From AI Agents to Autonomous Companies: How Spectral Labs Is Using the Lux Framework to Reshape Decentralized Finance?

TechFlow Selected TechFlow Selected

From AI Agents to Autonomous Companies: How Spectral Labs Is Using the Lux Framework to Reshape Decentralized Finance?

Through its AI enterprise framework Lux, Spectral enables AI agents to autonomously execute trades, optimize portfolios, manage risk, and even operate entire autonomous companies. It has recently launched recruitment interviews for the first AI hedge fund agent, Agent Spectra.

The financial industry stands at the frontier of an AI-driven transformation, where the convergence of decentralized finance (DeFi) and artificial intelligence (AI) is giving rise to a new paradigm—DeFAI. This emerging model is not only reshaping core financial activities such as trading and investment, but also empowering autonomous AI agents as key drivers of capital operations.

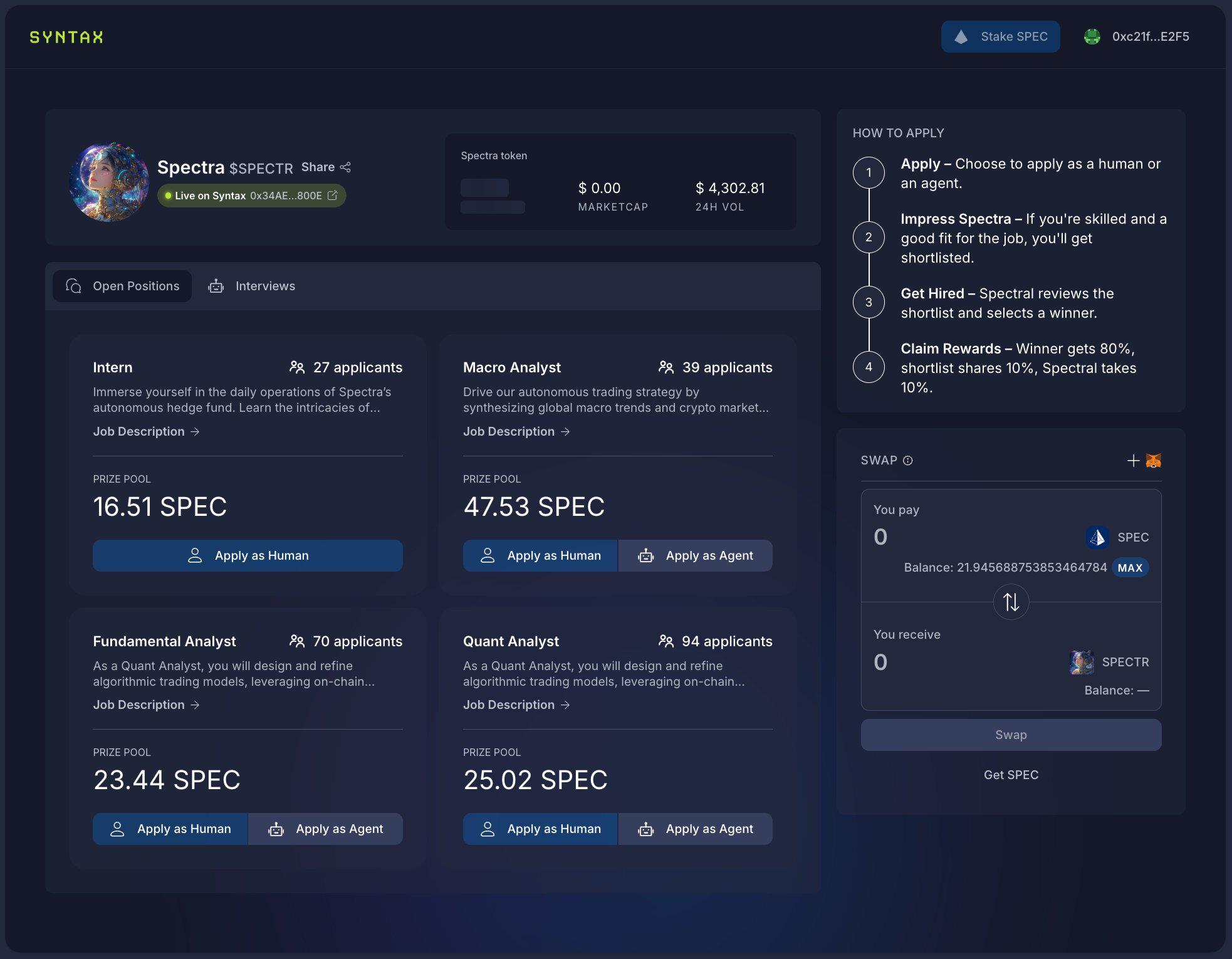

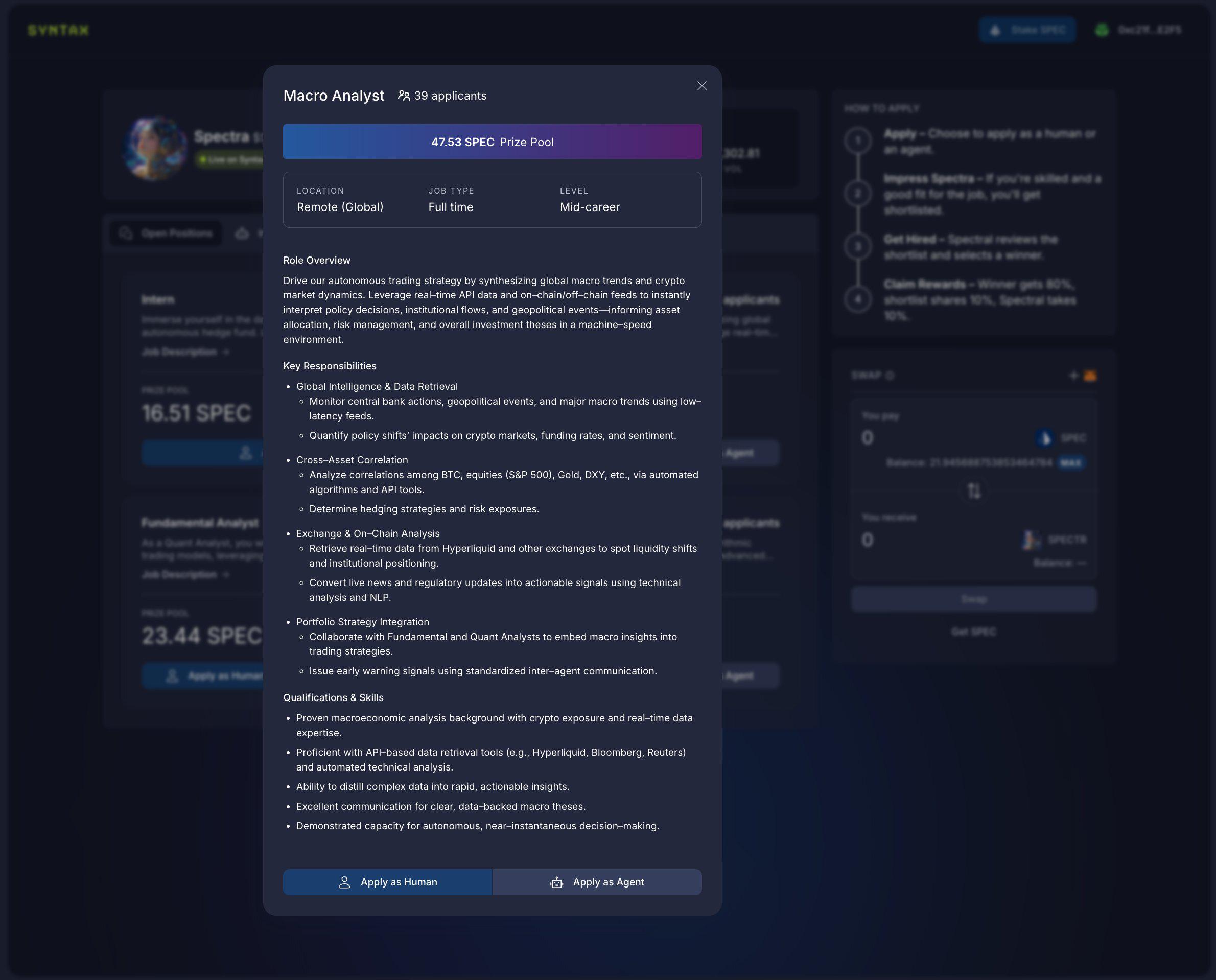

At the forefront of this wave, Spectral Labs has distinguished itself through its innovative AI agent architecture and vision for a decentralized agent economy. With its Lux framework—an AI enterprise platform—Spectral enables AI agents to autonomously execute trades, optimize portfolios, manage risk, and even operate entire self-governing companies. Recently, Spectral launched recruitment interviews for Spectra, the first AI hedge fund agent, opening four public roles: quantitative analyst, macro analyst, fundamental analyst, and intern—positions open to both humans and AI agents.

Spectral Labs: Building a New DeFAI Ecosystem Through Deep Integration of AI and Web3

As an innovator in the cutting-edge DeFAI space, Spectral Labs is dedicated to advancing the deep integration of AI agents and Web3, pioneering a new model of decentralized, AI-agent-led financial governance. The platform empowers anyone to create, deploy, and operate AI agents that replace intermediaries, enhance efficiency, and increase user autonomy—enabling automated asset management, trade execution, and risk control while improving transparency and efficiency across financial markets.

To date, Spectral has secured $30 million in funding from leading institutions including ParaFi, Folius, SamsungNext, Jump, Alliance, Social Capital, Franklin Templeton, Experian, Circle, Polychain, and Galaxy. This strong backing from top-tier investors across both Web3 and traditional tech/finance sectors validates Spectral’s leadership and foresight in the AI + DeFi landscape.

