Arthur Hayes: We're still in a bull market cycle; worst-case scenario, BTC could pull back to $70,000

TechFlow Selected TechFlow Selected

Arthur Hayes: We're still in a bull market cycle; worst-case scenario, BTC could pull back to $70,000

A severe correction in the U.S. stock market, driven by recession concerns, is imminent.

Author: Arthur Hayes

Translation and compilation: BitpushNews

(The views expressed in this article are those of the author alone and should not be taken as investment advice, nor should they be interpreted as recommendations or opinions regarding participation in investment transactions.)

Keep — It — Simple — Stupid = KISS

Many readers often forget the KISS principle when dealing with the flood of policies from U.S. President Donald Trump's administration.

Trump’s media strategy aims to ensure that every morning you wake up and say to your friends, partner, or inner monologue: “My God, did you see what Trump/Musk/RFK Jr. did yesterday? I can't believe they actually did that.” Whether you're elated or frustrated, this spectacle—this "Emperor's Day"—is highly entertaining.

For investors, however, this constant state of excitement is detrimental to accumulating bitcoin (sats). You might buy today and then sell quickly tomorrow after digesting the next headline. As markets keep churning, your bitcoin holdings rapidly shrink.

Remember the KISS principle.

Who is Trump? Trump is a real estate showman. To succeed in real estate, you must master the art of borrowing massive sums at the lowest possible interest rates. Then, to sell units or lease space, you must hype how impressive the new construction or development will be. I’m not interested in Trump’s ability to generate sympathy across global society—but I am deeply interested in his ability to finance policy objectives.

I am convinced that Trump wants to fund his “America First” agenda through debt financing. If he didn’t, he would allow the market to naturally purge embedded credit from the system and usher in a depression worse than the 1930s. Would Trump rather be remembered as Herbert Hoover of the 21st century, or Franklin D. Roosevelt (FDR)? American history vilifies Hoover because historians believe he didn’t print money fast enough, while glorifying Roosevelt, whose New Deal was funded by printing. I believe Trump wants to be seen as the greatest president in history, so he won’t destroy the empire’s foundations through austerity.

To emphasize this point, recall what Andrew Mellon, Hoover’s Treasury Secretary, said about responding to the over-leveraged U.S. and global economy after the stock market crash:

"Liquidate labor, liquidate stocks, liquidate the farmers, liquidate real estate. This will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live more morally. Values will be adjusted, and enterprising people will pick up the wrecks from less competent people."

Today’s U.S. Treasury Secretary, Scott Bessent, would never speak like that.

If my thesis is correct—that Trump will fund “America First” via debt—what does that mean for my outlook on global risk assets, especially cryptocurrencies?

To answer, I must form a view on how Trump might increase the quantity of money/credit (i.e., print) and lower its price (i.e., interest rates). Therefore, I need to assess how the relationship between the U.S. Treasury, led by Scott Bessent, and the Federal Reserve, led by Jerome Powell, will evolve.

KISS Principle

Who do Bessent and Powell serve? The same person?

Bessent was appointed under Trump 2.0. From his past and present interviews, he clearly aligns with the "Emperor’s" worldview.

Powell was appointed under Trump 1.0, but he’s an erratic traitor who defected to the Obama-Clinton camp. When Powell slashed rates by 0.5% in September 2024, he destroyed whatever credibility he had left. At that time, U.S. economic growth was above trend, and inflation still lingered—no justification for rate cuts. But Kamala Harris, the Obama-Clinton puppet, needed a boost, and Powell dutifully delivered. It didn’t work as intended, but after Trump’s election win, Powell declared he’d finish his term and fight inflation once again.

When you carry massive debt, several things happen.

First, interest payments consume most of your free cash flow. Second, you can’t finance additional asset purchases because no one will lend to you given your high leverage. So you must restructure your debt—extending maturities and lowering coupon rates. This is a form of soft default, mathematically reducing the present value of your debt burden. Once your effective debt load is reduced, you can borrow again affordably. Viewed this way, both the Treasury and the Fed play roles in restoring U.S. financial health. But since Bessent and Powell serve different masters, this effort is hindered.

