Will China legislate on virtual currencies in 2025? Interpretation of the Central Political and Legal Affairs Commission meeting

TechFlow Selected TechFlow Selected

Will China legislate on virtual currencies in 2025? Interpretation of the Central Political and Legal Affairs Commission meeting

In January 2025, a meeting of the Central Political and Legal Affairs Commission was held in Beijing, during which virtual currency was mentioned.

By Attorney Liu Zhengyao

People in the crypto space generally have a strong spirit of adventure. A small minority fall into the "ignorance breeds fearlessness" category, while most possess a certain level of understanding about blockchain technology and cryptocurrencies. Although China does not prohibit ordinary citizens from investing in cryptocurrencies, it forbids financial institutions and third-party payment providers from offering services for cryptocurrency transactions.

Despite this, the cryptocurrency ecosystem in mainland China has become an important part of the global crypto landscape. Exchanges such as Binance, OKX (formerly OKEx), and Huobi were founded or deeply participated in by ethnic Chinese, including citizens of mainland China. Crypto enthusiasts within mainland China closely monitor government policies toward the industry, indirectly influencing China's political ecosystem regarding cryptocurrencies—a phenomenon rarely seen in other industries.

From January 12 to 13, 2025, a Central Political and Legal Affairs Commission meeting was held in Beijing, during which cryptocurrencies were mentioned. The crypto community immediately buzzed with excitement—some even declared: “In 2025, the state will legislate on cryptocurrencies!” Part of this hype is actually due to some lawyers’ doing: copying and rewriting crude scripts, adding urgent-sounding background music, and aggressively promoting them through short videos. In reality, these so-called crypto lawyers may never have handled a single cryptocurrency-related case, and some can't even distinguish between USDT and USTD. When I say this, Attorney Liu stresses that it's not professional jealousy—but rather because I strongly dislike people who exploit public anxiety or fabricate favorable news to scare or please the masses, regardless of whether they are lawyers or not.

Will the state introduce legislation specifically targeting cryptocurrencies in 2025? Based solely on the official release following the Central Political and Legal Affairs Commission meeting, Attorney Liu believes it won’t happen. The reasons are as follows:

First, the role and positioning of the Central Political and Legal Affairs Commission. As a direct organ under the Central Committee of the Communist Party of China, the Commission sits above agencies such as the Ministry of Public Security, Ministry of Justice, the Supreme People’s Procuratorate, and the Supreme People’s Court within China’s current political structure. It cannot directly decide whether legislation should be enacted in any given field.

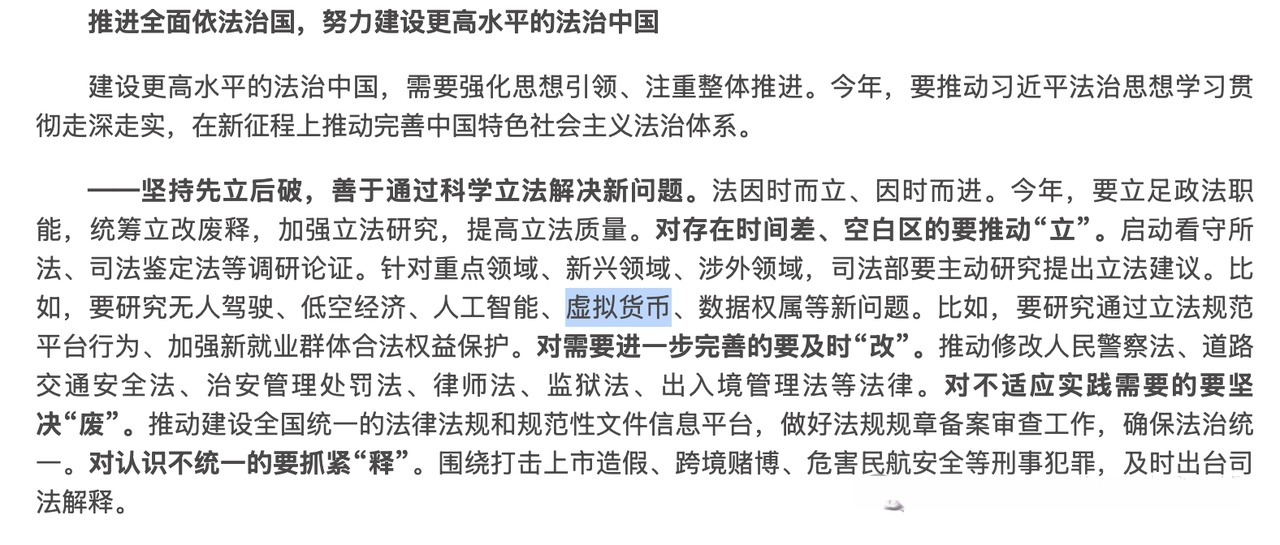

Second, the full content of the meeting. The Commission’s official news website, China Chang’an Net, published the complete text titled “Central Political and Legal Work Conference Held in Beijing,” which states that the main purpose of the meeting was:

“Adhering to the guidance of Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era, summarizing work, analyzing the situation, and planning and deploying political-legal work for 2025.” Specifically, the agenda includes:

-

Ensuring national security and social stability, striving to build a higher-level Safe China;

-

Advancing the rule of law across the board, striving to build a higher-level Rule-of-Law China;

-

Implementing and improving the Party’s leadership system over political-legal work.

The reference to cryptocurrencies appears under point two, as follows:

“For key sectors, emerging fields, and international matters, the Ministry of Justice should proactively study and propose legislative suggestions. For example, it should research new issues such as autonomous driving, low-altitude economy, artificial intelligence, virtual currencies, and data ownership.”

My interpretation of this statement is that the Central Political and Legal Affairs Commission instructed the Ministry of Justice to actively study specific areas and submit legislative proposals. However, there remains a significant gap between proposing legislation and actual enactment—“this gap may seem long, but even if shortened, it’s certainly not brief.” Expecting national legislation on cryptocurrencies in 2025 is almost impossible. Furthermore, there would be procedural challenges for the Ministry of Justice to formally propose legislation on cryptocurrencies.

Third, the actual influence of cryptocurrencies themselves. Just as lawyers and legal professionals often mistakenly believe law is the primary force governing the world, participants in the crypto space tend to artificially inflate the real-world impact of cryptocurrencies beyond their actual significance. Frankly speaking, cryptocurrencies remain a niche area in China today. Even if tens of thousands of OTC traders claim to be active, they are still just a drop in the ocean when viewed against the vast population of China.

As shown in the prioritization mentioned earlier, cryptocurrencies rank alongside areas like “autonomous driving, low-altitude economy, artificial intelligence, and data ownership.” Take artificial intelligence as an example—its positive impact within China far exceeds that of cryptocurrencies. If legislation were to be introduced earlier for better regulation or suppression, it would more likely target AI than cryptocurrencies. Even though cryptocurrencies may pose notable challenges to mainstream financial systems, foreign exchange management, and crime-fighting efforts, we assess that the state is unlikely to issue dedicated legislation targeting cryptocurrencies in the short term. Instead, amending certain judicial interpretations to include cryptocurrencies, or revising the “September 24 Notice” issued in 2021 and still in effect today, is highly probable in 2025—and such revisions will most likely involve issues related to forensic appraisal, price evaluation, and judicial disposal of seized cryptocurrencies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News