The Crisis Hidden in the Charts: America's Growing "Debt Snowball"

TechFlow Selected TechFlow Selected

The Crisis Hidden in the Charts: America's Growing "Debt Snowball"

DOGE led by Musk has not functioned effectively, and the U.S. government will fall into an economic crisis due to debt.

Author: NOAH SMITH

Translation: Tim, PANews

I know you're already worried about the Trump administration. Trump’s tariff policies are causing stock markets to plummet and consumer confidence to collapse. To appease Putin, Trump has abandoned America's European allies. Musk’s Department of Government Efficiency (DOGE) is recklessly slashing through U.S. government agencies in an attempt to purge left-wing ideologies. Meanwhile, Trump is expanding presidential power, seeking to jail opponents and deport undocumented immigrants.

But unfortunately, I have to add one more item to your list of concerns—because this issue truly matters. With national debt already becoming increasingly unsustainable, Trump and his Republican Party are planning massive new borrowing.

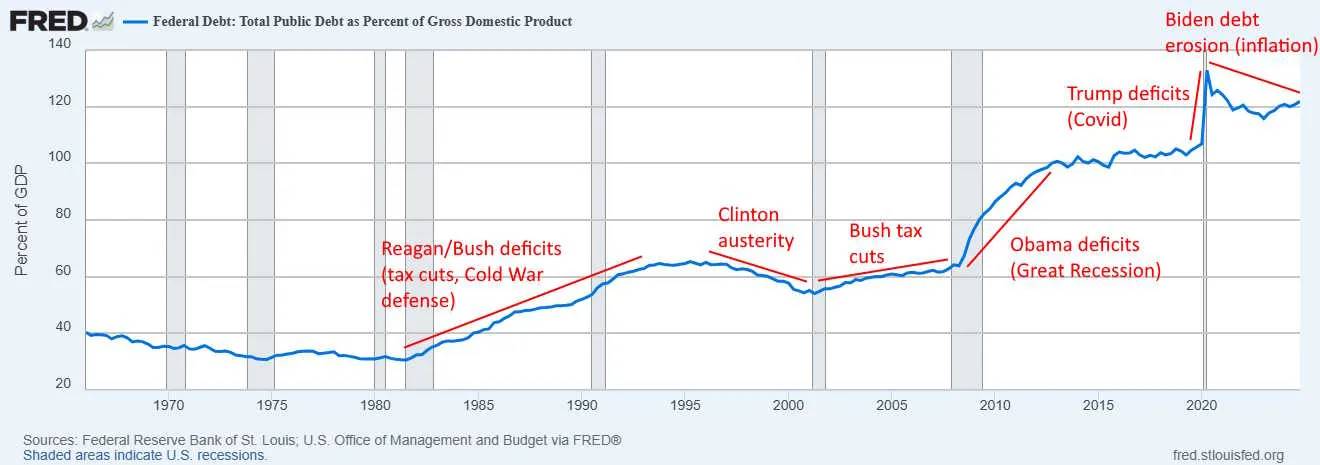

Before explaining why this crisis is so urgent, an important clarification: most of the responsibility for the current debt situation does not lie with Trump alone—both Democrats and Republicans bear nearly equal blame. Below is a brief history of the rise in U.S. federal debt since 1980.

As you can see, surges in U.S. national debt occurred primarily during three periods: first under Reagan and George H.W. Bush in the 1980s and early 1990s, second during Obama’s response to the Great Recession (the subprime crisis), and third during Trump’s first term amid the COVID-19 pandemic. Overall, the long-term rise in U.S. government debt has been driven by two main factors:

-

Major challenges prompting government borrowing (the Cold War, the Great Recession, and the pandemic)

