Attention is an asset—does the InfoFi sector still have potential?

TechFlow Selected TechFlow Selected

Attention is an asset—does the InfoFi sector still have potential?

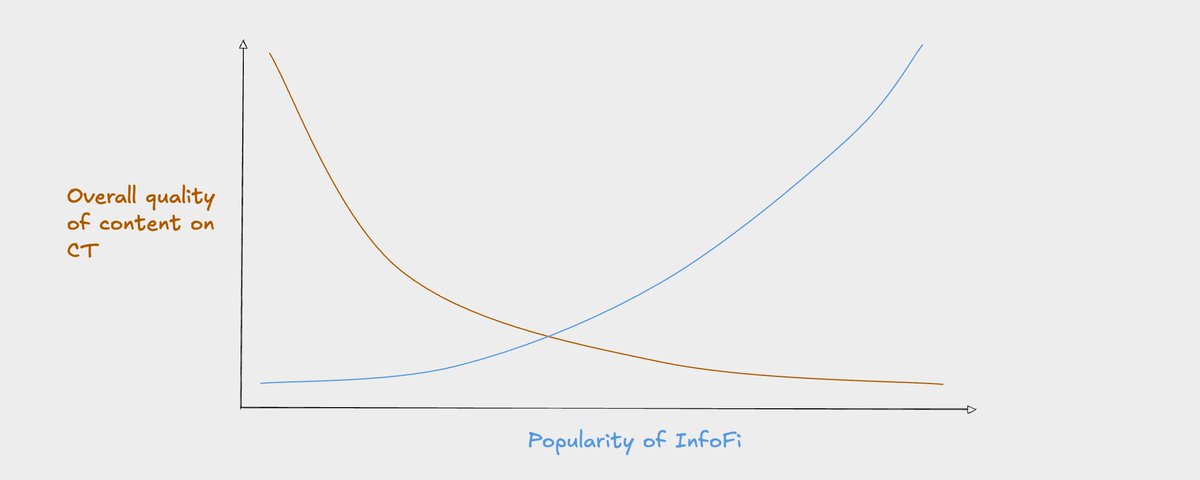

The financialization of attention is almost inevitable, and the core of the next wave of financial innovation will revolve around how to effectively assess and trade digital mindshare.

Author: Marco Manoppo

Translation: TechFlow

In 2025, attention has become the "new currency"—more valuable than data.

In today's world, mindshare has become the key to business success. If you think I'm starting with an obvious point like your typical venture capitalist, you're right—but keep reading.

Attention has always been the most important "currency" in commerce. It lies at the heart of how products are sold. Even before the internet, during the golden age of print media and advertising, this was already evident. Back then, cigarette companies boosted sales by associating themselves with controversial social causes and movements to capture public attention.

In short, attention generates mindshare, and mindshare determines distribution efficiency.

Then came the era of branding. Companies like Nike, Lucky Charms, and Nutella used emotionally driven marketing strategies to dominate consumer mindshare, enabling them to command higher profit margins. Consumers willingly pay a 30% premium for identical products simply because of brand perception. I’ve fallen for it myself—back in college, I obsessively collected Supreme Box Logo tees. Looking back, it was quite the “cringe phase.”

I almost spent $1,000 on that stuff—money I should’ve invested in ETH instead.

Fast-forward to the 2020s, our world is fully digital, and the battle for mindshare has moved online.

This trend accelerated dramatically during and after the pandemic, though its roots go back 15–20 years to the rise of YouTubers. Early content creators like Ryan Higa and Smosh started by making “fun little videos” just for fun. But the emergence of social media platforms changed everything. Platforms like Facebook, Twitter, and Instagram leveraged viral compounding effects to elevate YouTubers and independent creators to fame surpassing most B-list celebrities.

For example, Casey Neistat began his daily vlogs in 2015—a time when large-scale YouTubers launching commercial ventures were rare. Today, MrBeast has built a multi-million-dollar business empire through his content distribution channels. Rhett & Link successfully acquired and expanded the Mythical entertainment network based on their YouTube audience.

The truth is clear: every modern business is now competing for mindshare.

Mindshare translates directly into pricing power. In today’s capital markets, this premium is reflected immediately in your stock or token price. Take Tesla: if Elon Musk didn’t actively engage on social media, its market cap likely wouldn’t be where it is today. I believe this trend will continue over the next five years—and will become even more financialized. This sets the foundation for what we now call “InfoFi,” or information finance.

If you get this meme, we can be friends.

What is InfoFi?

