Turkey Devconnect Chronicles: Ethereum's Stale Narrative, Chaos as the Cryptographic Ladder

TechFlow Selected TechFlow Selected

Turkey Devconnect Chronicles: Ethereum's Stale Narrative, Chaos as the Cryptographic Ladder

This industry emerged at the boundary between order and chaos, moving toward transparency from a state of unease.

Author: @0x_claudia, PKU Blockchain Vice President

*Originally published on TechFlow

Have you ever seen a hillside nearly 90 degrees steep? Marble-paved paths, perpetually congested traffic—Turkish taxi drivers can floor it and rocket up these slopes. Taking a cab in Istanbul is like opening a mystery box; prices fly wildly, speeds are reckless, and sometimes when you open the door, you find a taxi driver actively trading crypto on an exchange.

“I’ve never trusted the lira—I always feel my money could go to zero.” This nation straddling Europe and Asia, commanding the entire Black Sea strait, is undergoing economic deconstruction and reconstruction. And borderless money—and the crypto industry that follows—is turning this ancient Roman capital into a city paved with gold.

During Devconnect, I randomly interviewed 10 taxi drivers, fully participated in 13 side events, and walked hundreds of streets, attempting to physically explore this 99% religiously practicing nation and its blockchain industry—to glimpse today, yesterday, and tomorrow.

I. Volatility and War: The Future of Crypto

Turkey’s official currency, the lira, is experiencing an unprecedented plunge.

Due to its geographical position and global economic trends, economic fluctuations in both Europe and Asia create massive butterfly effects on Turkey’s monetary system. So far this year, the lira has depreciated by over fifty percent. For Turkish locals familiar with crypto, USDT and USDC are undoubtedly the best options.

Interestingly, some people hold stablecoins but don’t venture into other cryptocurrencies. In this nation connecting Eurasia and indeed the globe, many residents simply desire financial stability.

Kucoin released a report in September showing that Turkey’s crypto adoption rate rose from 40% to 52% over the past year and a half. Among the ten drivers I interviewed, five knew about Bitcoin, two held stablecoins or crypto, and one I couldn’t understand due to poor English. When I asked about regulatory compliance, one driver enthusiastically told me that two years ago, the government banned crypto-related payments—but from his suggestive eyes and subtle phrasing, I recalled a familiar slogan from my childhood political textbooks: “Whatever is not prohibited is permitted.”

Getting more animated, he whispered behind his hand: “You know, I have a friend who got sent to jail because his transaction volume was too high.”

A local friend helped me translate a Turkish payment report, which showed explosive growth in ETFs, POS transactions, and bank cards.

-

In September 2023, Turkey recorded 2.1 billion electronic transfer transactions, totaling 3.5 trillion Turkish lira in value.

-

In September 2023, there were 1.5 billion POS transactions, valued at 238 billion Turkish lira.

-

In September 2023, there were 394 million bank cards in circulation. ATMs are everywhere, though exchange rates vary slightly by region.

Similar to South Korea, when discussing meme coins and altcoins, local favorites diverge somewhat from international leaders. The top three locally recognized domestic exchanges among interviewees were: Paribu, Bitci, and BTCTurk.

In Istanbul—the world capital linking continents—BTCTurk advertisements dominate the center of every boarding gate. Queen of cities, cryptocurrency burns bright.

II. Reheating Old Rice: Ethereum’s New Narrative Losing Steam?

From Hong Kong in April, to Paris in July, Singapore in September, and Turkey in November, I’ve attended all Ethereum staking events, while also keeping an eye on ZK, gaming, and other related areas.

Overall, Ethereum’s narrative has reached a dim point after a brief glimmer—it’s hard to find truly shining moments. Many arrive full of hope, only to leave somewhat disappointed.

The Plasma concept has resurfaced, with Vitalik mentioning that Plasma can avoid data availability issues and drastically reduce transaction fees. But it’s essentially reheating old rice—opinions remain divided.

If we categorize the themes of this conference, they’re quite simple: L2 wars and omnichain, Staking and Restaking, and Autonomous Worlds and fully on-chain games.

L2 Wars and Omnichain

At this Devconnect, Layer 2 events took center stage.

Beyond established public chains like Polygon, Arbitrum, and Zksync, projects such as Starknet, Linea, Scroll, Taiko, and Manta each brought unique strengths. Unlike before, when competition focused purely on performance, L2 rivalry now extends beyond infrastructure—increasing emphasis is placed on commercialization and user acquisition.

Many early-stage funds have already abandoned investments in infra and oversaturated Layer 2 projects, shifting focus to consumer applications. Like ghost cities in real estate, many blockchains today lack apps and users—just a bunch of nodes. The old playbook—launching Odyssey campaigns, attracting farming studios, pulling in projects via grants, then issuing tokens—is well known. Public chain ecosystems urgently need fresh strategies.

