Stablecoin market landscape shifts: USDC doubles its share, newcomer USDe surges

TechFlow Selected TechFlow Selected

Stablecoin market landscape shifts: USDC doubles its share, newcomer USDe surges

The stablecoin market has seen significant growth over the past year, with accelerated institutional adoption, the rise of decentralized stablecoins, and持续 increasing on-chain transaction activity.

Translation: Yuliya, PANews

Stablecoins are reshaping the global financial system at an unprecedented pace. According to the "State of Stablecoins 2025" report jointly released by Dune and Artemis, the stablecoin market has seen significant growth over the past year, with accelerating institutional adoption, the rise of decentralized stablecoins, and sustained increases in on-chain transaction activity.

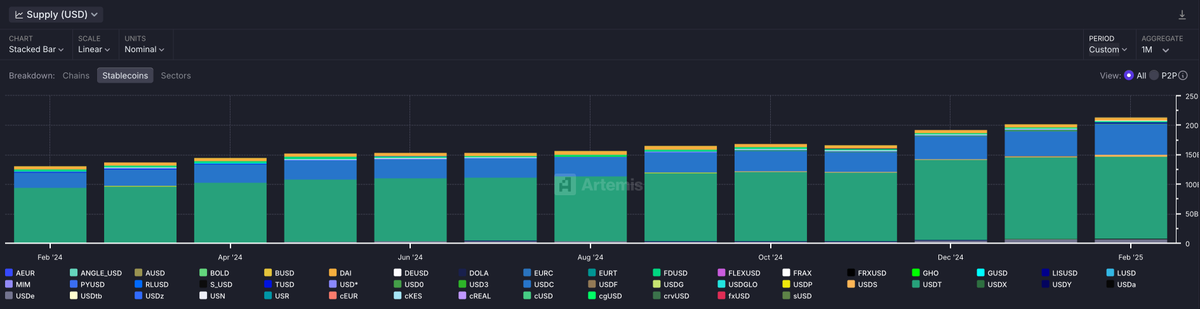

Market Size and Growth Trends

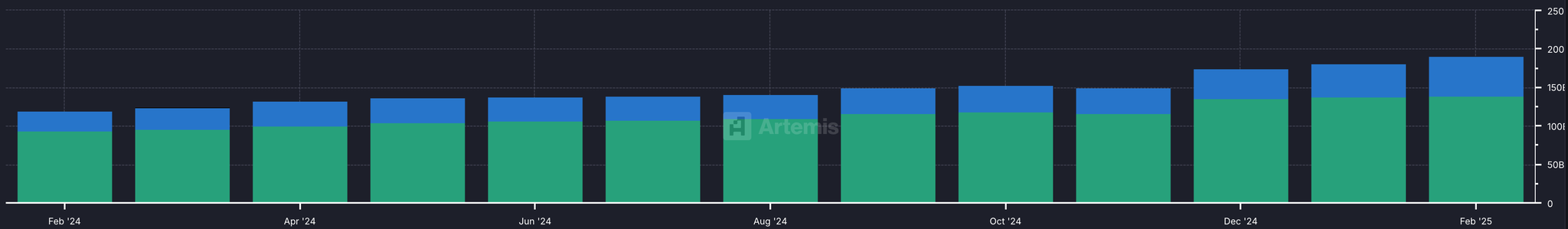

As of February 2025, the stablecoin supply has reached $214 billion, with annual transaction volume hitting $35 trillion—twice that of Visa’s annual volume. Market activity has also surged, with the number of active on-chain addresses increasing by 53% and surpassing 30 million. Institutional capital is flowing in at scale, driving deeper integration between traditional finance (TradFi) and crypto markets.

