Deep Dive into Dogecoin's Endgame Battle

TechFlow Selected TechFlow Selected

Deep Dive into Dogecoin's Endgame Battle

“One word $Doge” — Elon Musk

Author: b12ny

Dogecoin has long been regarded as the leading meme coin in the market. Its price surged at the end of 2024, driven by Trump and Musk-related effects during the U.S. presidential election, but subsequently entered a sharp correction phase, dropping over 60% at one point—consistent with the broader meme coin sector’s decline—highlighting its short-term momentum being heavily sentiment-driven.

On institutional adoption, Grayscale launched a Dogecoin Trust Fund in January 2025 (with a 2.5% management fee), available exclusively to accredited investors. Although still small in scale (approximately $2 million AUM), its significance outweighs the numbers, marking Dogecoin's formal inclusion into institutionally investable assets and representing a critical step in DOGE’s transition from meme-driven to institutional investment-grade status.

Meanwhile, an ETF proposal led by Bitwise, which submitted a $Doge ETF application to the SEC, could further enhance market liquidity if approved. However, no such approval has been granted yet, and future developments will depend on evolving regulatory conditions.

$Doge holds both short-term speculative value and long-term application potential, with its price historically showing strong correlation to Elon Musk. Notably, X is actively exploring integration into its payment system; if $Doge is incorporated into X’s payment infrastructure, it would be the most significant market catalyst since 2021.

The future trajectory of $Doge will hinge on three key variables: payment adoption, institutional investment, and on-chain holder behavior.

Currently, $Doge remains largely a community-driven speculative asset. If X or Tesla expand their use of Dogecoin for payments, new demand could emerge. Additionally, progress on ETF approvals and regulatory policies will influence institutional capital inflows and reshape DOGE’s market structure. This article offers a deep dive into Dogecoin’s history, narrative economics, and ownership structure to assess its current positioning and potential opportunities ahead.

Historical Review

Dogecoin was created in 2013 by Billy Markus and Jackson Palmer as a satirical take on cryptocurrency market bubbles, yet it unexpectedly grew into the world’s highest-market-cap meme coin. Dogecoin’s development can be divided into several distinct phases:

2013–2017: Community-Driven Growth and Charity Culture

-

The Reddit community popularized $Doge as an internet tipping currency.

-

In 2014, it sponsored Jamaica’s bobsled team to attend the Winter Olympics.

-

In 2015, Elon Musk first publicly expressed interest in $Doge.

2018–2020: Low Liquidity and Market Marginalization

-

Dogecoin remained low-priced with no dominant narratives driving market activity.

-

Liquidity primarily stemmed from community trading, with little institutional attention.

2021–2022: Elon Musk and the Meme Coin Surge

-

The GME event and Musk’s social media posts propelled $Doge, which rose 100x within four months.

-

Dogecoin’s market cap briefly exceeded $90 billion, making it one of the top three cryptocurrencies.

-

Major exchanges including Robinhood, Coinbase, Binance, and OKX listed $Doge.

2023–2025: Institutional Capital Entry and Payment Integration

-

Elon Musk’s acquisition of Twitter (now X) reignited bullish sentiment around $Doge.

-

Tesla began accepting $Doge for select merchandise.

-

Trump won the U.S. presidential election, adopting a crypto-friendly stance that may drive supportive policies.

-

Codes and information about “X Money” surfaced online, fueling speculation that it might support crypto payments including $Doge.

-

Grayscale launched a $Doge trust fund, while Bitwise filed a $Doge ETF application.

Narrative Economics

Dogecoin’s market value is predominantly driven by narratives, which determine its future growth, sources of liquidity, and capital rotation patterns between institutions and retail investors. The following are the key narratives currently shaping the market:

-

Leader Among Meme Coins and POW Mechanism

-

Musk Effect and $Doge Connection

-

Payment Use Case (Tesla, X Money)

-

Institutional Investment and ETF Application

Leader Among Meme Coins and POW Mechanism

-

Leader Among Meme Coins

Since its inception, $Doge was initially promoted by the Reddit community as a digital tipping tool. After the last bull run, its association with Elon Musk solidified its position as the largest meme coin by market cap. While influenced by overall market trends, it also maintains long-term correlations with other meme coins and has inspired many others such as $Shib, $Floki, and the once-popular $Babydoge. Notably, unlike most "meme tokens" built on existing blockchains, $Doge stands out as the largest proof-of-work (PoW) “meme coin” (second only to $BTC), followed by $LTC in third place.

