The Turkish lira has depreciated for several consecutive years. When fiat currencies collapse amid crises, can crypto assets become a safe haven?

TechFlow Selected TechFlow Selected

The Turkish lira has depreciated for several consecutive years. When fiat currencies collapse amid crises, can crypto assets become a safe haven?

Looking back over the past five years, whenever Turkey experienced a major fiat currency depreciation crisis, Bitcoin trading volume mostly saw a significant increase.

Author: Weilin, PANews

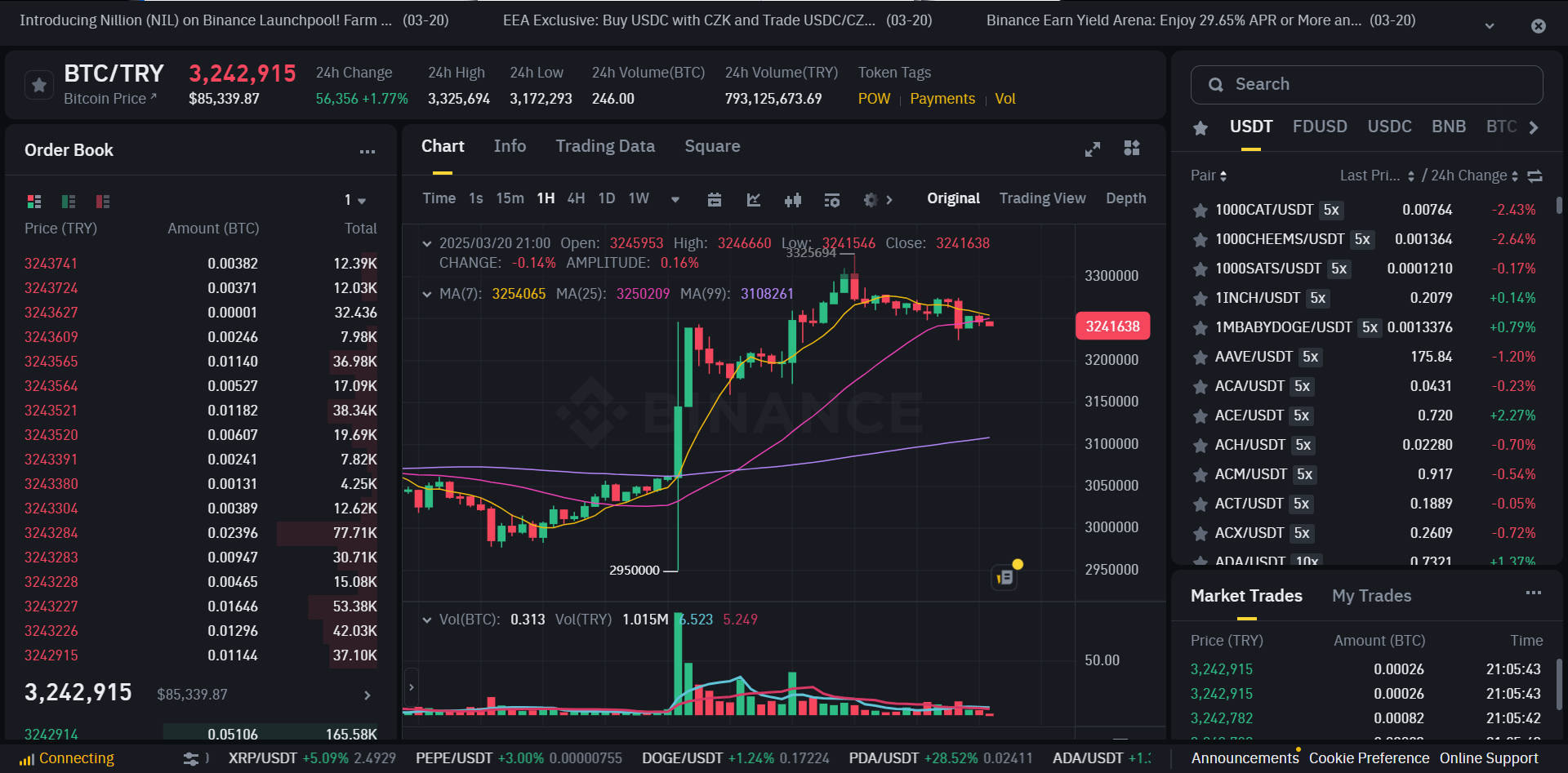

On March 19, Ekrem Imamoglu, the mayor of Istanbul and a political rival of President Erdogan, was arrested, sparking investor panic in Turkey. The Turkish lira plummeted around 4 PM to a new historic low of 41:1 (TRY:USD). About an hour later, a risk-aversion wave hit the crypto market, with trading volume for BTC/TRY surging dramatically on Binance.

