Data Analysis: Is Trump's Strategic Reserve Plan a Turning Point for Bitcoin's Price?

TechFlow Selected TechFlow Selected

Data Analysis: Is Trump's Strategic Reserve Plan a Turning Point for Bitcoin's Price?

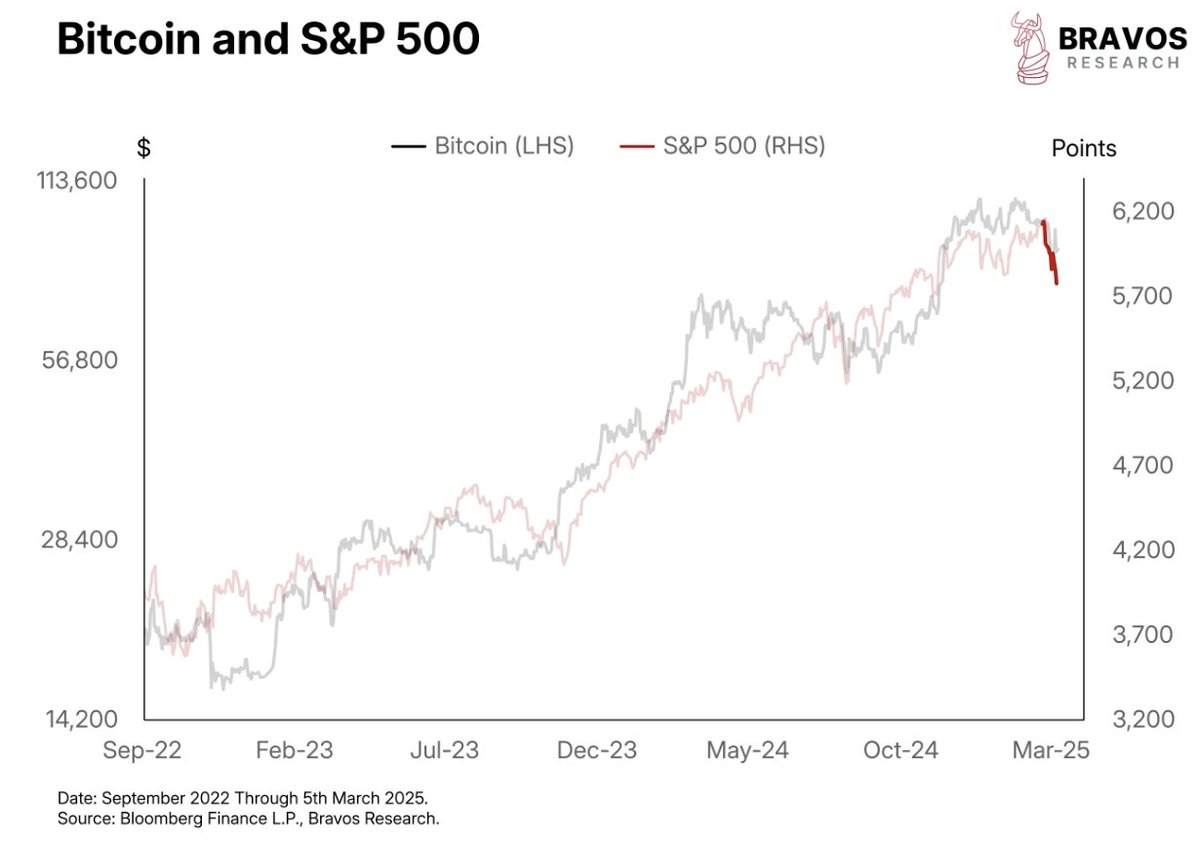

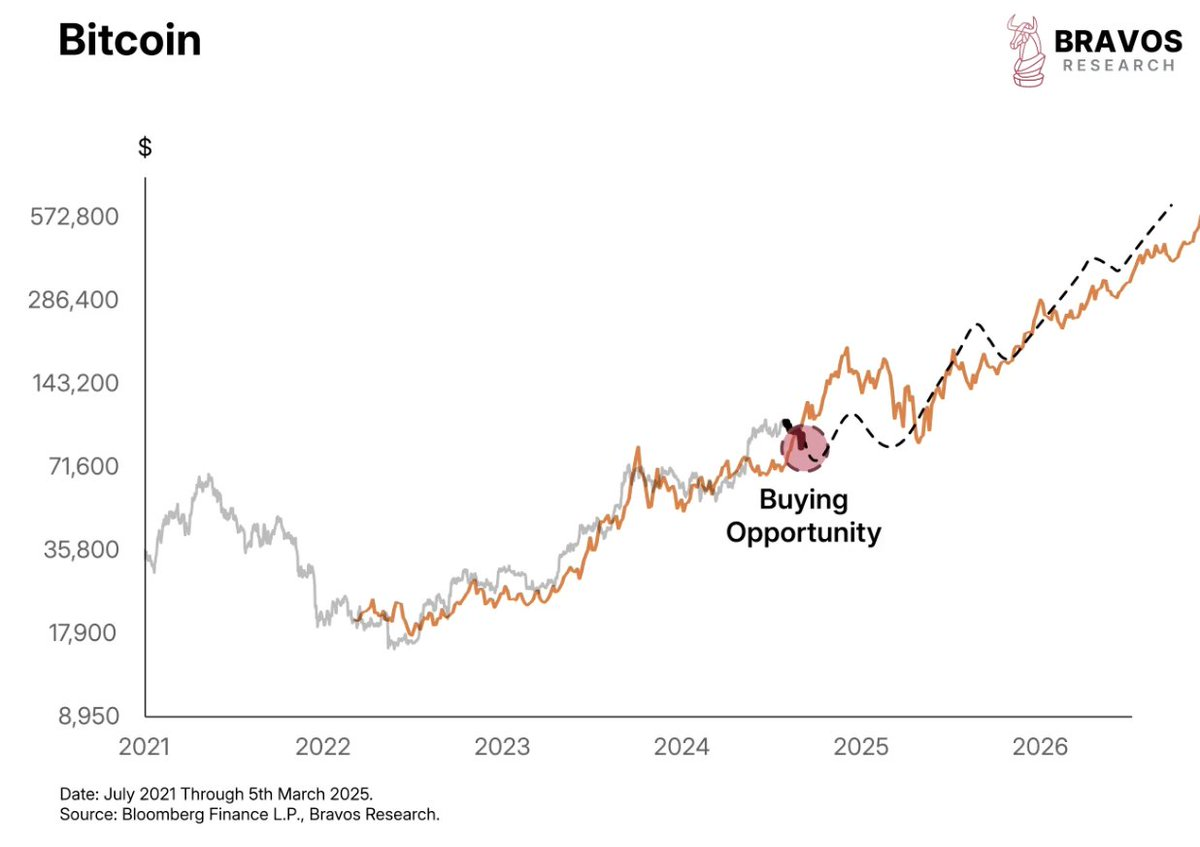

This pullback may be painful, but it does not appear to negate the overarching trend of institutional adoption.

Author: Bravos Research

Translation: TechFlow

Trump officially announces the creation of a Bitcoin strategic reserve—could this be a turning point for Bitcoin?

