model through collaboration.

-

M^0 ($106M): Founded by former MakerDAO and Circle veterans, M^0 aims to serve as a simple, trust-minimized settlement layer enabling any financial institution to mint and redeem its revenue-sharing stablecoin "M." The protocol shares most interest income with approved distributors ("yielders"). A key differentiator is that "M" can also serve as raw material for other stablecoins (e.g., Noble’s USDN).

-

Agora ($76M): Like USDG and "M," Agora’s AUSD shares revenue with integrated apps and market makers. Backed strategically by Wintermute, Galaxy, Consensys, and Kraken Ventures. Agora’s rev-share ratio isn’t fixed but favors returning most proceeds to partners.

4. Layer Four: Settlement Layer

The settlement layer forms the foundation of the stablecoin tech stack, ensuring transaction finality and security. It comprises payment rails—blockchain networks—that process and validate stablecoin transactions in real time. Today, several prominent L1/L2 networks serve as key settlement layers for stablecoin transactions:

-

Solana: A high-performance blockchain known for exceptional throughput, fast finality, and low fees. Solana has emerged as a critical settlement layer for stablecoin transactions, especially in consumer payments and remittances. The Solana Foundation actively encourages developers to build on Solana Pay and hosts PayFi conferences/hackathons to drive off-chain PayFi innovation, promoting stablecoin use in real-world scenarios.

-

Tron: A major L1 player in stablecoin payments. USDT on Tron is widely used for cross-border and P2P transactions due to its efficiency and deep liquidity. Tron focuses heavily on B2C use cases but currently lacks strong B2B support.

-

Codex (beta): An OP L2 designed for cross-border B2B payments. Codex aggregates on/off-ramp providers, market makers, exchanges, and stablecoin issuers to deliver one-stop stablecoin financial services for enterprises. It maintains strong distribution channels and shares 50% of sequencer fees with Circle to capture on-ramp traffic.

-

Noble: A USDC-native chain built for the Cosmos and IBC ecosystems. As the fourth-largest USDC issuance chain, Noble integrates with Coinbase. Projects on Noble can natively mint and transfer USDC across 90+ IBC modular chains (dYdX, Osmosis, Celestia, SEI, Injective) with one click.

-

1Money (beta): An L1 purpose-built for stablecoin payments. Transactions are processed in parallel with equal priority and fixed fees—no reordering or priority gas auctions. The network also offers gasless transactions via ecosystem partners, creating a fair and efficient environment for stablecoin payments.

3. Expanding Stablecoin Use: Serving Non-Crypto-Native Users

1. Current Bottlenecks

-

Regulatory Uncertainty: Banks, enterprises, and fintechs require clearer regulatory guidance before adopting stablecoins at scale to manage risks effectively.

-

User Side: Limited use cases hinder stablecoin adoption among mainstream consumers. Daily payment behaviors are entrenched, and stablecoins have yet to deeply penetrate everyday life. Many users lack practical reasons to hold or use stablecoins.

-

Enterprise Side: Corporate acceptance is crucial for stablecoin adoption. Currently, enterprises face dual challenges of willingness and capability. Some remain skeptical about the safety and stability of stablecoins. Even willing companies may struggle with technical integration, accounting, and compliance hurdles.

Despite these bottlenecks, we believe increasing regulatory clarity—especially in the U.S.—will encourage broader adoption of compliant stablecoins by traditional users and enterprises. While KYC/KYB friction may persist, the long-term market potential is immense.

If we segment the market into 1) crypto-native users and 2) non-crypto-native users, most interviewed projects primarily target the former—on-chain users. The latter remains largely untapped, presenting significant opportunities for innovators to gain first-mover advantage in onboarding new users into crypto.

On-chain, stablecoin competition is already intense. Participants compete by adding use cases, locking up TVL with higher yields, and incentivizing stablecoin holdings. Going forward, success will depend on expanding real-world applications, enhancing interoperability between stablecoins, and reducing friction for businesses and consumers.