Looking back over the past five years, each time Turkey has faced a major fiat currency devaluation crisis, Bitcoin trading volumes have generally increased significantly. Amid increasing global economic volatility, could cryptocurrencies become a financial safe haven for more citizens in countries with unstable currencies?

Amid Political Turmoil, Turkish Lira Hits Record Low While Bitcoin Trading Volume Soars

On March 19, affected by domestic political instability, the Turkish lira (TRY) against the U.S. dollar (USD) briefly fell to an all-time low of 41 TRY per USD, depreciating nearly 10% in a single day. As a direct consequence, capital flowed into the crypto market as a hedge, causing Bitcoin-lira (BTC/TRY) trading volume on Binance to surge sharply. Between 3 PM and 4 PM on March 19, this trading pair reached a volume of 93 BTC—the highest level in at least one year. Meanwhile, partly driven by U.S. macroeconomic policies, Bitcoin’s price also saw significant gains during this period. By 8 AM on March 20, BTC had broken through $87,000, rising 2.78% over the previous day. Some market analysts believe that demand from Turkey helped fuel the rise in BTC/USD.

Following this event, Michael Saylor, founder of Strategy, posted a chart of the lira's depreciation on social media platform X, urging people to "try Bitcoin," further drawing attention to BTC as a store of value.

Against the backdrop of sharp lira depreciation, investors are rapidly turning to Bitcoin and stablecoins in search of more stable value storage. This is not an isolated case. Over the past five years, every time Turkey has experienced a currency crisis, local trading volumes for Bitcoin and stablecoins have generally spiked, highlighting the role of cryptocurrencies as a "safe haven" in nations suffering from monetary instability.

How Did BTC/TRY Trading Volume and Bitcoin Perform After Lira Depreciations Over the Past Five Years?