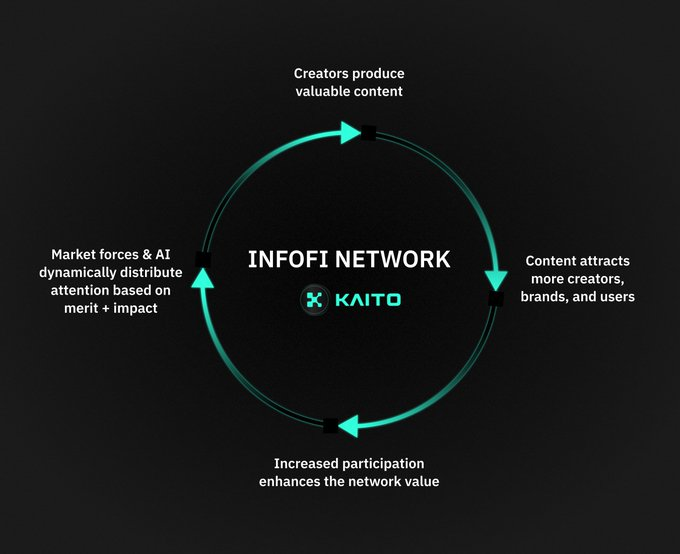

InfoFi (information finance) is a concept popularized by Kaito, but I believe its implications are far broader and deeper than originally defined.

According to Grok’s definition (quoting Kaito), InfoFi is:

“An emerging concept that combines financial incentives with the creation, verification, and distribution of information, primarily within decentralized systems. Its goal is to solve key problems in today’s information economy—such as unreliable data, algorithmic bias, and unfair value distribution—by introducing market mechanisms, ensuring information is more accurate, trustworthy, efficiently organized, and widely disseminated.”

This definition is correct, but I believe the core significance of InfoFi runs much deeper.

→ At its essence, InfoFi is about tokenizing the information supply chain.

In other words, information is no longer just a free resource—it becomes an asset that can be valued, traded, and optimized through financial mechanisms.

Historically, monetizing attention required building a separate product and directing attention toward it. This model has proven effective, for instance:

-

Chef influencers profit by promoting restaurants or ingredients (e.g., Uncle Roger and David Chang);

-

Fashion influencers launch clothing lines (e.g., Alexa Chung and the Kardashians);

-

Fitness influencers promote protein powders or energy drinks (e.g., Christian Guzman);

-

Investors and financial institutions profit by selling financial products (e.g., ARK Invest or hedge funds targeting high-net-worth clients);

-

Fake finance gurus profit from trading signal groups (you know the ones);

-

Toxic male influencers profit via pyramid schemes (again, you know who).

But now we’re entering a new era—one where mindshare itself can be directly traded.

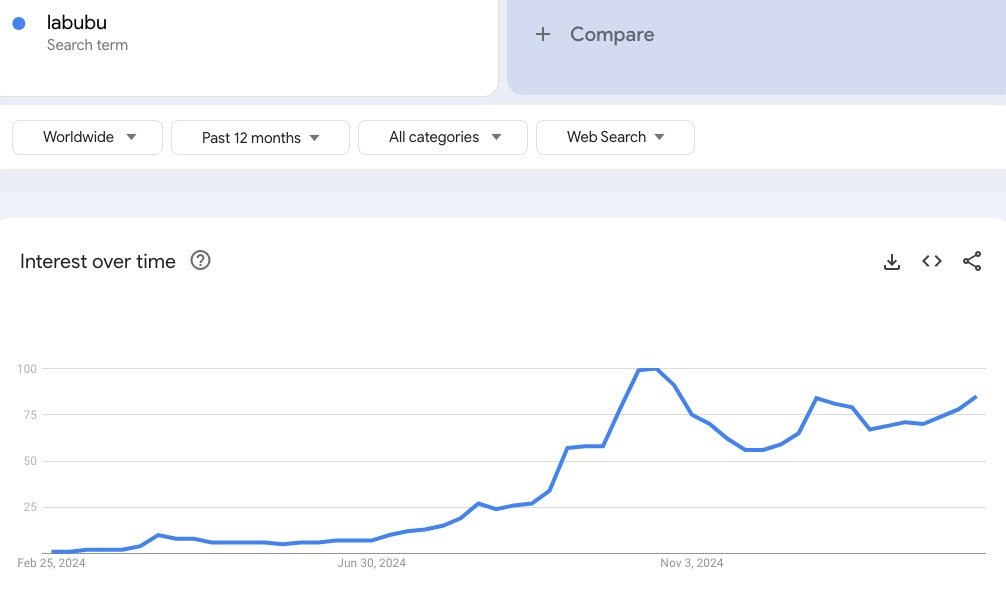

Imagine a future where people no longer need to create derivative businesses to monetize attention, but can instead directly invest in and trade cultural trends, narratives, or attention cycles. For example, when Labubu goes viral, there’s currently no efficient way for people to bet on its sustained popularity. While a memecoin called $LABUBU briefly appeared, its price was driven more by overall crypto market volatility than by Labubu’s actual热度 or shifts in mindshare.