ZK remains a key catalyst across Layer 2. Moreover, many project teams now say they’re hesitant to fully commit to a single L2, opting instead for multi-chain deployments and diversified node distribution. Omnichain appears to be an increasingly dominant trend. Developers play a crucial role throughout this process.

Most agree that public chains led by Western and Indian teams are more open, foster stronger community concepts, and exhibit better service-oriented equality, whereas certain Chinese-led projects are very closed-off, resembling agencies, making it difficult for them to thrive.

Despite low expectations for Linea following MetaMask’s announcement against token issuance, the Linea team actually stood out during the event.

Meanwhile, major exchanges are actively launching new public chains. OKX announced a Layer 2, X1, developed in partnership with Polygon. Sources indicate Foresight is also preparing to launch a new public chain.

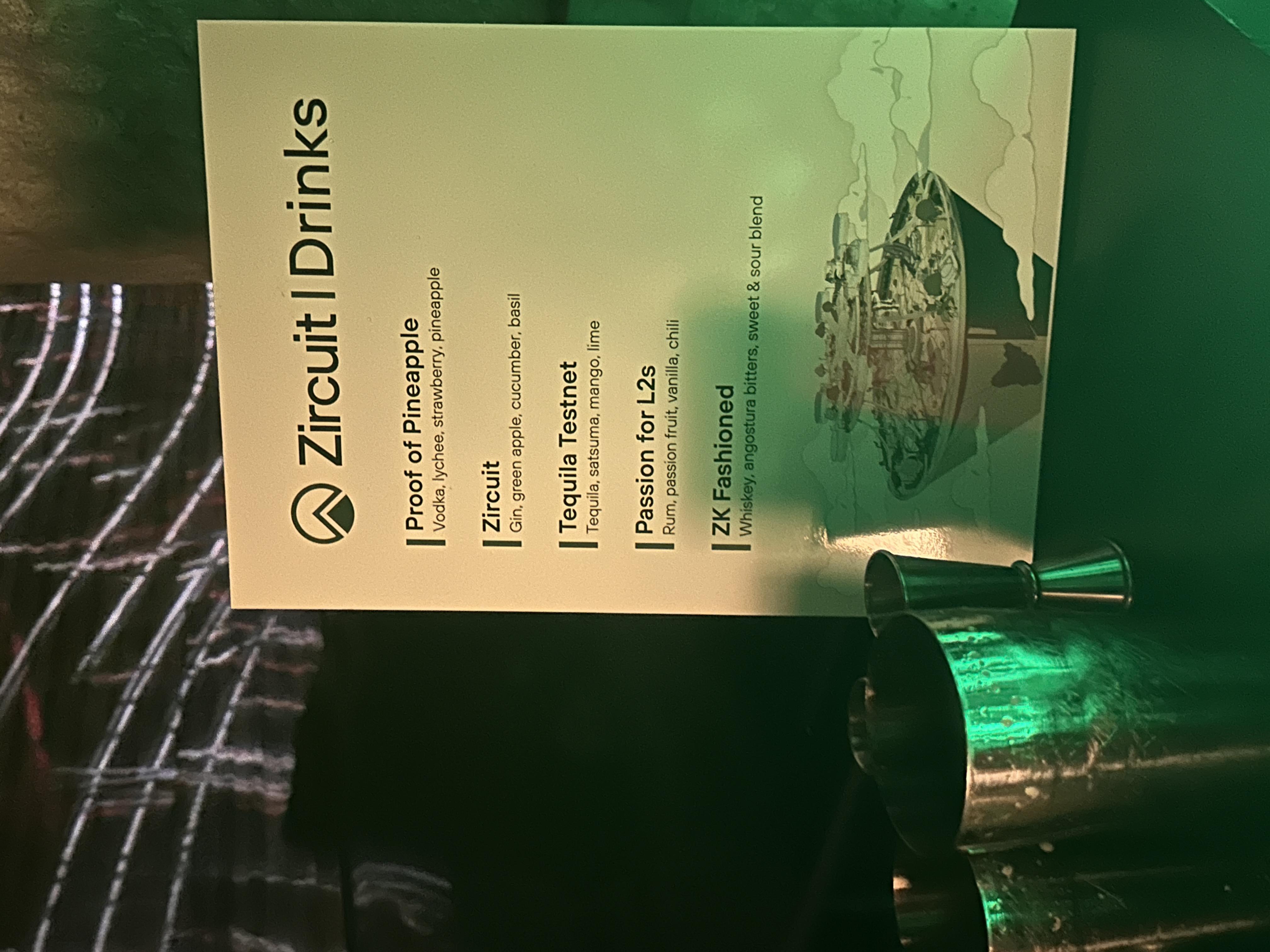

Finally, Taiko drew widespread attention with its entire team dressed in pink, while Zircuit’s dungeon-themed event received broad acclaim.

The traditional side-event format of Panel + Networking no longer attracts seasoned global crypto attendees. Not only must narratives innovate, but event formats must too!