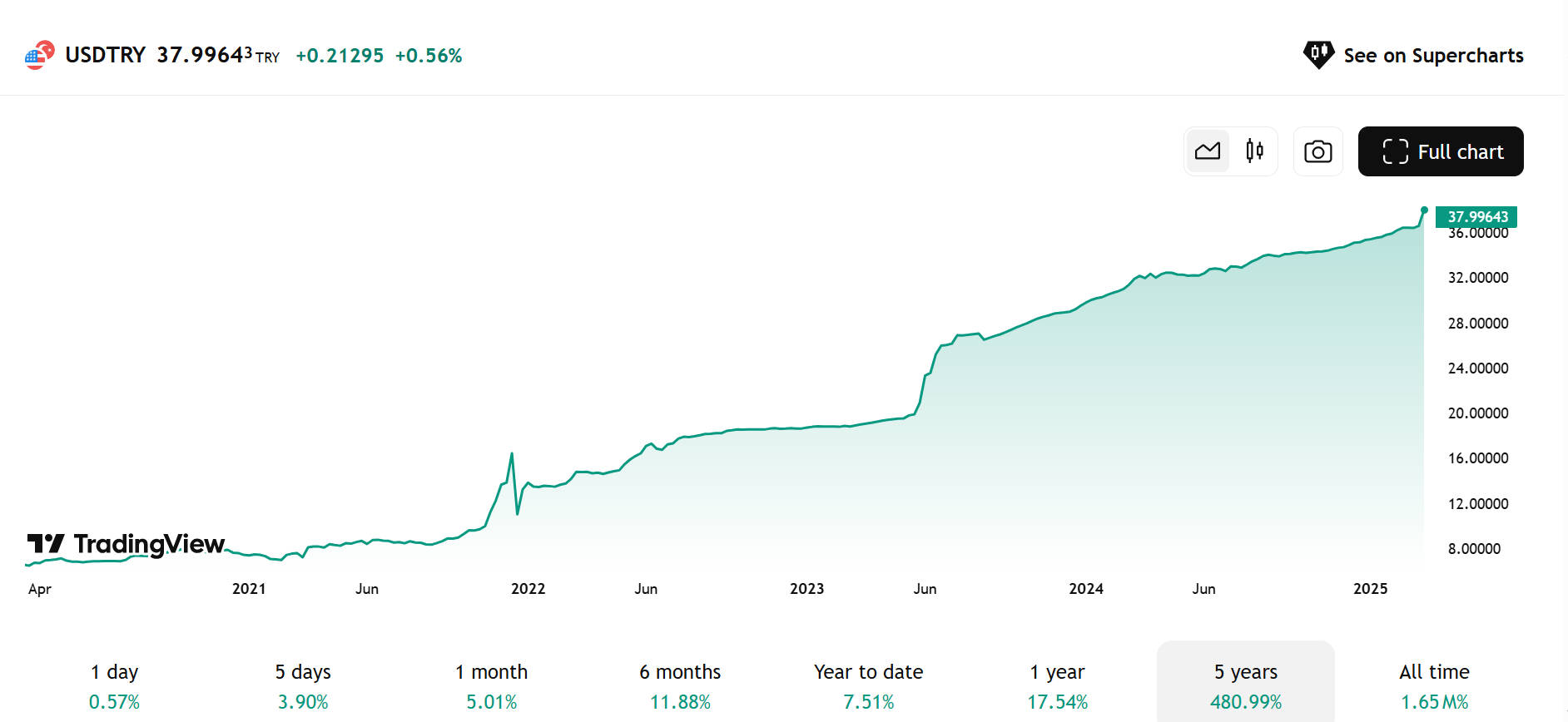

From 2020 to 2025, the USD/TRY exchange rate shows a continuous decline in the lira's value.

In recent years, the Turkish lira has suffered several notable downturns against the U.S. dollar.

2020: Global Pandemic Shock and Policy Missteps — Lira Falls Below 7 Per Dollar

In 2020, the outbreak of the global pandemic severely impacted emerging markets. Turkey’s foreign exchange reserves rapidly declined, while the Erdogan government maintained its low-interest-rate policy, accelerating capital outflows. By late July, the lira broke through the 7:1 threshold against the dollar. According to Binance data, BTC/TRY daily trading volume rose from 43.79 BTC on July 21 to 60.33 BTC on August 21. On November 7, the lira further weakened to 8.43:1 against the dollar. That year, the lira depreciated nearly 26% cumulatively.

Bitcoin performed strongly in 2020, climbing from $7,194 at the beginning of the year to $28,990 by year-end—an increase of 303%. Although the "March 12 crash" brought BTC down to $4,106, its subsequent robust recovery reaffirmed Bitcoin’s potential as an inflation-resistant asset.

2021: Central Bank Turmoil Triggers 17% Single-Day Drop in Lira

In 2021, Turkey’s financial markets plunged into a crisis of confidence. On March 20, central bank governor Naci Agbal was abruptly dismissed, triggering market panic. On March 22, the lira plunged nearly 17% in a single day, reaching 8.4:1 against the dollar. From then until April 13, daily BTC/TRY trading volume on Binance remained on an upward trend. During the same period, Google Trends data showed a 566% surge in Bitcoin-related searches within Turkey, indicating soaring demand for BTC as a hedge. However, globally, Bitcoin prices did not see a significant rise in March.

On November 23, 2021, Erdogan defended his interest rate-cutting stance and rejected orthodox rate hikes to combat inflation, which had approached 20%. On that day, the lira dropped more than 15%, and by the end of November, it fell below 12:1. On November 24, BTC/TRY daily trading volume surged to 873.52 BTC.

This time, however, Bitcoin did not experience a significant short-term rally in global markets (BTC/USD); instead, it even declined slightly from late November to early December.

For the full year of 2021, the lira depreciated approximately 82%, falling from about 7.43 at the start of the year to around 13.50 by year-end.