2. Enterprise Side: How to Increase Stablecoin Adoption?

-

Integration into Mainstream Payment Apps: Apple Pay, PayPal, Stripe, and others have begun supporting stablecoin transactions. This dramatically expands use cases and significantly reduces FX costs in international payments, offering businesses and users more efficient cross-border experiences.

-

Incentivize Enterprises with Revenue-Sharing Stablecoins: These stablecoins prioritize distribution channels by aligning incentives between stablecoins and apps, creating powerful network effects. Instead of targeting end consumers directly, they focus on financial apps and distribution platforms. Examples include Paxos’ USDG, M^0’s "M," and Agora’s AUSD.

-

Enable Easy Enterprise Stablecoin Issuance: Allowing regular businesses to easily issue and manage their own stablecoins is becoming a key trend. Perena, Bridge, and Brale are pioneers in this space. As infrastructure improves, the trend toward enterprise- or nation-issued proprietary stablecoins is likely to grow.

-

B2B Stablecoin Liquidity & Treasury Management Solutions: Help enterprises securely hold and manage stablecoin assets for working capital and yield generation. For example, Mountain Protocol’s on-chain yield platform offers professional treasury solutions, improving capital efficiency.

-

Developer-Focused (Enterprise) Payment Infrastructure: Many successful platforms position themselves as crypto-native versions of traditional financial services. Currently, enterprises manually coordinate liquidity providers, exchange partners, and local payment rails—inefficient at scale. BVNK solves this by automating the entire payment workflow, integrating local banks, crypto liquidity providers, and fiat off-ramps into a single engine. Instead of managing multiple intermediaries, BVNK routes funds automatically through the “fastest, cheapest, most reliable channel,” optimizing every transaction in real time. As enterprise adoption accelerates, solutions like BVNK will be pivotal in making stablecoin payments frictionless, scalable, and fully integrated with global commerce.

-

Dedicated Settlement Networks for Cross-Border Payments: Purpose-built L1/L2s for B2B or B2C cross-border transactions offer seamless integration and full regulatory compliance, meeting complex enterprise needs. For example, Codex—a dedicated L2 for cross-border payments—aggregates on/off-ramp providers, market makers, exchanges, and issuers into a one-stop stablecoin financial service. Solana strongly supports PayFi; beyond its technical strengths, it actively promotes Solana Pay to partners, Shopify, PayPal, and offline merchants—especially in underbanked regions like Latin America and Southeast Asia. A key trend is that competition among L1/L2 settlement networks is shifting beyond technology to include developer ecosystems, merchant BD, and partnerships with traditional enterprises.

3. Consumer Side: How to Expand to Non-Crypto-Native Users?

As stablecoins become easier to access and embedded in traditional financial apps, non-crypto-native users will begin using them seamlessly—without even realizing it. Just as users today don’t need to understand banking infrastructure to use digital payments, stablecoins will increasingly become invisible infrastructure, powering faster, cheaper, and more efficient transactions across industries.

Embedded Stablecoin Payments in E-commerce & Remittances

Applying stablecoins to everyday transactions is a key driver of adoption—especially in e-commerce and cross-border remittances, where traditional systems are inefficient, costly, and reliant on outdated banking rails. Embedded stablecoin payments offer the following benefits:

-

Faster, Lower-Cost Experience: By removing intermediaries, stablecoins significantly reduce transaction fees and settlement times for merchants and consumers. When integrated into major e-commerce platforms, they can replace credit card networks, enabling instant finality and lower processing costs.

-

Gig Economy, Cross-Border Freelancer Pay, Currency Preservation Needs in LATAM & SEA: These specific use cases create demand for frictionless cross-border payments. Compared to traditional banking and remittance services, stablecoins enable gig workers and freelancers to receive funds in seconds at lower cost—making them the preferred payment method in global labor markets.

As stablecoin payment rails become deeply embedded in mainstream platforms, their usage will extend beyond crypto-native circles. Consumers will soon use blockchain-powered transactions seamlessly in daily financial activities.