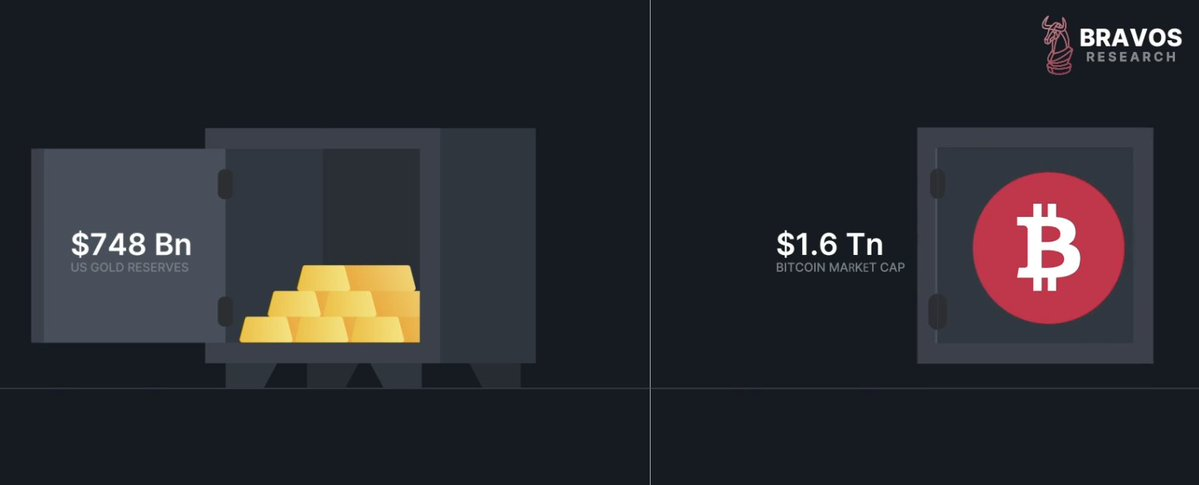

The United States currently holds $748 billion in gold reserves, while Bitcoin's market capitalization is approximately $1.6 trillion.

If governments establish reserves similar to gold holdings, it could drive Bitcoin prices up by 50%.

