Behind the Market's Overnight Collapse: Who Is Orchestrating This Bull-Bear Battle?

TechFlow Selected TechFlow Selected

Behind the Market's Overnight Collapse: Who Is Orchestrating This Bull-Bear Battle?

The CME Bitcoin futures gap fill has become a trigger for technical correction.

Author: Luke

In the early hours of March 4, the crypto market's "night of terror" gave investors a stark reminder of its inherent ruthlessness. Data showed BTC plunging from weekend highs, breaking below $86,000 with a 24-hour drop of 4.39%. ETH fared worse, losing ground below $2,200 and falling over 6%. This sharp correction not only filled the CME Bitcoin futures gap at $77,000 but also exposed deep-seated tensions beneath the surface of apparent market prosperity—when policy optimism, technical patterns, and capital博弈 intersect, who is truly steering the market?

The Illusion of Prosperity: The Paper Bull of March 2

Looking back at the euphoria on March 2 when Trump announced plans to include XRP, SOL, and ADA in the U.S. Strategic Reserve, the image of Bitcoin surging $10,000 in just three hours now feels like a distant dream. However, on-chain data reveals the true nature of this rally: it was a leveraged derivatives-driven "castle in the air."

-

Fake heat in the spot market: Although major exchanges recorded a net inflow of 13,000 BTC, Binance’s spot trading volume reached only 65,000 BTC (approximately $5.97 billion), significantly lower than the 104,000 BTC ($7.7 billion) traded during similar price surges in November last year. What actually drove prices were surging futures positions on CME and Bybit—open interest exceeded $53.8 billion, with $14.3 billion concentrated on CME.

-

Stablecoins as a “contrarian signal”: USDT and USDC reserves decreased by $580 million within 24 hours, while stablecoin/BTC trading pairs surged to 67% of volume. This may appear to be fresh capital entering crypto, but in reality, it reflects existing funds engaging in leveraged "hot potato" trading.

-

Whales’ precise harvesting: Addresses holding over 1,000 BTC net-added 42,000 BTC during the rally, with three anonymous addresses each depositing more than 10,000 BTC in single transactions. On-chain trails indicate these coins largely came from cold wallet activations, suggesting well-prepared "smart money" took advantage of positive news to offload holdings.

This surge, lacking real underlying capital support, had already sown the seeds for the subsequent crash.