Shifting Dominance Between USDC and USDT

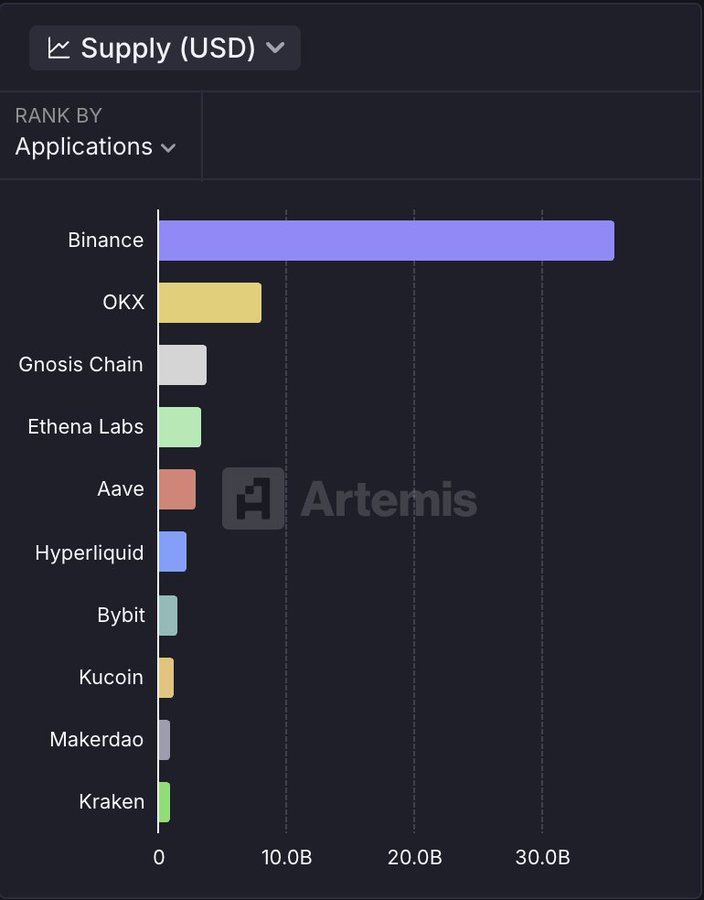

Driven by compliance progress and strategic initiatives, USDC and USDT remain dominant players, though their market shares have experienced subtle shifts.

-

USDC’s market cap doubled to $56 billion, fueled by regulatory approvals under MiCA and DIFC, key strategic partnerships with companies like Stripe and MoneyGram, and rapid global expansion.

-

USDT’s total market cap grew to $146 billion, maintaining its position as the largest stablecoin by market cap. However, its market share has slightly declined due to reduced institutional adoption, as it increasingly focuses on P2P remittance markets to strengthen its role in global payments.

Rise of Decentralized Stablecoins

In the decentralized finance (DeFi) ecosystem, decentralized stablecoins have significantly increased their influence, with several emerging projects achieving breakthrough growth.

-

USDe (Ethena Labs): Market cap surged from $146 million to $6.2 billion, making it the third-largest stablecoin. This growth was driven by its innovative yield-generation strategy and delta-neutral hedging mechanism.

-

USDS (MakerDAO): MakerDAO rebranded to Sky and launched USDS, a compliance-friendly stablecoin. By February 2025, its market cap reached $2.6 billion, enhancing its competitiveness in the decentralized stablecoin space.

Capital Flows and Sector Distribution

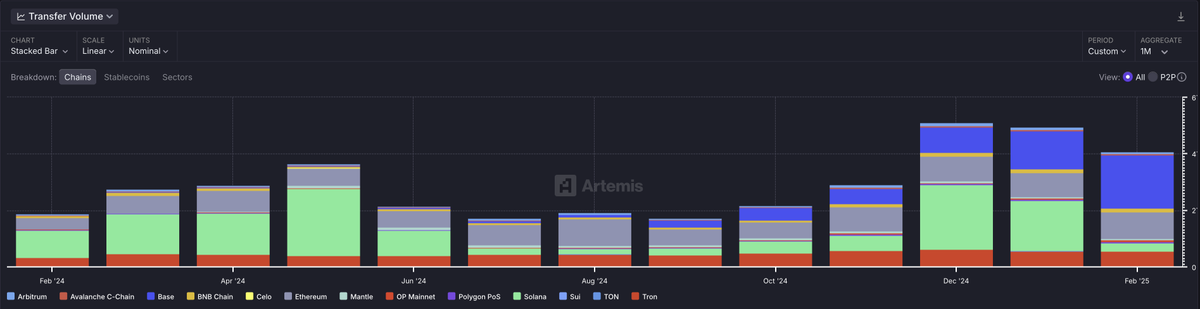

Trends in stablecoin flows reflect the positioning and competitiveness of different blockchains:

-

Ethereum remains the primary issuance platform for stablecoins, holding 55% of total supply.