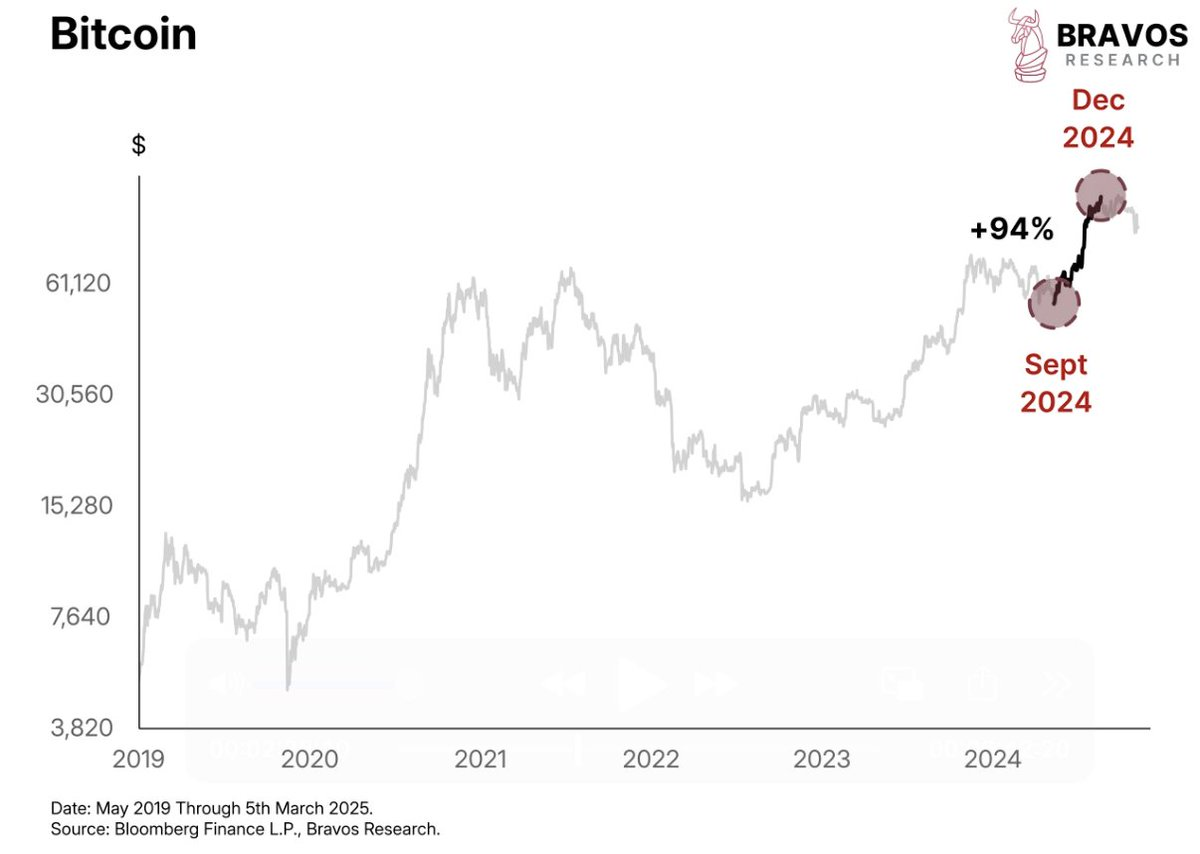

Recall that between September 2024 (before the election) and December 2024 (after Trump’s victory), Bitcoin surged by 94%. At that time, rumors about Bitcoin reserves had already begun to circulate.

This suggests the reserve narrative may have already been priced into the market. Meanwhile, Bitcoin now faces other risks, such as the sharp decline in U.S. equities over the past month.

Nonetheless, we still believe the significance of the reserve announcement could exceed expectations, potentially laying the foundation for a major Bitcoin rally in 2025. After all, the U.S. is not the only country with strategic reserves.

Global gold reserves total around $2 trillion, exceeding Bitcoin’s current market cap. Moreover, U.S. government ownership of Bitcoin adds credibility to the asset class, which thrives on trust and confidence.