Macroeconomic Downturn Casts Shadow Over Markets

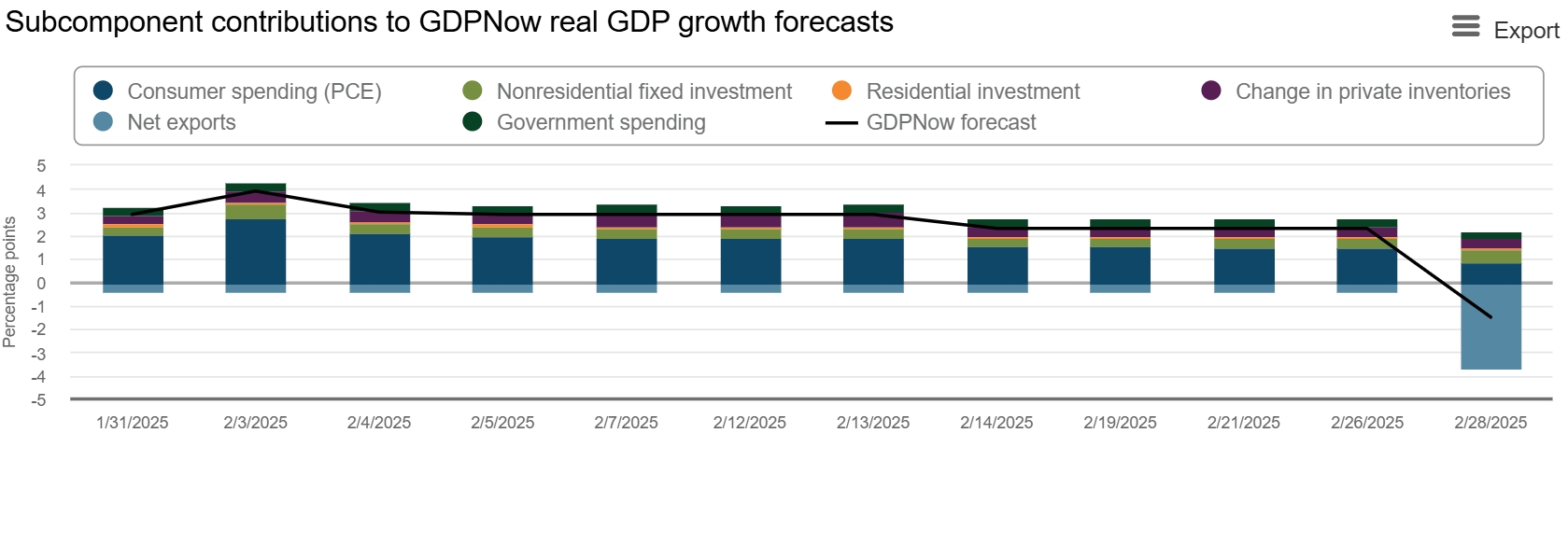

Currently, global macroeconomic conditions are exerting significant pressure on the cryptocurrency market. In the U.S., for example, the Atlanta Fed’s GDPNow model forecasts a contraction of 2.8% by the end of Q1 2025—marking a catastrophic reversal from its previous growth projection of 3.9% just four weeks earlier. Such recession expectations have made investors increasingly cautious toward risk assets, and cryptocurrencies, being among the highest-risk categories, are naturally hit first and hardest.

Since the approval of spot Bitcoin ETFs, the integration between crypto and traditional financial markets has grown tighter. During economic booms, this linkage might attract more capital into crypto; however, amid recession fears, its downside becomes glaringly evident. Should the U.S. economy enter a downturn, turbulence in traditional markets will swiftly spill over into crypto, undermining investor confidence. The past few days’ extreme volatility in Bitcoin prices exemplify this trend—despite a brief rebound over the weekend, gains were quickly erased, reflecting clearly weakened market sentiment.

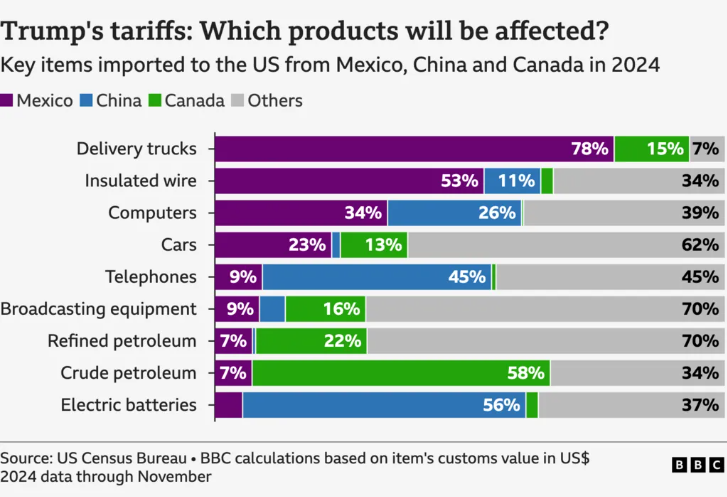

Trade War: Tariff Policies Shatter Illusions

Escalating trade tensions have further amplified market uncertainty. Recently, President Trump announced new tariffs on Mexico and Canada, stating there was “no room for negotiation.” He later posted on Truth Social that starting April 2, he would implement “reciprocal tariffs” on the EU, Japan, South Korea, and others—matching their tariff rates on U.S. goods. This hardline stance surpassed market expectations. Previously, many viewed Trump’s tariff talk as mere negotiating tactics with some flexibility. But his latest statements confirm that a full-scale tariff war has begun, forcing markets to confront this new reality.

New tariffs will raise import prices, exacerbating inflationary pressures in the U.S. Under such high inflation, the Federal Reserve’s ability to cut interest rates diminishes, potentially prolonging the high-rate environment. This not only increases the risk of economic recession but also weighs heavily on the crypto market, which relies on liquidity and risk appetite. The market crash on March 4 was a direct reflection of this shift in expectations.

Additionally, the ongoing Russia-Ukraine conflict continues to cast a shadow. Ukrainian President Zelenskyy stated the war won’t end soon, dashing hopes for a quick resolution. Combined with trade tensions, geopolitical risks further dampen investor risk appetite.