-

Republican administrations cutting taxes without reducing spending

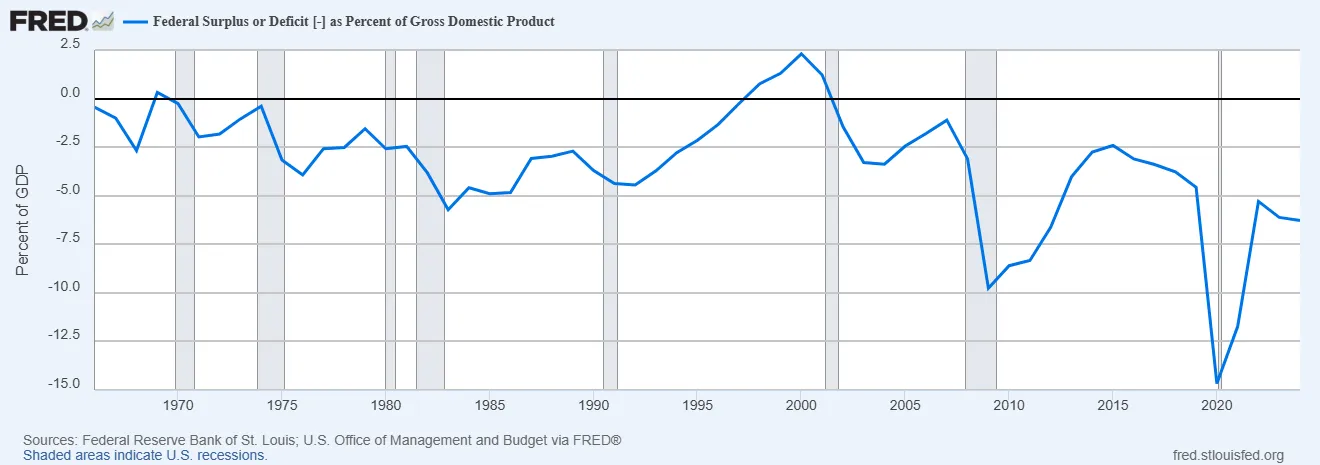

In the 1990s and early 2000s, Democrats were generally the fiscally more responsible party—a pattern broken under Biden. Federal debt burdens did decline under Biden, but only due to soaring inflation. Biden enacted large-scale spending: first on pandemic relief, then on student loan forgiveness and healthcare subsidies. Although pandemic-related spending has ended, other expenditures continue, and Biden has made no effort to pay for them through tax increases. As a result, even as the U.S. economy recovers strongly and pandemic threats fade, Biden continues to borrow at a pace unprecedented for non-recessionary or non-crisis times:

This is clearly unwise. From 2021 to 2022, I paid insufficient attention to the debt problem for three reasons: A) inflation was eroding the real value of debt; B) I expected interest rates to fall; and C) I believed government deficits would be brought under control once pandemic relief spending ended. Most troubling, however, is that the Democratic Party’s core fiscal philosophy has undergone a major shift: from advocating tax increases to embracing unfunded spending programs. It was only later that I realized the severity of the issue and began calling for fiscal austerity.

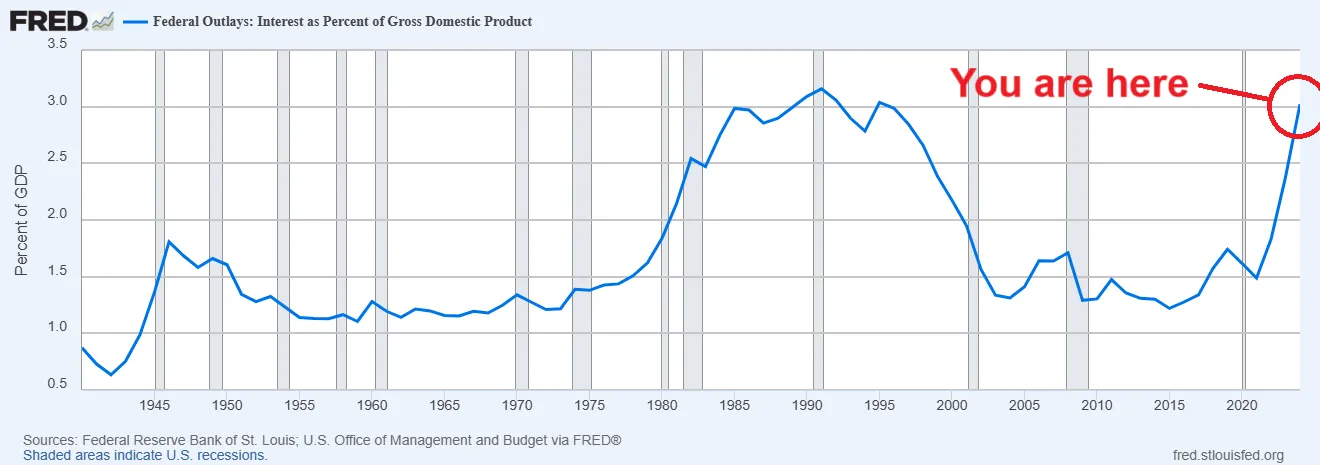

But as the top chart shows, rising interest rates are now directly exposing the debt problem. As the government rolls over its ever-growing stock of bonds, it must refinance them at higher interest rates, causing interest payments as a share of GDP to surge. This interest burden is poised to exceed the historical peak set in the 1990s.

That’s bad enough. But the bigger problem is that Republicans are preparing sweeping tax cuts that will make things far worse—while Musk’s Department of Government Efficiency (DOGE) takes no effective action to control spending. Democrats have become fiscally irresponsible, and even more shockingly, Republicans are not responding with austerity but instead doubling down on profligacy. The result is that the U.S. economy is heading into serious trouble.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News