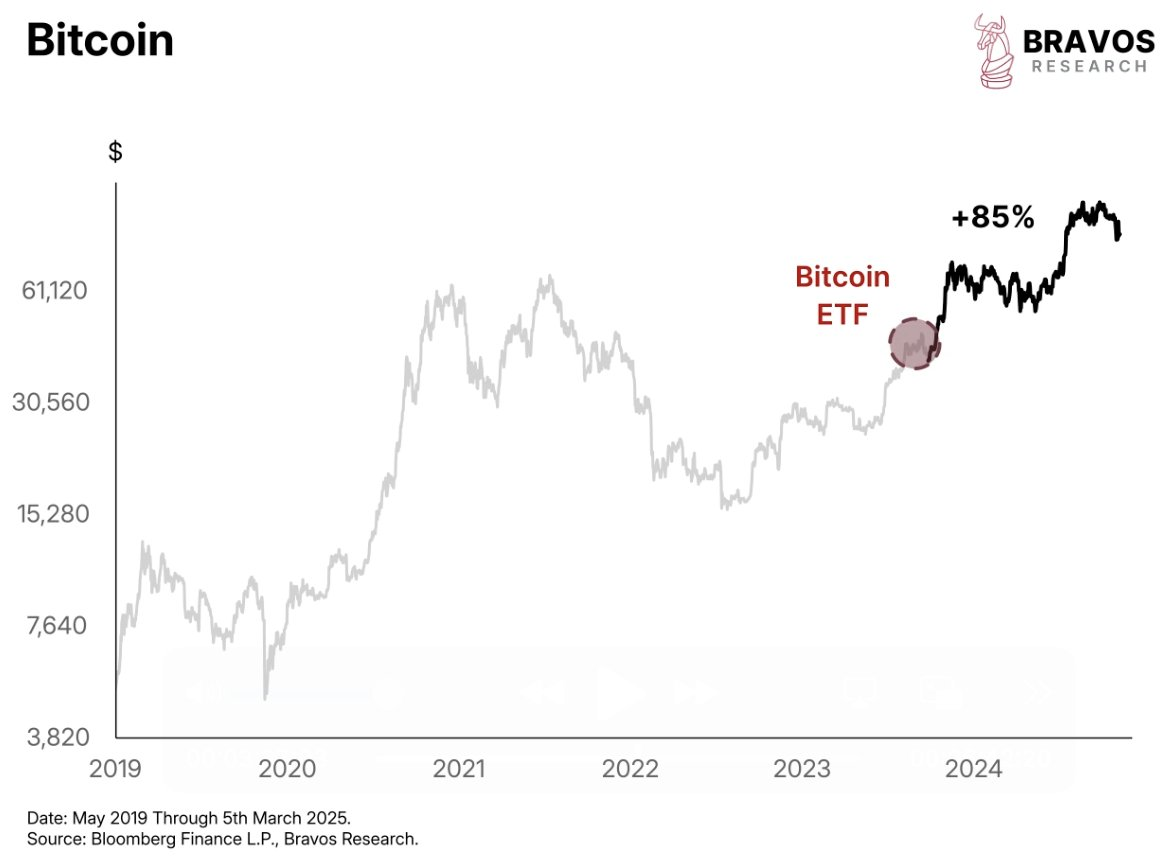

Since December 2022, Bitcoin’s bull market has primarily been driven by institutional adoption. The launch of Bitcoin ETFs in November 2023 triggered massive optimism, fueling an 85% rise in Bitcoin’s price since then.