-

POW Mechanism

You may recall the saying from the previous cycle: “Bitcoin is gold, Litecoin is silver, Dogecoin is copper,” due to their similar PoW architectures and codebases. The main difference lies in Dogecoin’s inflationary model: 5 billion new coins are minted annually, whereas BTC and LTC have fixed supply caps. The table below compares these three assets:

In 2014, Litecoin’s hash rate reached 600 GH/s, while Dogecoin’s was under 40 GH/s, making DOGE vulnerable to mining pool attacks. As a result, Dogecoin suffered a network attack and wallet breach, causing its price to crash by 95.26%. To improve security, Litecoin founder Charles Lee proposed merged mining (AuxPoW) between $Doge and $LTC—a controversial idea that ultimately gained community support.

By sharing mining power, Dogecoin’s network hash rate steadily increased, raising the cost of attacks and enhancing chain security. Miners’ $Doge rewards also became a meaningful income stream (early LTC miners were often major $Doge holders). In hindsight, this collaboration created a win-win outcome.

Musk Effect and $Doge Correlation

It’s widely known that Elon Musk was the primary force behind Dogecoin’s resurgence in 2021. Over time, the link between $Doge and Musk has grown stronger—for example, when Musk announced on April 28, 2021, that he would appear on *Saturday Night Live* (SNL), airing live on May 8.

During the show, when asked about $Doge, Musk jokingly replied, “It’s a hustle,” sending the price tumbling 30% from $0.74. At the time, Grayscale CEO Barry Silbert even tweeted that he had shorted $Doge for $1 million on FTX. Ironically, today $Doge is part of Grayscale’s trust offerings—showing a clear shift in institutional sentiment.

In this election cycle, Musk strongly supported Trump, even proposing a Department of Government Efficiency (D.O.G.E)—an agency aimed at improving government efficiency and cutting costs. Markets initially linked this move directly to $Doge, especially after the D.O.G.E website briefly displayed the Dogecoin logo in early January.

However, looking back, the environment has changed. The market no longer reacts strongly to Musk’s mere memes or tweets. Instead, expectations now center on tangible actions where Musk can materially support $Doge’s adoption.

Payment Narrative (Tesla, X Money)

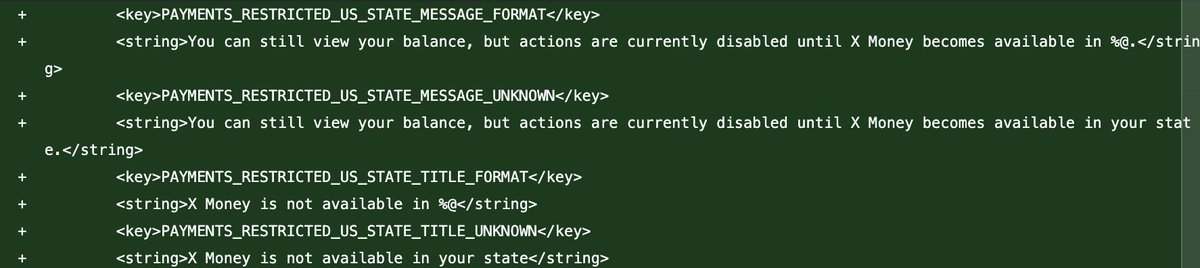

In 2025, X announced plans to launch its payment service, X Money, a pivotal step toward Musk’s vision of turning X into an “all-in-one app.” Based on available information, features already include digital wallets, instant transfers, QR code payments, and Visa integration—with deeper system integrations expected soon.

For crypto traders, the crucial question is whether X Money will actually integrate with $Doge. Combined with Tesla’s existing partial acceptance of $Doge for certain products—and reports that some U.S. Supercharger stations accept Dogecoin for charging fees—the possibility of real-world utility is gaining traction.