-

Base and Solana have seen rapid growth in transaction volume, driven by DeFi and meme coin markets, establishing themselves as key ecosystems for stablecoin circulation.

-

TRON continues to dominate global P2P payments and cross-border remittances, especially in emerging markets where stablecoins are widely used for payments and savings.

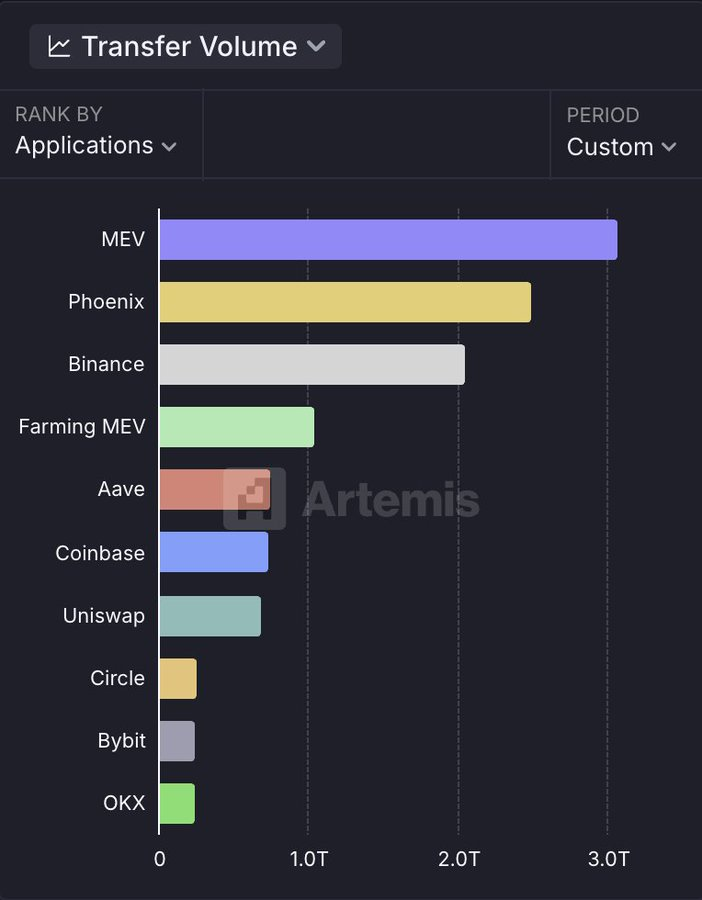

The majority of stablecoin liquidity remains concentrated on centralized exchanges (CEX), while transaction volumes are primarily driven by DeFi activities (DEXs, lending, yield farming), reflecting efficient capital turnover and innovation.

Core Roles and Future Outlook

Stablecoins have become critical infrastructure in the crypto market and are also driving innovation in traditional finance. Industry experts express optimism about their future development:

"Stablecoins are the lifeblood of crypto markets and superconductors for the financial system. They open new markets and financial opportunities, enabling innovations that were previously out of reach."

— Dragonfly General Partner Rob Hadick

"The advantages of stablecoins in cross-border payments are clear. I hope Base supports more local-currency stablecoins so global users can transact on-chain using familiar currencies, improving blockchain adoption."

— Base Product Lead Neodaoist

"Next-generation stablecoins must possess market resilience. The core of USDe is its yield-backed stability mechanism, ensuring users receive a reliable dollar alternative."

— Ethena Labs Research Lead Conor Ryder

"Stablecoin flows depend on infrastructure quality—low cost, fast transactions, and market demand. On Solana, meme coin trading demands high liquidity and instant settlement, making stablecoins indispensable."

— Herd Founder and Data Analyst Andrew Hong

"TRON has become the blockchain of choice for stablecoin transactions, with daily volumes reaching tens of billions of dollars. USDT on TRON enables real-world economic activity, serving as a key tool for payments and savings, especially in emerging markets."

— TRON DAO Community Spokesperson Sam Elfarra

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News