Debt Restructuring

Bessent has publicly stated that the current structure of U.S. debt must change. He wants to extend the average maturity of the debt burden—a move known on Wall Street as “extending the debt maturity.” Various macroeconomic experts have proposed ways to achieve this; I’ve discussed such solutions in detail in The Genie. But for investors, the key takeaway is that the U.S. will soft-default on its debt burden by reducing its net present value.

Given the global distribution of U.S. debt holders, achieving such a restructuring will take time. It’s a geopolitical Gordian knot. Thus, in the short term—over the next three to six months—this doesn’t concern us crypto inventors.

New Lending

Powell and the Fed have broad control over the quantity and price of credit. Legally, the Fed can print money to buy debt securities, increasing money/credit supply—i.e., printing. The Fed also sets short-term interest rates. Since the U.S. cannot default in nominal dollars, the Fed determines the dollar’s risk-free rate—the Effective Federal Funds Rate (EFFR).

The Fed has four main levers to manipulate short-term rates: the Reverse Repo Program (RRP), Interest on Reserve Balances (IORB), the lower bound of the federal funds rate, and the upper bound. Without diving into monetary market complexities, we simply need to understand that the Fed can unilaterally increase the quantity of dollars and lower their price.

If Bessent and Powell served the same leader, analyzing the future path of dollar liquidity and responses from China, Japan, and the EU to U.S. monetary policy would be straightforward. Since they clearly don’t serve the same person, I wonder how Trump can manipulate Powell into printing and cutting rates while allowing Powell to maintain his anti-inflation mandate.

Crippling the Economy

Fed-Recession Law: If the U.S. economy enters recession—or if the Fed fears it will—the Fed will cut rates and/or print.