Here’s my interpretation based on current information:

-

Tesla

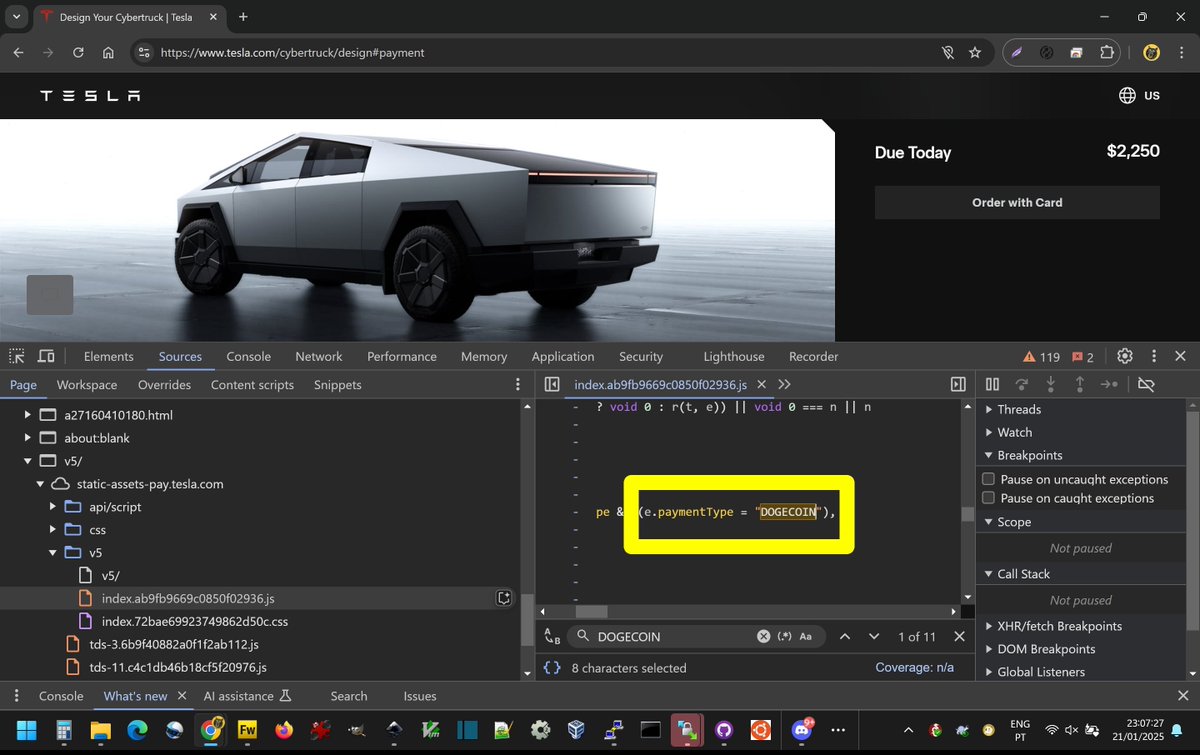

According to @inevitable360, frontend code analysis of the Cybertruck page revealed references to “DOGECOIN.” Between 2022 and 2023, I personally discovered “DOGEPAY” and “DOGECOIN” tags through similar code checks, later confirmed by Musk’s official announcement of payment functionality. Given this precedent, it’s highly plausible that vehicle purchases via Dogecoin could be enabled this year.

-

X Money

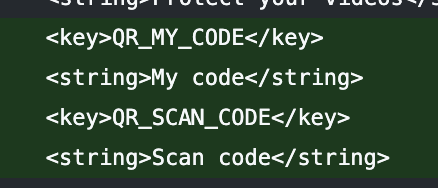

@aaronp613 reported that X plans to roll out X Money first in the United States. Since X Money hasn’t secured full licensing across all 50 states, it may launch initially in the 39 states where permits are already obtained. This phased rollout allows for testing and refinement. Each user will reportedly receive a unique QR code enabling peer-to-peer transfers and remittances.

Based on my prior research and observations, Musk changed X’s bird logo to the Dogecoin dog in April 2023—fulfilling a promise made in 2022. Similarly, the temporary D.O.G.E. website rebranding suggests Musk honors both commitments and jokes (just like his Twitter acquisition). Practically speaking, launching X Money in select states allows feasibility testing before wider expansion.

Regulatory hurdles will likely become a speculative theme: whether X Money can overcome them may attract investor attention and drive capital into $Doge. Moreover, $Doge could emerge as a viable method for cross-border payments.