On-Chain Yield Products for Non-Crypto Users

Earning yield on digital dollars is another core value proposition of stablecoins—one still underdeveloped in traditional finance. While DeFi natives have long accessed on-chain yields, new products are bringing these opportunities to mainstream users through simplified, compliant interfaces.

The key is introducing traditional finance users to on-chain yield in a seamless and intuitive way. Historically, accessing DeFi yields required technical knowledge, self-custody, and complex protocol interactions. Now, compliant platforms abstract away complexity, offering intuitive interfaces so users can earn yield on stablecoins without needing crypto expertise.

As a pioneer in this space, Mountain Protocol recognizes the democratizing power of on-chain yield. Unlike traditional stablecoins that serve only as mediums of exchange, Mountain’s USDM distributes yield directly to holders by default. With a current ~4.70% APY backed by short-term, low-risk U.S. Treasuries, USDM serves as a dual alternative to traditional bank deposits and DeFi staking. Mountain attracts non-crypto-native users by:

-

Frictionless Passive Yield: Simply holding USDM automatically accumulates yield—no staking, complex DeFi strategies, or active management required.

-

Compliance & Security: USDM undergoes full audits, is fully collateralized, and uses segregated bankruptcy-remote accounts, offering transparency and investor protection comparable to off-chain money market instruments.

-

On-Chain Risk Mitigation: Mountain limits reserves strictly to U.S. Treasuries and establishes USDC-denominated credit lines to minimize risks of bank failure or stablecoin depeg, addressing common concerns of non-crypto users.

Mountain represents a paradigm shift: for individual users, USDM offers low-risk exposure to digital asset yields without DeFi knowledge; for institutional and corporate treasuries, it provides a compliant, stable, yield-bearing alternative to traditional banking products. Mountain’s long-term strategy includes deeper integration with DeFi and TradFi ecosystems, multi-chain expansion, and institutional partnerships (e.g., with BlackRock). These efforts will further simplify access to on-chain yields and accelerate stablecoin adoption among non-crypto users.

Optimizing KYC for Seamless Onboarding

To achieve mass consumer adoption, KYC processes must be drastically simplified while remaining compliant. A major barrier for non-crypto users is cumbersome identity verification. Leading stablecoin payment providers are now embedding KYC directly into their platforms for smooth onboarding.

Modern platforms no longer require standalone verification but integrate KYC into the payment flow. For example:

-

Ramp and MoonPay allow users to complete KYC in real time when purchasing stablecoins with a debit card, reducing manual review delays;

-

BVNK offers embedded KYC for enterprises, enabling quick and secure customer verification without disrupting the payment experience.

Fragmented regulatory frameworks across jurisdictions remain a challenge. Top providers tackle regional differences with modular KYC systems. For instance:

-

Circle’s USDC platform uses tiered verification: users can perform small transactions with basic KYC and unlock higher limits through advanced verification.

In the future, turning KYC into a frictionless, invisible step through automation and optimization will be key to breaking down entry barriers and accelerating mainstream adoption of stablecoin payments.

4. Stablecoin-Native Economy: Will Consumers Skip Fiat?

Although stablecoins dramatically accelerate global payments and save time and money, real-world transactions still rely on fiat on/off-ramps. This creates a metaphorical “stablecoin sandwich” model—where stablecoins merely act as a bridge between fiat currencies. Many stablecoin payment providers focus on fiat interoperability, making stablecoins a temporary transit layer between fiat systems. However, a more forward-looking vision involves stablecoin-native payment service providers (PSPs) that operate natively on stablecoins. This would entail rebuilding the payment system from the ground up—assuming transactions, settlements, and treasury functions occur entirely on-chain.

Companies like Iron are pioneering this space, aiming to build a future where stablecoins are not just bridges between fiat systems but foundational elements of the entire on-chain financial ecosystem. Unlike most solutions that replicate traditional finance tracks using stablecoins, Iron is developing an on-chain-first payment and treasury stack, envisioning a world where funds stay on-chain end-to-end, financial markets achieve true interoperability, and 24/7 real-time settlement occurs on shared public ledgers.