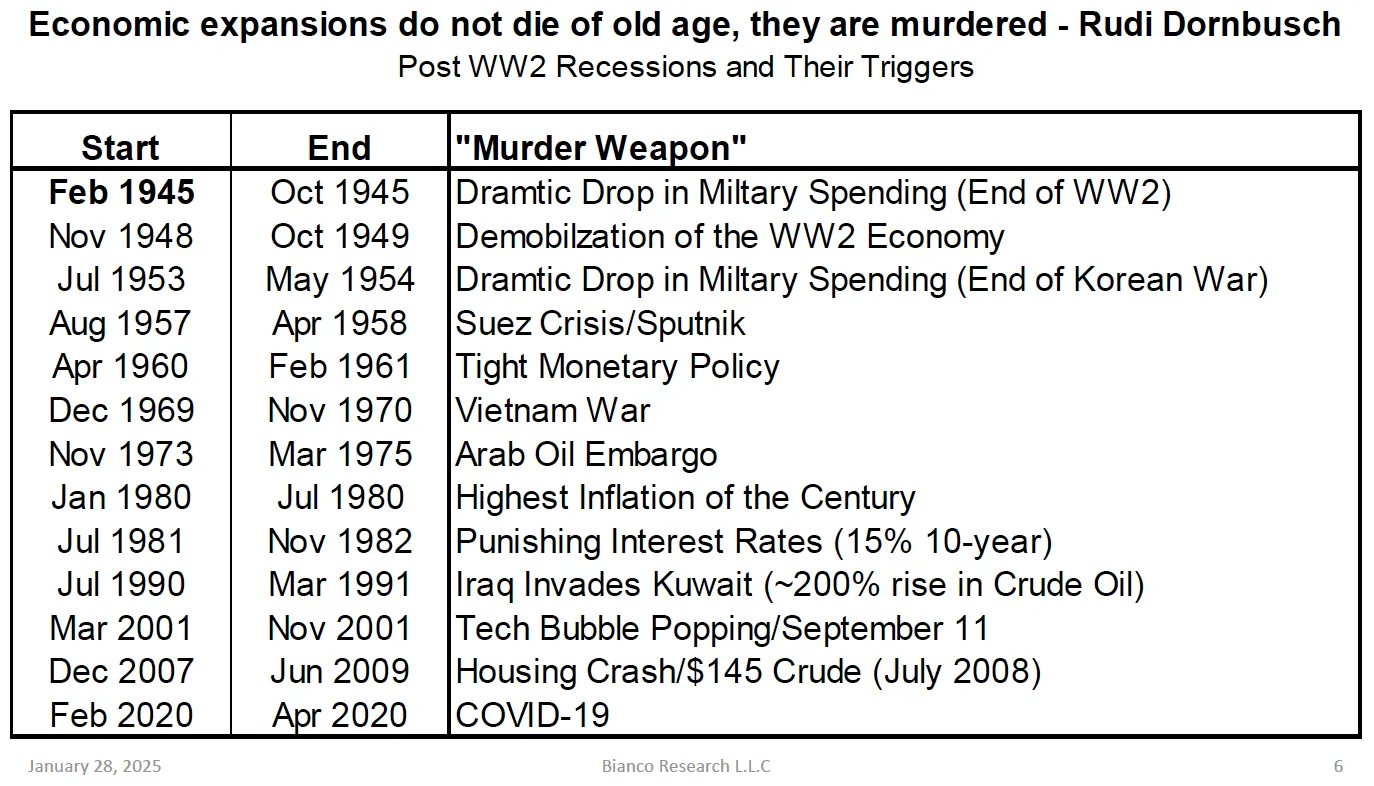

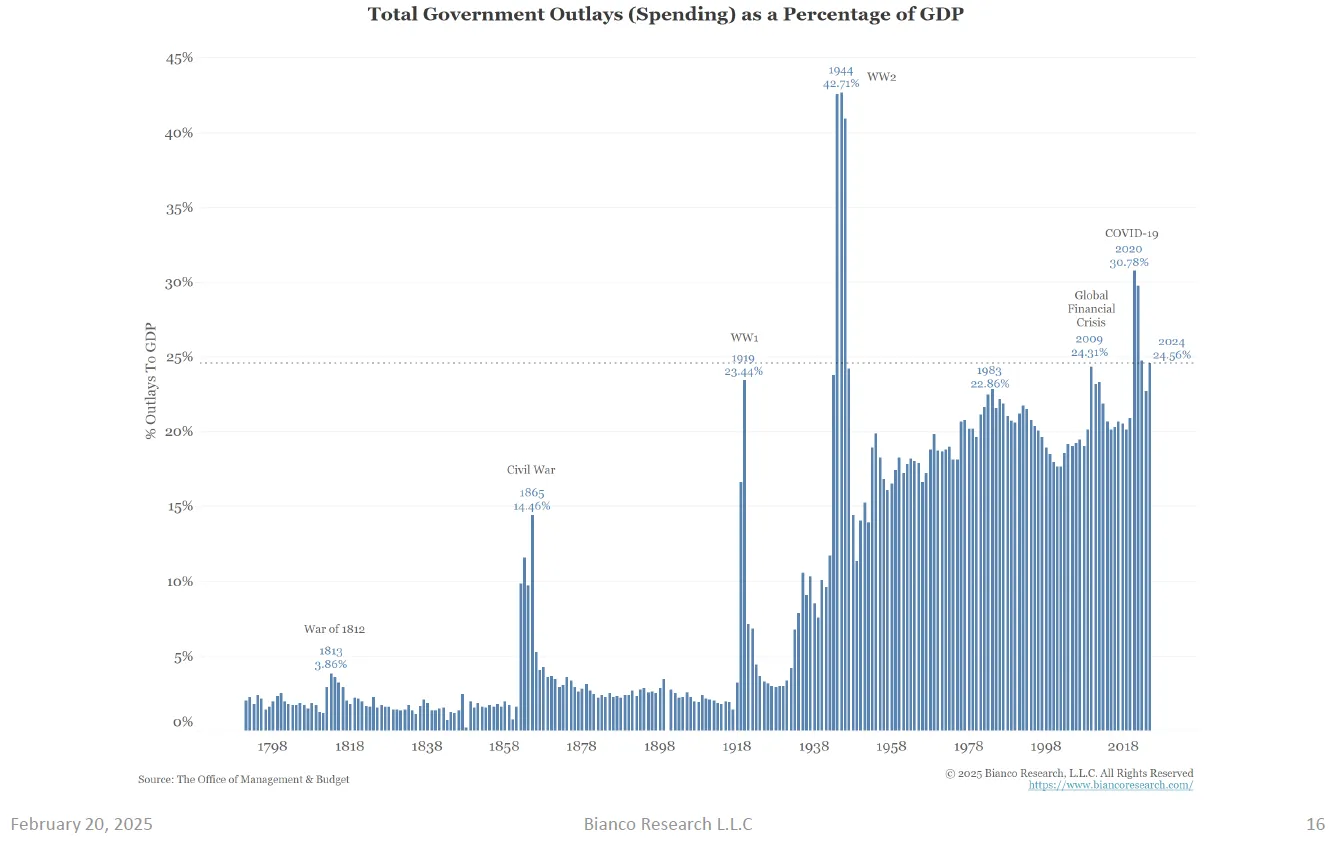

Let’s test this law against recent economic history (thanks to Bianco Research for this excellent table).

This is a list of direct causes of post-WWII modern U.S. recessions. Recession is defined as negative quarter-on-quarter GDP growth. I’ll focus on the 1980s onward.

This chart shows the lower bound of the federal funds rate. Each red arrow marks the start of an easing cycle coinciding with a recession. Clearly, the Fed cuts rates at least during recessions.

Fundamentally, “Pax Americana” and the global economy it dominates are debt-financed. Large corporations issue bonds to fund expansion and operations. If cash flow growth slows sharply or declines, debt repayment comes into question. This is problematic because corporate liabilities are largely bank assets. Banks’ holdings of corporate debt back their deposit liabilities. In short, if debts go unpaid, the “value” of all existing fiat credit banknotes is called into doubt.

Moreover, most American households are leveraged. Their consumption is marginally funded by mortgages, auto loans, and personal loans. If their cash flow generation slows or falls, they can’t meet debt obligations. Again, banks hold these debts and back them with deposits.

Crucially, the Fed cannot allow widespread defaults or rising probabilities of corporate and/or household debt defaults during or before a recession or cash flow slowdown. That would trigger systemic financial distress. To protect the solvency of the debt-financed economic system, the Fed proactively or reactively cuts rates and prints whenever a recession looms or fear intensifies.

KISS Principle

Trump manipulates Powell into loosening financial conditions by triggering a recession or making the market believe one is coming.