InfoFi offers an alternative: a more direct and liquid mechanism for speculating on and trading attention itself.

The Critical Role of Trusted Oracles in InfoFi

For InfoFi (information finance) to become a mature and reliable field, trusted oracles are essential. Oracles securely bring off-chain data—such as market sentiment and social trends—onto blockchain systems while ensuring immutability. Since InfoFi revolves around trading narratives, trends, and market emotions, real-time and accurate data feeds are crucial.

Solutions like UMA, Chainlink, Pyth, and API3 already provide critical off-chain data services for decentralized finance (DeFi). These oracles help DeFi applications settle bets, verify market trends, and aggregate price data from multiple sources.

Challenges and Limitations of Current Oracle Technology

Despite progress in decentralized oracle tech, several challenges remain before they can fully support InfoFi:

-

Lack of real-time sentiment analysis. Most oracle networks focus on price data or structured event outcomes. InfoFi demands oracles capable of tracking and quantifying social sentiment, user engagement trends, and virality metrics in real time—with minimal latency.

-

Data verifiability and subjectivity issues. Unlike price data, sentiment analysis involves subjectivity. How do we define “positive” or “negative” sentiment? How can we ensure objectivity and prevent manipulation?

-

Scalability of data sources. Current oracles rely on limited, pre-vetted sources like exchanges or select news sites. InfoFi requires broader coverage—including news articles, social media posts, prediction markets, and niche forums—to deliver comprehensive insights.

-

Risk of data manipulation. Because InfoFi enables speculation on narratives and trends, bad actors might use bot farms or fake engagement to artificially inflate certain stories. Oracles must detect and filter such anomalies to prevent data tampering.

-

Economic incentives for data providers. How do we ensure oracle data is reliable? Mechanisms like staking, slashing, and reputation scoring must align incentives, rewarding honest reporting and penalizing misconduct.

Future Directions for Oracle Development

To meet InfoFi’s needs, oracle technology must evolve. Future oracles may integrate these key features:

-

AI-driven data aggregation: Using artificial intelligence to extract meaningful signals from massive datasets and analyze them rapidly.

-

Incentive-aligned reputation systems: Designing reward and penalty structures that align data providers’ behavior with system integrity.

-

Real-time trend validation: Offering faster, more precise trend analysis to support financial products built around narratives.

With these advancements, oracles will better support InfoFi by enhancing security, scalability, and resistance to manipulation for narrative-based financial instruments.

Expanding the Scope of InfoFi Markets

Prediction markets represent an early form of InfoFi, allowing users to bet on real-world events using informational advantages. Platforms like Polymarket, Kalshi, and Augur have demonstrated potential, though they remain niche.

Similarly, the idea of data markets emerged during the 2017 ICO boom (revealing my age), aiming to commoditize datasets for trading. However, due to unclear value propositions and flawed token economics, these projects failed to gain broad traction.

In contrast, InfoFi represents a more mature and scalable evolution. Rather than simple betting or data trading, InfoFi transforms “mindshare”—public attention and interest—into a new class of tradable assets.

Potential InfoFi applications include:

-

Narrative-based ETFs: Tokenized portfolios tracking specific themes. For example, an “AI Trends Index” could follow AI-related topics, while a “Metaverse Hype Basket” tracks discourse around metaverse concepts.

-

Influencer-linked financial instruments: Tokenizing a creator’s future revenue, allowing fans to speculate on their long-term influence.

-

Memecoin derivatives: Offering refined ways to speculate on cultural phenomena without relying solely on traditional crypto-economic models.

-

Tokenized media channels: Converting content subscription platforms into tradable tokens, enabling ownership shares to be bought and sold.

Still, a key question remains: Will a killer application emerge to establish InfoFi as a standalone financial domain—not just a subcategory of decentralized finance (DeFi)?

Key Insights

-

Re-defining the value of information. InfoFi challenges the notion that “information is free.” It asserts that attention, narratives, and data possess intrinsic value that can be traded and speculated upon through financialization.

-

A natural evolution of the attention economy. As mindshare plays an increasingly decisive role in financial outcomes, markets will develop more direct methods to capture and monetize attention cycles.

-

Unlocking entirely new financial markets. InfoFi opens avenues for direct speculation on cultural phenomena, influencer growth, and trending narratives—beyond merely redirecting attention to traditional business models.

-

Success hinges on product-market fit. The challenge for InfoFi is designing financial instruments that are liquid, scalable, and compelling enough to become a new paradigm—not just another DeFi gimmick.

Final Thoughts

While still in its infancy, the financialization of attention is nearly inevitable. From prediction markets to influencer-linked finance and tokenized trends, the next wave of financial innovation will center on how we measure, evaluate, and trade digital mindshare.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News