Whether a fully on-chain future is feasible depends ultimately on consumer choice: whether to convert stablecoins back to fiat via traditional rails or keep funds on-chain. Several factors could drive this shift:

1. On-Chain Yield & Capital Efficiency

A compelling reason for consumers to keep funds in stablecoins is the ability to earn passive, risk-adjusted yield directly on-chain. In a stablecoin-native economy, users gain greater control over their capital and can access returns superior to traditional savings accounts almost instantly. But to realize this, users must discover highly attractive yield opportunities, and the protocols offering them must mature to near-zero counterparty risk levels.

2. Reduced Reliance on Custodial Intermediaries

Holding stablecoins reduces dependence on traditional banking relationships. Today, users rely heavily on banks for custody, payments, and financial services. Stablecoins enable self-custody wallets and programmable finance, allowing users to hold and manage funds independently. This is particularly valuable in regions with unstable banking systems or limited financial access. While self-custody is increasingly appealing, most non-crypto-native users either don’t know about it or are cautious about managing funds this way. To advance this model, consumers may demand stronger regulatory safeguards and more robust applications.

3. Regulatory Maturity & Institutional Adoption

As stablecoin regulation becomes clearer and more accepted, consumer confidence in their long-term value preservation will grow. If large enterprises, payroll providers, and financial institutions begin settling transactions natively in stablecoins, the need to convert back to fiat will diminish. Much like the shift from cash to digital banking, once new infrastructure is widely adopted, reliance on old systems naturally declines.

Notably, a transition to a stablecoin-native economy could disrupt many existing payment rails. If consumers and enterprises increasingly store value in stablecoins rather than fiat in traditional bank accounts, it would significantly impact current systems. Credit card networks, remittance firms, and banks rely on transaction fees and FX spreads for revenue. Stablecoins, however, enable near-zero-cost, instant settlements on blockchains. If stablecoins circulate freely within a country’s economy like fiat, traditional payment players could be cut out of the middleman role.

Moreover, a stablecoin-native economy challenges fiat-based banking models. Traditionally, deposits fuel lending and credit creation. If funds stay on-chain, banks may face deposit outflows, weakening their lending capacity and ability to profit from customer funds. This could accelerate financial transformation, pushing decentralized and on-chain financial services to gradually replace traditional banking roles.

Clearly, if incentives favor keeping funds on-chain, a theoretical stablecoin-native economy could become reality. This shift will be gradual—as on-chain yield opportunities grow, legacy banking friction persists, and stablecoin payment networks mature, consumers may increasingly choose stablecoins over fiat, rendering certain traditional financial rails obsolete.

5. Conclusion: How Do We Accelerate Stablecoin Adoption?

-

Application Layer: Focus on simplifying the consumer experience. Build regulation-first stablecoin solutions that offer lower prices, higher asset yields, and faster, more convenient transfers than Web2 payment rails.

-

Payment Processor Layer: Prioritize enterprise-friendly, plug-and-play middleware infrastructure. Due to varying regional licensing and compliance needs, this layer remains fragmented and competitive.

-

Asset Issuer Layer: Actively share stablecoin yields with non-crypto-native companies and everyday users to incentivize holding stablecoins over fiat.

-

Settlement Network Layer: Competition among L1/L2 networks extends beyond technology to include developer ecosystems, merchant BD, and partnerships with traditional enterprises—accelerating stablecoin payments into real-world use.

Of course, widespread stablecoin adoption depends not only on startups but also on collaboration with established financial giants. In recent months, four major financial institutions have entered the stablecoin space: Robinhood and Revolut are launching their own stablecoins, Stripe acquired Bridge to enable faster, cheaper global payments, and Visa—despite its own interests—is helping banks launch stablecoins.

Additionally, we observe Web3 startups leveraging these mature distribution channels by integrating crypto payment products into existing companies via SDKs, offering users both fiat and crypto payment options. This strategy helps solve cold-start problems and builds trust with enterprises and users from day one.

Stablecoins have the potential to reshape global financial transactions—but mass adoption hinges on bridging the gap between the on-chain ecosystem and the broader economy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News