Can Buffett Still Predict a Market Crash? The Legend's Credibility Is Rising

TechFlow Selected TechFlow Selected

Can Buffett Still Predict a Market Crash? The Legend's Credibility Is Rising

Big opportunities don't come often; when gold falls from the sky, use a bucket to catch it, not a thimble.

By BitpushNews Mary Liu

"Be fearful when others are greedy, and be greedy when others are fearful." This simple yet profoundly wise motto comes from Warren Buffett, the 94-year-old billionaire investor.

The market sage known as the "Oracle of Omaha" has once again proven the value of this adage—with what appears to be a prescient anticipation that Donald Trump's policies might bring a storm to Wall Street.

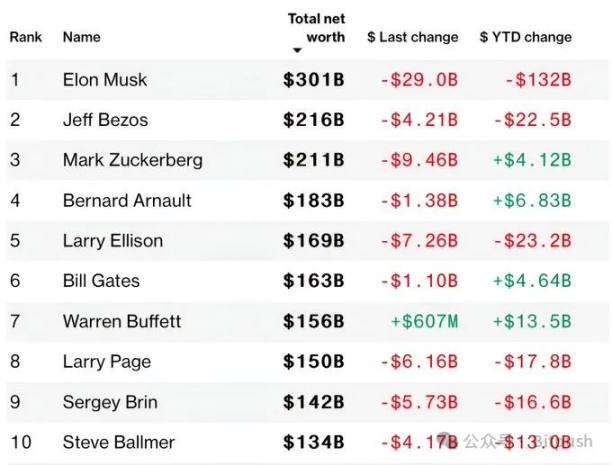

Yesterday, Wall Street suffered a "Black Monday," with markets plunging sharply—validating Buffett’s “prediction.” As fears of an economic recession intensified, investors panicked and sold off en masse. The S&P 500 index dropped more than 9% from its record high on February 19, edging dangerously close to a "correction" (defined as a decline of 10% or more). Among the Top 10 billionaires, only Buffett saw his net worth rise against the tide.

For Buffett, the market crash is yet another confirmation of the foresight and correctness of his investment strategy.

Preparing for a 'Trump Recession'

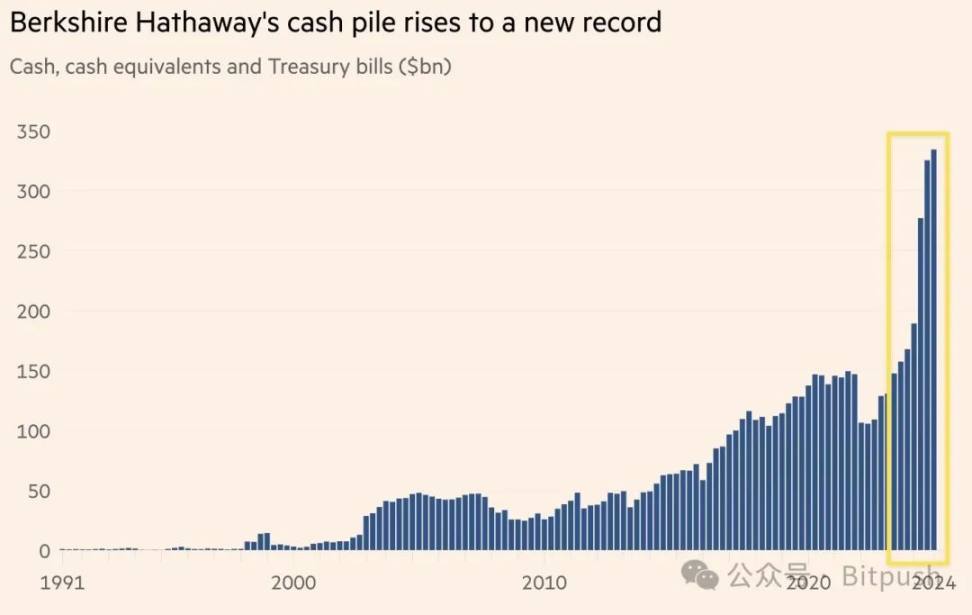

In recent years, Buffett's Berkshire Hathaway has been steadily selling stocks on a scale of tens of billions of dollars, shifting instead into massive cash holdings.

Data shows Buffett has sold more stocks than he has bought for nine consecutive quarters, including significant reductions in stakes in well-known companies. As early as last year—before the Trump administration even took office—Buffett began selling most of his Apple shares and cutting positions in Bank of America and Citigroup.

Over recent months, Berkshire Hathaway’s cash reserves have surged to an astonishing $334 billion, accounting for over one-third of its entire investment portfolio. Remarkably, this cash pile exceeds the combined market capitalization of all companies listed on the UK’s FTSE 100 Index.

Buffett is a quintessential long-term investor who prefers to sit patiently on the sidelines, waiting for the optimal moment rather than chasing market fads and trends.

Despite holding such vast cash reserves, Buffett has clearly rejected the notion that he “prefers cash over stocks.” In his February letter to shareholders, he emphasized: “Although some commentators believe Berkshire’s cash position is unusually large, most of your funds remain invested in equities—and this preference will not change.”

Fear Spreads—Buffett’s Wisdom Becomes Golden Rule Once Again

In times of market volatility, it pays to revisit the advice of this legendary investor.

In his 2017 letter to shareholders, he wrote: “No one can tell you how far stocks might fall in the short term.” But he immediately followed up by urging readers to remember a passage from Rudyard Kipling’s classic poem *“If”*, written around 1895:

“If you can keep your head when all about you / Are losing theirs… If you can wait and not be tired by waiting… If you can think—and not make thoughts your aim… If you can trust yourself when all men doubt you… Yours is the Earth and everything that’s in it.”

Why does staying calm lead to rewards?

It’s important to note that Buffett was referring to major U.S. stock market downturns—such as the bear market between 2007 and 2009, during which the S&P 500 lost over 50% of its value. By comparison, the current pullback pales in magnitude.

In fact, market corrections are a normal part of capital markets. According to Bedel Financial Consulting, the S&P 500 has experienced 21 declines of 10% or more since 1980, with an average intra-year drop of 14%.

Certainly, when markets turn turbulent, predicting the future becomes nearly impossible. As Buffett wrote in 2017:

“No one can tell you when these [plunges] will occur. The light can go from green to red instantly, with no yellow warning.”

Buffett firmly believes that periods of market weakness contain “extraordinary opportunities.” Historical data has repeatedly shown that markets eventually recover their upward trajectory. All value investors need to do is wait patiently and take full advantage of downturns to pick up high-quality assets at bargain prices.

Data from Hartford Funds shows that since 1928, the average U.S. bear market (defined as a drop of 20% or more from recent highs) has lasted less than 10 months. For investors planning decades-long horizons, bear markets are merely brief moments in the grand arc of investing.

Therefore, even amid the fear and pain of a bear market, one must keep sight of the ultimate prize—the long-term financial goals you’re striving for. Continuing to invest during market declines is akin to buying stocks on sale. As long as you maintain a diversified investment strategy, the deeper stocks fall, the better the bargains you can secure.

Buffett’s investment philosophy echoes a famous line from his 2009 shareholder letter, both underscoring the importance of seizing opportunities during downturns: “Opportunities come infrequently. When it’s raining gold, reach for a bucket, not a thimble.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News