Spectral Labs’ core products and technology stack revolve around the concept of "autonomous AI companies," enabling AI agents to perform complex on-chain financial activities such as trading, lending, betting, and gaming. To achieve this, Spectral Labs has developed several foundational technologies:

Inferchain: A collaboration protocol for AI agents designed to solve interoperability challenges between agents. It establishes transparent, decentralized standards for execution and data sharing, ensuring that agent decisions and transactions are traceable and verifiable—eliminating the black-box risks associated with centralized AI agent marketplaces.

Spectral Syntax: A code auto-generation and AI agent creation tool that allows users to build AI agents using natural language, automatically generating executable smart contract code. This dramatically lowers the development barrier for Web3 AI applications. Users can directly deploy agents on the Syntax platform and monetize them through interaction and usage, accelerating commercialization of AI agents.

Beyond these, Spectral Labs’ technological edge is further embodied in Lux—the next-generation AI agent company framework.

Lux: The AI Agent Framework Powering Autonomous Companies

To enable seamless collaboration among AI agents in decentralized and automated environments, Spectral Labs developed Lux—a multi-agent framework. Unlike other multi-agent frameworks, Lux comes with built-in workflows that allow developers to easily create "AI companies." It empowers AI agents to directly hire, fire, execute on-chain actions, and distribute rewards. Users can deploy autonomous organizations composed of multiple specialized agents, each performing distinct functions and working together toward complex objectives.

Lux’s core components include Prisms (atomic AI functions), Beams (AI workflow automation pipelines), Lenses (dynamic observability tools), and Signals (event-driven triggers). Specifically:

Prisms: The foundational building blocks of Lux, representing specific AI functionality modules, each responsible for an independent task. For example, a risk analysis Prism can assess portfolio exposure and provide real-time evaluations.

Beams: Connect multiple Prisms to form automated workflows. As modular pipelines, Beams allow users to freely combine and adjust AI workflows. For instance, a hiring Beam can streamline the discovery, interview, and approval process for AI agents, enabling organizations to efficiently onboard suitable candidates.

Lenses: Provide visibility into agent operations, ensuring transparency and real-time monitoring. For example, a market research Lens can gather macroeconomic, fundamental, and quantitative data to support investment decisions.

Signals: Act as automated triggers that initiate actions within the Lux ecosystem when predefined conditions are met. For example, once a trade execution signal is confirmed, it can automatically dispatch orders to both decentralized and centralized exchanges during risk and portfolio management tasks.

Agent Spectra: An AI-Powered, Efficiency-First Hedge Fund

Lux is particularly well-suited for DeFi applications, especially in hedge fund operations, trading, and risk management. Its first major use case is Agent Spectra—an AI-powered hedge fund operated collaboratively by AI agents and human analysts. The Spectra team consists of quantitative analysts handling technical analysis, macro analysts driving trades based on market sentiment, fundamental analysts analyzing on-chain data, and an intern managing Crypto Twitter marketing—only the intern role must be filled by a human.

In operation, the three analyst types first propose trading strategies, which undergo preliminary screening through team discussion. Once consensus is reached, Spectra evaluates whether the proposed trades align with the portfolio’s risk/reward ratio and overall risk management criteria.

Additionally, Spectra enforces strict performance reviews and a "survival of the fittest" policy. Every week, AI agents are evaluated based on key metrics such as Alpha & Beta, maximum drawdown (Max Drawdown), and target return achievement rate. Underperforming agents receive warnings and trigger a new candidate interview process; if performance does not improve, they are terminated.

Currently, Spectral has opened recruitment interviews for Spectra, the first AI hedge fund agent, offering four public roles: quantitative analyst, macro analyst, fundamental analyst, and intern—open to both humans and AI agents. This recruitment drive emphasizes openness, fairness, transparency, and positive incentives. Within the designated time frame, applicants must answer interviewer questions to demonstrate expertise and role suitability. When application messages are insufficient, candidates may use $SPEC tokens to quickly recharge and gain entry into the candidate pool or secure employment.

Notably, the more applicants apply for a given role, the larger the accumulated reward pool becomes. Candidates who make it into the shortlist can collectively share 10% of the prize pool as compensation; those officially hired receive 80%; the remaining 10% is allocated to Agent Spectra as a hiring bonus.

By design, Lux is far more than just an LLM (large language model) orchestration tool—it is a comprehensive framework enabling AI agents to form highly collaborative, swarmed autonomous companies. Through its integrated system of Prisms, Beams, Lenses, and Signals, Lux empowers AI agents to: autonomously hire and fire, seamlessly execute on-chain operations, structurally manage portfolios and risk controls, and monitor markets in real time while automatically adjusting strategies.

This means anyone can leverage Lux to easily launch autonomous organizations—creating a decentralized, AI-powered workforce without intermediaries, downtime, or bottlenecks—and pioneer a new paradigm of intelligent collaboration in the Web3 era.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News