To avoid financial crisis, Powell will then likely implement some or all of the following: rate cuts, ending Quantitative Tightening (QT), restarting Quantitative Easing (QE), and/or suspending the Supplementary Leverage Ratio (SLR) for banks buying Treasuries.

Insert DOGE chart here:

How Can Trump Unilaterally Trigger a Recession?

The marginal driver of U.S. economic growth has always been government itself. Whether spending is fraudulent or necessary, government spending creates economic activity. Plus, there’s a monetary multiplier effect. That’s why the Washington D.C. metro area is one of America’s wealthiest—home to countless professionals parasitizing off government. The exact multiplier is hard to estimate, but conceptually, government spending has ripple effects.

According to Perplexity data:

● Median household income in Washington D.C. is $122,246—well above the national median.

● This places D.C. at the 96th percentile among U.S. cities by household income.

As a former president, Trump knows the extent of fraud, waste, and abuse within government. The bipartisan establishment doesn’t want to stop it—everyone benefits. But Trumpists stand outside both parties and aren’t afraid to expose flaws in government spending. Establishing a council called the Department of Government Efficiency (DOGE), backed by Trump and led by Elon Musk, is central to drastically cutting government spending.

How does DOGE achieve this when many largest expenditures are non-discretionary? Stop fraudulent payments. Replace government employees managing programs with computers—drastically cutting HR costs. The question becomes: How much fraud and inefficiency exists in annual government spending? If DOGE and Trump are right, it could amount to trillions per year.