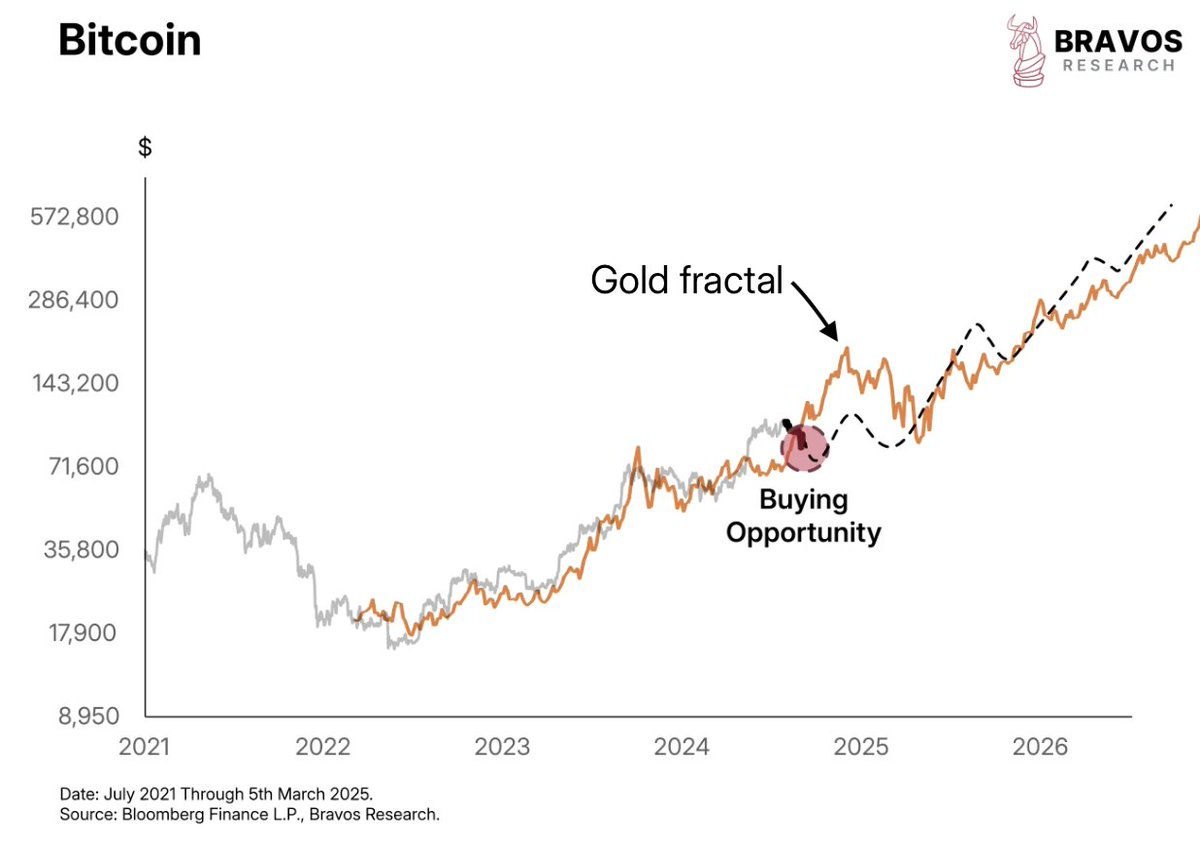

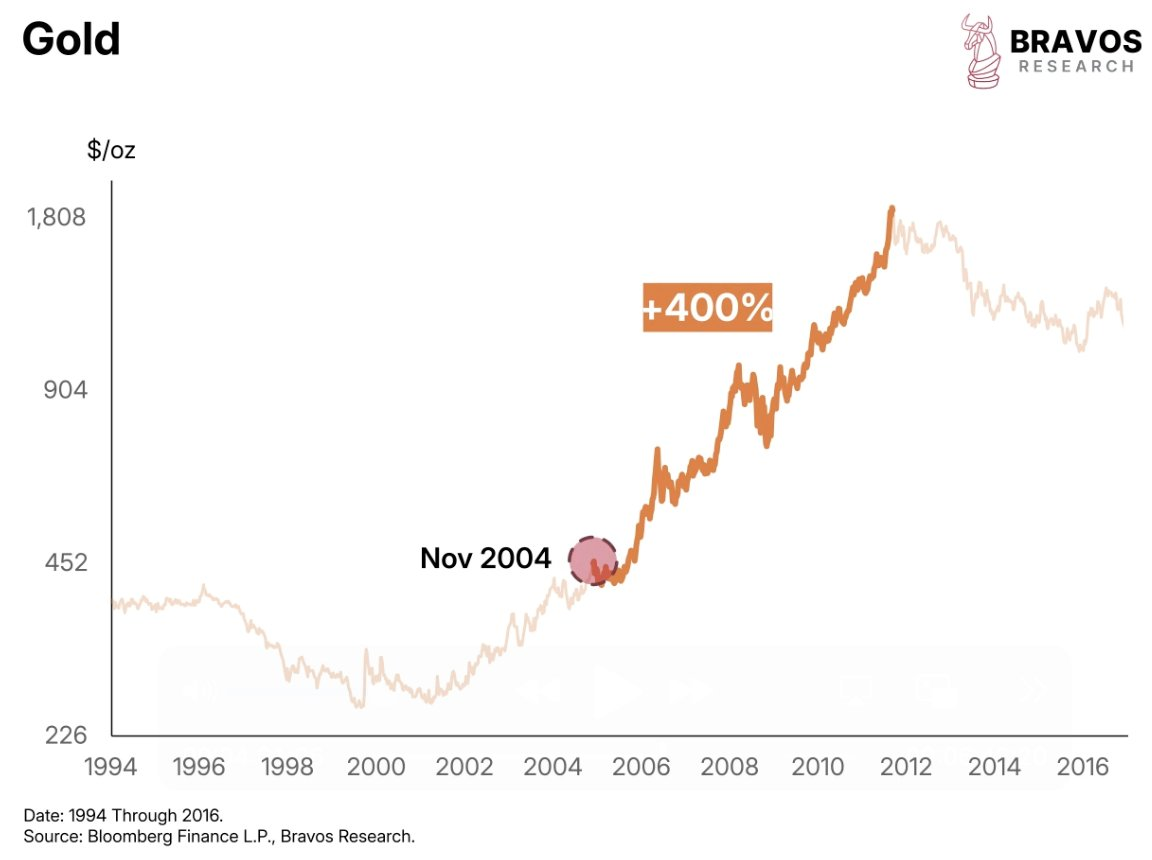

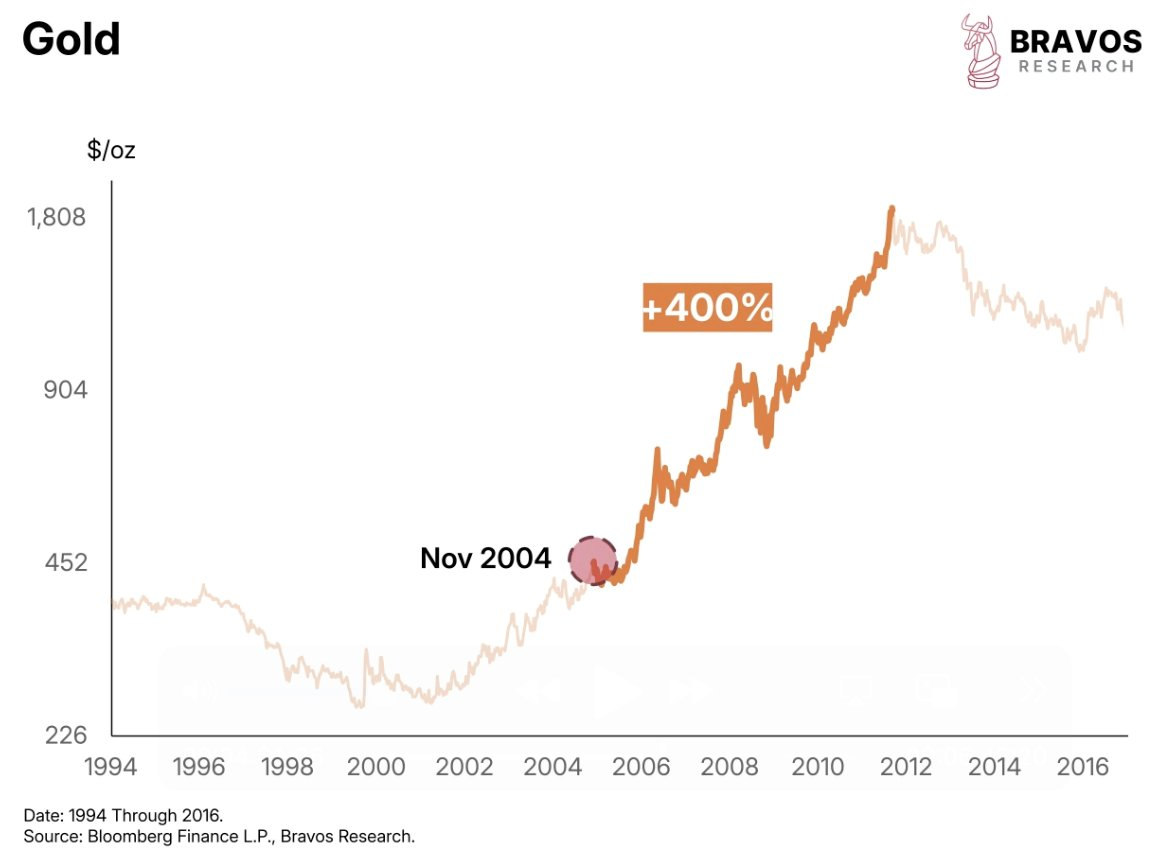

In our view, this closely resembles gold’s adoption pattern in the early 2000s: the debut of the first U.S. gold ETF in November 2004 marked the beginning of a 400% bull run over the following years.

However, gold’s bull market did not happen overnight. The rise was gradual, with multiple pullbacks along the way.

If we compare the 2000s gold bull market with Bitcoin’s current uptrend, the patterns are strikingly similar. This correction may feel painful, but it does not appear to negate the broader trend of institutional adoption.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News