2022: Amid Hyperinflation, Crypto Trading Activity Surges

In 2022, Turkey’s inflation rate soared to an 85% two-decade high. Although the government introduced a "lira deposit protection" scheme to stabilize sentiment, investor confidence remained fragile. By mid-December, the lira broke through 18:1 against the dollar, with annual depreciation reaching 39%. A new peak in BTC trading emerged on Binance the following January.

Bitcoin entered a bear market in 2022, declining 64% for the year due to factors such as Federal Reserve rate hikes and the FTX collapse. Nevertheless, Turkish investors remained active in the crypto space. Dogecoin (DOGE) became one of the most popular trading assets, surpassing the combined trading volume of BTC and ETH between October and November 2022, reaching $380 million. Despite warnings from the Erdogan administration urging the public to avoid cryptocurrencies, many citizens continued using them as tools to hedge against inflation.

2023: Post-Election Policy Shifts Fail to Reverse Decline — BTC/TRY Volume Rises

In May 2023, Erdogan secured re-election, and his economic team began adjusting monetary policy, with the central bank implementing aggressive rate hikes. However, due to prior economic damage, inflation remained stubbornly high. By June, the lira had fallen to 23:1 against the dollar, weakening further to 29.5:1 by year-end—a 58% annual depreciation. On June 27, BTC/TRY recorded a daily trading volume of 502.9 BTC.

During this period, the global Bitcoin market rebounded strongly from June to December 2023, rising from $26,800 to $42,300—a 58% gain. This rally was primarily driven by institutional inflows and expectations surrounding ETF approvals. Locally in Turkey, however, Bitcoin’s price appreciation was even more pronounced due to lira depreciation—climbing from 700,000 lira to 1.25 million lira, a 78% increase.

2024: Widening Current Account Deficits — BTC Breaks $100K

In October 2024, a stronger U.S. dollar and elevated energy prices due to the Russia-Ukraine conflict worsened Turkey’s current account deficit. Mid-month, the lira broke through 35:1 against the dollar, with total annual depreciation reaching 19%.

During the same period, Bitcoin initially dropped to $58,000 under pressure from a strong dollar. However, following clarity in U.S. post-election policy and positive developments in the crypto market—including surging ETF trading volumes—BTC repeatedly broke the $100,000 mark. This momentum boosted trading activity in the BTC/TRY pair. For example, Binance data showed increased enthusiasm after the U.S. election, with BTC/TRY reaching a daily volume of 123.23 BTC on December 17.

BTC and Stablecoins: Safe Havens for Citizens in Economies with Unstable Currencies

In economies suffering from hyperinflation and local currency depreciation, BTC and stablecoins are increasingly becoming vital tools for financial protection.

According to a report by CoinGecko, Venezuela’s inflation rate remained at 60% in 2024—down from its 2018 peak but still reflecting severe economic distress. The government-backed Petro cryptocurrency collapsed in 2024, yet trading volumes for Bitcoin and stablecoins surged. In 2024, cryptocurrency usage for remittances grew sharply, with 9% of Venezuela’s $5.4 billion in annual remittances now flowing through crypto channels.

In Argentina, where inflation hit 276% in 2024, Bitcoin has become a key instrument for hedging against peso depreciation. The country’s crypto trading volume reached $91.1 billion between 2023 and 2024, surpassing Brazil to become one of Latin America’s most active crypto markets.

Bitcoin, due to its decentralized nature, fixed supply cap (21 million coins), and censorship resistance, is widely regarded as “digital gold,” suitable for long-term value preservation. Stablecoins like USDT and USDC, being pegged to the U.S. dollar, offer price stability and are better suited for short-term transactions and risk mitigation.

In countries with unstable currencies, BTC and stablecoins form a complementary system: Bitcoin serves as a long-term hedge against inflation, while stablecoins meet immediate liquidity needs. While cryptocurrencies cannot solve fundamental economic problems, they undeniably provide individuals with practical solutions for wealth preservation and transactional continuity during episodes of hyperinflation and exchange rate crises.

Overall, the recent plunge in the lira underscores how, in economies ravaged by hyperinflation, cryptocurrencies highlight their importance as tools for individuals facing financial turmoil. Assets like Bitcoin and stablecoins offer timely and practical solutions for protecting wealth and enabling commerce—especially when traditional money fails. Going forward, cryptocurrencies may become an integral part of the global financial ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News