A glaring example may be who the Social Security Administration (SSA) sends checks to. If we believe DOGE, the agency is sending nearly a trillion dollars to deceased individuals and others without proper identity verification. I don’t know if this is true. But imagine you’re an SSA benefits fraudster, knowing Elon and the “Big Man” are digging into data and might uncover your years of fraudulent payments and hand them to the DOJ. Do you keep cheating or flee? The threat of exposure alone could reduce fraud. As the old Chinese saying goes: kill the chicken to scare the monkeys. So even if not a trillion, I believe hundreds of billions are at stake.

Now consider the human resource side of government spending. Trump and DOGE are firing hundreds of thousands of government workers. Whether unions can legally challenge mass purges of “useless” staff remains to be seen. But consequences are already visible.

DeAntonio explains: “The layoffs we’ve seen so far may be just the tip of the iceberg. The scale and timing of future layoffs will determine whether the labor market remains stable. We currently expect federal employment to decline by about 400,000 by 2025 due to ongoing hiring freezes, delayed resignations, and DOGE-led layoffs.”

Even though Trump 2.0 has only just begun—just over a month—DOGE’s impact is clear. Unemployment claims in the D.C. area have surged. Home prices are crashing. Consumer discretionary spending—arguably fueled by massive government fraud and abuse—is disappointing financial analysts. Markets are starting to use the word “recession.”

A new analysis by real estate platform Parcl Labs shows home prices in Washington D.C. have fallen 11% since the beginning of the year, tracking the impact of the Department of Government Efficiency (DOGE) on the city’s housing market.

– Newsweek

Rothstein posted on Bluesky that the U.S. is almost certainly heading toward severe economic contraction due to mass layoffs in government and sudden cancellation of federal contracts.

The word “recession” is economic shame. Powell doesn’t want to become a modern-day Hester Prynne—publicly shamed and condemned—so he must respond.

Powell Pivots Again

After pivoting so many times since 2018, Powell must be dizzy. The investor question is: Will Powell act preemptively to save the financial system from collapse, or wait until a major institution fails? His choice is purely political. Therefore, I cannot predict it.

But I do know that $2.08 trillion in U.S. corporate debt and $10 trillion in U.S. Treasury debt must be refinanced this year. If the U.S. is on the edge of or in recession, cash flow shocks will make rolling over these massive bonds at current rates nearly impossible. Therefore, to preserve the sanctity of the “Pax Americana” financial system, the Fed must—and will—act.

For us crypto investors, the question is: How fast and how large will the U.S. credit release be? Let’s break down the four main measures the Fed will take to reverse course.

Rate Cuts

It’s estimated that each 0.25% cut in the federal funds rate equates to $100 billion in QE or printing. Assume the Fed cuts rates from 4.25% to 0%.

That equals $1.7 trillion in QE. Powell may not cut to zero, but you can bet Trump will let Elon keep slashing spending until Powell cuts to a desirable level. Once acceptable rates are reached, Trump will rein in his “mad dog.”

End Quantitative Tightening (QT)

Recent minutes from the Fed’s January 2025 meeting reveal that certain committee members believe QT must end at some point in 2025. QT is the process of shrinking the Fed’s balance sheet, thereby reducing dollar credit. The Fed conducts $60 billion in QT monthly. Assume the Fed acts starting April—this means ending QT injects $540 billion in liquidity relative to prior expectations in 2025.

Restart QE / SLR Exemption

To absorb Treasury supply, the Fed can restart QE and grant banks SLR exemptions. Through QE, the Fed prints money to buy Treasuries, increasing credit. SLR exemptions allow U.S. commercial banks to use unlimited leverage to buy Treasuries, increasing credit. The point is: both the Fed and banking system are allowed to create money from nothing. Restarting QE and granting SLR exemptions are decisions only the Fed can make.

If the federal deficit stays between $1–2 trillion annually, and the Fed or banks absorb half the new issuance, that adds $500 billion to $1 trillion annually to money supply. A 50% absorption rate is conservative—during COVID, the Fed bought 40% of new issuance. Still, in 2025, major exporters (China) or oil producers (Saudi Arabia) have stopped or slowed using dollar surpluses to buy Treasuries—so the Fed and banks have more room to maneuver.