Staking and Restaking

Staking played a major role at this event, with the Staking Summit lasting two days followed immediately by the Restaking Summit.

Buzz, Word, and other institutional staking players began entering the space, and decentralized staking emerged as a key discussion topic. Risks around validator centralization and consensus-layer burdens—previously highlighted by Vitalik—are now being gradually addressed. During this process, DVT technology advanced, and infrastructure services like SSV and Obol enabling validator layer development started gaining traction. The entire staking ecosystem is growing rapidly. Although Ethereum’s current staking rate hovers around 20%, many believe yield-bearing Ethereum will define the next generation of money.

EigenLayer also performed impressively, with restaking progress particularly encouraging. According to incomplete statistics, EigenLayer’s ecosystem already includes 58 projects—a scale of activity rivaling some entire public chains.

From LSD and LSDFi, to LST and LSTFi, to newly emerging concepts like LRT (Liquidity Restaking Token) and LRTFi appearing repeatedly at this event, DeFi legos in staking continue stacking higher. At one staking event, I even witnessed two founders building Index LSTs staring awkwardly at each other. Whether it’s tired models like CDPs or lending, once EigenLayer’s mainnet launches next year, a new war for deposits is inevitable.

Layer upon layer, another layer. As DeFi blocks stack higher, does the thrill and euphoria fueled by leverage conceal new risks?

Notably, a Lido team member told me they’re currently preparing materials for an ETF application. Once conditions allow, yield-bearing Ethereum could become a significant ETF asset.

Autonomous Worlds and Fully On-Chain Games

Before arriving, I didn’t expect the wind behind Autonomous Worlds (AW) and fully on-chain games to blow so fiercely. AW events attracted a majority of participants. When I spoke with friends who attended ETH CC and other Ethereum events, they generally agreed: if there’s any new narrative emerging, it’s Autonomous Worlds.

Within this space, using the MUD engine for fully on-chain game development became a key topic. Projects like Primodium and Redstone sparked extensive discussion, with concepts like OP, Plasma, DA, and L2 pushed to the forefront. In combining AW and fully on-chain gaming, three areas stand out:

(1) Leveraging ZK to ensure fairness and privacy in games, with ZKML and similar computing paradigms opening broader design possibilities;

(2) Integrating DeFi’s financial attributes, drawing from existing tokenomics experience to expand financial interactions;

(3) Community governance, full-stack dApp development, and building hyperapps to provide new governance paradigms for autonomous worlds.

Of course, for many, AW still exists largely at the narrative (narrative) level—every creator is a dreamer and storyteller. When you step deeply into an AW-constructed world, you seem to glimpse the future. But when you step back out, everything feels blank again.

III. Chaos is Ladder: Where Order Collapses, Crypto Flourishes

“Look, people here are literally degens when it comes to crypto, main cause is the high inflation and continues drop in local currency, so anything can generate income for them, they are open for it!”

A Turkish KOL messaged me on Telegram. In Turkey, people don’t trust the lira or banks. They convert savings into gold and land, passing them down through generations.

Another Turkish crypto practitioner told me Turkey has over 80 million people, with 8–10 million crypto holders. Local exchanges Paribu and Btcturk each have over 6 million registered local users. He used to be a CMO at an institution—crypto brought him substantial wealth. Another figure, relayed orally by a friend: 16% of Turkey’s population owns a crypto wallet.

When we look globally, despite repeated crypto winters and market crashes, Argentina in South America sees growing numbers of crypto believers. As South America’s second-largest economy, with inflation nearing 100% in 2022, people are shifting their gaze from dollars to crypto. In hyperinflationary countries, wage increases lag far behind price surges—savings erode quickly, driving demand for stablecoins. War, economic crisis—in places where order collapses, chaos is ladder.

Unlike East Asian cultures, these countries see more bold, creative female entrepreneurs. Perhaps life pushes them to extremes, or perhaps it’s resistance against religious headscarves and moral constraints. Talking with them, I felt the power of life.

Indeed, just like female practitioners seeking opportunities amid adversity, stateless currencies born from chaos are gradually moving from disorder toward order.

In Turkey, almost every crypto practitioner I met holds strong belief in the approval of ETFs. Some say Blackrock’s application is highly professional—they never fight unprepared battles; others analyze that global market sentiment has placed immense pressure on the SEC; a few even claim to have insider information… No matter what, belief is everything.

Currently, while Ethereum’s narrative falters, BTC’s ecosystem shines brighter than ever. For today’s market, more opportunities lie not with large institutional capital or value-focused VCs, but with individuals. Where does Ethereum go from here? What excitement awaits in the next cycle?

This industry rises at the boundary between order and chaos, moving from instability toward transparency.

Just as many local practitioners anticipate mid-2024 crypto regulations, every digital nomad who arrives in Turkey reunites in this ancient Roman capital, recharges their faith, and then disperses back across the globe.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News