These policies not only hurt U.S. equities but also impact crypto through market correlation. Efficient Frontier, a crypto market maker, noted that if U.S. stocks continue weakening, the crypto market could face even greater downward pressure.

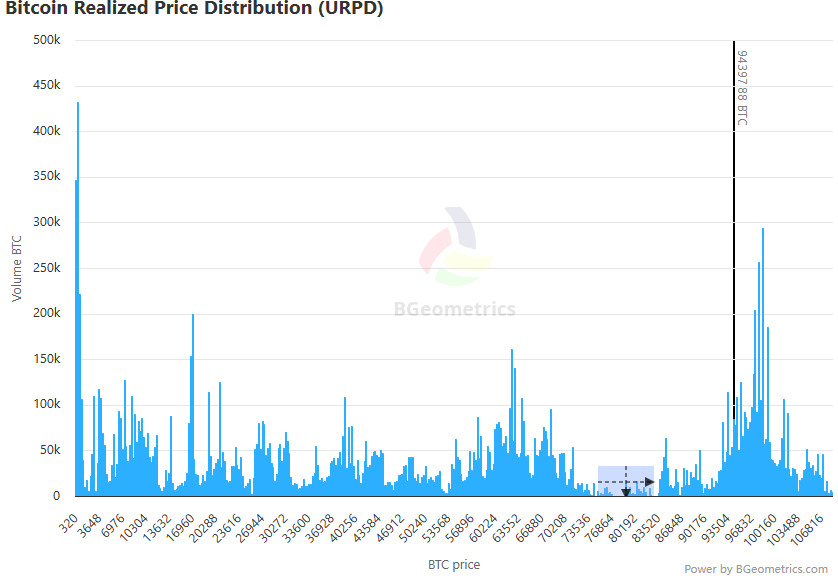

Futures Gap Fill: Technical Drivers Behind the Correction

From a technical perspective, the closing of the CME (Chicago Mercantile Exchange) Bitcoin futures gap played a key role in triggering the recent sell-off. A CME gap refers to the price discrepancy between CME Bitcoin futures and spot prices, typically forming over weekends or holidays. Historical data shows over 90% probability that such gaps get filled, and the URPD (Unrealized Profit/Loss Distribution) indicator confirms a significant gap around $77,000. Historically, every URPD-identified gap has eventually been filled.

Recently, prices rapidly dropped to this level before bouncing back—a pattern highly consistent with gap-filling behavior. Amid weak sentiment and rising technical selling pressure, gap fills often amplify price swings, laying the technical foundation for what traders call a “closed door” move. While timing remains uncertain, the likelihood and impact of such events cannot be ignored.

Outlook: Regulation and Capital Flows Will Be Decisive

Looking ahead, several factors may shape the trajectory of the crypto market:

-

Market fragmentation under regulatory pressure: The SEC has established a “Crypto Regulatory Task Force,” signaling intent to crack down on speculative tokens lacking utility (e.g., meme coins). DeFi and GameFi sectors may also face scrutiny due to excessive narratives. Meanwhile, the EU’s MiCA regulations will fully take effect in January 2025, potentially squeezing altcoin survival space even further.

-

Capital concentration in compliant assets: Executive orders like Trump’s “Enhancing American Leadership in Digital Financial Technology” and the proposed “Payment Stablecoin Clarity Act” send positive signals. However, capital is likely to flow preferentially into policy-supported assets (such as BTC, ETH, and stablecoins), rather than broadly lifting the entire altcoin market.

-

Opportunities amid short-term volatility: Despite lingering macro risks, developments such as Ethena securing $100 million in funding and the launch of Ethereum’s Pectra upgrade testnet continue to inject localized momentum. If Trump’s “Crypto Summit” on March 7 provides clear policy direction, it could become a catalyst for a new market cycle.

Conclusion: When the Tide Recedes

The filling of the CME gap completes a technical self-correction, but the real test for the market has only just begun. The White House crypto summit on March 7 may spark new policy hope, but investors should remain vigilant: amid macro headwinds, unclear regulation, and zero-sum capital battles, any positive news could turn into a double-edged sword for bulls and bears alike. For retail investors, maintaining rationality during such “closed door” moves is crucial. Focusing on compliant narratives and fundamentally sound assets may offer a better path through market cycles.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News