Do the math:

Rate cuts: $1.7 trillion

+

End QT: $0.54 trillion

+

Restart QE / SLR exemption: $0.5–1 trillion

=

Total = $2.74–3.24 trillion

Covid vs. DOGE Money Printing

In the U.S. alone, the Fed and Treasury created around $4 trillion in credit from 2020 to 2022 to combat the Covid-19 pandemic.

DOGE-inspired money printing could reach 70% to 80% of the Covid scale.

With only $4 trillion printed in the U.S., Bitcoin rose approximately 24x from its 2020 low to its 2021 high. Given Bitcoin’s market cap is now much larger, let’s be conservative and call a $3.24 trillion U.S.-only print a 10x gain. For those wondering how Bitcoin reaches $1 million under Trump, that’s the answer.

A Few Key Assumptions

Even amid current market chaos, I’ve painted a very bullish future for Bitcoin. Let’s review my assumptions so readers can judge their reasonableness.

-

Trump will fund “America First” via debt financing.

-

Trump is using DOGE to purge political opponents dependent on fraudulent revenue streams, cut government spending, and increase the likelihood of a recession triggered by slowing government expenditure.

-

The Fed will implement a series of policies before or after recession to increase money supply and lower its cost.

Based on your worldview, it’s up to you to decide if this is reasonable.

U.S. Strategic Reserve

Monday morning, I woke up to see the Trump narrative kick in. On Truth Social, Trump reiterated that the U.S. will build a strategic reserve filled with Bitcoin and a bunch of shitcoins. Markets surged on the “news.” Nothing new—but the market used Trump’s reaffirmation of crypto policy intent as an excuse for a violent dead-cat bounce.

For this reserve to positively impact prices, the U.S. government must actually have the capacity to purchase these cryptos. There’s no secret pile of dollars waiting to deploy. Trump needs help from Republican lawmakers to raise the debt ceiling and/or revalue gold to match current market prices. These are the only two ways to fund a crypto strategic reserve. I’m not saying Trump won’t keep his promise—but the timeframe for any purchases may be longer than leveraged traders can survive before blowing up. Therefore, sell the rally.

Trading Strategy

Bitcoin and the broader cryptocurrency market are the only truly free global markets in existence. Bitcoin’s price tells the world in real-time how global society views current fiat liquidity conditions. Bitcoin hit an all-time high of $110,000 in mid-January ahead of Trump’s coronation, then dipped to a local low of $78,000—a roughly 30% drop. Bitcoin is screaming: a liquidity crisis is coming, even as U.S. equity indices remain near all-time highs. I trust Bitcoin’s signal, so a severe correction in U.S. equities driven by recession fears is imminent.

If Bitcoin leads the market down, it will lead it up too. Given minor financial tremors rapidly escalate into full-blown panic due to massive embedded leverage, if my overall forecast is correct, we won’t have to wait long for the Fed to act. Bitcoin will bottom first, then rebound first. As for the rotten traditional financial system led by U.S. stocks, they’ll lag—only catching up after suffering a brutal selloff.

I firmly believe we’re still in a bull market cycle, so the worst-case bottom will be the previous cycle’s all-time high of $70,000. I’m not sure we’ll go that low. A positive dollar liquidity signal is the declining balance in the U.S. Treasury General Account, which effectively injects liquidity.

Based on my confidence in Trump as a financier and his ultimate goals, Maelstrom increased exposure when Bitcoin traded between $80,000 and $90,000. If this is merely a “dead cat bounce,” I expect Bitcoin could revisit lows around $80,000.

If the S&P 500 or Nasdaq 100 drops 20%–30% from all-time highs, combined with a major financial institution nearing collapse, we could see full global market synchronization. This means all risk assets get hammered simultaneously, and Bitcoin could fall below $80,000—even testing $70,000. Whatever happens, we’ll cautiously accumulate on dips, avoid leverage, and anticipate the eventual re-inflation of global (especially U.S.-led) fiat financial markets that will propel Bitcoin to $1 million—or higher!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News