A notable moment occurred in 2022 when Robinhood CEO Vladimir Tenev (one of the largest $Doge holders) suggested that Dogecoin could become a practical daily transaction asset by increasing block size and reducing block time to address low throughput. Both Dogecoin co-founders and Elon Musk expressed agreement.

Tenev noted that Dogecoin’s transaction fees are already minimal, positioning it well as a leading electronic cash option. However, he emphasized that block size and confirmation speed remain key areas for improvement. If these technical limitations are resolved (which I believe Musk is fully capable of achieving), and considering Tesla already accepts $Doge, the combined potential with X Money could scale globally.

Institutional Investment and ETF Application

-

Institutional Investment

Beyond Grayscale launching a Dogecoin Trust Fund (~$2M AUM)—a milestone in DOGE’s shift from meme to institutional asset—the Dogecoin Foundation plays a central role in promoting and supporting Dogecoin’s development.

In early 2023, the foundation announced a “Core Development Fund,” allocating 5 million $Doge (~$360,000), to support core developers. In November 2024, it launched a fundraising appeal seeking major sponsors to drive mass adoption in 2025, with funds directed toward building “Dogebox,” a decentralized payment infrastructure to help small and medium enterprises accept Dogecoin.

The foundation’s membership is also noteworthy. Reorganized in 2021, its advisory board includes Dogecoin co-founder Billy Markus, core developer Max Keller, Ethereum founder Vitalik Buterin, and Jared Birchall, Elon Musk’s longtime financial partner—all influential figures in the space.

-

ETF Application

In early February, Bloomberg analysts James Seyffart and Eric Balchunas published predictions on the likelihood of ETF approvals for $Sol, $Doge, $Ltc, and $Xrp:

$Doge (75%): As the largest meme coin, the 19b-4 filings by Grayscale and Bitwise have received SEC acknowledgment, increasing its chances of approval.

Institutional momentum is further boosted by Trump’s pro-crypto policy stance, favoring deregulation and market growth—raising the odds for $Doge ETF approval. Thus, the real question isn’t *if*, but *when*.

I believe the approval must happen by year-end to maintain the positive impact of the ETF narrative before marginal effects diminish. With more meme and altcoin ETF applications emerging, timely approval is essential to maximize market anticipation and price response based on liquidity precedence.

If $Doge, as the leading meme coin, is approved as expected, its legitimacy and viability as a legal payment method could rise significantly. Therefore, the actual implementation of Trump’s crypto policies will critically influence Musk’s ability to advance $Doge in both payment systems and financial markets.

Ownership Structure

Dogecoin’s supply is highly concentrated, with the top 115 addresses holding 65.4% of circulating supply—including Robinhood alone holding 21.06%. Understanding the behavior of these large holders is crucial for anticipating price movements. Historical analysis often reveals early signals before major rallies or downturns, offering valuable insights for traders. Below is a comparison I compiled of Top 20 addresses versus Robinhood holdings:

According to the report titled Beyond Musk: Who Are Dogecoin’s Real Price Drivers? Ownership Distribution and Market Impact Explained—Identify Key Signals Before Major Rallies, analyzing on-chain transfer behaviors of the top 20 $Doge holders—especially smart money addresses—reveals high correlation between their activities and price movements. The chart below highlights addresses with strong historical price correlation:

Tracking these addresses can assist in planning buy-low/sell-high strategies and identifying large outflows that may signal upcoming selling pressure—providing useful reference points for short-term market direction. For traders, monitoring these whale movements enhances predictive capability, though the involvement of large smart money players adds complexity to DOGE’s ownership dynamics.

Current Positioning and Future Potential of $Doge

Based on historical price cycles, there is a strong possibility that a bottom will form around $0.18–$0.20, potentially leading to a breakout above previous all-time highs. I previously stated on Twitter that I am willing to accumulate heavily at $0.18. If I had to make a price prediction, I believe the highest probability scenario is for this cycle to reach $1—just as $100,000 holds symbolic importance for $BTC.

At present, $Doge remains dependent on market narratives and capital flows, likely maintaining high volatility in the near term. However, if key catalysts like X Money integration and ETF approval materialize as expected, Dogecoin could genuinely evolve from a meme coin into a “payment-focused cryptocurrency.”

This analysis represents five years of deep research and personal experience since entering the crypto space. If you enjoyed this content or wish to discuss further, feel free to comment, like, or share.

See you on the moon.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News